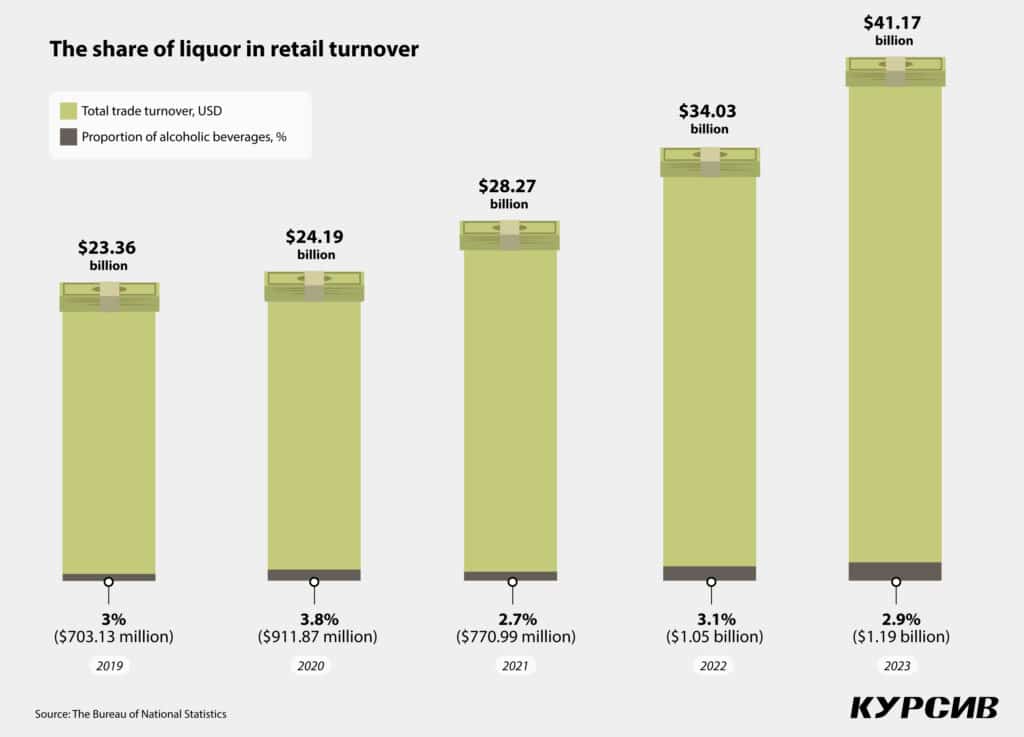

On average, liquors account for 3% of monetary turnover in retail and 2% in wholesale trade. The last five years demonstrate no fluctuation except for 2020 — trapped at their houses amidst the COVID-19 pandemic, Kazakhstanis set a decade record for alcoholic beverage purchases. The year the pandemic broke out, liquor sales surged by 30% in monetary expression compared to the previous year, 2019, reaching a 3.8% share of the entire retail market.

Liquor distribution channels

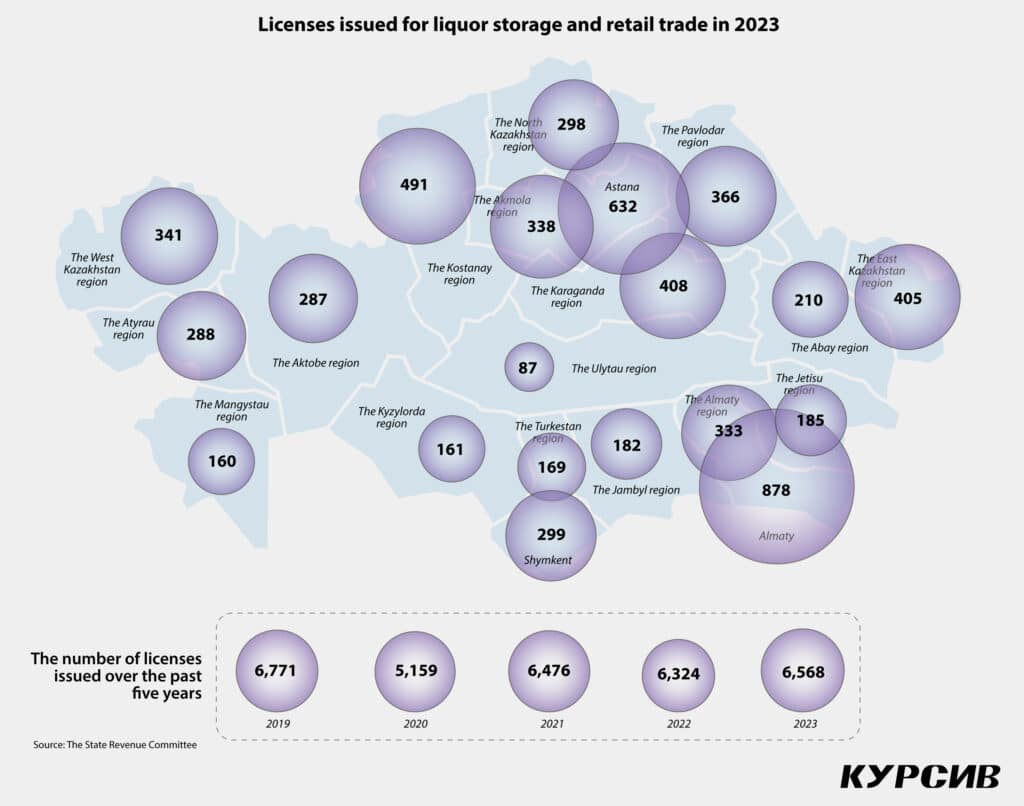

According to the State Revenue Committee, around 6,500 licenses for retail and nearly 230 for wholesale trade were issued (dining establishments excluded). The agency doesn’t provide data on shopping facility types.

Retailers state that the main liquor distribution channel in Kazakhstan is traditional trade. More than 50% of mass-market beverages are sold in convenience stores, bazaars and wholesale markets, while the proportion for premium liquors is different.

“Wholesale outlets remain active, particularly in provincial areas, but are also relevant in large cities. People continue to purchase alcoholic beverages from these locations, making the wholesale market a significant distribution channel,” said Nikolay Grachyov, National Key Account Manager at Global Beverages Holding. The company manages businesses that produce mineral water, soft drinks and alcoholic beverages. Its most popular brands include Khaoma and Kyzylzhar vodka.

Modern retail, including liquor stores and specialty shops focusing on specific beverage types like wine or beer, accounts for approximately 30% of overall sales on average.

However, the proportions depend on the beverage type and its price. If we consider the premium segment, the figures will be completely different. The main distribution channels in this case are hotels, restaurants and cafés (HoReCa) and modern retail; 30% of total supplies may account for liquor stores alone. According to Kazakhstan Beer Company — an importer and distributor of elite alcoholic beverages and a beer producer — from 20% to 30% of Line Brew canned beer is delivered to liquor stores.

Rise of liquor stores

Based on retailers’ estimates, the number of liquor stores in Kazakhstan is steadily growing every year.

«I see the liquor stores gradually expanding. Taking a look at beer shops like Volna or Barik, one may see them developing throughout the entire country. The store format itself is undergoing changes; for example, new wine shops with interesting concepts appear,» said Andrey Pavlov, sales manager at Kazakhstan Beer Company.

«We sell roughly 20% of our products via liquor stores. Shares of liquor stores and online alcoholic beverage stores have only been increasing over the past years,» expressed Global Wine, a wine shop owner and a distributor with its own branch chain across Kazakhstan. According to Global Wine, the share of liquor stores has grown by 10% over three years.

Nikolay Grachyov believes that liquor stores attract more customers by offering a wider range of drinks than the Fast-Moving Consumer Goods (FMCG) facilities and traditional retail. It’s worth noting that demand for professional recommendations is also expanding, which can be ensured by the advisors, sommeliers and wine experts who are willing to help at the liquor stores.

Rise of wine shops

In addition to liquor stores, new formats like wine shops are on the rise. The establishment of such stores is one of the latest steady trends. Distributors believe that a key driver behind this is the overall improvement in Kazakhstan’s consumer drinking culture.

«Wine shops are gaining more popularity amid customers paying more attention to quality drinks and wine-drinking culture. They became more selective and began to appreciate individual approaches,» said Elena Yasvilko, marketing specialist at AlmaWine.

AlmaWine operates a chain of four shops in Almaty and one in Astana. The company plans to open two more locations in Almaty, expand further in Astana and enter new regions like Aktau, Shymkent and Oskemen. These ambitious plans show that wine shops are in high demand and growing in popularity.

Consumers have switched sides in favor of wine drinkers and have begun to show interest in non-mainstream products.

«We see more people paying attention to various unique terroirs, particular wine-growing areas and less mass-market grape variety, and wine shops are here to meet this kind of demand,» explained Valentina Kirichkova, brand manager at Monte Bianco and a member of the Kazakhstan Sommelier Association. «People started to discover new kinds of wine and appreciate the origin and unique terroirs. Of course, Sauvignon Blanc from New Zealand isn’t going anywhere, yet people are now more open to everything new. This tendency is driving demand for wines from smaller farms and exclusive items, like craft drinks,» she added.

“While wines from Georgia and Moldova used to be the favorites, Italian, Spanish, and New World wines are now preferred. People are more inclined to try different styles of wine and increasingly seek advice from specialists. As a result, sales in wine shops and liquor stores are clearly on the rise,” Andrey Pavlov noted.

Wine retailers are also trying to promote good taste among their clients by organizing various workshops and even founding sommelier schools. Some businesses go further by opening entire restaurants. For example, Elitalco, a company that has been selling alcoholic beverages for 15 years, opened the Rojo restaurant last year, building it around its store. «We’ve opened the restaurant to conduct all sorts of tasting sessions and business meetings, and just for people to enjoy quality drinks and tasty appetizers,» said Alexey Svetlov, managing director at Elitalco.

E-commerce for alcoholic beverages

Elitalco is one of the first companies to digitize alcohol retail. Online alcohol sales are a global trend that Kazakhstan has embraced. Kirichkova pointed out that an increasing number of customers prefer to purchase alcoholic beverages online, which is helping to develop this distribution channel in Kazakhstan. AlmaWine views the growth of e-commerce as a key strategic goal for the current year.

Although online alcohol sales are technically prohibited in Kazakhstan, there are ways to circumvent this restriction. Liquor stores create websites that serve as display windows, while the actual purchase transaction occurs on-site with a delivery person. The courier then verifies the buyer’s ID to ensure they are over 21 years old. Buyers also sign an electronic offer confirming their age. It is worth noting that online alcohol retail is currently available in over 60 countries, where authorities have acknowledged the technological advancements in retail and the overall growth of the online sales sector.