Shares of Liberty Energy, an oilfield services company, advanced about 5% on Monday, November 18, following the announcement by President-elect Donald Trump that he would nominate Liberty’s founder and CEO, Christopher Wright, as the next U.S. secretary of energy, as MarketWatch reports.

Details

On the news about Trump’s nomination of Wright, Liberty Energy shares climbed almost 5% on Monday to $17.70 per share before extending those gains in after-hours trading.

“I am deeply honored by this nomination and opportunity to serve our country and continue the mission of bringing affordable, reliable energy to the citizens of the United States and beyond,” Wright said in a statement released by the company.

The nomination requires Senate confirmation. Until then, Wright will remain chairman and CEO of Liberty Energy.

As of this writing on Tuesday, November 19, Liberty Energy shares were down about 1.3% during early trading.

About Wright and Liberty Energy

Founded in 2011, Liberty Energy provides services to onshore oil and natural gas exploration and production companies, including solutions for hydraulic fracturing, which unlocks otherwise unreachable reserves.

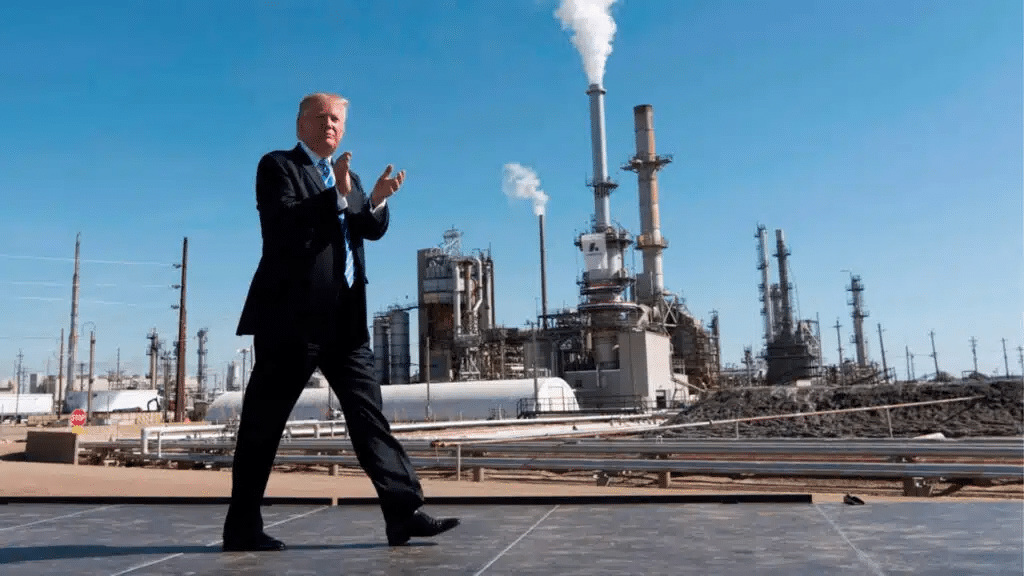

Wright is a strong supporter of oil and gas development, according to the Associated Press. He has been an outspoken critic of efforts to fight climate change and is expected to give fossil fuels a boost if confirmed. Liberty Energy highlights Wright’s commitment to “abundant, affordable, and reliable” energy.

Wright is also a board member of Oklo, a nuclear power company founded by Sam Altman, the CEO of OpenAI, the company behind ChatGPT. On Monday, Oklo shares surged nearly 15% to $20.70 per share.

Analyst insights

According to MarketWatch, 14 analysts track Liberty Energy. Six have a “buy” recommendation, while eight rate the stock a “hold.” Their average target price is $21 per share, for upside of about 19%.