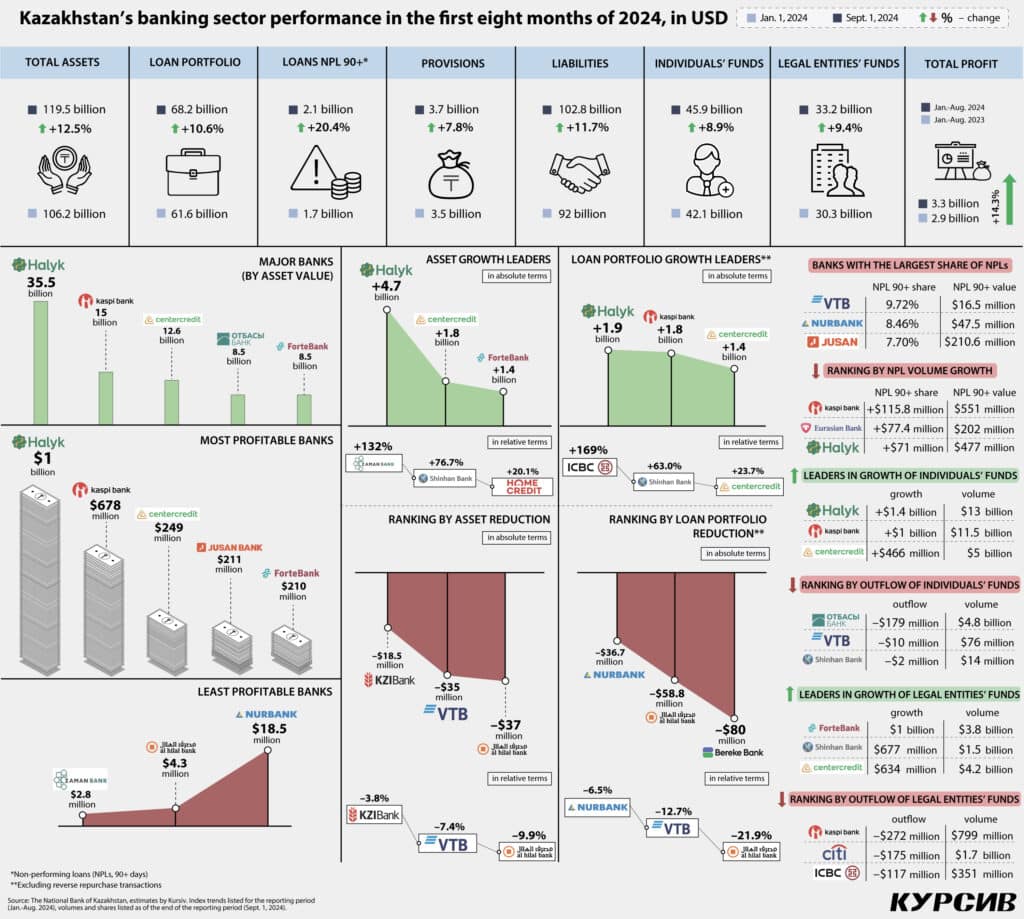

The National Bank of Kazakhstan has recently published financial indicators for second-tier banks for August 2024. The sector saw a rise in bad loans by $41 million, which represents only a minimal increase of 0.01%. Kursiv.media analyzed how the balance of power in the country’s banking system has shifted based on the latest monthly report.

Corporate withdrawals

August reports from Kazakhstan’s banking sector indicate a significant increase in liquidity demand from corporate clients, large enterprises to be precise. The total outflow of corporate funds from the banking system reached $1 billion, representing a 3.1% decline for the month. The actual outflow was even higher, factoring in the positive exchange rate revaluation, as the tenge weakened by 1.6% against the U.S. dollar in August.

Halyk Bank’s corporate clients led the negative trend, with legal entity deposits shrinking by $682.5 million in just one month. Kaspi Bank also saw a significant outflow of $278 million, followed by Citibank with $223 million. Other banks, including Eurasian Bank (-$82 million), Altyn Bank (-$51 million), Bereke Bank (-$22.5 million) and four smaller players recorded outflows of less than $20.5 million. In contrast, ForteBank bucked the trend, reporting an increase of $184.5 million in corporate deposits. Other entities with modest growth included Bank RBK (+$59 million), Bank CenterCredit (+$20.5 million) and eight banks with gains below $20.5 million.

Since the beginning of the year, corporate funds in the sector have grown by $2.8 billion or 9.4%, despite the tenge depreciating by 6.0% against the dollar. ForteBank led the way in absolute growth, with corporate funds rising by $1 billion over the first eight months, followed by Shinhan (+$672 million) and Bank CenterCredit (+$629 million). Halyk Bank, which had been in the top spot, dropped to fourth (+$418 million), followed closely by Bereke Bank (+$395.6 million). Other notable performers included Freedom Bank (+$129 million) and seven banks that saw gains ranging from $10 million to $108 million. In relative terms, among major players with assets over $2 billion, Forte (+36%), Bereke (+34%) and Freedom (+23%) posted the highest growth rates.

Despite this cumulative growth, eight second-tier banks experienced outflows. Kaspi Bank, for example, saw a corporate fund decline of $272 million since the start of the year, likely due to withdrawals by affiliated companies under the public parent holding, Kaspi.kz.

Several foreign banks operating in Kazakhstan experienced significant portfolio reductions in August. Citibank saw the largest outflow, with a decrease of $175 million. Other notable withdrawals include Industrial and Commercial Bank of China (ICBC, -$117 million), Altyn Bank (-$82 million), Bank of China (-$59 million), VTB (-$45 million) and Turkish KZI Bank (-$39 million). Eurasian Bank also reported corporate outflows, totaling $34.8 million. In relative terms, the sanctioned VTB bank, ICBC and Kaspi Bank witnessed the most rapid portfolio shrinkage, with declines of 36%, 25% and 25%, respectively.

Personal expenditures

In August, individuals deposited $586 million into banks, leading to a 1.3% increase in personal funds within the banking system over the month. However, when accounting for exchange rate gains and interest accrued, the actual inflow of new money was notably lower than the nominal figure. Almost half of August’s growth (44%) came from Kaspi clients, whose deposits grew by $256 million. Other banks that saw rather modest increases were Halyk Bank (+$116 million), Bank CenterCredit (+$90 million), Jusan Bank (+$51 million), Bank RBK (+$36.8 million) and Home Credit Bank (+$28.6 million). A surprising development occurred at Islamic Zaman Bank, Kazakhstan’s smallest bank, based in Ekibastuz. Retail funds there skyrocketed from a mere $1.3 million on Aug. 1 to $34.8 million by Sept. 1, marking a $33.6 million increase for the month. According to unconfirmed reports, these funds may have been placed by large Russian clients.

By the end of August, household deposits in the banking system had grown by $3.6 billion or 8.9%. Halyk, Kaspi and Bank CenterCredit led in terms of absolute growth in retail accounts and deposits, with increases of $1.4 billion, $1 billion and $463 million, respectively. Following them were Bereke Bank (+$215 million), Home Credit Bank (+$190.6 million) and Jusan Bank (+$178 million). Moderate gains were reported by Eurasian Bank (+$121 million), Bank RBK (+$77.8 million) and Freedom Bank (+$63.5 million), while ForteBank (+$45 million) and Altyn Bank (+$32.7 million) lagged behind their competitors. Zaman Bank’s individual deposits also grew by $34.8 million. Among universal banks, outflows were only observed at the sanctioned VTB (-$11 million) and Nurbank (-$438,600).

In relative terms, excluding players with a low starting base, Home Credit (+28.7%) and Bereke (+24.4%) have seen the fastest growth this year. Meanwhile, Halyk (+12.0%), Jusan (+11.8%), Kaspi (+10.4%) and Bank CenterCredit (+10.2%) grew at a similar pace, while Bank RBK (+7.9%), Freedom (+6.8%) and Eurasian Bank (+5.6%) underperformed the market average. ForteBank’s retail deposit portfolio showed near stagnation with only a 2.4% increase. Given that deposit interest rates averaged at least 8% over the past eight months, it suggests that banks with growth below this threshold have not seen net inflows of new individual deposits. This could indicate that many individuals either lack the funds to save or choose to spend their income instead of saving it.

Asset growth

Despite the $449 million decrease in client funds in August, second-tier banks’ total assets increased by $2.1 billion (+1.9%). This growth was primarily due to a $2 billion rise in other liabilities (non-deposit obligations), offsetting the decline in client funds.

Halyk Bank saw the highest asset growth in August, adding $1 billion for the month. ForteBank (+$563 million) and Bank CenterCredit (+$506.3 million) also experienced notable increases. Positive trends were observed at Bank RBK (+$186.5 million) and Bereke Bank (+$182.4 million). However, seven banks saw a decrease in assets during the month, with the steepest decline at Eurasian Bank (-$332 million), followed by Kaspi Bank (-$160 million), Bank of China (-$88 million) and Otbasy Bank (-$75.8 million). Smaller decreases were recorded at Altyn Bank, Shinhan Bank and VTB.

Since the beginning of the year, assets in the banking system have grown by $13 billion or 12.5%. In absolute terms, Halyk Bank leads with a growth of $4.7 billion over eight months. Bank CenterCredit moved up to second place with $1.8 billion and ForteBank took third with $1.4 billion. Kaspi, which had previously been second, dropped to fourth, increasing its assets by $1.3 billion. The next banks in line were Jusan (+$895 million), Shinhan (+$746 million), Bereke (+$537 million), Home Credit (+$330 million), Otbasy (+$297 million), Freedom (+$274 million) and Bank RBK (+$258 million).

In terms of relative asset growth, excluding non-universal players, Home Credit (+20.1%) and Forte (+19.6%) lead the market. Other strong performers include Bank CenterCredit (+16.6%), Halyk (+15.3%), Jusan (+15.2%) and Bereke (+12.6%). On the other end of the spectrum, Eurasian Bank’s assets grew by only 3.6%, the slowest among comparable-sized banks. Four second-tier banks, none of which are systemically significant, reported declines in their asset base (see Infographics).

Loan portfolio

In August, the banking sector’s total loan portfolio (excluding reverse repos) grew by $1.2 billion or 2%. Over half (56%) of the total growth was driven by the two largest players: Halyk Bank (+$381 million) and Kaspi (+$338 million). Bank CenterCredit (+$133 million), Otbasy Bank (+$110 million) and ForteBank (+$104 million) contributed to the second tier of active lenders. On the other hand, Bereke (-$36.8 million), Nurbank (-$22.5 million), City (-$6 million) and VTB (-$4 million) saw declines in their loan portfolios.

Over the first eight months of the year, the sector’s loan portfolio grew by $6.9 billion or 11.7%. The top three banks by absolute portfolio growth were Halyk (+$1.9 billion), Kaspi (+$1.8 billion) and Bank CenterCredit (+$1.4 billion). ForteBank also saw significant growth (+$631 million), followed by Bank RBK (+$354.6 million) and Home Credit (+$252 million). Altyn Bank was close to reaching $200 million in growth with an increase of $182 million. Other players, such as Jusan (+$100 million), Eurasian Bank (+$92 million) and Freedom (+$69.6 million), were less active in lending. Shinhan Bank, however, showed increasing activity with a $61.4 million or +63% boost in its loan portfolio, after accumulating significant liquidity from two Korean automotive companies that operated in Russia before the war.

In relative terms, excluding banks with a low starting base, the fastest loan portfolio growth was seen at Bank CenterCredit (+23.7%, growing at twice the market rate), Altyn Bank (+21.4%), ForteBank (+21.1%), Kaspi Bank (+20.4%) and Home Credit (+20.1%). While Halyk Bank leads in absolute portfolio growth, its percentage increase of 9.9% is still below the average market rate of 11.7%. The slowest growth among major players is at Jusan Bank (+4.0%) and Eurasian Bank (+3.1%).

On the other hand, five banks have seen declines in their portfolios. The most significant drop was at the quasi-state Bereke Bank, which shrank by $80 million since the start of the year. Islamic Al Hilal (-$59 million), Nurbank (-$36.8 million), VTB (-$22.5 million) and Citi (-$6 million) also experienced portfolio reductions. Among these, Bereke Bank stands out as a major player in the lending market, with its decline likely linked to its transition due to the ongoing sale to investors from Qatar.

Loan quality declines

Loan quality, measured by the average non-performing loans (NPLs) of 90+ days, worsened slightly in August, rising from 3.14% to 3.15%. In dollar terms, bad debt rose by around $41 million, a 2% increase. The largest contributors to this were Halyk (+$20.5 million), Eurasian Bank (+$15 million), Kaspi (+$12 million) and Bank RBK (+$7 million). On the positive side, Bereke Bank managed to clean up its portfolio, reducing NPLs by $11 million, while Bank CenterCredit saw a $10 million improvement.

Since the start of the year, total NPLs in the sector have grown by $360.7 million or 20.4%. Four banks are responsible for 84% of the increase in bad debts over the past eight months: Kaspi (+$114.7 million), Eurasian Bank (+$77.8 million), Halyk (+$69.6 million) and Home Credit (+$41 million). However, the share of NPLs in each bank’s portfolio varies greatly. For example, Halyk’s non-performing loans make up only 2.2% of its total portfolio, while Kaspi’s NPLs account for 5.0%, Home Credit’s for 6.5% and Eurasian Bank’s for 6.6%. The highest NPL ratios are seen at Jusan (7.7%), Nurbank (8.5%) and the sanctioned VTB (9.7%).