Heart monitor maker iRhythm surges after FDA approval for design changes

Quotes on iRhythm Technologies, which makes heart monitors, surged more than 20% in premarket trading today, Tuesday, October 22, following an announcement that the U.S. Food and Drug Administration (FDA) had approved design changes for its Zio AT monitor. Scrutiny from the regulator and the U.S. Department of Justice dating back to last year led iRhythm to modify the device.

Details

iRhythm stock had jumped more than 20% to $74.80 per share in premarket trading today as of this writing. Yesterday, the company announced that the FDA had granted clearance to its submission related for updates previously made to its Zio AT cardiac telemetry device. iRhythm said that these changes had been made to improve the device’s quality and safety at the request of regulators without specifying what exactly had been modified. MarketWatch pointed out that by law companies must give the FDA 90-day advance notice before they can market a medical device.

About iRhythm Technologies

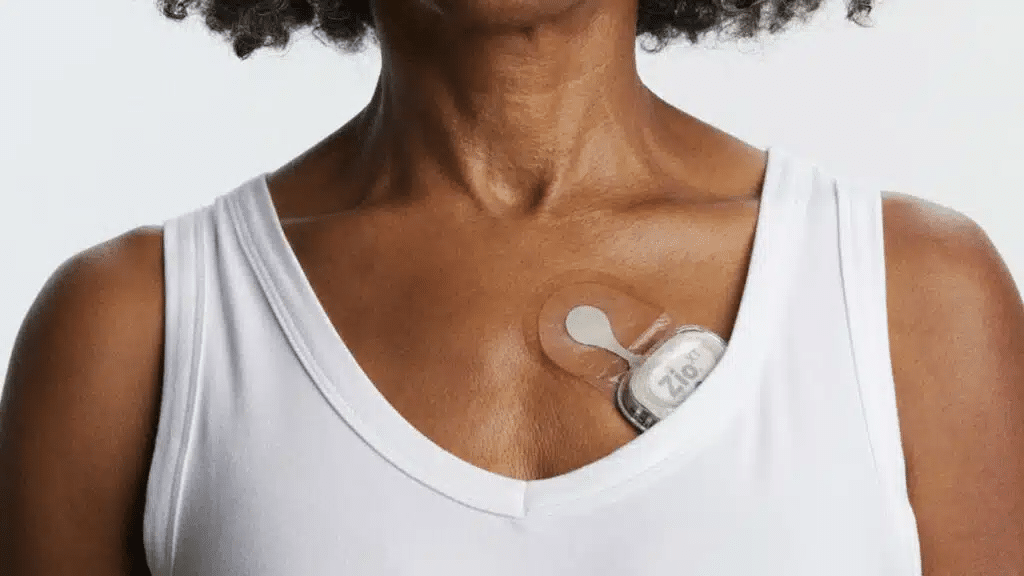

iRhythm creates solutions to detect, predict, and prevent heart disease. This includes wearable biosensors that use proprietary algorithms to distill data that can then be acted on by physicians to treat patients. The Zio AT device, available by prescription, is such a monitor.

Zio AT officially came under scrutiny in May 2023, when iRhythm received an FDA warning letter concerning the device, as reported by med-tech news site Mass Device. Among other things, the regulator raised questions about the reporting system for data collected by the monitors. In at least two cases, iRhythm reported patient deaths later than the legally required 30-day period, according to the FDA. Regulators also inspected the company’s facility and found it less than fully compliant with medical device quality requirements. Neither side has provided further details.

The regulator had a lengthy list of corrective actions to be taken by the company, Mass Device noted, adding that the Justice Department was also looking into iRhythm’s business. In response, iRhythm sent two submissions to the FDA, with one now cleared and the other pending.

Stock performance

iRhythm stock is down nearly 24% in the last 12 months and 42% since the beginning of the year. According to MarketWatch, 12 analysts cover the company. Eleven recommend buying the stock, while one rates it a «hold.» Their average target price is $111.70 per share, nearly double the October 21 closing price.