Afghan Bazaar: Entrepreneurs’ guide to start cooperation with Afghanistan

Zaman Bank’s bold decision to establish cooperation with Afghanistan led to a successful $10,000 test transfer between the Kazakhstani bank and Afghanistan’s Ghazanfar Bank. Kursiv.media has spoken with Kazakhstani entrepreneurs who either have already been trading with Afghanistan or are considering starting such a cooperation.

Spectrum of opinion

Kazakhstani businessmen cooperating (or planning to do so) with entrepreneurs in Afghanistan can be divided into three groups.

The first group comprises those already satisfied with the current situation. For instance, a flour miller from the Kostanay region, who has already been supplying goods to Afghanistan for 25 years, said that he has worked with Afghan businessmen for many years and they have trust in each other. «The only thing we need is just to be free from anyone who would hinder this cooperation.» According to the entrepreneur, his Afghan partners handle all the logistics and payment-related issues on their own, so the news about the first successful money transfer didn’t spark any interest in him. «I don’t think about it. They make me get the money and I don’t care how they do this. When I see the money in my account, I ship flour. That’s it,» the miller explained.

The second group highlights both business and mindset-related challenges. For instance, a pasta producer from Taraz, who is still contemplating trade with Afghanistan, is putting stake in barter deals. The volatility of dollar exchange rates doesn’t appeal to him, so he is probing to find stability in commodity exchange rates.

«I am not considering cross-border transfers; my target is a barter,» he confessed. «We are going to give them what they lack and grab what we need in return. Saffron, for example, it can also be sold to China, or pomegranate juice. Let’s say I give a kilogram of pasta and in exchange, I get two liters of juice. In this case, the dollar doesn’t play a role. I calculate pasta in tenge, the same with juice.»

To cooperate with partners in Afghanistan, the entrepreneur is learning English. «All educated people speak English there: 20 years of U.S. presence haven’t passed without leaving a trace. But there are also people who can speak Russian, mostly from the older generation. I mean, it’s not a problem to find an interpreter.» The businessman discovered this during his trip to Kabul, where he attended a Kazakhstani trade fair. At the exhibition, he noticed the attitude of Afghan businesswomen. «The popular opinion states that it’s forbidden to talk to a female stranger or look at her, but they were coming to me and inquiring about my products,» he wondered.

The business owner from Almaty who wants to order handmade rugs from Afghanistan believes that successful cooperation with Afghans can only be established after meeting in person in Afghanistan, Kazakhstan or a neutral area like Dubai. «Once you were invited as a guest to your Afghan partner’s home, you’re considered a reliable partner,» he noted. «This is the Oriental culture — they value reverence.» Insiders also consider mandatory small talk referring to how things are going at home or how the kids are doing before starting business negotiations as part of Oriental culture.

The third group admits that many problems have accumulated in trade between Kazakhstan and Afghanistan, and the crisis of trust is visible. According to an Afghan bulk buyer of Kazakhstani flour, who has been working in the market for 15 years, the key problem associated with trade with Kazakhstan is rogue suppliers who delay the shipment for months after receiving the down payment or deliver goods of poor quality.

«The current price difference between decent and poor flour is $50. Last year, the difference was $100. Moreover, some mills delay the shipments. Instead of taking loans from a bank, they use our money as leverage for two or five months. They neither return the money nor ship flour. That’s why the majority of Afghans are abandoning cooperation with Kazakhstani suppliers.»

Nevertheless, the merchant highlights that he has several reliable partners in Kazakhstan he can call by name with whom the work has been flawless for years. However, he can also name all the «rogue mills» outright.

The government’s view on business relationships

Kazakhstan officials have their own opinion on such disputes.

Arman Yessentayev, the regional representative of Kazakhstan’s Chamber of International Commerce and head of Kazakhstan’s Trading House in Afghanistan, attributed the low quality of last year’s Kazakhstani wheat yield to poor weather conditions.

«However, this year, Kazakhstan’s elevators are stocked with 6.9 million tons of grain, including 5.5 million tons of wheat. Notably, 60% of this wheat falls into the third class of quality. In summary, the harvest is not only abundant but also largely composed of high-quality wheat,» he said.

Yessentayev encourages Kazakhstani companies to «actively sell wheat to Afghanistan, even at the relatively low prices set by the market.» «Since this is business, trust issues exist on both sides. For example, there are outstanding debts from 2018 and 2020, but we are successfully resolving them,» he noted, addressing trust issues.

The official also highlighted several critical issues that Kazakhstani businessmen need to consider.

Payments. Banking transactions are conducted through third countries such as Kyrgyzstan, Tajikistan, Uzbekistan, Turkey and the UAE. Additional challenges can arise when closing export contracts, as Afghan companies may sometimes transfer payments from countries not specified in the contract. This requires additional explanations regarding the source of proceeds. However, the situation is changing. Beyond the agreement between Zaman Bank and Ghazanfar Bank, new arrangements are expected with the Afghan International Bank, Afghan United Bank and Azizi Bank.

Despite Afghanistan’s current challenging economic situation, Yessentayev remains confident in the paying capacity of the country’s business community. In fact, they are often ready to make advance payments.

The Chamber of Commerce representative also highlighted differences in business approaches that must be considered. Afghans typically start negotiations with unreasonably low prices and gradually increase them, while Kazakhstanis begin with realistic prices that include a small margin.

Logistics. Despite the availability of railways and roads, logistical challenges exist, Yessentayev admitted. The Afghan route is not profitable for Kazakhstani freight forwarders, leaving the market for logistics companies from Turkmenistan and Uzbekistan.

Seasonal shortages may occur, leading to an increase in railway car prices. However, in the fall of 2024, there have been no issues with car availability, either through Uzbekistan or Turkmenistan.

Visas. Afghanistan’s visa policy is relatively lenient, as the government has issued instructions to promote trade in the region. As a result, business visas for Kazakhstani citizens are issued quickly, and an «on-arrival» visa option is also available. At the same time, Afghan entrepreneurs note that obtaining a Kazakhstani visa can be challenging. However, there are no legal obstacles; the main reason for denial is often a mismatch between the visa type and the purpose of the trip. For example, applying for a tourist multiple-trip visa when attending a trade fair.

Duties. Many goods of Afghan origin are subject to zero or reduced customs duties in Kazakhstan. These include handmade rugs, nuts and dried fruit.

On the other hand, Afghan authorities are focused on developing the domestic milling sector, prioritizing wheat acquisition. The customs duty on flour increased from 5% to 10% in October.

«Afghanistan today is like Kazakhstan in the 1990s»

Yessentayev sees potential in barter deals. He believes that the two governments should think about establishing a commodity exchange mechanism to boost Kazakhstan’s wheat and flour exports not only to Afghanistan but to Pakistan and Iran.

What else can be sold to Afghanistan? Cars, batteries, transformers, cables, electrical conductors, fittings for pipelines, boilers, reservoirs, cisterns, fuel tanks, fertilizers, household appliances, sunflower oil, polypropylene, polyvinyl chloride, household chemicals, medicines, gases, bitumen, rolled metal, bars, metal structures, wire, cheese and sausages, Yessentayev specified.

The entrepreneurs Kursiv.media spoke with frequently compared Afghanistan to China and Uzbekistan. They emphasized that Afghanistan significantly lags in technological development, which is exactly where the business opportunities lie.

«I traveled around Uzbekistan and saw that we have nothing to catch there, as it is a country developed in all aspects. They have massive protective duties on imports of processed goods. The Uzbeks buy wheat and make their own pasta. In comparison, Afghanistan’s production capacity is much weaker. So we can go there not only with flour but also with ready pasta. Afghanistan is going through our Dashing 90s, the time when we consumed everything imported.»

«You feel fear at first, but then the stereotypes fade,» was the main sentiment shared by Kazakhstani entrepreneurs. With almost childlike wonder, they described how they realized that ordinary people in Afghanistan are no different from people anywhere else.

«I felt uneasy at first; it’s not the same as going to the U.S. or anything. However, after spending a month there, I relaxed and traveled by local car without fear. Before the trip, I was controlled by stereotypes, but when I arrived, I saw friendly people. Ordinary people at the airport, smiling at you in shops, glad to see you,» a businessman from Almaty shared his experience.

What products do Afghanistan and Kazakhstan trade with each other today?

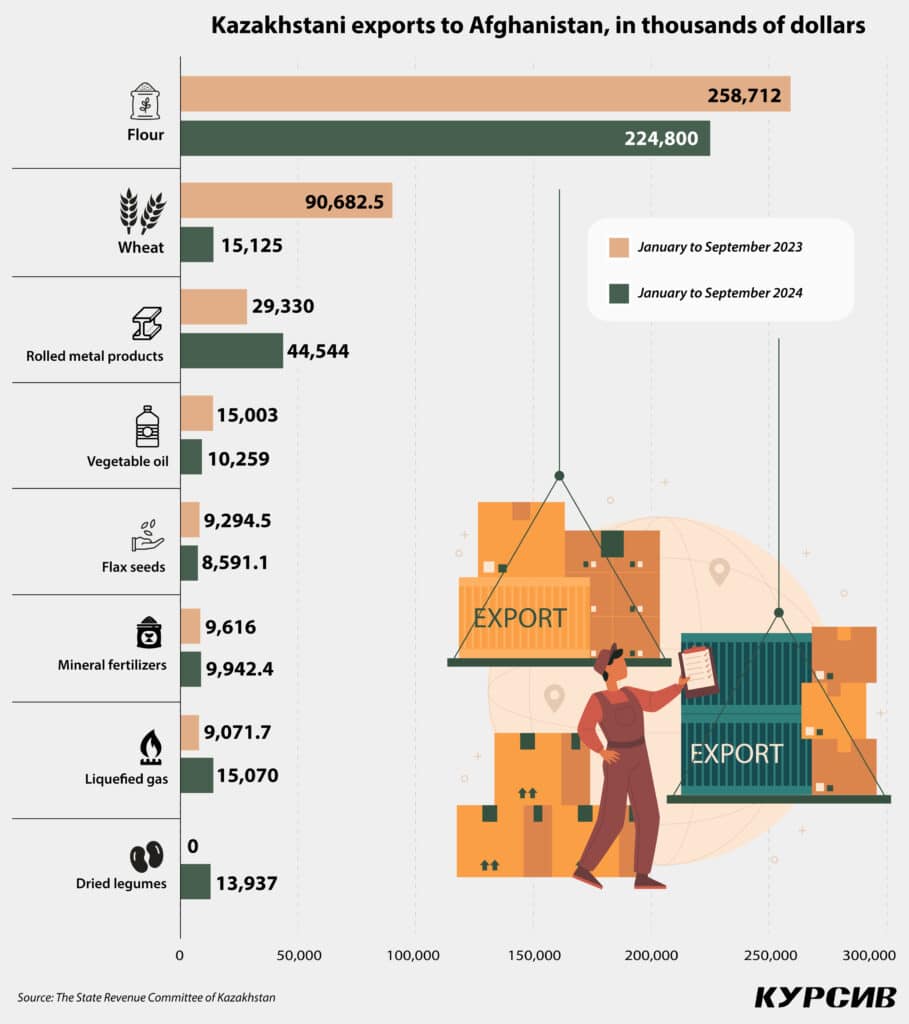

Speaking of mutual trade between Kazakhstan and Afghanistan, the imports from Afghanistan may be ignored as it is 30 times smaller than exports, mainly consisting of fruits and vegetables. Kazakhstan is focused on increasing its sales, using 2022 as a benchmark when exports unexpectedly doubled, reaching roughly $1 billion. However, this surge didn’t last long, as trade fell back to 2020 levels the following year. This year also fails to inspire as figures are declining. Over the period from January to September, Kazakhstan’s exports to Afghanistan totaled $356.3 million, a 20.7% drop compared to the same period last year.

The main item of export is flour; it exceeds 60% in the sales pattern, making Kazakhstan’s commodity turnover with Afghanistan highly dependent on the grain market situation. Kazakhstan experienced great success in terms of yield and grain prices in 2022, enabling it to deliver record-breaking volumes of flour to Afghanistan. We should also remember that the groundbreaking event of the year — the outbreak of the military conflict in Ukraine — had a significant impact on the global food market at that time.

The market trend of 2022 has not been repeated since. In 2023, while flour exports to Afghanistan in physical terms decreased only by 6.4% to 1.271 million tons, their monetary value dropped by a third, from $554 million to $368 million. Despite a good harvest in 2024, it seems unlikely for any price miracle to happen.

Nevertheless, sales of other items are on the rise, such as rolled metal products and liquefied gas, and the export of some items, like peas and other legumes, has even emerged from scratch.