Exchange rate volatility and high interest rates on tenge deposits make it challenging to objectively assess the trends in financial flows between banks and retail clients. To tackle these challenges, Kursiv.media sought to eliminate the impact of these two distorting factors to provide a clearer analysis.

Kursiv.media surveyed Kazakhstan’s 10 leading universal banks, which are the most popular choices for placing temporarily idle funds. According to the National Bank, by the end of the first three quarters of 2024, the aggregate balances in retail customer accounts at the 10 banks surveyed increased by 2 trillion tenge (from 17.4 trillion tenge on Jan. 1 to 19.4 trillion tenge on Oct. 1), approximately $4 billion (USD 1 = KZT480.11 as of Oct. 1, 2024), representing growth of 11.5%. Judging only by the nominal size of the portfolio at the beginning and end of the period, the overall growth looks quite high, and it seems that citizens are actively replenishing their bank accounts. However, the nominal trend does not take into account two important factors.

First, exchange rate revaluation introduces certain distortions in interpreting the actual trend. Since the beginning of the year, the tenge has depreciated against the dollar by 5.9% (from KZT454.6 to KZT481.2 per USD). The foreign exchange part of the bank portfolios automatically grew by the same amount when recalculated in the tenge equivalent, creating an illusion of fund inflows. Data from the National Bank, which outlines the structure of retail funds in second-tier banks (STBs) by currency, helps to account for this distortion.

Secondly, banks contribute significantly to nominal growth by accruing monthly interest on deposits. This factor does not impact foreign currency deposits or funds in current accounts (except for the minimal 1% annual interest on dollar deposits). However, it has a tangible effect on the tenge portfolio. For example, in September, the weighted average rate on individual deposits was 13.4% per annum. Over the past nine months, the portfolio of deposits in the national currency has grown by at least 10% solely due to accrued interest. For comparison, in nominal terms, the volume of tenge deposits in the top 10 banks surveyed increased by 22.6% since the beginning of the year (from 10.0 trillion tenge to 12.3 trillion tenge). Thus, accrued interest accounts for almost half of the nominal growth in this sub-portfolio.

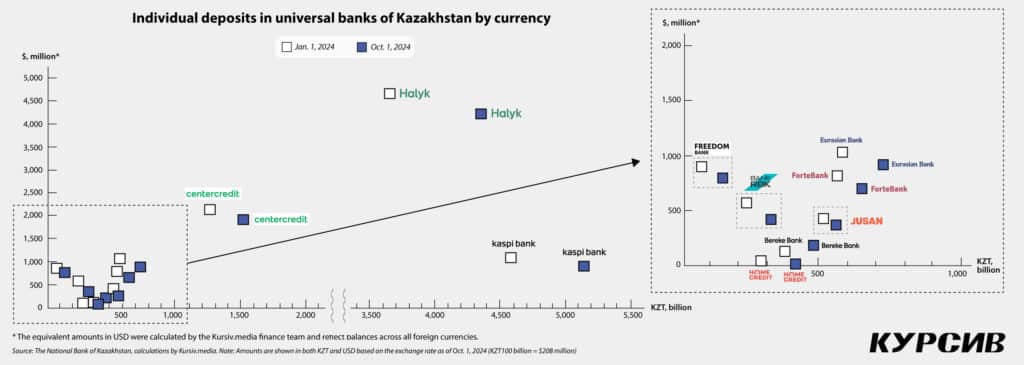

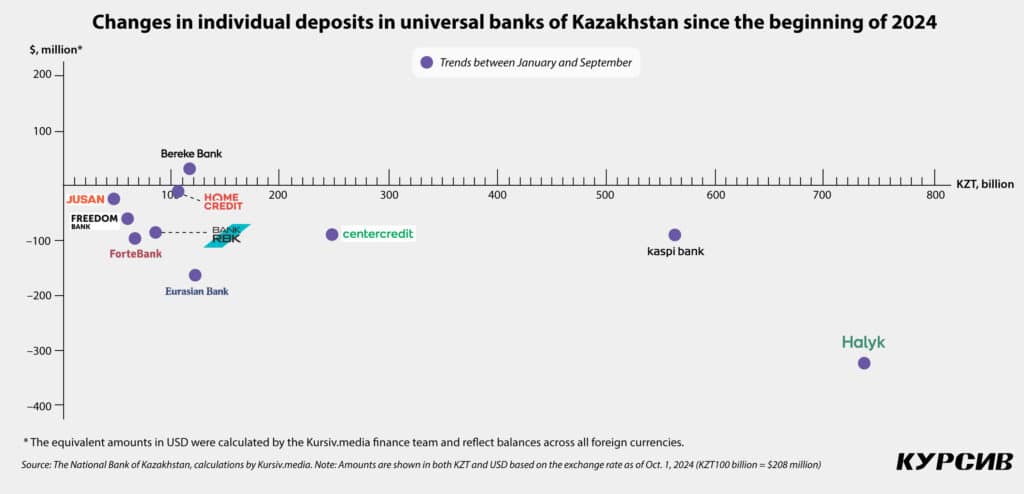

As shown in the infographics (changes in individual deposits by currency, including current accounts), by the end of the first three quarters, all banks in the top 10 had increased the tenge portion of their portfolios. Meanwhile, all of them except for Bereke Bank experienced a reduction in the foreign exchange portion. In every case, the inflow of tenge deposits outweighed the outflow of dollars. It can be assumed with a high degree of probability that clients did not withdraw dollars from banks but converted them into tenge in pursuit of higher returns. All in all, the tenge portfolio increased by 2.2 trillion tenge ($4.5 billion), while the foreign currency portfolio (in tenge equivalent) decreased by only 156 billion tenge ($324 million). However, in dollar terms (recalculating the foreign currency portfolio based on the exchange rates at the beginning and end of the period), the reduction in foreign currency funds amounted to $955 million or 438 billion tenge (calculated at the average exchange rate for the three quarters). Taking exchange rate revaluation into account, the growth of the total portfolio declines from 2.0 trillion tenge to 1.7 trillion.

Further basic calculations (to understand the weight of accrued interest in the nominal growth) are approximate, as they are based on the deposit base at the beginning of the year and do not account for subsequent net inflows, capitalization of interest or interest on dollar deposits. Let’s illustrate this with an example from one of the top 10 banks.

As of Jan. 1, its tenge portfolio of term and savings deposits (excluding current accounts, on-demand deposits and conditional deposits) amounted to 457 billion tenge ($951 million). Nine months later, it had grown to 537 billion tenge ($1.1 billion). The nominal increase was 80 billion tenge, but at least 46 billion tenge was accrued interest. Accordingly, the net inflow of tenge deposits from the population for the three quarters did not exceed 34 billion. As for the bank’s retail deposits in foreign currency, over the period under review, their volume decreased by $78 million or 36 billion tenge (at the average exchange rate for nine months).

Thus, while the deposits of individuals in this bank appear to be growing in nominal terms, Kursiv.media’s calculations reveal that, in real terms, the bank is experiencing minor retail outflows. This example does not necessarily characterize the bank: it could simply be uninterested in aggressively attracting new funds from retail clients due to excess liquidity. The example merely illustrates how much and why the nominal trends of certain financial indicators can differ from actual cash flows.

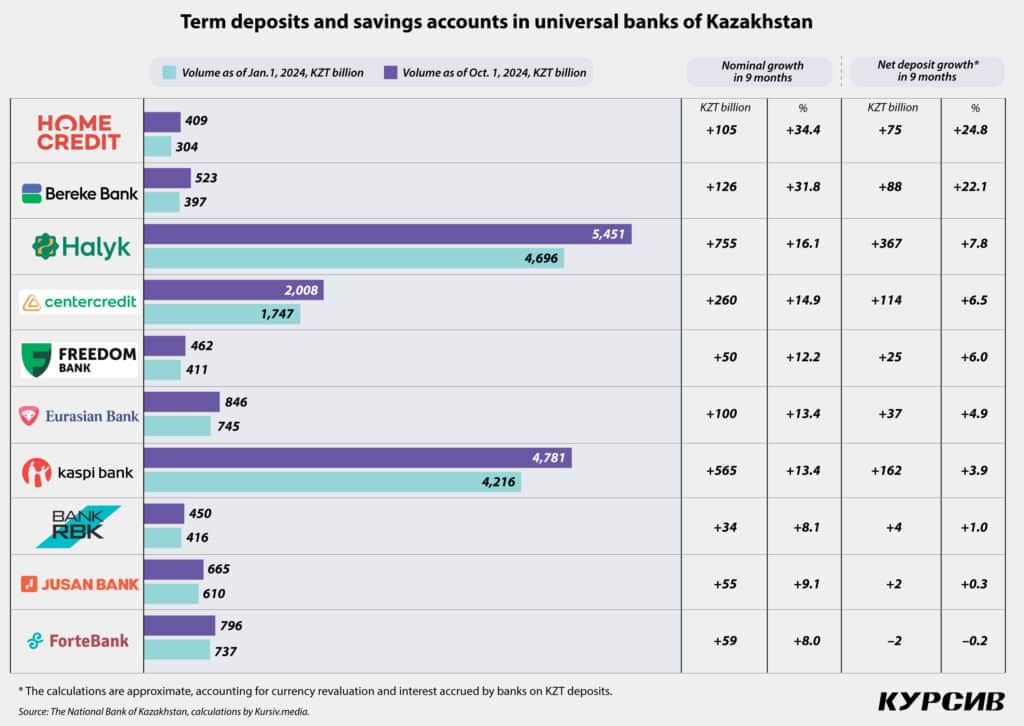

Applying the above calculation methodology to the entire sector indicates that the nominal growth of retail deposits (across the 10 largest universal STBs) of 14.8% (+2.1 trillion tenge since the beginning of the year) slows to just 6.1% (+872 billion) in real terms. Halyk Bank leads in retail net inflows in absolute terms, an indicator of public confidence in a bank, with +367 billion tenge ($764 million) during the reporting period. It is followed by Kaspi Bank (+162 billion tenge or $337 million) and Bank CenterCredit (+114 billion), which trails significantly behind. Among banks outside the top tier, the best performance has been seen by Bereke Bank (+88 billion tenge) and Home Credit Bank (+75 billion). Moderate growth has been reported by Eurasian Bank (+37 billion tenge) and Freedom Bank (+25 billion). Bank RBK (+4 billion tenge), Jusan Bank (+2 billion) and ForteBank (–2 billion) have shown minimal growth.

In relative terms, Home Credit Bank (+24.8% for the three quarters) and Bereke Bank (+22.1%) have shown the fastest growth rates. On the one hand, these banks have the lowest starting base within the top 10, which makes rapid growth easier. On the other hand, their significant overperformance cannot be overlooked: they are growing four times faster than the market and three times faster than their closest competitor, Halyk Bank (+7.8%). Halyk Bank, in turn, is growing twice as fast as Kaspi Bank (+3.9%), which it likely views as its primary competitor in the retail segment. The worst dynamics in the top 10 are shown by Bank RBK (+1.0%), Jusan Bank (+0.3%) and ForteBank (-0.2%). ForteBank compensates for its lag in retail by attracting funds from corporate clients, with +410 billion tenge ($853 million) in nominal terms since the beginning of the year, the best performance in the sector. However, the same cannot be said for Bank RBK and Jusan Bank: the former’s portfolio of legal entity funds has decreased by 10 billion tenge in nominal terms over the past three quarters, while the latter has seen growth, but only by 32 billion.

The ranking of banks based on deposit performance (excluding current accounts) appears to be relevant because, over the past nine months, there has been a clear trend in the population’s preferences between deposits (which yield interest) and current accounts (which are interest-free but offer opportunities to earn rewards through cards). This shift increasingly favors deposits. The current level of digitalization, which allows for instant transfers from deposits to cards, makes it less rational to keep large sums of money in an interest-free card account.

In nine banks (except Bank RBK), the share of money in current accounts within the retail portfolio has decreased. On average, for the top 10, this share dropped by 2.4 percentage points (from 17.8% on Jan. 1 to 15.4% on Oct. 1). The three banks with the lowest share of current accounts are Home Credit Bank (4.4%), Bereke Bank (6.8%) and Freedom Bank (8.3%). These institutions likely have fewer payroll projects than their competitors, and their retail clients are primarily market-driven (i.e., clients voluntarily apply for cards without employer participation). In contrast, the highest share of current accounts (24.9%) is observed at Eurasian Bank, whose shareholders control several large enterprises in the mining and metallurgical sectors. These enterprises are unlikely to allow their plants and factories to cooperate with competing banks for payroll projects. The other six players in the top 10 have a share of current accounts ranging from 14.6% (Kaspi Bank) to 18.8% (Bank CenterCredit).

As for the structure of current accounts in terms of foreign exchange, six banks have a tenge component that significantly exceeds the foreign currency component. For example, as of Oct. 1, Kaspi Bank’s balance was 807 billion in tenge and 10 billion in foreign currency equivalent ($20.8 million). Halyk Bank’s balance was 720 billion in tenge and 218 billion ($454 million), respectively. Conversely, Freedom Bank, Bank RBK, Bank CenterCredit and Eurasian Bank, had a more significant foreign currency component. Eurasian Bank, for instance, held 52 billion tenge in local currency and 228 billion tenge in foreign currency. There are three possible explanations for this: the cards issued by these four banks may be particularly convenient for use abroad; the cardholders might predominantly be non-residents; or the foreign currency in current (likely card) accounts could belong to a few large customers affiliated with the issuing bank, who have unlimited trust in it.

As for dollarization of deposits, the average for the top 10 banks decreased from 29.7% on Jan. 1 to 24.9% on Oct. 1. The regulator’s reported 19.3% at the end of September is slightly misleading. This official figure excludes non-resident accounts and includes deposits in Otbasy Bank, which, by their nature, cannot be converted into dollars and therefore don’t directly impact the exchange rate of the national currency.

Among the top 10, only Freedom Bank has more foreign currency deposits than tenge deposits. As of Oct. 1, its dollarization rate was 72.0%, down significantly from 83.2% at the beginning of the year. The share of foreign currency deposits for six banks ranges from 37.1% (Bank RBK) to 21.2% (Eurasian Bank). Bereke Bank (10.4%), Kaspi Bank (9.0%) and Home Credit Bank (5.2%) have the lowest currency risk in the retail funding segment.