Sidus Space, a small space services company, plunged over 40% in premarket trading today, November 13, after the company announced it would sell 5.6 million new shares at $1.25 each. This is the lowest price Sidus shares have ever been offered to investors.

Details

Sidus Space stock dropped more than 40% to $1.30 per share in premarket trading today. Late yesterday, Tuesday, November 12, Sidus revealed the pricing for a previously announced new share issue: It will sell 5.6 million shares at $1.25 per share. With Sidus closing at $2.25 per share on Tuesday, the offering price represented a nearly 45% discount.

A company may set a below-market price when it needs to urgently raise capital, explains Sergey Glinyanov, a senior analyst at Freedom Finance Global. Sidus finds itself in such a situation, as its burn rate is significantly higher than currently available liquidity on its balance sheet, Glinyanov notes. Sidus has not yet reported its third-quarter results, but its net loss for the second quarter stood at $4.1 million.

Sidus expects to raise $7 million before fees from this offering, which is set to close tomorrow, Thursday, November 14. The proceeds will be used to supplement working capital and cover general corporate expenses.

About Sidus Space

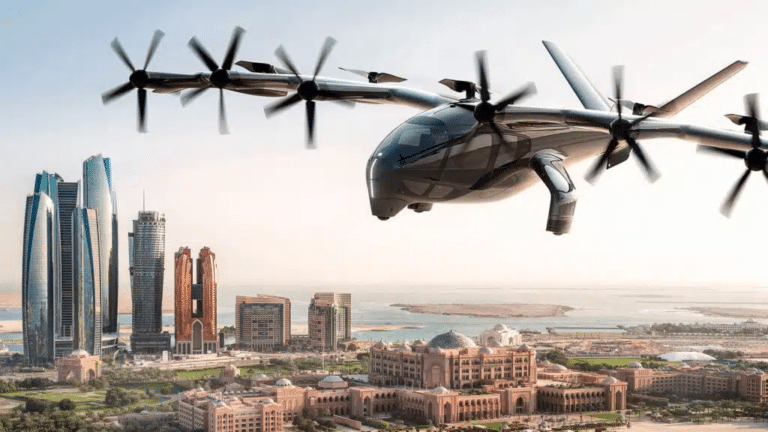

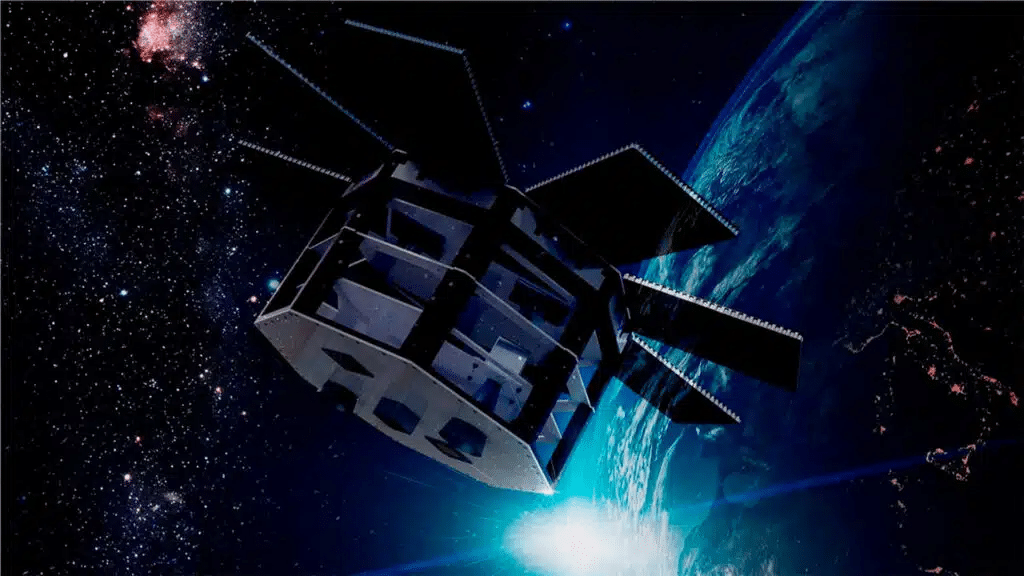

Sidus Space, with a market capitalization of $9.4 million, is a space-as-a-service company. It was founded in 2021 by Carol Craig, one of the first women authorized to operate combat aircraft in the U.S. Navy. That same year, Sidus went public on the Nasdaq at $5 per share, raising $15 million.

Sidus is building a constellation of 100 of its LizzieSat satellites, which allow clients to integrate their own sensors and technologies to gather space-based data. The company’s first satellite was launched in March as part of the Transporter rideshare mission of Elon Musk’s SpaceX. Sidus plans to launch its second satellite by the end of this year.

Since the beginning of 2024, Sidus has already gone to the market twice with share offerings. It sold 1.18 million shares at $4.50 each in January and then 1.30 million shares at $6.00 each in March. Over the last 12 months, Sidus has lost 75% of its market value. The company is followed by a single analyst from ThinkEquity, who, according to MarketWatch, has a “buy” rating with a target price of $10 per share. ThinkEquity is also the bookrunner for the current offering.