‘Patriotic marketplace’ stock surges after additional share issue, payments platform launch

Quotes on PSQ Holdings, which brands itself as a marketplace for family-oriented Americans, jumped over 7% on Monday, October 28. This came after the company announced a raft of updates, including its payments platform launch, a $5.35 million private investment, staff cuts, and plans for achieving profitability in the near term.

Details

On Monday, PSQ Holdings (also known as PublicSquare) stock gained more than 7% on the Nasdaq to $2.86 per share, later extending the gains in after-hours trading. In premarket trading today, Tuesday, October 29, it soared over 10%.

Before the opening bell on Monday, the company made three announcements. First, it officially launched its payments platform. Founder and CEO Michael Seifert reported executed contracts could potentially generate over $700 million in annualized payments processing gross merchandise value, with the company aiming to increase that to $1 billion by the Christmas shopping season.

The second announcement: The marketplace raised $5.35 million by selling stock to two affiliated investors and one unaffiliated investor at a price of $2.70 per share, slightly above the 14-day average closing price. According to a filing submitted to the U.S. SEC, PSQ Holdings board member Kelly Lynn Loeffler, a former U.S. senator representing Georgia and ex-CEO of Intercontinental Exchange subsidiary Bakkt, purchased shares worth about $3.2 million.

Finally, PSQ Holdings announced that it had reduced its staff by more than 35% as part of a strategic plan to streamline the organization.

«With a bolstered cash position to help fund payments initiatives and a leaner organization, we believe we can focus on our goal of reaching profitability in near term,» Seifert stated.

In the first half of 2024, PSQ Holdings posted a net loss of $23.8 million on revenue of $9.5 million.

About PSQ Holdings

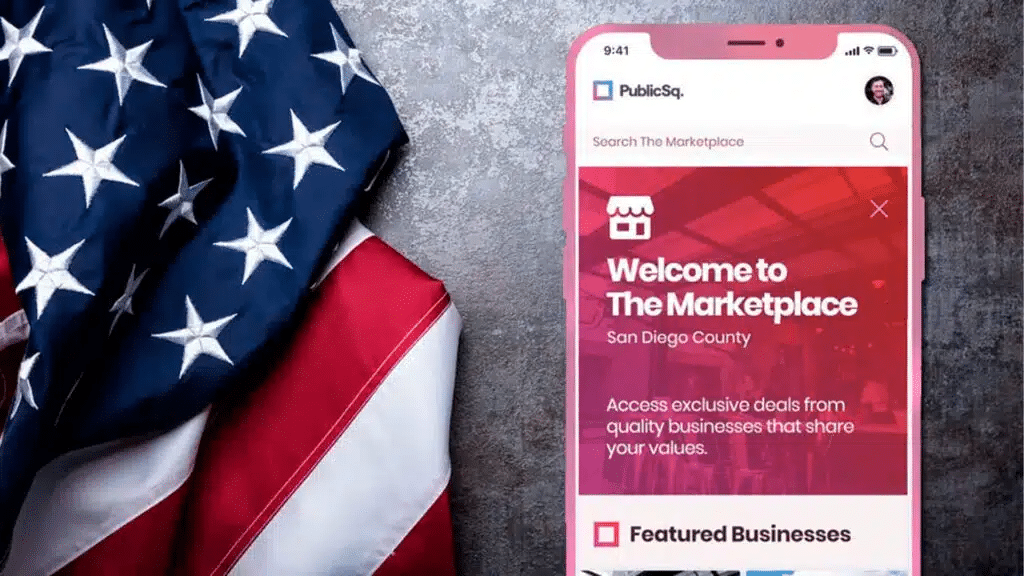

PSQ Holdings was founded in 2021 by Seifert, who promotes traditional values and opposes «woke» views. He claims to have built the company on five core values: family, freedom, a strong nation, support for small businesses, and a commitment to the Constitution. Currently, the PSQ Holdings business consists of three key divisions: the PublicSquare marketplace, the payments system, and the premium diaper and baby wipe brand EveryLife. Vendors must agree to respect the platform’s core values to list their products on the marketplace.

Seifert sees the business as part of an emerging «parallel economy,» which, he believes, is gaining traction among Americans. To prove this point, the company has reported that within nine months of the marketplace’s nationwide launch, it had 75,000 sellers and over 1.6 million buyers. PublicSquare, which, according to Seifert, could become «the new Amazon,» has attracted many public figures who style themselves as patriots. It counts Donald Trump Jr. among its investors and politician Robert F. Kennedy Jr., director Robby Starbuck, and commentator and former Fox News host Tucker Carlson among its partners.

Stock Performance

PSQ Holdings stock is off more than 45% since the beginning of the year and almost 56% over the last 12 months. According to MarketWatch, the one analyst who covers PSQ Holdings rates it a «buy,» with a target price of $5.00 per share, implying upside of nearly 75% versus the last closing price.