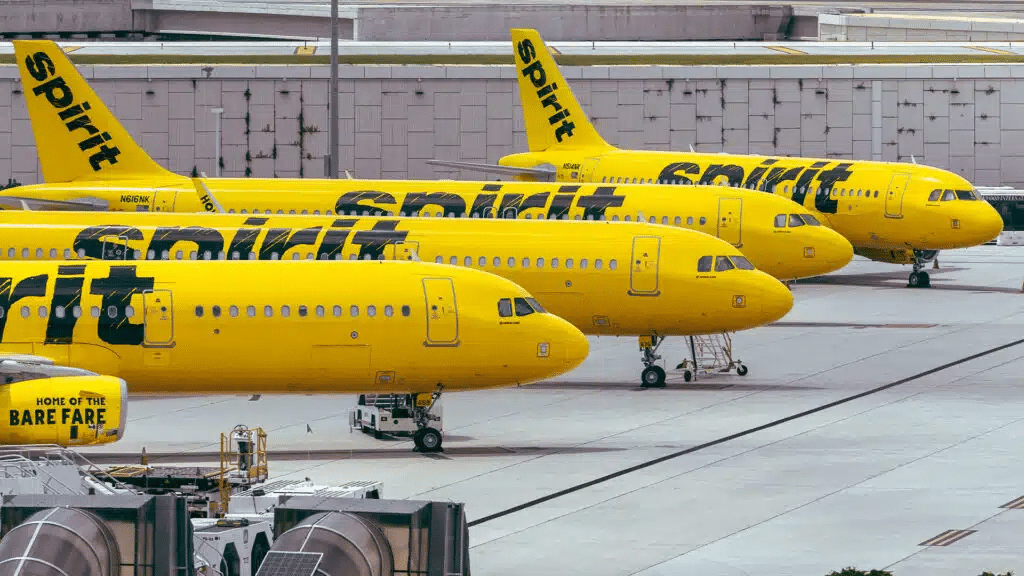

Shares of low-cost carrier Spirit Airlines jumped more than 18% in premarket trading today, Wednesday, October 23. Earlier in the day, the Wall Street Journal reported that the company had revived merger discussions with Frontier Airlines. This is not Spirit’s first attempt to strike a deal with a competitor — a previous merger attempt, with JetBlue Airways, was blocked by a federal judge.

Details

Spirit, which has been facing a cash crunch, saw its stock soar more than 18% to $2.50 per share in premarket trading today as of this writing. The gains came in response to the news — broken by the WSJ, citing “people familiar with the matter” — that Frontier Airlines is exploring another bid to acquire Spirit, with the sides having had preliminary discussions on a potential deal.

The two airlines have been in on-and-off merger talks since 2016, as the Journal pointed out. In 2022, they finally reached an agreement for Frontier to buy Spirit in a deal then valued at $2.9 billion. However, JetBlue made a competing offer, triggering a fierce bidding war that it eventually won. The U.S. Department of Justice (DOJ) then filed a lawsuit to block the merger, which it won in early 2024, with a federal judge ruling that Spirit’s cost-conscious customers could lose out if the deal went through. The sides considered appealing the decision before eventually abandoning the deal.

This new merger attempt with Frontier is still in its early stages, but if a deal is reached, it would likely happen as part of Spirit restructuring its debt and other liabilities in bankruptcy, according to the WSJ sources. As previously noted by the newspaper, Spirit now faces a $3.3 billion debt load and is in talks with bondholders to avoid potential bankruptcy following the failed merger with JetBlue.

Context

Spirit has been struggling financially for a while. Its negative $192.9 million bottom line in the second quarter of 2024 was 97 times the size of the net loss in the previous-year period. As reported by the financial news site The Street, the company’s poor financial performance can be attributed to rising costs and a recall of the Pratt & Whitney engines used in Spirit’s Airbus A321neo EADSF planes that limited the number of available routes.

This is the second good day this week for Spirit shares, which have lost 87% since the beginning of the year. On Monday, the stock jumped 53% after the company secured an extension with U.S. Bank National Association to get a debt refinancing deal done with bondholders. Spirit now has until December 23 to do that, with the previous deadline having passed on October 21.

Stock performance

According to MarketWatch, 12 analysts cover Spirit. Four of them recommend holding the stock, while the rest rate it a “sell.” At the time of this writing, Spirit is trading above their average target price of $2.00 per share.