Overly optimistic budget planning has led Kazakhstan’s cabinet to significantly increase withdrawals from the National Fund, raising the total to KZT5.6 trillion (around $11 billion) to cover treasury expenses — a sum that surpasses even the withdrawals made during the crisis year of 2020.

Between January and September 2024, national budget revenues fell below forecasts and some year-on-year (YoY) comparisons with 2023, expanding the gap between government revenues and expenditures. Finance Minister Madi Takiyev attributed this shortfall to «overly ambitious revenue forecasts» made last year. As a result, the government plans to increase National Fund withdrawals to offset the lagging tax collections.

Tapping wealth fund to offset falling tax revenues

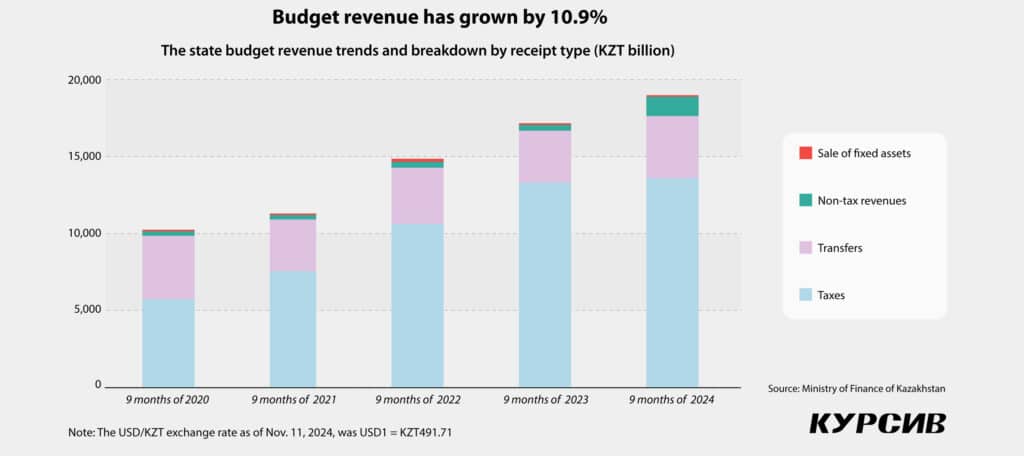

From January to September 2024, tax revenues totaled nearly $27 billion (KZT 13.6 trillion), reflecting just a 2.1% growth YoY. Gains in individual income tax (+KZT349.3 billion), social tax (+KZT209.9 billion) and corporate income tax (+KZT108.5 billion) supported this slight increase but were insufficient to meet budgetary needs.

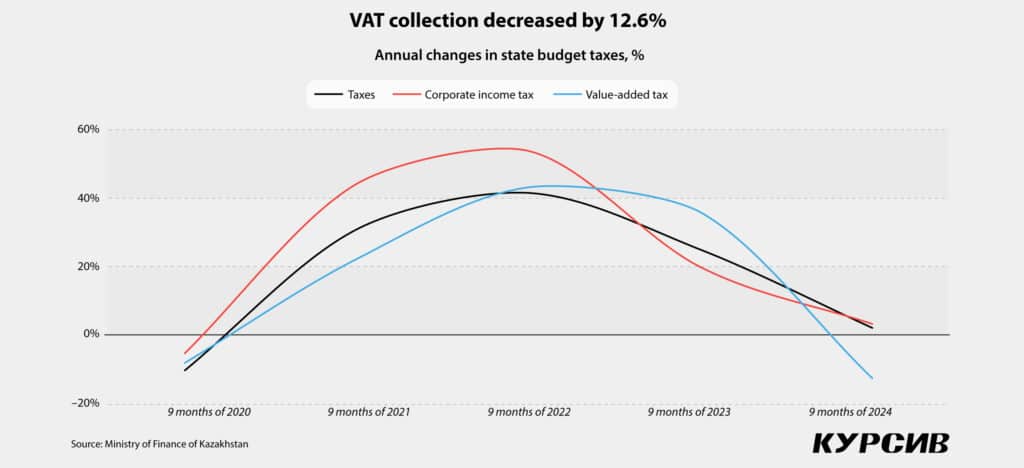

However, value-added tax (VAT) payments, which in recent years have made up over a quarter of all tax revenues and a fifth of total state budget income, saw a substantial decline. Between January and September 2024, VAT contributions to the budget were KZT3.6 trillion (nearly $7 billion), marking a 12.6% decrease YoY. The last time Kazakhstan saw a comparable decline in VAT revenues was in the pandemic year of 2020, when VAT receipts dropped by 8.2% over the same nine-month period.

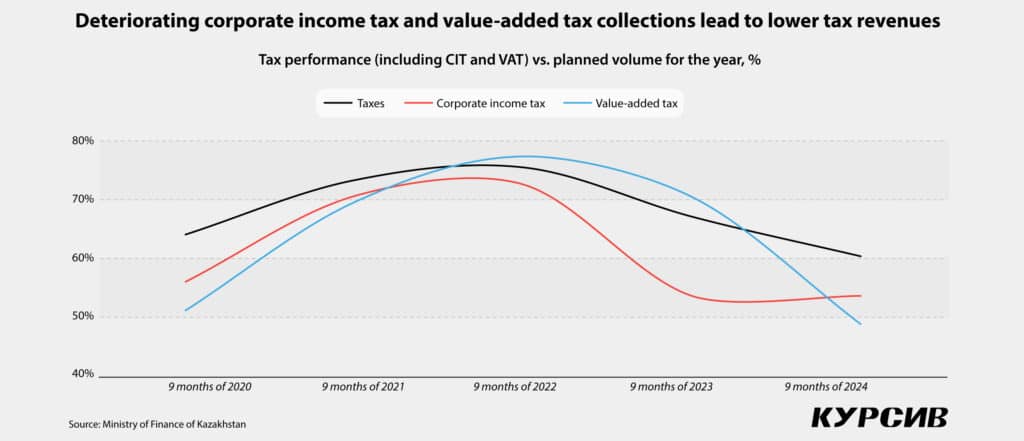

This decrease in VAT collection is underscored by another key metric: the ratio of actual revenues during the reporting period to the planned annual total. In the first nine months of 2024, the VAT collection rate stood at 48.8%, a 22 percentage points drop YoY. However, the 2023 data is challenging as a comparison point due to the budget crisis the country narrowly avoided that year. For a steadier benchmark, the average VAT collection rate during the more stable post-crisis years of 2021 and 2022 was 74%.

Based on our calculations, the State Revenue Committee fell short of the government’s VAT revenue expectations by about KZT1.5 trillion (around $3 billion) during the reporting period. Most of this shortfall originated from VAT on imports from non-Eurasian Economic Union (EEU) countries, with a deficit of about KZT683 billion ($1.3 billion). From January to September, imports from these countries decreased in value by 7.6%. Additionally, VAT on domestically produced goods and services recorded a shortfall of KZT540.2 billion ($1 billion).

The short-term economic indicators for January-September 2024 do not signal a slowdown in business activity within Kazakhstan. However, official GDP data for this period has yet to be released. The VAT shortfall included KZT232.5 billion from goods imported from EEU countries. While statistics on imports from the EEU for September remain unpublished, data for the first eight months shows a slight 0.9% increase in import values YoY, indicating no significant downturn.

Meanwhile, corporate income tax (CIT) revenue, which historically contributes around a quarter of state budget taxes, increased only modestly. However, this small rise obscures challenges in tax collection. CIT is divided between large companies, whose payments go to the national budget, and small and medium-sized enterprises (SMEs), whose taxes support local budgets.

The CIT contributions from SMEs were 18.3% higher than anticipated in the first nine months of the year. In contrast, CIT collections from large businesses (excluding oil companies) fell significantly short of expectations, with an estimated deficit of KZT913.7 billion — nearly 30% below the planned target for January-September 2024.

Lower tax collections led the cabinet to draw more from the National Fund than initially budgeted for 2024. The government again employed indirect withdrawals: last year, the Ministry of Finance purchased a 20% stake in KazMunayGas (KMG) from Samruk-Kazyna using funds from the National Fund. Subsequently, KMG issued KZT1.3 trillion in dividends to its new shareholder — the Ministry of Finance of Kazakhstan — which were then directed to the state budget.

This year, Kazatomprom shares served a similar role. By leveraging these securities, the state budget received an additional KZT694 billion in dividends from state-owned shares. Additionally, the government withdrew just over KZT4 trillion from the National Fund in guaranteed and targeted transfers, surpassing the KZT3.6 trillion initially planned.

Budget deficit leads to an increase in public debt

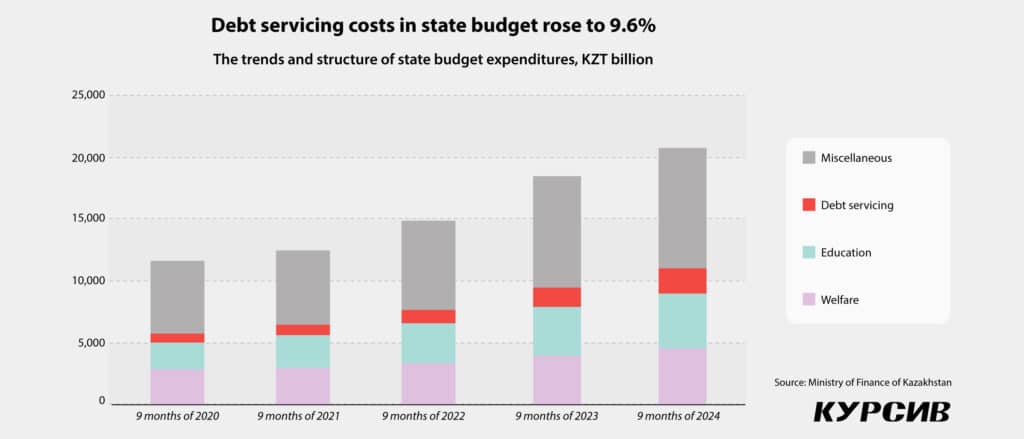

The budget deficit has also driven an increase in public debt. The extra withdrawals helped the cabinet avoid cuts to state budget spending, which reached KZT20.7 trillion from January to September 2024, a 12.4% increase YoY. The state budget expenditure execution rate remained stable at 67.3%, closely aligning with the historical average of 68%.

The government’s rising costs are being financed not only through additional National Fund withdrawals but also through increased borrowing, reflecting a persistent trend of closing the budget with a deficit.

This approach has impacted the structure of state budget spending, traditionally dominated by education, social security and healthcare. However, in January-September 2024, healthcare spending dropped to fourth place, replaced by rising debt servicing costs, which reached almost KZT2 trillion or 9.6% of total expenditures, up from KZT1.6 trillion (8.8%) over the same period last year.

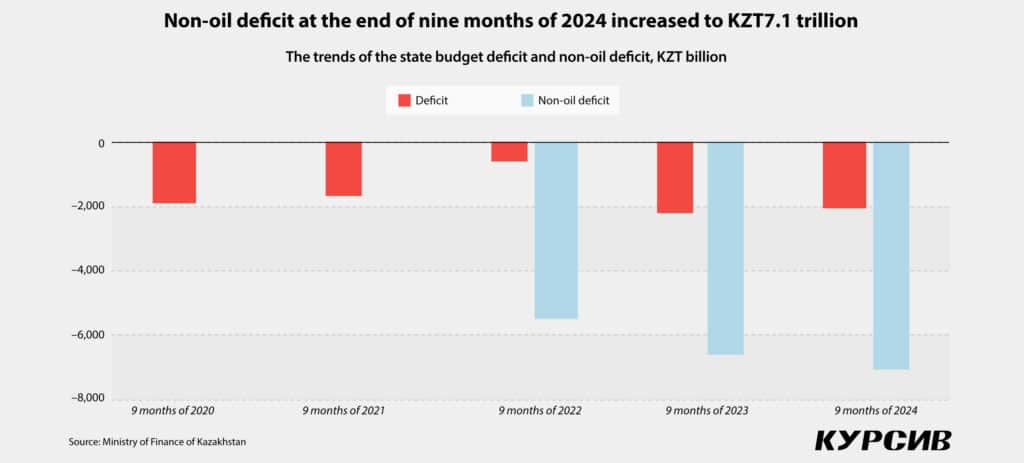

The gap between state budget revenues and expenditures continues to widen, reaching KZT1.7 trillion in January-September 2024, compared to KZT1.3 trillion in 2023. This ongoing fiscal imbalance drives growth in the non-oil budget deficit, which rose to KZT7.1 trillion, a 6.7% increase YoY.

National Fund faces massive withdrawals

National Fund withdrawals are set to reach unprecedented levels. In early November, the Ministry of Finance proposed amendments to the 2024 national budget law for public review, showing that tax collection performance is not expected to improve in the final months of the year.

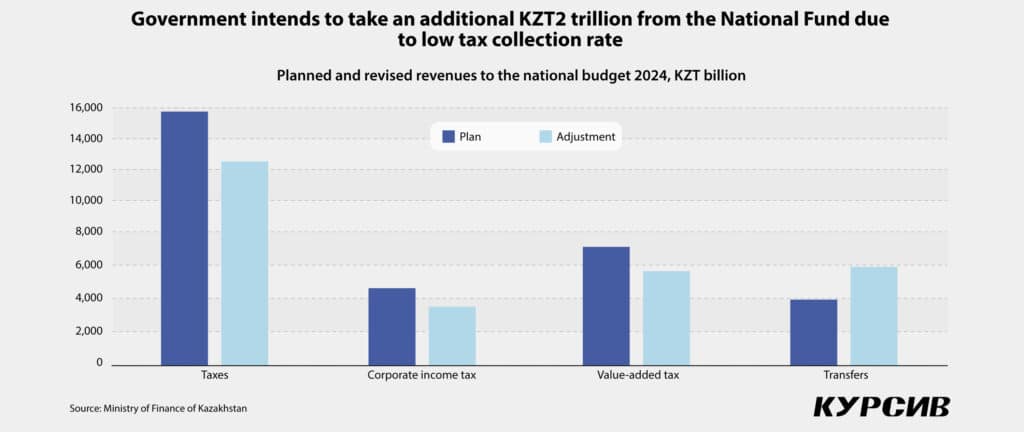

While budget expenditures remain largely on track, tax revenue projections have been adjusted downward. The Ministry has revised its tax revenue forecast to KZT12.7 trillion, a reduction of KZT3.1 trillion from the original target. The CIT from the non-oil sector is now forecasted at KZT3.7 trillion, down by KZT1.1 trillion, and VAT expectations have been adjusted to KZT5.8 trillion, a decrease of KZT1.5 trillion from the initial plan.

To cover this projected shortfall, the government plans additional withdrawals from the National Fund, likely through an indirect withdrawal mechanism. According to the draft law, «dividend payouts on the state block of shares and receipts of part of the net income of the state-owned enterprises» will increase by over KZT1 trillion. These two sources generated around KZT751.9 billion for the state budget from January through September 2024.

Additionally, targeted transfers from the National Fund will rise from the approved KZT2 trillion to KZT3.6 trillion to meet budgetary needs. According to the draft law, additional funds from the National Fund will be directed toward supporting regional economic growth and financing infrastructure projects of high social and strategic importance, especially given the risk of slowing GDP growth. With the already-approved KZT2 trillion guaranteed transfer, the government’s total withdrawal from the National Fund in 2024 will reach KZT5.6 trillion, surpassing the crisis-level withdrawals made in 2020 by KZT830 billion. When including costs associated with the Kazatomprom transaction, total fund utilization reaches an unprecedented KZT6.3 trillion, at least.