The consumer confidence index (CCI) continues to strengthen in the optimistic zone. For the first time in a long while, actual (perceived) inflation has exceeded the population’s inflation expectations, despite consumers increasingly noticing the rise in prices for goods and services. There is a decline in overall anxiety, including concerns about the labor market. Credit confidence is on the rise, along with the proportion of Kazakhstanis planning to take out loans, though sentiment around deposit confidence remains unchanged.

This report highlights the findings from the 23rd wave of Freedom Finance Global PLC’s Consumer Confidence Survey, conducted monthly since November 2022 using United Research Technologies Group’s methodology.

Rising consumer optimism

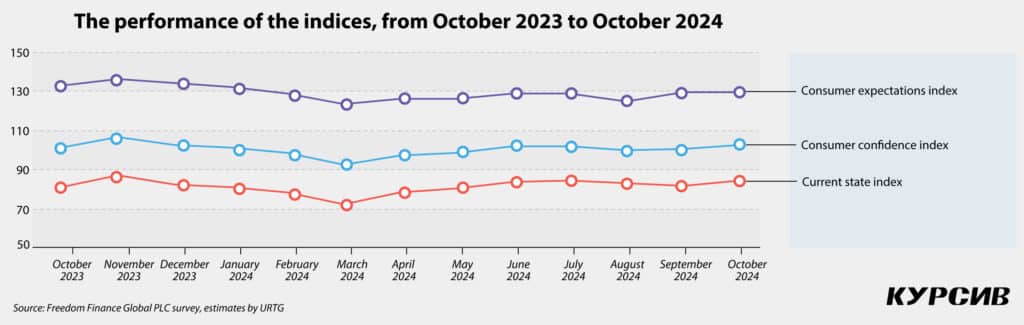

The October survey shows that consumer confidence continues to strengthen. After a decline in August, consumer optimism rose to 104.5 points in both September and October. The CCI increased by 1.9 points since September, nearly reaching July’s level of 104.2 points, which was one of the highest readings on record. The current state index also saw an increase, rising by 2.5 points to 86.8, while the consumer expectations index remained steady at 130.9.

Among the sub-indices, the most significant growth in October was seen in the personal finances index, which rose by 3.4 points to 132.5. At the same time, Kazakhstanis are adjusting their assessments of their personal financial situation to be more optimistic, with a 2.2-point increase to 104.4. In contrast, Kazakhstanis’ expectations for the country’s economy are moderating compared to the September survey, with both short-term expectations dropping by 1.4 points to 129.8 and long-term expectations falling by 2 points to 130.4.

Current trends in the CCI align with those of last year, when consumer confidence grew between September and November, reaching its highest value for the entire observation period.

Women and retirees are more pessimistic

A somewhat unusual situation is observed in the gender profile, where women — typically more optimistic — are showing more pessimistic assessments (102.8 points, down by 1.6 points) than men (106.5 points, up by 5.8 points), although both groups remain in the optimistic zone.

However, the trend in terms of age groups is more typical. Adult consumers (ages 45+) remain in the pessimistic zone, while younger consumers are more optimistic (118.3 points for young people and 105.3 points for young adults). Consumers aged 45 to 59 are approaching the neutral zone (99.6 points), while retirees not only remain the most pessimistic group (92.7 points) but are also the only age cohort experiencing a decline in consumer confidence (down by 2.2 points).

Regional stability

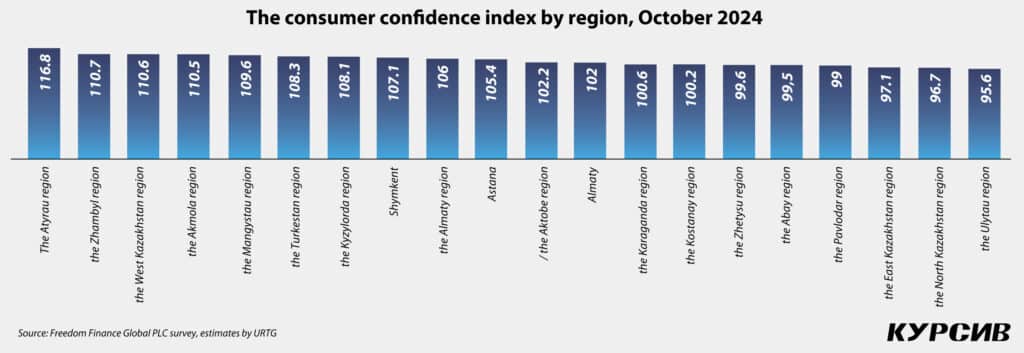

As in the previous month, October saw 14 regions of Kazakhstan in the consumer optimism zone. The following six regions are still in the pessimistic zone: the Abay (up 1.9 points to 99.5), East Kazakhstan (up 0.4 points to 97.1), North Kazakhstan (up 0.8 points to 95.9) and Ulytau (up 1.4 points to 95.6) regions. The Zhetysu (down 6.4 points to 99.6) and Pavlodar (down 2.1 points to 99) regions also returned to the pessimistic zone, while the Akmola (up 11.9 points to 110.5) and Atyrau (up 17.6 points to 116.8) regions moved out of it.

Along with the Akmola and Atyrau regions, the most noticeable growth in consumer confidence was observed in the Zhambyl (up 9.5 points to 110.7), West Kazakhstan (up 7.6 points to 110.6) and Kyzylorda (up 5.9 points to 108.1 points) regions.

Decreased anxiety

Continuing the trend observed in September, October also saw a decline in anxiety and concerns among Kazakhstanis, although the decrease was less pronounced than the previous month. The anxiety level dropped by 0.8 percentage points (p.p.) to 36.6%. Financial difficulties remained the leading cause of concern, mentioned by nearly a third of respondents (28.4%, an increase of 0.7 p.p.), followed by health issues, which were mentioned by one in ten Kazakhstanis (11.1%, a rise of 2.9 p.p.).

However, concerns about inflation and rising costs saw a slight uptick, with 8.1% of respondents (+1.2 p.p.) reporting worries. Concerns about unemployment (4.2%, +1.3 p.p.), social issues (3.4%, +1.9 p.p.) and infrastructure problems (3.0%, +1.1 p.p.) also rose slightly.

Accelerated inflation

According to the Bureau of National Statistics, annual inflation in October accelerated to 8.5%, reversing the slowdown trend since August and marking a 0.2% increase year-on-year (YoY). Interestingly, despite the acceleration in actual inflation, Kazakhstani consumers appeared to moderate their perceptions of price changes. Fewer respondents reported that prices grew faster than before (-3.3 p.p. to 47.5%). Meanwhile, the share of those who believed prices rose more slowly (+1.9 p.p. to 13.3%) or stayed the same (+1.5 p.p. to 5.7%) compared to the previous year increased.

Monthly inflation rose sharply, reaching 0.9% in October compared to 0.4% in September. Similarly, the subjective assessment of inflation over the past month reflected a slightly improved sentiment, with fewer Kazakhstanis noting a significant price increase (-2.2 p.p. to 37.5%) during October.

Actual inflation outpaces population expectations

This survey employs probabilistic quantification based on Burke’s methodology to calculate inflation expectations, which are inherently inertial.

In October 2024, the expected annual inflation rate decreased month-on-month, settling at 8.3%. However, for the first time in a long period, actual annual inflation (October 2024 vs. October 2023) surpassed population expectations, reaching 8.5%. The ratio of expected to perceived inflation dropped sharply to 0.998, signaling a significant adjustment in public inflation expectations, despite the rising U.S. dollar exchange rate.

Inflation assessments varied notably across regions. In Astana, the ratio of expected annual inflation to actual inflation was 1.10, while in Almaty, it was 1.01, with the national average at 1.0. Astana has experienced worsening inflation expectations for three consecutive months, likely driven by the devaluation of the tenge against the U.S. dollar. In contrast, residents’ expectations in Almaty have improved, aligning closely with the national average.

Women and young adults are concerned about rising prices

Women remain more concerned than men about rising prices, both over the past year (52.1% of women vs. 42.3% of men) and the past month (39.5% of women vs. 35.4% of men). Notably, this gender gap widened further in October.

Among age groups, young adults continue to express the highest concern about inflation. Over half (51.8%) believe prices have risen faster than last year, while more than a third (40.7%) reported a very sharp price increase over the past month.

In late October, a sharp increase in prices was more likely to be noted by residents of the Atyrau (56.1%) and Zhambyl (49.4%) regions. Over the past year, the Atyrau region recorded the highest share of less moderate assessments (59%), making it the leader in subjective inflation perceptions among the population for both the long and short term.

Frequent price hikes

In October, Kazakhstani consumers reported noticing price spikes more frequently, not only for essential food items and services like housing, utilities and communications, which consistently rank among the top 10 most expensive categories, but also for a broader range of goods. Reports of price hikes became more common for tea and coffee (+4.2 p.p. to 11.2%), fish and seafood (+3.5 p.p. to 10%), cheese and sausages (+2.9 p.p. to 13.3%), and vegetable oil (+5.8 p.p. to 18.6%).

Similarly, a growing share of respondents noted price spikes for key goods and services such as housing and utilities (+2.5 p.p. to 19.5%), meat and poultry (+4.1 p.p. to 40.2%), fruits and vegetables (+3.5 p.p. to 30.8%), flour (+4.8 p.p. to 20.5%), salt and sugar (+3.3 p.p. to 18.7%), and eggs (+3.9 p.p. to 17.2%).

Predicting price growth

Last month, Kazakhstani consumers showed greater optimism in their long-term inflation expectations. The share of those predicting slower price growth increased by 2.5 p.p. to 14.7%, while those expecting no price change rose by 1.7 p.p. to 8.9%. Despite this, the predominant view remains that prices will grow at a pace similar to last year, although the share of such respondents decreased by 5.2 p.p. to 34.8%.

Conversely, short-term inflation expectations became more pessimistic. The share of those anticipating a very sharp price increase next month rose by 2 p.p. to 21.9%. However, a significant proportion (33.1%) still expect moderate price growth in the coming month, maintaining the trend of moderate forecasts being the most common for both monthly and annual price trends.

Concerns about price growth

As usual, women continue to provide more pessimistic forecasts regarding price growth, both in the short-term outlook of a month (up 1.6 p.p. to 23.5%) and the long-term outlook of a year (up 0.7 p.p. to 26.3%). However, the gender gap is narrowing due to increased pessimistic forecasts among men for the second consecutive month. Men’s pessimism rose to 20.2% (a 2.4 p.p. rise) for the monthly outlook and to 24.3% (a 0.3 p.p. rise) for the annual forecast.

Regarding age differences, the group most pessimistic about price growth in the next month is adult Kazakhstanis aged 45 to 59, with 23.4% expressing concerns. For the annual outlook, young people (26.3%) remain the most concerned, though other age groups are closely aligned in their forecasts: young adults report 25.8%, Kazakhstanis aged 45 to 59 report 25.2% and retirees report 23.6%, indicating a relatively similar perspective across socio-demographic groups.

Geographically, residents of the Atyrau (31%) and Ulytau (28.4%) regions are most likely to expect significant price increases in the coming month. For the annual outlook, the highest levels of concern are found among residents of the Abay (31.2%), Kyzylorda (32%) and Atyrau (31.5%) regions.

Betting on dollar growth

Both in the short and long term, upward sentiment regarding the dollar’s exchange rate against the tenge has increased, with short-term forecasts showing greater polarization. Over the next year, the share of those expecting the dollar to strengthen has risen (+1.8 p.p. to 59.3%), driven by a decline in the share of those who expect the exchange rate to remain stable (-1.4 p.p. to 14.9%). A similar trend is observed in monthly forecasts, but the growth in upward sentiment is more pronounced, with a significant increase in the share of respondents expecting the dollar to rise (+5.3 p.p. to 40.5%).

Interestingly, short-term forecasts show a sharper rise in upward sentiment among women (+6 p.p. to 40.4%) compared to men (+4.5 p.p. to 40.6%). However, for the annual outlook, men report a larger increase in upward sentiment (+2.7 p.p. to 60.5%) than women (+1.1 p.p. to 58.3%). In age groups, young people remain the most confident in the dollar’s growth over the next year (69.8%, +3.4 p.p.), while those aged 30 to 44 years lead in short-term upward sentiment (45.7%, +12.7 p.p.). Regionally, residents of major cities express the strongest confidence in the dollar’s growth over the next year, with 68.8% in Almaty and 69% in Astana expecting an increase. Residents of the Abay region are the most optimistic, with 52.2% anticipating a stronger dollar in the month ahead.

Less concerns about the labor market

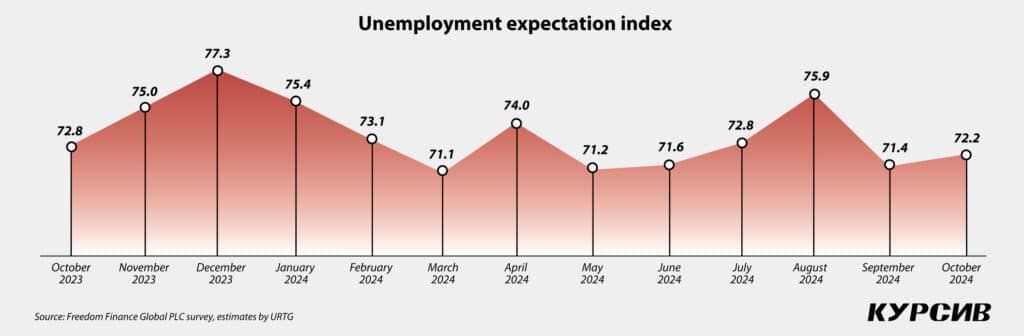

The October survey reveals a decline in concerns about the domestic labor market, as the unemployment expectation index rose by 0.8 points to 72.2. This shift stems from a decrease in the share of respondents who believe that unemployment will increase over the next year (-1 p.p. to 41.8%).

Men, who are typically more worried about labor market conditions, showed a slight reduction in pessimistic assessments (41.5%, -0.8 p.p.), while women, despite a larger decrease in their concerns (42.1%, -1.1 p.p.), continue to lead in expressing labor market anxieties. Concern about unemployment remains highest among older age groups, particularly pre-retirees (44%, -1.5 p.p.) and retirees (43.6%, -1.4 p.p.). Residents of the Atyrau (58.5%), Zhetysu (52.3%) and Ulytau (51.2%) regions remain the most anxious about job losses, whereas those in the Akmola region (33.6%) express the least concern about unemployment.

Fall is the season for purchases

In October, the share of Kazakhstanis planning to take out loans within the next 12 months rose significantly, with one in five respondents (21.1%, +3.2 p.p.) considering loans due to a corresponding drop in those previously uninterested in borrowing (-3.5 p.p. to 76.4%). The growth in borrowing intentions was more notable among women (+4.3 p.p. to 21.5%) compared to men (+2.1 p.p. to 20.7%) and among young adults (+6.6 p.p. to 26.1%). Regionally, residents of the West Kazakhstan (32.3%), Kyzylorda (30%) and Mangystau (30%) regions are the most likely to consider loans, while those in the North Kazakhstan region (9.4%) remain the least inclined toward borrowing.

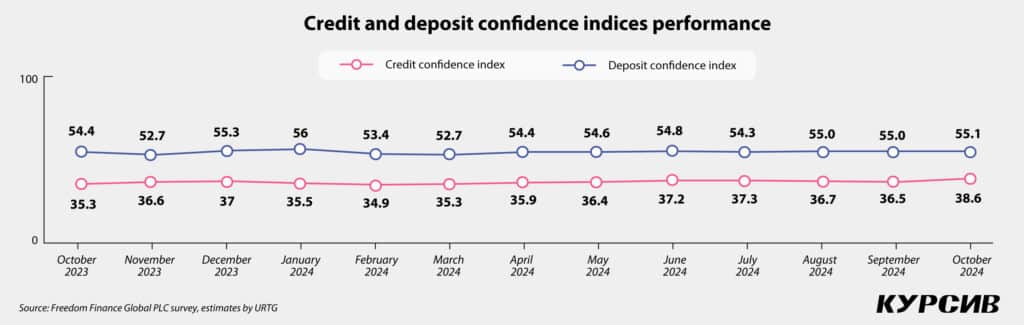

The credit confidence index rose by 2.1 points to 38.6, driven by a decrease in the share of Kazakhstanis who believe it is an unfavorable time to apply for loans (-4.1 p.p. to 46.1%). In October, both men (+2.2 points to 37.3) and women (+2 points to 39.8) showed a proportional increase in credit confidence. Among age groups, the youngest Kazakhstanis saw the most significant growth in credit confidence, rising by 4.7 points to 41.4. Despite age differences, trust in credit instruments increased across all groups. Regionally, the highest levels of credit confidence were reported by residents of the West Kazakhstan (44.4) region, the Mangystau region (45.6) and Astana (44), while the lowest was observed in the Zhetysu region (33.3).

However, the deposit confidence index showed little change in October, increasing by just 0.1 points to 55.1. Despite this, women slightly reduced their deposit confidence (+1.4 points to 56), while men saw an increase in confidence (-1.1 points to 54).

Among age groups, young people also showed a rise in deposit confidence (+1.7 points to 60.5), while adults expressed more cautious assessments — Kazakhstanis aged 45 to 59 scored 53.3 points and those over 60 scored 49.6 points. The highest deposit confidence was seen in the western macro-region, particularly in the Atyrau and West Kazakhstan regions (61 points each), while the lowest was in the Kostanay (49.7) and North Kazakhstan (49.4) regions.

The atmosphere is rather calm

The proportion of Kazakhstanis who believe the general atmosphere around them is calm has remained nearly unchanged at 56.7% (-0.3 p.p.). The share of those who describe the mood as anxious has also stayed steady since September (36.9%). As a result, the anxiety index decreased slightly by 0.3 p.p., reaching 119.7. Men are more likely to describe their environment as clearly calm (36.4%, compared to 30.5% of women), while the share of those noting a somewhat calm sentiment is the same for both genders (23.4%). Young people continue to report the highest levels of calm sentiment, with nearly two-thirds (65%) feeling surrounded by calm moods. In contrast, anxiety tends to increase with age. The highest levels of anxiety are found in the Pavlodar region (44.4%) and Almaty (44.3%), while the lowest are in the Kyzylorda (23.3%) and Mangystau (22.3%) regions.

Alongside the increase in calm moods, the percentage of Kazakhstanis who reported not facing stress in the past month has slightly risen to 47.4% (+0.6 p.p.), though nearly one in ten Kazakhstanis noted experiencing daily stress during the month (-1 p.p. to 9.8%). Women continue to experience higher levels of stress (54.6%, compared to 44% of men), and young adults (54.3%) report the highest frequency of stress. Regionally, residents of Almaty (57.6%) and the West Kazakhstan region (56.2%) report encountering stress most often, while those in the Mangystau region (34.2%) experience it the least.

Optimistic October despite accelerating inflation

October 2024 saw further growth in the consumer confidence index, strengthening its position in the optimistic zone. However, compared to the previous month, Kazakhstanis have become more pessimistic about the country’s economic development. Adult consumers are nearing the neutral zone of consumer confidence, while retirees and residents of a quarter of the country’s regions remain in the pessimistic zone.

For the first time in a long while, perceived inflation has surpassed the population’s inflation expectations. When assessing past price trends, Kazakhstanis have tended to adjust their views toward more moderate assessments. The rise in prices for goods and services — some not typically included in the conventional top categories — has become more noticeable. Kazakhstani consumers are more inclined to expect price increases in the coming month, though their annual price growth forecasts remain relatively moderate.

Overall, anxiety levels have decreased, though financial difficulties and health concerns continue to be the primary sources of worry. Anxiety about unemployment is also declining. While deposit confidence remained unchanged in October, credit confidence saw an increase, as did the proportion of those planning to take out loans in the next 12 months. However, the index for major purchases did not show a significant increase.