Inuvo, a provider of AI-driven marketing technology, saw its stock fall 3.5% after releasing its third-quarter earnings on Friday, November 8. Revenue grew 23% quarter over quarter but declined about 9% year over year.

Details

Inuvo stock lost 3.5% on the Nasdaq on Friday to close at $0.23 per share, with the losses carrying over to premarket trading today, November 11. Inuvo is down 46% since the beginning of the year but up 22% over the last 12 months.

Earlier in the day on Friday, the company reported its 2024 third-quarter results. While the top line grew 23% versus the second quarter to $22.4 million, it was down around 9% compared to the previous-year period. CEO Richard Howe pointed out on the earnings call that the 2023 third quarter was the best quarter in the company’s history for revenue.

In the 2024 third quarter, the net loss jumped 80% year over year to $2 million, including a one-time noncash impairment charge of $600,000, the company noted.

Howe also mentioned that in the first five days of November, the company averaged $290,000 in daily revenue, with double-digit revenue growth projected for the fourth quarter.

About the company

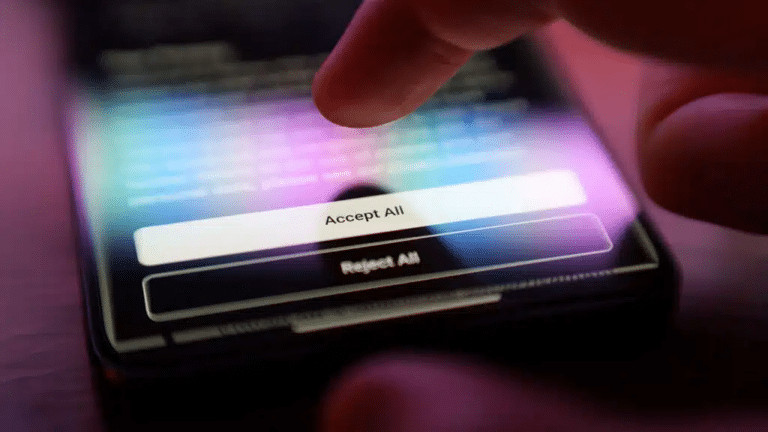

Inuvo specializes in AI-driven advertising solutions. According to Howe, this segment is roughly $6 billion annually. The company’s flagship product, IntentKey, offers cookieless and indentityless audience targeting, which focuses on the underlying reasons consumers are interested in specific products, services, and brands.

This solution aligns with the current global trend of privacy-first advertising. For instance, Howe notes that Apple has already restricted consumer tracking in its Safari browser, while Google has promised to offer Chrome users more control, although specifics have yet to be disclosed.

In 2025, Inuvo plans to enhance IntentKey’s capabilities, which Howe believes will take AI-driven audience curation and targeting to an “entirely new level.”

Analyst insights

According to MarketWatch, three analysts currently cover the company, all of whom rate the stock as a “buy.” Their average target price is $0.95 per share, implying upside of more than four times the most recent closing price.