Royce spotlights a pair of high-conviction small-cap stocks

The portfolio managers of three micro-cap Royce funds have highlighted two high-conviction small-cap stocks: Transcat, a company specializing in equipment calibration, and Applied Optoelectronics, a provider of optical components. They stand out not only on fundamental metrics but also for features that cannot be quantified, such as customer-centricity and value chain analysis.

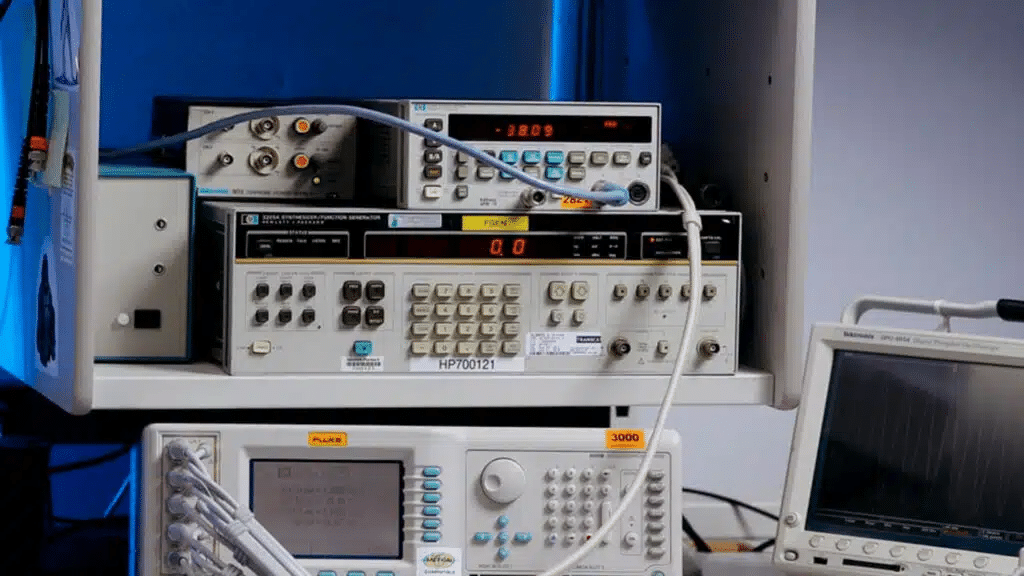

Transcat

With a market capitalization of just over $991 million, Transcat provides equipment calibration and repair services to various customers, including laboratories and pharmaceutical companies, on-site or at its own facilities. Another line of business is the distribution of complementary test and measurement equipment in the life science, aerospace & defense, and manufacturing sectors. The company’s differentiating features include a lower cost to acquire customers and the ability to attach calibration services at the initial sale, notes Andrew Palen, an assistant portfolio manager of the three micro-cap Royce funds.

According to MarketWatch, five analysts cover Transcat. Three have it as “buy,” while two advise holding it. Their average target price is $119.75 per share, indicating upside of more than 11%.

Applied Optoelectronics

With a market capitalization of $1.23 billion, Applied Optoelectronics makes fiber-optic cables, transceivers, and optical communication solutions. Its customers include cable TV market players, data centers, and telecom companies. Applied exemplifies a niche player well-positioned to benefit from major trends, as noted by portfolio manager Jim Stoeffel. It is at the forefront of rising demand for the optical components needed to build the infrastructure to support AI applications. In the third quarter of 2024, its revenue grew 4% year over year and 50% quarter over quarter to $65.2 million. The company reported that its cable TV business more than tripled as its customers transitioned to new architectures.

According to MarketWatch, among the four analysts covering Applied Optoelectronics, there are three “buys” and one “hold.” The average target price is $22.38 per share, above its current market price. Since the start of the year, the stock has gained almost 46%.

For investors

Given the tendency of micro-cap stocks to have greater volatility, all three Royce funds that invest in this segment are highly diversified, points out Stoeffel. Sound companies with more historically manageable growth rates and associated lower multiples are given higher weightings. Still, features that cannot be quantified, such as customer-centricity and value chain analysis, are also important, Palen adds.