The Motley Fool has highlighted two small-cap investments of the world’s second-most valuable company, the chipmaker Nvidia. According to Nvidia’s financials, it holds shares of voice assistant developer SoundHound AI and Applied Digital, a builder of data centers. The Motley Fool encourages investors to follow Nvidia’s lead.

SoundHound AI

With a market capitalization of $2.8 billion, SoundHound develops AI-powered voice assistants. Over the last few years, the company’s stock has been on a roller coaster, but the Motley Fool notes steady growth of late, with the share price surging 252% in the last 12 months. The investing advice outfit attributes these gains to robust demand for the company’s voice technology.

For the third quarter of 2024, SoundHound reported record revenue of $25.1 million, up 89% year over year. The company also expanded its client base: a year ago, its largest client accounted for 72% of revenue, but now it is just 12%. Today, the list of clients includes BNP Paribas, Hoffman Financial Group, Nordic Bank, and Stellantis, several of whose car brands use SoundHound voice assistants. Nvidia, another of its clients, is partnering with SoundHound to integrate its voice assistant into Nvidia’s DRIVE platform, the Motley Fool adds.

According to MarketWatch, out of the six analysts covering SoundHound, four have “buy” recommendations, while two rate it as a “hold.” Their average target price is $8.25 per share, implying 8% upside versus the last closing price. The Motley Fool believes that if the company continues to see growing adoption across multiple markets, investors stand to earn “tremendous returns” in the coming years.

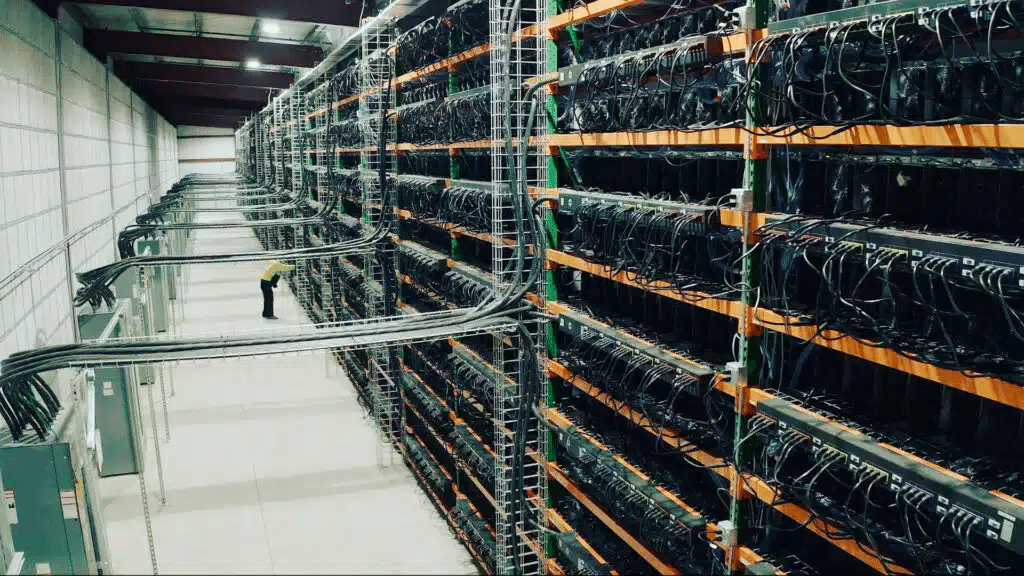

Applied Digital

With a market capitalization of just over $2 billion, Applied Digital builds data centers for high-performance computing applications, including AI, machine learning, and cryptocurrency mining. The company offers scalable data centers that utilize liquid cooling solutions, placing them near renewable energy sources to ensure cost-effectiveness and environmental sustainability.

For the first quarter of fiscal 2025 (ended August 31), Applied Digital reported 67% year-over-year revenue growth to $60.7 million. In September, the company raised $160 million in a private placement, Nvidia being one of the investors. Explaining the benefit of this investment for the tech giant, the Motley Fool points out that Nvidia is contributing to the expansion of Applied’s data center network, which will ultimately boost sales of Nvidia GPUs.

According to MarketWatch, all seven analysts who cover Applied Digital recommend buying the stock. Their average target price is $11.14 per share, implying upside of more than 14%.