“There’s no doubt: the higher the levels of crime and violence, the greater the demand for our services,” says Eyal Sheratzky, co-CEO of Ituran, in an exclusive interview with Kursiv.Investments.

This Israeli company, with a market capitalization of almost $580 million on the Nasdaq, provides satellite vehicle-tracking services. It helps clients to locate stolen cars, insurance companies to monitor driver behavior, and vehicles to exchange information with one another about direction, speed, sudden braking, and more.

“I don’t think crime will vanish anytime soon as instability is growing in the world,” Sheratzky remarks while sitting at the company’s headquarters in Azor, a small town near Tel Aviv.

During the interview, a rocket warning siren goes off, prompting him to seek shelter.

A small dream

Ituran is largely a family business. It was founded by Izzy Sheratzky and his two sons — the eldest, Eyal, and the middle one, Nir. Later, Izzy’s youngest son, Gil, brother, Efraim, and niece, Tal Sheratzky-Jaffa, joined the business. Thus, two generations of the Sheratzky family are now involved in the company.

Eyal Sheratzky cofounded Ituran alongside his father / Photo: en.globes.co.il

The company’s journey began in 1995. By then, Izzy Sheratzky had worked in the insurance industry for 20 years, investigating claims for insurance firms, recalls Eyal Sheratzky.

This made him acutely aware of Israel’s problem with car theft, and he was after a solution. He found one at Tadiran, an engineering company that had developed a radio frequency-based tracking system capable of locating stolen cars. Izzy Sheratzky led an investor group that acquired the technology for “several million dollars,” says Eyal Sheratzky.

Tadiran had originally developed the technology for the Israel Defense Forces before adapting it for civilian use, but it did not succeed commercially.

At the time, the system was hampered, recalls Eyal, as GPS was primarily used by the military, and its civilian application and mobile penetration were limited. As a result, the new technology relied on radio frequencies.

Initially, Ituran hoped to attract insurance companies as clients. However, it soon discovered that insurers needed proven cases demonstrating the technology’s effectiveness.

Thus, Ituran began offering drivers the opportunity to use its services through a monthly subscription. This allowed the company to demonstrate the results needed by insurance companies and desired by drivers.

In the early years, Ituran’s growth was constrained by the limited bandwidth of radio frequencies.

“At the time, we dreamed of reaching 300,000 subscribers, but everyone thought we were crazy as the Israeli market was so small,” Eyal Sheratzky recalls. “It’s funny to look back on that now.”

Everything changed with the advent of GSM and later GPRS technologies, which enabled data exchange not only within the GSM network but also with external networks. This allowed Ituran to begin providing satellite vehicle-tracking services.

At the system’s core lies a black box with sensors installed in the car and software that transfers the data collected — such as location, whether the driver is speeding, mechanical problems, and more — to a server.

Today, Ituran has 2.3 million subscribers across 26 countries. “This far exceeds our initial expectations,” Eyal Sheratzky says.

From local to global

With the expansion of network bandwidth, Ituran began exploring new solutions to drive growth, recalls Eyal Sheratzky.

This led to the development of fleet management solutions and usage-based insurance (UBI) for insurers. This type of auto insurance calculates premiums based not only on a driver’s age and experience but also on mileage, cornering style, and airbag deployment, an indicator of accidents.

Sheratzky puts the company’s clients into two groups: individual consumers who purchase Ituran products for personal use and businesses such as fleet operators, insurance companies, car dealers, and automakers. He explained that since the company’s clients and their preferred products vary by country due to cultural differences, Ituran always tailors solutions to local needs first before trying to introduce them to other markets.

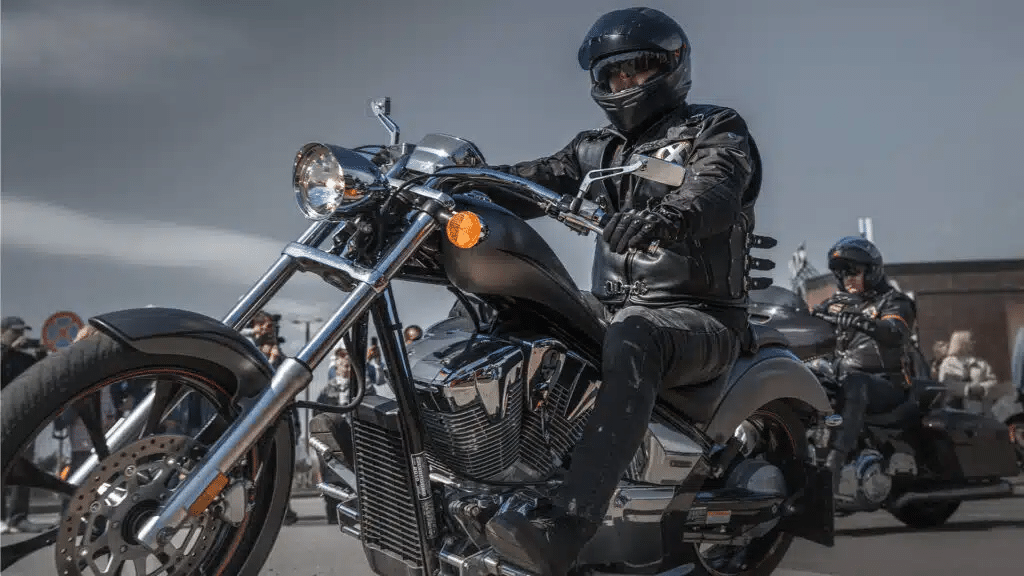

He provides an example: In Brazil, motorcycles are a popular mode of transportation, but insurance was historically so expensive that people went without it.

“We developed a special device that can be installed in motorcycles to send signals to their owners and to our control center. This helped reduce risks for insurers,” he says.

In this case, Ituran acts as a broker, bringing customers to insurance companies.

Conversely, in the U.S. and Israel, motorcycle owners use Ituran services to avoid insuring their vehicles.

“So, I don’t think we’re competing with insurers,” Sheratzky argues. “We attract an audience that would never have been their customers, unlocking a vast and untapped segment without cannibalizing the market.”

In 2023, Ituran signed its first-ever contract with a bank, a subsidiary of Santander in Brazil, allowing its clients who had installed an Ituran tracker to secure auto loan approvals faster and at better rates.

Sheratzky calls the project mutually beneficial: “We have saved them tens of millions of reals (BRL10 million, for example, is about $1.72 million) by ensuring the bank’s collateral is covered. Our profitability has also been great, so we’re doing everything to extend the contract.”

Sheratzky notes that Santander’s subsidiary currently holds exclusivity rights that prevent Ituran from signing similar agreements with any other bank until the contract expires in February 2025. In the meantime, Ituran has already begun talks with another player (whose name Sheratzky did not disclose), and it does not plan to stop there.

Adding value

The main driver of demand for Ituran services is stolen vehicle recovery. Nevertheless, as Sheratzky points out, while this segment accounted for 95% of the business a decade ago, it represents only two thirds now.

In recent years, the company has been expanding its value-added services, such as a concierge that helps drivers find, say, the nearest gas station or hospital, along with roadside assistance in case of a breakdown or other mishaps, and a connected car platform that offers an array of features, including maintenance history, system diagnostics, and remote connectivity — it can even schedule check-ups.

Ituran also partners with automakers like Nissan and General Motors. However, since it is more interested in generating recurring revenue, the company prefers to offer its services through the automakers’ software platforms, Sheratzky notes.

A year ago, an Ituran division, IturanMob, partnered with Porsche Cup Brazil to provide real-time performance and endurance data, such as engine and tire management, to Porsche’s engineering team.

Two stock exchanges

Sheratzky describes Ituran’s approach to business as conservative: minimal debt and tight cost control. He says that whereas the company once relied on loan financing, it has largely stopped taking out loans since the early 2000s. At that time, the dot-com bubble burst and many internet startups went bankrupt, causing investment funds to lose about $5 trillion.

Instead, Ituran has raised equity funding as a public company. In 1998, it went public on the Tel Aviv Stock Exchange, raising $6 million at a valuation at $30 million. The offering was a resounding success, as reported by the Israeli newspaper Globes. Initially valued at ILS142 million in the run-up to the IPO, the valuation had risen to ILS162 million at the time of the placement. The proceeds were used to expand operations in Brazil and Argentina and enter the U.S. market.

Seven years later, in 2005, Ituran went public on the Nasdaq.

“Our shareholders wanted more liquidity, and we wanted to broaden our shareholder base and gain access to new investments,” Sheratzky explains.

In New York, Ituran raised $49.9 million at a $294.0 million valuation, with an additional $12.5 million worth of shares sold by its shareholders.

Sheratzky adds that over the past 19 years, Ituran has paid out about $400 million in dividends. Because of that, a Forbes contributor recently included it in a list of five “unloved small-cap stocks with strong dividends,” while pointing out that “generous dividend payers tend to operate in mature industries and markets that offer limited growth potential.” Sheratzky disagrees: “Ituran is growing, its client base is expanding, the company has no debt, and it shares profits with shareholders — it doesn’t get any better than this.”

Simply Wall St has included Ituran in a list of three dividend stocks for stability-seeking investors. Meanwhile, Freedom Broker has spotlighted it as one of six stocks with impressive upside. According to MarketWatch, the two analysts covering Ituran recommend buying the stock with a target price of $36.10 per share. On Monday, November 25, Ituran closed at $29.14 per share on the Nasdaq.

Over the past three years, Ituran has experienced the fastest growth in its history, Sheratzky says. In 2023, revenue advanced 9% year over year to $320 million, with net profit up 30% at $48.1 million. In 2022, the top and bottom lines grew 8% apiece to $293.1 million and $37.1 million, respectively. In 2021, the company posted $270.9 million in revenue (up 10%) and $34.3 million in net profit.

Sheratzky recalls two particularly challenging periods in the company’s history: the 2008 financial crisis and the COVID-19 pandemic. However, its conservative strategy helped Ituran to weather both. For example, in 2008, Ituran had $25 million in cash with no debt, which meant it was largely unaffected by the breakdown of the banking system.

At the height of the pandemic, car sales plummeted due to lockdowns, reducing demand for Ituran’s devices. But car owners continued paying for Ituran subscription services. In 2020, the company’s revenue fell 12% year over year to $245.6 million, while net profit came in at $16.1 million.

Now, Ituran has a new goal: In five years, Sheratzky says, the company aims to reach over 3 million subscribers and have a portfolio of “diverse services and cutting-edge solutions.” It plans to achieve this by entering new segments and geographies and selling new technologies such as big data engines.