Freedom Bank experiments with AI to optimize compliance checks

Freedom Bank wants to leverage artificial intelligence (AI) to automate compliance checks on transactions and customers. The financial organization said that once the new mechanism is commenced, the analysis time will be reduced from two days to a few minutes. According to Aidos Zhumagulov, a member of the bank’s board, the new technology will mitigate the risks of secondary sanctions and become a benchmark for other financial institutions.

«Geopolitics has made us stand in the crosshairs of the corresponding banks since we are in a somewhat risky zone for them. They keep an eye on every single transaction we conduct. The whole squad of compliance officers is on duty to inspect our transactions. Transfers take longer — it took two to three days earlier, but now it may be as long as several weeks,» Zhumagulov explained.

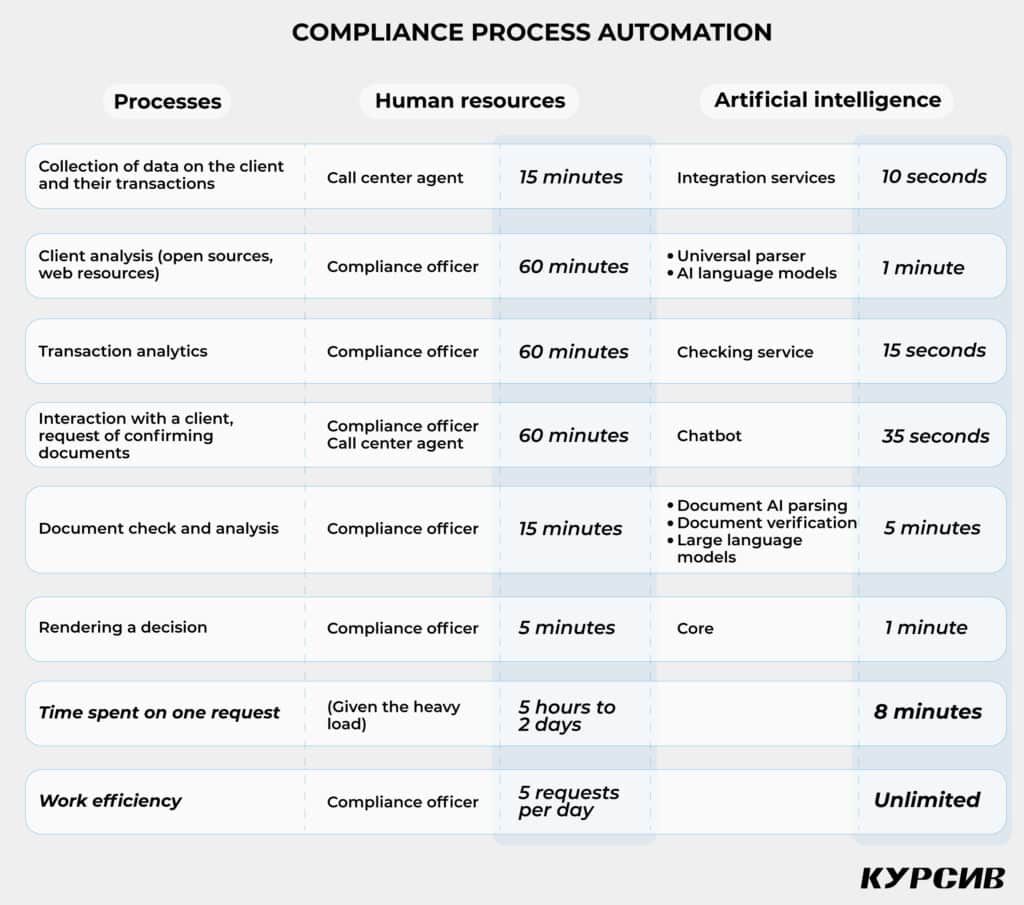

This situation drove Freedom to a decision to shorten the compliance checking process to eight minutes using AI and language models. The technology is in closed testing, but the bank announced its release in November or December. Zhumagulov noted that around 80% of applications will be checked automatically. The bank is going to create a digital profile of a client with all information available from the databases and for the transactions.

«We are integrated with all major databases, including Dow Jones, WorldChef and Spark. In total, we conduct checks across seven or eight different systems. This comprehensive integration allows us to verify whether a client is sanctioned, blacklisted, or who their relatives are,» the speaker added.

The newly developed AI incorporates multiple language models to verify various aspects of a transaction. For instance, one model handles document verification, another assesses transaction details and structure, and a third ensures the authenticity and validity of documents.

«To establish the compliance checking process, we had to train more than ten language models. One challenge was that we needed to handle all the necessary tasks, such as training these models and analyzing our historical database ourselves since the GPT option wasn’t available to us because as a bank we are a restricted-access facility. As a result, this check takes only a few minutes. If the triggering system is activated, the compliance officer will immediately receive a notification of any suspicious or risky transaction,» Zhumagulov highlighted.

With the help of AI-based compliance checking, there is no need to hire thousands of specialists. However, Zhumagulov doesn’t think that this automation will replace humans completely.

«We have discussed the possibilities of this AI model with compliance officers regarding its potential to replace human workers. Of course, AI won’t replace humans. We still need humans’ logic to handle complicated cases,» the board’s member said.

Once the technology is fully deployed, it will be presented to the Agency for Regulation and Development of the Financial Market (ARDFM), as well as showcased at international conferences in different countries. In addition, Freedom Bank is ready to share its expertise with other Kazakhstani banks.

Zhumagulov believes that this matter is important not only at the company level but also on a national scale. He is convinced that effective and secure compliance will enhance Kazakhstan’s reputation on the global stage.