Shares of U.S. drone manufacturer Unusual Machines, with a market capitalization of $75 million, more than doubled on Wednesday, November 27. The catalyst was the announcement that Donald Trump Jr., the son of the U.S. president-elect, had joined the company’s advisory board. Trump Jr. expressed his support for Unusual Machines’ efforts to manufacture drones domestically and said the U.S. must stop buying Chinese-made drones, CNBC reports.

Details

Shares of Unusual Machines, a maker of drones and components for them, gained as much 115% during Wednesday’s trading session, hitting an all-time high. Later in the day, the gains were pared back some, and Unusual Machines was up approximately 70% as of this writing.

Unusual Machines stock is known for high volatility, as mentioned by CNBC. Over the last 52 weeks, the lowest price was $0.98 per share, while it closed at $5.36 per share on Tuesday before climbing above $11.50 per share on Wednesday. Trading volumes on Wednesday were abnormally high, with over 13.5 million shares changing hands, far exceeding the 10-day average of around 380,000 traded shares, CNBC notes.

What drove the gains

On Wednesday, Unusual Machines announced that Donald Trump Jr. had joined its advisory board. Previously, Trump Jr. was a shareholder in the company, owning 331,580 shares, but he has since sold his stake, according to CNBC.

Trump Jr. voiced his support for the Florida-based company’s mission to bring drone manufacturing back to the U.S.

“The need for drones is obvious. It is also obvious that we must stop buying Chinese drones and Chinese drone parts,” Trump Jr. said. “I love what Unusual Machines is doing to bring drone manufacturing jobs back to the U.S. and am excited to take on a bigger role in the movement.“

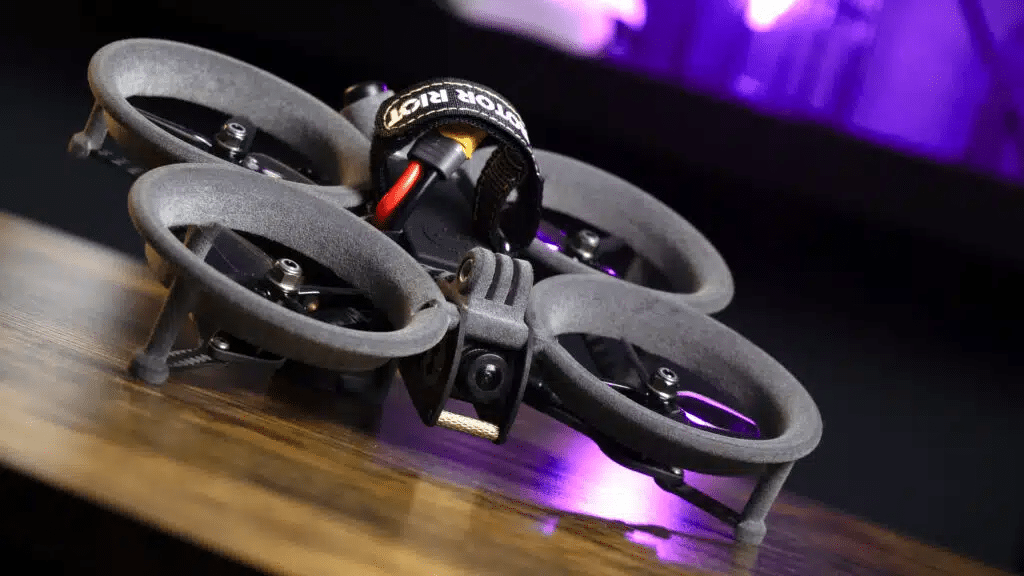

Unusual Machines’ strategic goal is to scale U.S.-based production and become the country’s largest supplier of drones and drone components, creating a “crucial alternative to Chinese suppliers,” according to an investor presentation. The company notes that China has dominated the drone industry for the last decade. Unusual Machines has previously acknowledged its own heavy reliance on Chinese imports, which poses risks amid President-elect Donald Trump’s plans to impose additional tariffs on Chinese goods.

About the company

Unusual Machines went public in February, selling 1.25 million shares and raising $3.85 million in net proceeds, CNBC reports. Since its IPO, the stock had risen 34% before Wednesday’s surge. According to MarketWatch, the company’s stock is tracked by a single analyst, who has a “buy” rating and an average target price of $4 per share.

Post-IPO, Unusual Machines has acquired two drone brands, Fat Shark and Rotor Riot, from Red Cat, whose founder and CEO, Jeffrey Thompson, is also the founder, the former CEO, and a current board member of Unusual Machines.

In November, the company reported $3.56 million in revenue for the first nine months of 2024. While it did not disclose revenue figures for the same period last year, it stated plans to surpass $5 million in revenue for the 2024 full year. Its net loss for the first nine months of the year amounted to $4.86 million, a 150% increase compared to the same period last year.

In a recent report, Unusual Machines disclosed that it had changed its auditor in April. The new accounting firm conducted a reaudit of the company’s prior financial statements and identified errors, including misreported transactions and expenses.