There is only one large mall in Tashkent but this won’t last long. How is retail market changing in Uzbekistan?

According to the InfoLine information agency, shopping centers in Uzbekistan have occupied only 13% of the retail market in 2024, whereas in neighboring Kazakhstan, this rate reached 30%. Meanwhile, bazaars still hold 85% of the market (compared to 58% in Kazakhstan). However, the number of high-quality retail centers in Uzbekistan’s capital city is expanding rapidly.

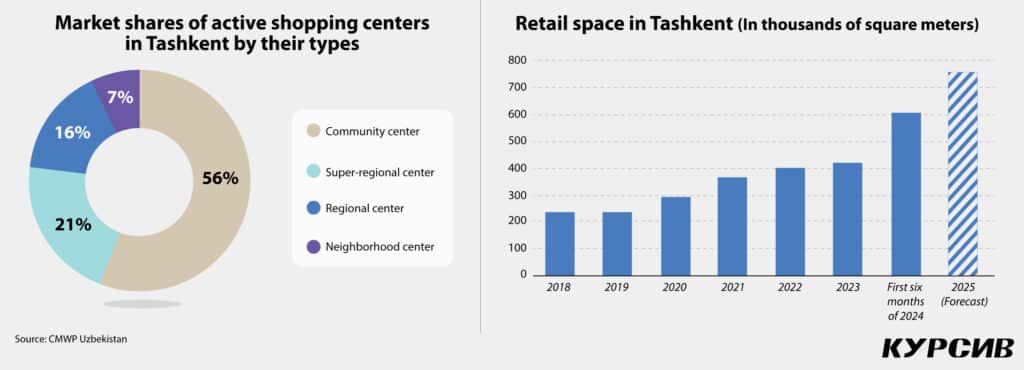

According to CMWP Uzbekistan, Tashkent’s retail space market saw significant growth in gross leasable area (GLA) of 478,500 square meters in 2024. This figure represents a 3.5-fold increase compared to the same indicator in 2019. Looking ahead, Tashkent’s retail market is expected to continue expanding, with an anticipated addition of 100,000 square meters of GLA in 2025.

As reported by CMWP Uzbekistan, there are 170,000 square meters of high-quality retail space available per thousand residents in Tashkent. This is 2.6 times lower than in Almaty.

The indicative lease rate for a 100-square-meter space on the ground floor in a large Tashkent shopping center has increased by 11% per year on average over the past five years, the agency said. For instance, in 2019, the rate was $24 per square meter, while in 2024, it has risen to $41 per square meter.

«The country’s sustained economic growth (anticipated GDP growth in 2025 is 6%), growing population (annual population growth is 2.2%) and yet a low level of competition make the Tashkent retail market an attractive spot for international retail chains,» Amal Khaitov, consultant at CMWP Uzbekistan, explained.

However, the only truly large shopping center in the city is Tashkent City Mall, with 103,000 square meters of floor space. Other centers range from 16,000 to 26,000 square meters. On top of that, foreign retailers face challenges like a shortage of high-quality warehouses, logistics difficulties and issues related to customs regulations when entering the market, Khaitov added.

Tashkent residents typically prefer visiting smaller neighborhood centers for their everyday shopping, purchasing clothes, groceries and other petty items. On the other hand, when it comes to larger shopping centers like Tashkent City Mall, people are visiting them not just for shopping but also for spending time in cafés and restaurants or watching movies.

«Judging by the volume of space occupied by retailers, fashion-retail items are the most in-demand goods at large shopping centers in Tashkent, as they account for half of GLA. The share of GLA that goes for restaurants/cafés and entertainment varies from 1% to 10% on average,» Khaitov said.

For comparison, in Kazakhstani shopping and entertainment centers, restaurants/cafés and entertainment spots cover up to half of the retail area if combined.

Online retail is also relatively uncommon in Uzbekistan, accounting for a modest 2% of the market, about six times less than in Kazakhstan. However, the sector is rapidly expanding, with a 100% year-on-year increase rate.