Snacking smarter: Kazakhstan’s growing demand for healthy options

On average, Kazakhstanis eat more than four times a day, and the number of those who prefer to grab a bite between meals is increasing. Kursiv.media has examined why people have started to snack more often and how businesses adjust to these new habits.

Every second urban dweller in Kazakhstan eats fractional meals throughout the day. A growing number of people are embracing this lifestyle. In 2023, 41% of the urban population had a snack at least once a day, while in 2024, that figure has risen to 49%. This is evidenced by a survey on the major trends in eating behavior, conducted jointly by Mondelēz International and the JD Expert agency, which covered 422 respondents from 22 cities in Kazakhstan. In this survey, snacks include any food and drink consumed outside the traditional three full-course meals.

Why snacking demand is growing

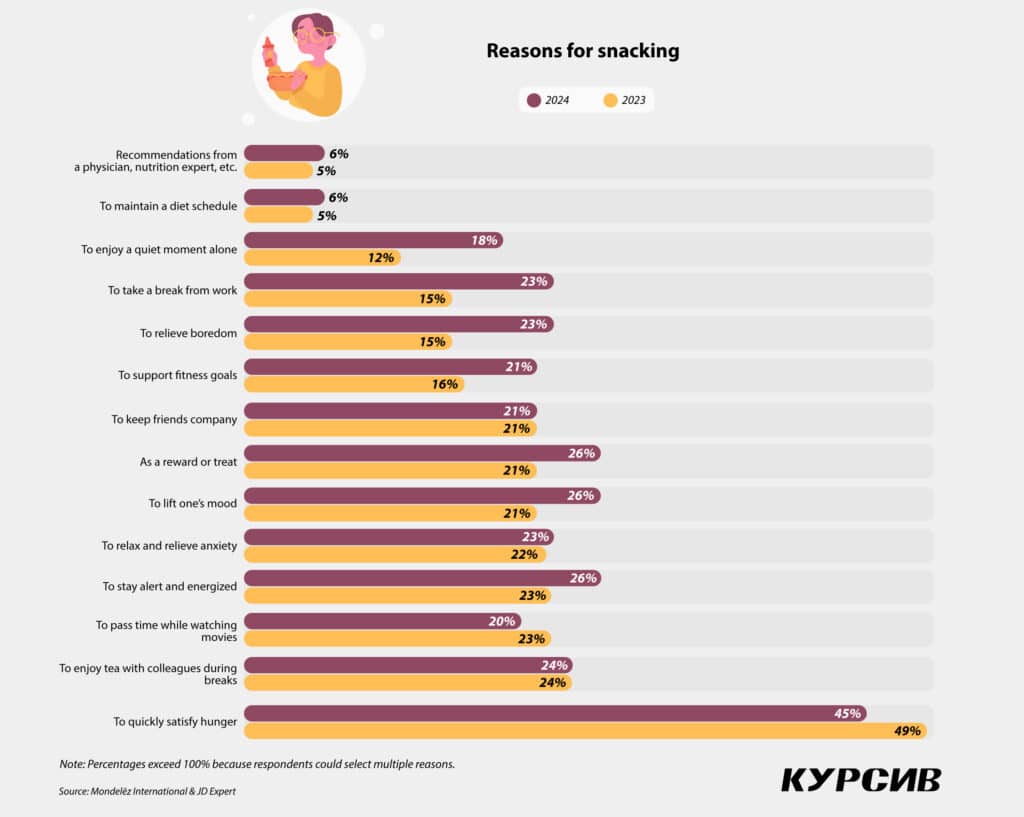

The growing demand for snacks has both rational and emotional explanations. The accelerating pace of life forces urban residents to eat more often on the go or to replace a full meal with several snacks. Among the reasons for snacking, the option «to satisfy hunger quickly» gained 49%, adding 4 percentage points (p.p.) over the year. At the same time, for a significant number of respondents, the emotions associated with a meal are also important, as snacks are often seen as opportunities to indulge oneself or to cope with stress using a favorite chocolate bar. Among the reasons for snacking, the options «to treat or reward oneself» and «to lift one’s mood» gained 26% each, adding 5 p.p. over the year. Meanwhile, the option «to take a break from work» increased in popularity by 8 p.p., reaching 23%.

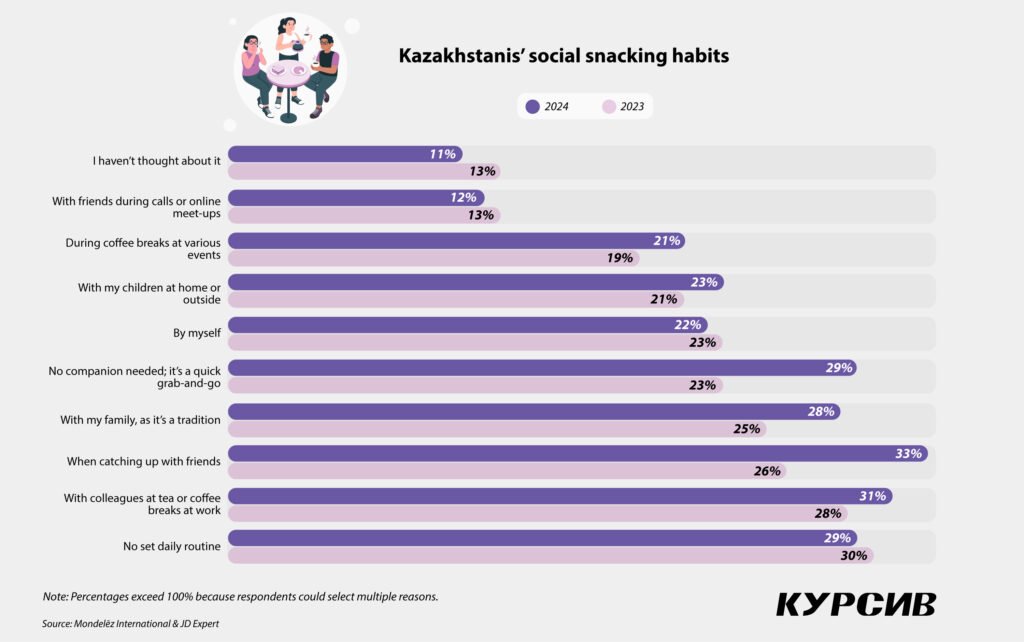

Social reasons remain traditionally strong, with snacking providing an additional opportunity to spend time with friends, family or colleagues. When asked how and with whom they snack, respondents most often chose the options «with friends in person» (33%) and «with coworkers during a break at work» (31%).

«For ‘remote workers back in the office,’ taking time to unwind from work has grown more meaningful. Rather than relying on gadgets, people are reconnecting face-to-face, often over food, tea gatherings and snacks. Office tea parties have become an essential ritual for daily bonding with friends and colleagues,» said Julia Dmitriyeva, head of JD Expert.

We shall not live by bread alone

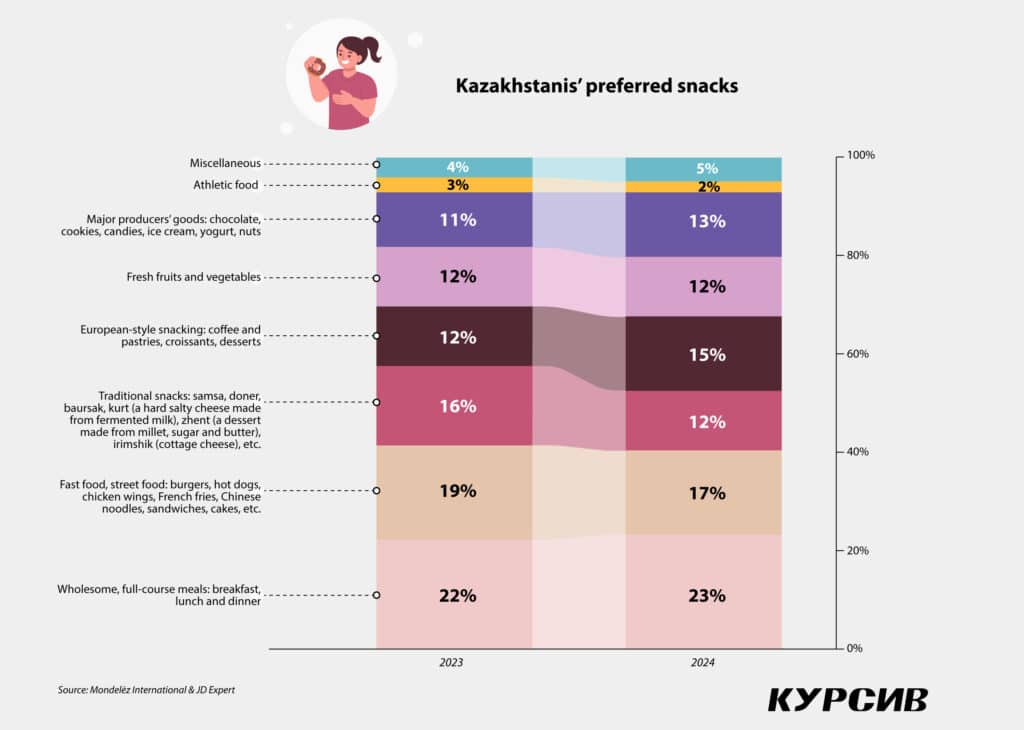

The most common snack options among Kazakhstanis are fast food or street food, along with local baked goods. These include samsa (a bun stuffed with meat), burgers, hot dogs, sandwiches, pies, baursaks (puffy fried bread served on special occasions) and doners. However, the popularity of this type of snack is gradually declining. In 2023, 35% of respondents favored it, but this year’s survey shows that the figure has dropped to 29%.

More respondents are opting for the so-called European snack option — coffee and dessert (croissants, cheesecakes, etc.) — instead of samsa or hot dogs. This option was chosen by 15% of respondents, a 3-p.p. increase over the year. Packaged products from large manufacturers, such as chocolate, biscuits, cookies, candies, yogurt and nuts are also trending positively, accounting for 13% of responses, up by 2 p.p. year-on-year (YoY).

«We observe that, on the one hand, people are planning their purchases more thoughtfully by switching to food delivery and reducing impulsive consumption. From a rational perspective, this is a positive shift. However, this behavior can also lead to a diminished sense of daily enjoyment. To compensate for this ‘reduced pleasure,’ people often seek out vibrant flavors, attractive packaging and the emotional appeal provided by advertising campaigns and promises,» Dmitriyeva explained the growth in demand for «sweet snacks in beautiful packages.»

According to her, this is the most accessible way to achieve a quick serotonin boost.

Maria Kombarova, marketing director for Eurasia at Mondelēz International, noted that the «chocolate» category — including brands like Milka, Alpen Gold, Toblerone and Picnic — is experiencing the fastest growth in Kazakhstan.

Healthy snacks

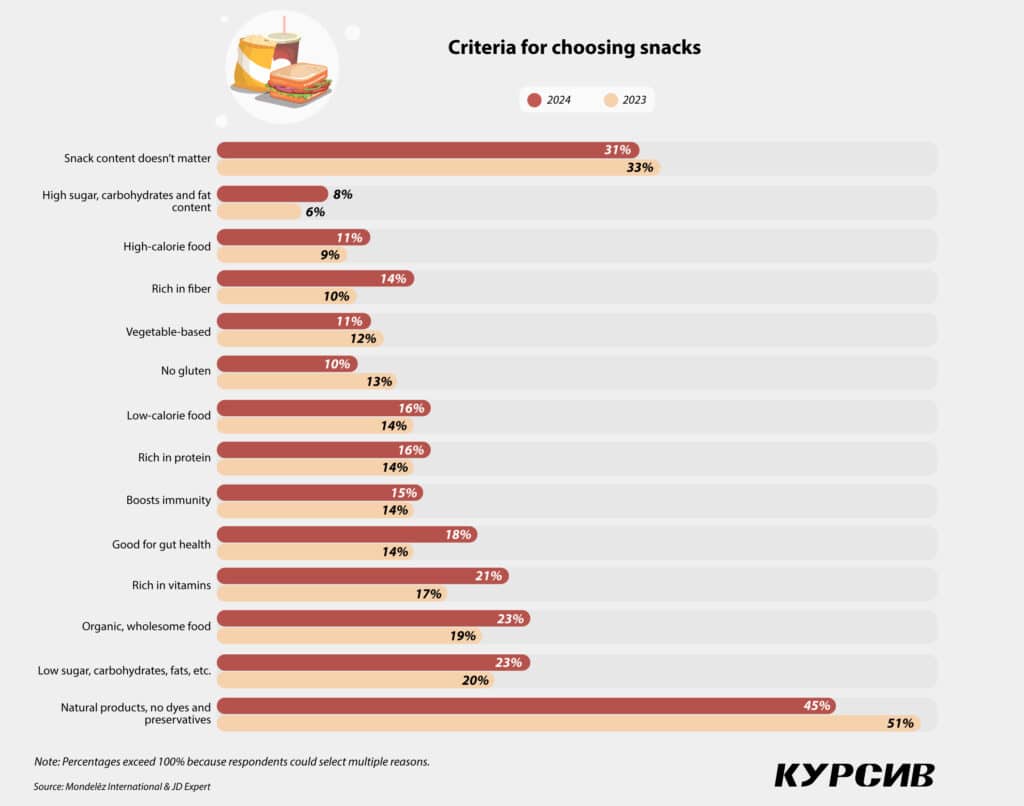

When seeking a tasty source of «quick serotonin,» consumers are increasingly making more mindful snack choices. When selecting a snack based on its ingredients, 23% of respondents indicated that it was important for the product to be low in sugar, carbohydrates, fats, etc. (+4 p.p. YoY). Additionally, 21% prioritized products rich in vitamins, 18% sought options that support gut health and 16% looked for high-protein snacks.

Whey.kz, one of the major sports nutrition stores operating in the Kazakhstani market for over 10 years, notes that protein bars are gaining popularity not only among athletes but also with people outside the fitness industry, serving as convenient travel snacks and healthy options for school.

«This trend is driven by the fact that protein bars have a good composition, featuring a high content of nutrients. Many people are beginning to pay closer attention to their diet, particularly regarding their intake of macro- and micronutrients. Protein bars are ideal for replenishing these nutrients because they are rich in protein and often contain complex carbohydrates. Additionally, they typically do not contain sugar, making them suitable for individuals with diabetes or those who, for various reasons, cannot consume regular sugar,» a representative from Whey.kz stated.

According to their data, sales of protein bars have increased by approximately 10% to 15% over the past year.

«The pace of life also plays a role; people with busy schedules cannot always find time for a full meal. As a result, they turn to protein bars, which are not only healthy and tasty but also nutritious. One bar can provide long-lasting satiety, allowing individuals to feel satisfied,» the store added.

Snack manufacturers are also commenting on this trend.

«We have seen a significant increase in demand for our snack products. This is especially true for peanuts in a bread-flavor crust, which has proven to be a convenient and nutritious snack, experiencing up to 30% growth depending on the regions and sales channels. It helps to quickly satisfy hunger and provide energy, which is very important in today’s fast-paced lifestyle,» said RB Brands, the company behind brands such as Golden Nuts and Kurt O.

The company also sells Pringles chips, but this category has not shown active growth, possibly because the potato chip market is flooded with multiple players, making data somewhat unclear. «Demand for pistachios is also not as strong, likely due to their high price,» RB Brands added.

How businesses are adjusting to the growing demand for snacks

Among the key trends, manufacturers see a growing interest in healthy snacks and products made with natural ingredients.

«Consumers are increasingly choosing snacks without extra additives and preservatives. Flavor diversity also plays an important role — nuts with unusual flavors attract more attention. It is also important to note the trend toward environmentally friendly packaging, which is becoming increasingly significant for our customers,» RB Brands stated.

The company is introducing new flavors and packaging in their production.

The growing demand for protein bars, according to Whey.kz, has prompted manufacturers to expand the range of sports snacks. «If previously there were only standard bars and cookies, now we see various types of muffins, cupcakes, pancakes, dragees and similar products,» Whey.kz reported.

«Bars rich in protein are becoming increasingly popular. We are also keeping up with these trends and are currently developing and introducing the production of bars with the addition of plant proteins,» said Inna Kuznetsova, head of Bio Elite LLC, the company that produces fruit and nut bars called be OK and Bio Elite.

According to the company, the year-on-year growth in sales of protein bars is about 10%.

Mondelez International also intends to expand certain categories.

«Mondelez International has focused on expanding its presence in the confectionery category, making significant investments, especially in chocolate brands and innovations, such as chocobakery (snacks that combine chocolate and cookies),» Kombarova said.

Among the products offered by this manufacturer in the Kazakhstani market, there are currently no sugar-free snacks. They address the trend for healthy snacking differently — through portion control, indicating on the packaging what amount of their product can be considered a daily norm.

«Based on the survey results, we found that more people in Kazakhstan are examining product compositions and studying their nutritional value. As part of our global ‘smart portion’ approach, we promote portioned products and conscious consumption through individually packaged servings and information on labels indicating recommended serving sizes. By the end of 2024, all this information will be included on the labels of our entire core portfolio in Kazakhstan,» promised Oleh Savchuk, country manager at Mondelēz International.