Playboy Group stock soars after founder’s son makes offer to buy back the brand

Shares of Playboy Group (officially PLBY Group) surged over 15% on Monday, October 21, after news broke that Cooper Hefner, the youngest son of Playboy founder Hugh Hefner, is offering $100 million for the brand, as reported by the Wall Street Journal. The current market capitalization of PLBY Group stands at $61.7 million.

Details

PLBY Group stock gained more than 15% on the Nasdaq on Monday to $0.84 per share. For the year to date, it is still off 16.5%.

According to the Journal, Cooper Hefner, together with coinvestors, has submitted an offer to buy back the Playboy brand for $100 million. “It’s a great American company and a great American brand,” he said in an interview, adding that it “has been managed to a state of potentially nonexistence.”

About PLBY Group

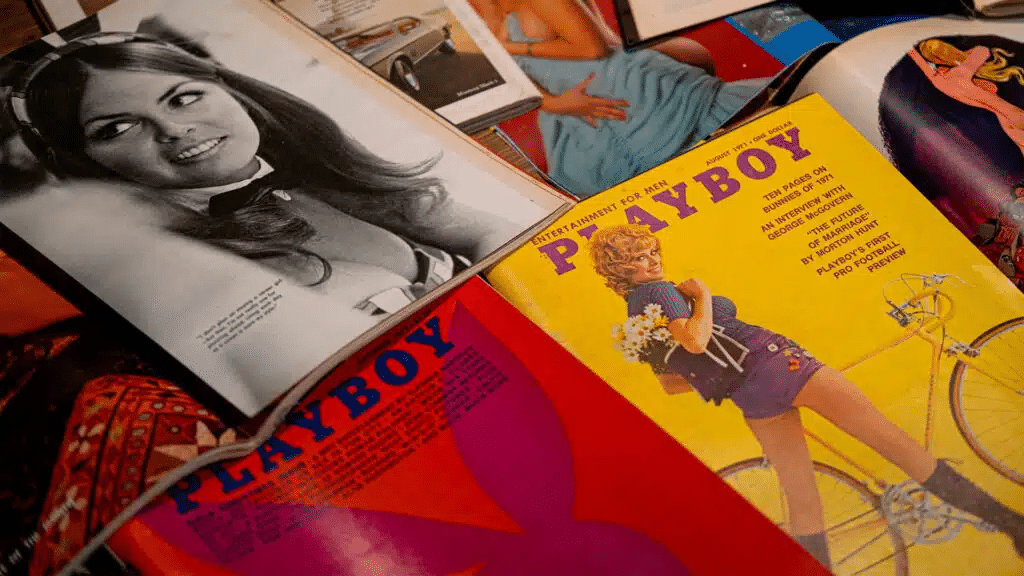

Hugh Hefner founded Playboy in 1953, targeting a sophisticated male audience. Beyond its iconic nude images, the magazine became known for its in-depth journalism featuring prominent writers, the WSJ points out. Over time, it expanded into video production and branded merchandise. In 1971, the company went public, reaching its peak market capitalization of $671 million in 1999.

Playboy’s fortunes subsequently declined, however, as it lost advertising revenue, which made the magazine unprofitable. In 2011, Hugh Hefner took the company private in a deal worth $207.3 million, partnering with the investment firm Rizvi Traverse Management. Three years after Hefner passed away in 2017, Playboy stopped publishing a regular print magazine, and the Hefner family withdrew from the business.

In 2021, Playboy returned to the public markets via a SPAC merger. It was valued at $415 million in the deal and rebranded as PLBY Group. Shortly after, the group’s market value soared to above $2 billion.

In the second quarter of 2024, PLBY Group’s top line came in down 29% year over year at $24.9 million, weighed on by lower licensing revenue. The company is currently loss-making and has over $200 million in debt, but it claimed in its second-quarter financials to be working to change that. For instance, it announced an agreement with creditors to extend debt repayments, along with plans to relaunch the print edition of the magazine in 2025.

Hefner’s vision

Cooper Hefner believes that the current management of PLBY Group has made several missteps. In particular, he claims that Playboy has ventured into businesses it had not previously pursued, while its products are failing to resonate with consumers, as reported by the WSJ. In 2021, PLBY Group spent more than $330 million to acquire Australian lingerie brand Honey Birdette, which had sales of just $3.8 million in the second quarter of 2024, for a 21% year-on-year decline.

Hefner argues that the decline of the business and the brand’s fading relevance are direct results of decisions made by the current management. If the offer is accepted, Hefner plans to split the business in two. One part would retain the Playboy brand and intellectual property, with Hefner overseeing it through his investment firm, Hefner Capital. Meanwhile, all noncore operations would be spun off into a separate company with a new name, with shareholders receiving a 10% stake in the restructured Playboy brand.