Morgan Stanley spotlights 10 small-cap stocks with at least 50% upside

Morgan Stanley has put together a list of small-cap stocks that, on their numbers, have 50% upside or more, as reported by Business Insider. Meanwhile, the investment bank forecasts double-digit growth in the small-cap-tracking Russell 2000 index in the coming months.

Small caps tend to outperform at the beginning of an economic cycle, Nicholas Lentini, an equity strategist at the bank, explained in an October 16 note. He points to improvement in small-business optimism, upward revisions to GDP, and widespread earnings upgrades as signs of a new cycle.

Here are the stocks from Morgan Stanley’s list:

Structure Therapeutics

Structure Therapeutics develops drugs for cardiovascular, metabolic, and pulmonary conditions and has a market capitalization of $2.3 billion. Its portfolio includes the GSBR-1290 molecule for weight loss. The company is betting on oral medications as an alternative to popular injections like Novo Nordisk’s Wegovy and Eli Lilly’s Zepbound, according to InvestorPlace senior analyst Luke Lango. On Friday, October 18, the stock was quoted at $39.50 per share, with Morgan Stanley seeing upside of a little over 222%.

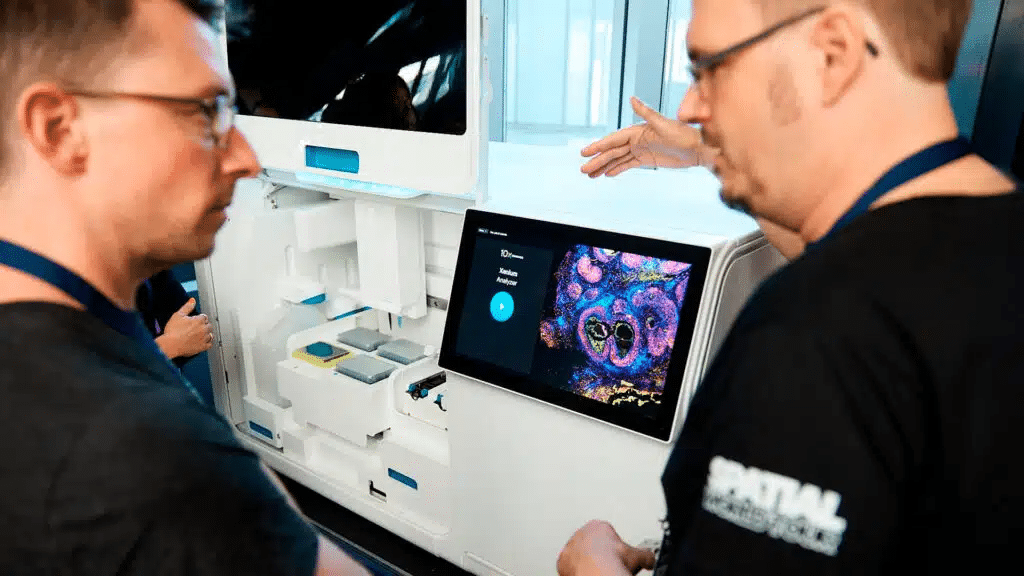

10X Genomics Inc

10X Genomics is a company with a $1.86 billion market capitalization that designs and manufactures gene sequencing technology for scientists, doctors, and pharmaceutical companies. Its analyzers can characterize up to 5,000 genes in cells and tissues and sequence individual cells. 10X Genomics claims that its products are behind breakthroughs in oncology, immunology, neuroscience, and other fields. Morgan Stanley’s target price implies almost 183% upside to the $15.44 per share market price as of October 18.

Bloom Energy Corp

Bloom Energy, with a market capitalization of $2.3 billion, makes the Bloom Energy Server, essentially a distributed power generation system that provides constant supply and can be scaled to meet customer needs. Morgan Stanley’s target price implies 110.1% upside to the stock’s October 18 price of $10.16 per share.

Bicara Therapeutics

Bicara Therapeutics, with a $1 billion market capitalization, went public just over a month ago. It develops new treatments for solid tumors (those with well-defined shapes and borders). The company’s lead program is ficerafusp alfa, a bifunctional antibody that both inhibits cancer cell survival and targets a signaling molecule promoting tumor growth and suppressing the immune response. On October 18, Bicara Therapeutics was trading at $21.96 per share, with Morgan Stanley seeing over 75% upside.

Legend Biotech Corp

Legend Biotech is a company with a market capitalization of $7.9 billion that develops treatments for life-threatening diseases, including hematologic malignancies and solid tumors. It already has one approved drug for adult patients with relapsed or refractory (i.e., treatment-resistant) multiple myeloma who have received at least one prior line of therapy that failed. Morgan Stanley’s target price for Legend Biotech implies 65% upside to the October 18 share price of $42.87.

ArcBest Corp

ArcBest, with a market capitalization of $2.45 billion, is a logistics company that offers both standard and custom services. Additionally, its solutions allow for shipment tracking throughout delivery. Morgan Stanley sees close to 65% upside for ArcBest, which was trading at $103.5 per share on October 18.

Viking Therapeutics

Viking Therapeutics, like Structure Therapeutics, is vying to disrupt Novo Nordisk and Eli Lilly’s duopoly in the obesity market. It currently has a market capitalization of $7.29 billion. The company is testing its VK2735 molecule in both injection and pill form, with JPMorgan estimating that the tablets could capture around 10% of the market after their expected launch in 2030. In September, the investment bank initiated coverage on Viking with a “buy” at a target price of $80 per share. On October 18, Viking was quoted at $65.80 per share, meaning almost 60% upside to the Morgan Stanley target price.

Alaska Air Group

Alaska Air, with a market capitalization of $5.67 billion, serves over 140 destinations throughout the Americas and the Asia-Pacific region through its subsidiaries, including major airline Alaska Airlines, regional carrier Horizon Air, newly acquired Hawaiian Airlines, and aircraft management company McGee Air Services. On October 18, the Alaska Air holding was trading at $44.94 per share, with Morgan Stanley’s target price implying close to 57% upside.

Dyne Therapeutics Inc

Dyne Therapeutics, with a market capitalization of $3.54 billion, specializes in therapies for progressive muscle diseases, such as myotonic dystrophy type 1, Duchenne muscular dystrophy, and facioscapulohumeral muscular dystrophy. Morgan Stanley’s target price implies 56.1% upside to the Dyne share price of $35.20 on October 18.

American Airlines Group

In its current form, American Airlines, with a market capitalization of $8.6 billion, came about in 2013 through the merger of American Airlines and US Airways Group. The group’s airlines now offer about 6,700 flights a day to nearly 350 destinations in more than 50 countries. In the second quarter of 2024, the company reported record quarterly revenue of $14.3 billion, up 2% year over year. On October 18, American Airlines shares were quoted at $13.00 per share, with Morgan Stanley’s target price implying almost 52% upside.