Kazakhstani oil price surge contributes to boosting export revenue

Oil has helped Kazakhstan increase export revenue one more time. This became possible thanks to the rising price of Kazakhstani oil, although the benchmark oil cost remained mostly unchanged.

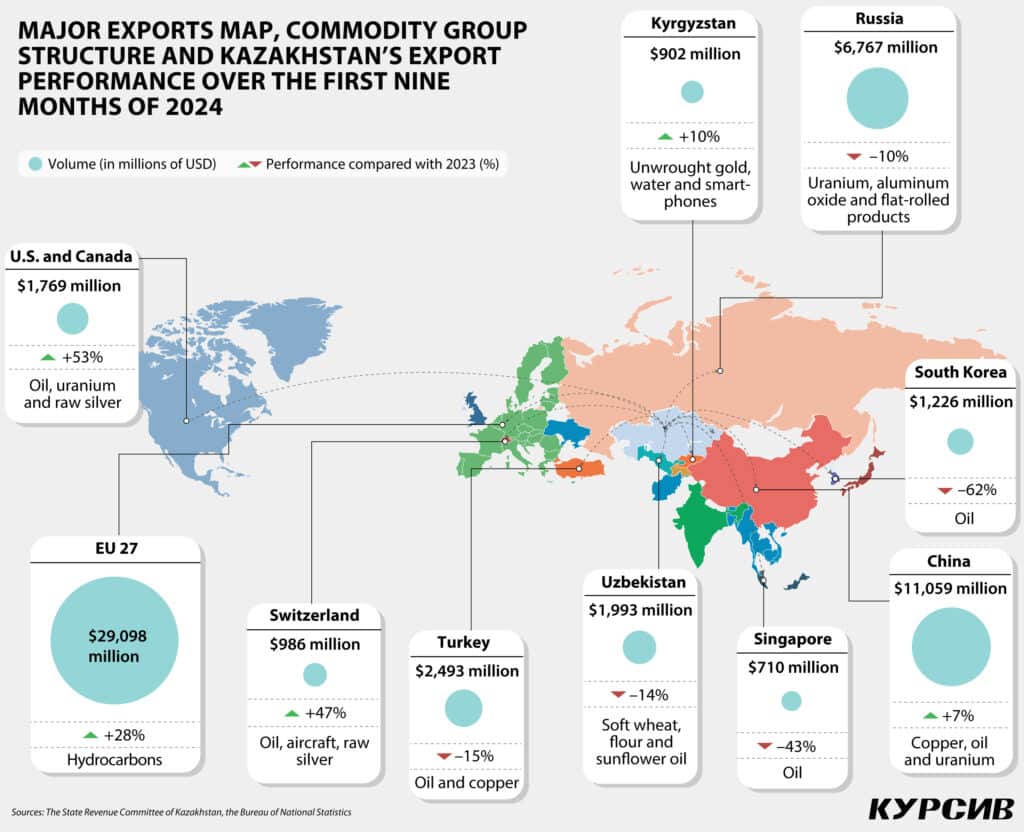

Kazakhstani exports from January to September of 2024 grew by 5.6% in monetary terms compared to the same period in 2023. A positive trend has continued for the second consecutive quarter, following a recovery in the first half of this year after an 18-month pause. Kursiv Research is breaking down the factors that boosted Kazakhstan’s commodity exports.

Oil, uranium and copper

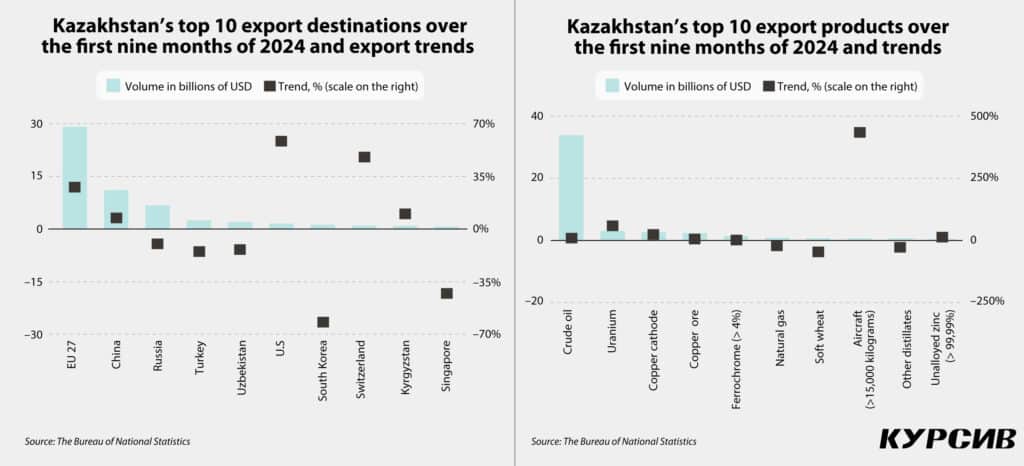

Over the first nine months of this year, Kazakhstani exports made $61.4 billion, marking a 5.6% year-on-year increase in nominal terms. The export revenue growth was accompanied by strengthening commodity concentration, which remains extremely high. In the reporting period, the ten most traded commodities generated roughly 76% of the entire export revenue, whereas a year earlier, the rate was 73.2%.

Seven items out of Kazakhstan’s ten most exported goods closed the reporting period with a profit. «Black gold» shipments secured the most significant absolute increase; the oil export revenue made $33.9 billion, increasing by $2.7 billion (+8.2%).

The increase in revenue is not related to the improvements in Kazakhstan’s critical oil industry parameters. During the reporting period, the country’s oil production declined by 0.4%, reaching 66.7 million tons. Among the three megaprojects vital for exports, slight declines were recorded at Tengiz (-1%) and Karachaganak (-0.8%). The Tengiz field, which accounted for one-third of Kazakhstan’s total oil production in 2023, reported a drop in output due to planned maintenance of two production trains at the Complex Technology Line (KTL) plant in August. Similarly, the Karachaganak field reported a 0.8% decline in oil and condensate production, caused by unscheduled shutdowns of reinjection compressors and reduced gas volumes accepted by the Orenburg Gas Processing Plant. The Kashagan field saw a slight production increase of 0.2%, as there were no unscheduled repairs during the reporting period.

Setbacks in oil production impacted the physical deliveries, which only saw a modest increase of 0.6%, reaching 53.8 million tons. However, market dynamics worked in favor of Kazakhstani oil producers. Against the backdrop of a slight increase in Brent Crude prices (+0.7%), the customs value of Kazakhstani oil surged significantly, averaging $629.10 per ton (+8%).

Uranium exports hold the second position, though they fall far behind the leading export sector. This type of export grew to $3.1 billion (+59.7%). This growth was driven by a combination of higher prices and increased supply volumes. During the reporting period, the average price for uranium oxide produced by Kazatomprom rose to $66.80 per pound, reflecting a 38% increase compared to the previous year.

Uranium production increased to 16,800 tons (+9%), while Kazatomprom’s sales decreased to 11.6 tons (-5%). It is worth noting that quarterly sales volumes can vary year-on-year, influenced by client demand and physical delivery terms. This explains why customs statistics recorded a 13% increase in shipments (an additional 2,200 tons) despite the drop in Kazatomprom’s sales.

Two types of copper products are traditionally included in the top 10 list of Kazakhstani export commodities. In the reporting period, copper cathode holds the third position, exports of which brought the country roughly $2.7 billion (+24.4%). The strong growth has been fueled by an increase in the price and shipment quantity. According to the World Bank, a ton of copper cost $9,100 on the global market between January and September, marking a 6.2% increase over the price last year. As a result, the cost of Kazakhstan’s copper cathode has grown by 5.3% to $8,600 per ton. Amid these favorable pricing conditions, Kazakhstani copper cathode producers boosted their output by an additional 53,900 tons to 352,500 tons (+18.1%). The exports also increased by 48,800 tons, reaching a total of 318,300 tons.

Copper ores and concentrates generated the fourth largest export revenue of $2.4 billion (+4.6%) for Kazakhstan during the reporting period. Although the production of copper ore and copper concentrates increased by 7.7% and 2.8%, respectively, the growth was quite moderate due to the reduction of physical deliveries (-4%) despite an 8.9% increase in export prices.

High-carbon ferrochrome holds the fifth position in export volumes, increasing to $1.3 billion (+2.7%) in monetary terms. The weak positive trend was established due to an increase in physical volumes by 24.5%, despite a 17.5% drop in export value. The export volume grew due to a 25% increase in domestic production.

Passenger aircraft and other flying machines weighing over 15 tons reported the highest growth among Kazakhstan’s top 10 export products. The export revenue grew five-fold, reaching $658.9 million. According to the State Revenue Committee, Kazakhstan exported 16 wide-body aircraft: eight to Ireland, five to Turkey and one each to Georgia, Jordan and Switzerland.

Three positions in the top 10 list closed the reporting period with a loss. Export revenue declined for natural gas (-22% to $807.7 million), soft wheat (-45.1% to $695.1 million), and distillates (-25.9% to $636.3 million). In absolute terms, soft wheat shipments saw the largest drop, with a $571 million loss.

Between January and September 2024, export revenue for seven positions grew by $5.1 billion, while three positions reported losses exceeding $1 billion. As a result, consolidated export revenue increased by $3.3 billion. Notably, about 55% of the losses came from goods within the top 10 export categories, while the remaining 45% originated from goods outside the list.

Rapid doping victories

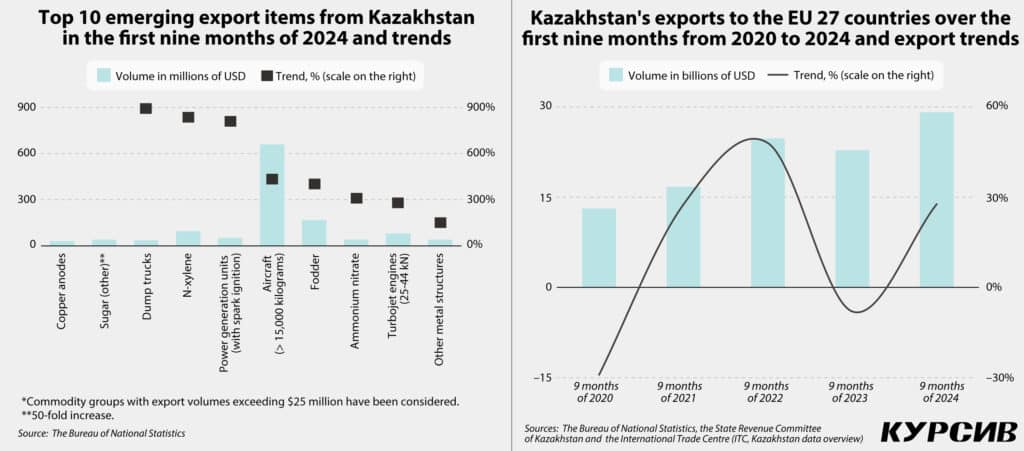

Kursiv Research gathers the top ten emerging export items in its surveys to highlight economic processes in Kazakhstan. A group of emerging items can serve as an additional indicator reflecting systemic successes and failures in the country’s export activities. It also helps identify future export champions.

To analyze emerging export items, we considered only articles valued at over $25 million during the reporting period. These figures are then divided by the previous year’s rate. The $25 million threshold is set to exclude potentially unsustainable variables from the analysis.

The ten most promising export articles can be divided into two groups. The first one comprises goods Kazakhstan’s economy can produce effectively, as it possesses all the necessary capacities and knowledge. The second group includes items that are less common in the country’s economy.

There are six products in the first group. Copper anode exports reached $30.8 million between January and September 2024, compared to just $19,700 during the same period in 2023. Exports of sugar soared from $810,100 to $40.4 million over a year, reflecting a 50-fold increase. N-Xylene export revenue rose nine-fold to $95.2 million between January and September, compared to $10.1 million over the same period last year. Animal fodder supply increased by 403%, reaching $168.3 million, while ammonium nitrate exports grew by 308%, totaling $40 million. Exports of metal structures made entirely or mostly of plate materials rose by 151%, amounting to $41.2 million.

Copper anode exports showed significant growth due to the low base effect. Official statistics have consistently reported shipments worth tens of millions of dollars since the early 2000s, with a record set in 2012 when copper anode exports surpassed $100 million. Traditionally, Russia has been the main buyer of Kazakhstani copper anodes. It skipped purchasing the product from Kazakhstan last year (with exports totaling $23,000 in 2023) and resumed contracts this year.

Increases in N-Xylene and ammonium nitrate exports were also driven by the low base effect. Sugar, on the other hand, has followed a different growth pattern. Exports of the product ceased in 2021, with minimal supplies thereafter. However, the first nine months of this year marked a significant turnaround, with sales volumes surpassing the annual totals of the past 19 years.

The growth trajectory of fodder has reflected several development stages of the industry since the early 2000s. Even though these supplies have been easily tracked since 2004, their volumes remained insignificant for a long time. Kazakhstani producers surpassed the $1 million mark only in 2010. However, this positive trend was followed by a seven-year decline. The situation reversed in 2018, with sales doubling annually and exports exceeding $50 million for the first time last year. This year, growth accelerated further, with foodstuff exports reaching $168.3 million in the first nine months of 2024, marking an all-time high.

China has been actively increasing its imports and has emerged as a key destination for Kazakhstani animal fodder exports since 2022. This year, the country accounted for approximately 95% of all exports in this category. Notably, the rise in shipments has been supported by sustained growth in the production of feed flour and ready-made animal feed (excluding flour and alfalfa pellets). Over the past five years, production of these items has grown by 86% and 20%, respectively.

In the second group of goods — those for which Kazakhstan lacks the necessary production infrastructure and expertise — significant export growth has been recorded in wide-body aircraft (+890%, reaching $36 million), power generation units with spark ignition (+808%, reaching $51.7 million) and turbojet engines with a thrust of 24 to 44 kN (+282%, reaching $80.4 million).

Passenger airliners have appeared in customs statistics due to complex aircraft leasing schemes, while the supply of power generation units was part of re-export activities. Kursiv Research covered this topic in detail in its previous survey. Another notable addition to the list of goods that Kazakhstan exports, despite not producing them, is turbojet engines.

The growth in turbojet engine exports is driven by the need for aircraft fleet maintenance. Exports of turbojets with a thrust ranging from 25 to 44 kN first reached a significant value of $53 million in 2014. Notable amounts were also recorded in 2020 ($69 million), 2021 ($65 million) and 2022 ($107 million). During these years, Kazakhstan primarily exported turbojets to the U.S., Germany and France — countries with full cycle modern aircraft engine manufacturing capabilities, providing support and maintenance services. Meanwhile, Kazakhstan has not exported turbojets to Russia, which is currently unable to access spare parts and support services due to imposed sanctions.

West-eastern growth

Kursiv Research has identified four key directions for analyzing the export commodity structure: the EU 27, EEU member states, Central Asian nations and China. Relations with the EU are less complicated as Kazakhstan’s main exports to this region are crude oil, gas and oil products. Spikes in hydrocarbon production or oil prices lead to increases in export revenue and vice versa.

Between January and September 2024, Kazakhstani exports to the EU 27 totaled $29.1 billion (+27.7%), with crude oil accounting for 91.5% of this amount. During the reporting period, European contractors acquired an additional 7 million tons of oil. Combined with a noticeable 7.4% drop in Kazakhstan’s oil price for Europe, this allowed the country to earn an additional $6.4 billion compared to the same period last year. Italy has become the main contributor to the rise in the physical supply of Kazakhstani raw materials to the EU, expanding its imports by an additional 5 million tons of oil.

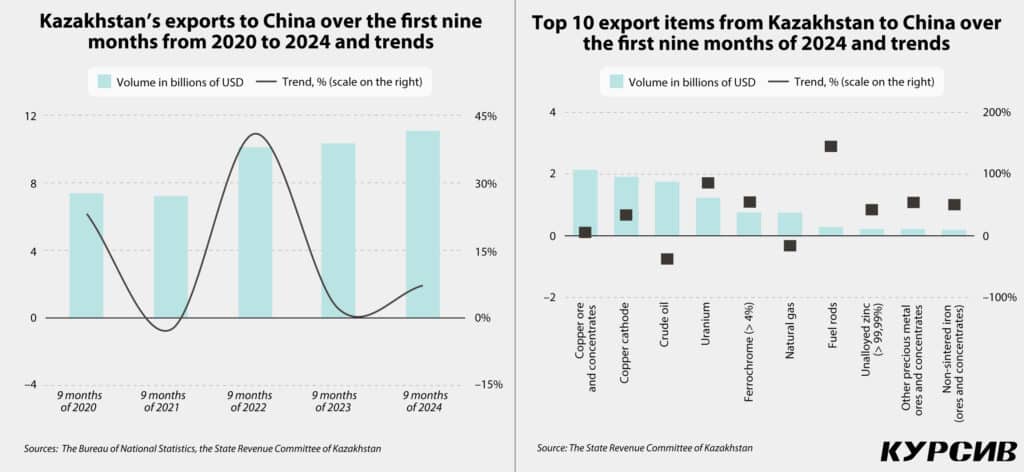

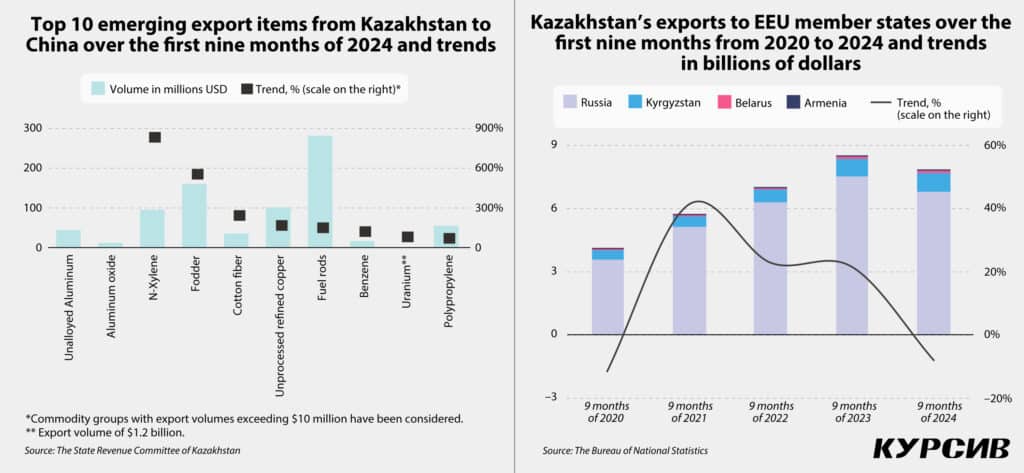

Kazakhstan’s exports to China reached $11.1 billion (+7.1%). Eight articles in the top ten Kazakhstani exports to China showed positive trends: copper ores and concentrates (+5.4%, to $2.1 billion); copper cathode (+33.4%, to $1.9 billion); uranium (+85.7%, to $1.2 billion); ferrochrome (+54.8%, to $761.6 million); fuel rods (+145.5%, to $281.6 million), unalloyed zinc with 99.99% zinc content (+41.9%, to $218.3 million); precious metal ores and concentrates (+53.6%, to $216.5 million) and non-sintered iron ores and concentrates (+50.8%, to $185.3 million).

However, the positive contribution from the abovementioned export articles is outweighed by the losses generated by the two remaining items in the top ten. China significantly reduced its import of Kazakhstani oil (-38.2%, to $1.8 billion) and natural gas (-16.2%, to $750.4 million) in the reporting period. This suggests that the increase in exports to China was driven by goods outside the top ten list.

An analysis of emerging export products to China (with a $10 million threshold for some export articles) reveals a dramatic increase in the export of unalloyed aluminum and aluminum oxide, compared to nearly zero values last year. Along with uranium supplies, exports of foodstuff (other) and fuel rods showed the largest absolute growth by $135.2 million and $166.9 million, respectively.

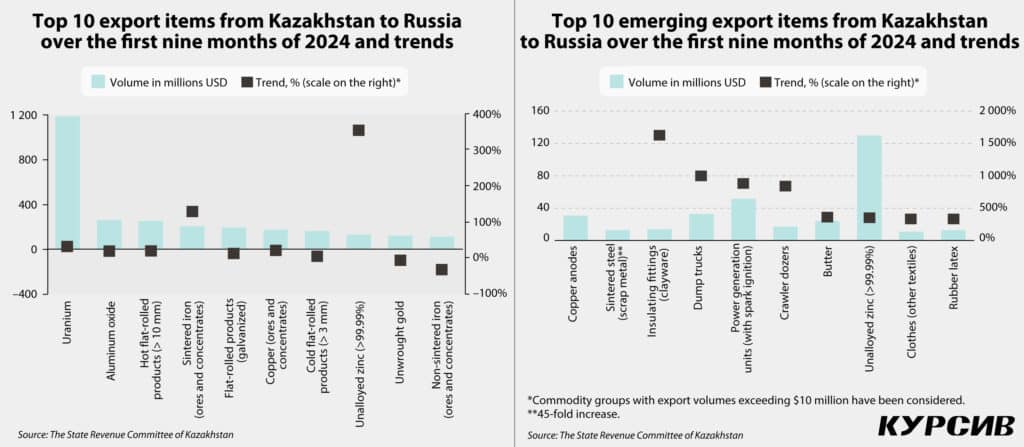

Exports to three out of the four EEU member states have declined: shipments to Russia fell by 10.1% (to $6.8 billion), to Belarus by 10.3% (to $112.2 million) and to Armenia by 40.7% (to $12.6 million). In contrast, exports to Kyrgyzstan have grown by 10.3% (to $901.6 million).

Russia, which accounts for 87% of Kazakhstani exports within the EEU, has reduced imports of two crucial export articles: unwrought gold (-5.3%, to $121 million) and non-sintered iron ores and concentrates (-33.1%, to $113.4 million). Consequently, eight articles made profit: uranium (+32.3%, to $1.2 billion); aluminum oxide (+19.2%, to $260.1 million); hot flat-rolled products with thickness over 10 millimeters (+20.5%; to $252.2 million), sintered iron ores and concentrates (+130.4%, to $203.9 million), galvanized flat-rolled products (+13.5%, to $193.5 million); copper ores and concentrates (+21%, to $172.9 million); cold flat-rolled with thickness over 3 millimeters (+4.5%, to $160.8 million), and unalloyed zinc with 99.99% zinc content of (+355.4%, to $129.8 million).

Cumulative losses for Kazakhstani exports to Russia totaled approximately $758.8 million, with $62.7 million stemming from items in the top ten export list. Given that Russia has the lowest commodity concentration among Kazakhstan’s trade partners (the top ten accounted for 41.6% in the reporting period), the main losses were reported by items outside the top ten.

Copper anodes and sintered steel scrap metal stand out as emerging exports to Russia. Exports of copper anodes rose from zero in 2023, while sintered steel scrap metal experienced a 45-fold increase. Notable growth trends were also observed in exports of insulating fittings (+1630%), dump trucks (+999%) and power generation units (+888%).

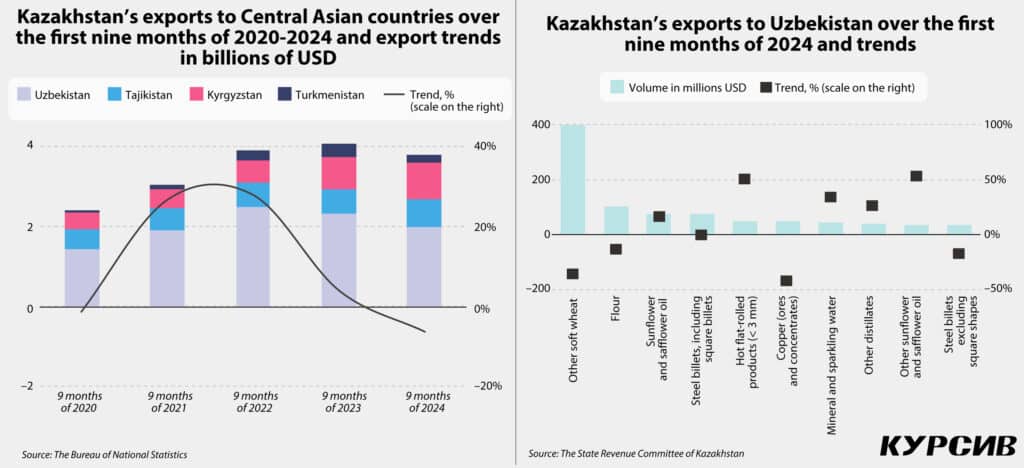

Between January and September 2024, Kazakhstani exports to Central Asia declined by 6.3%, totaling $3.8 billion. This decline was primarily driven by reduced trade with Uzbekistan, which accounts for 52.4% of Kazakhstan’s trade in the region; exports to Uzbekistan fell by 13.9% to $2 billion. Exports to Turkmenistan also dropped significantly, by 34.7%, to $207.7 million. In contrast, imports from Kazakhstan increased in Kyrgyzstan and Tajikistan, with Kyrgyzstan’s imports rising by 15.2% to $703.3 million and Tajikistan’s by 10.3% to $901.6 million.

In the structure of Kazakhstan’s exports to Uzbekistan, its main trading partner in Central Asia, the top ten products account for 46%. Declines were observed in five key categories, including a continued decrease in soft wheat exports — the long-term leader — between January and September 2024. During the reporting period, shipments of this product fell by 34.8% (to $399 million). Declines were also recorded for flour (-13%, to $104 million), steel billets, including square billets (-0.7%, to $73.9 million), copper ores and concentrates (-42.4%, to $50 million) and steel billets, excluding square shapes (-16.8%, to $36.1 million).

At the same time, exports of several products saw an increase, including raw sunflower and safflower oil (+15.9%, to $76.2 million), hot flat-rolled products with a thickness of less than 3 millimeters (+50.4%, to $50.5 million), mineral and sparkling water (+34.3%, to $46.1 million), other distillates (+26.6%, to $39.6 million) and other sunflower and safflower oil (+53.1%, to $36.3 million).

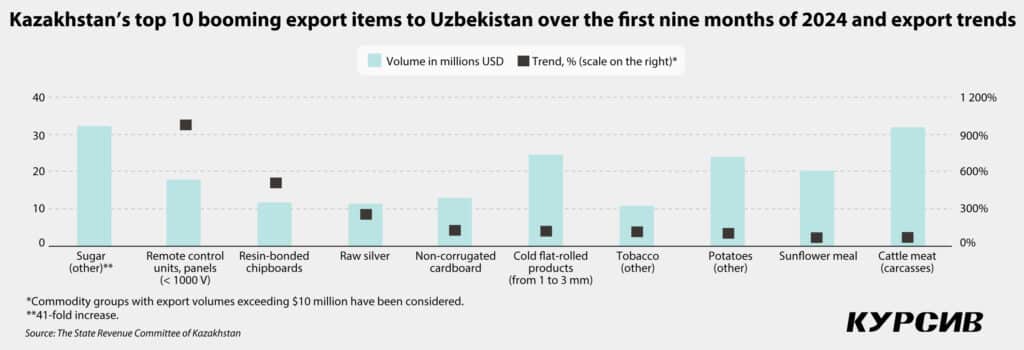

Among the emerging export items with a volume exceeding $10 million, two product categories stand out in the reporting period. Shipments of solid sugar saw a dramatic 41-fold increase in monetary terms. Notable growth was also recorded in the export of remote-control units and panels for voltages not exceeding 1000 V (+972%, to $17.8 million), resin-bonded chipboards (+512%, to $11.7 million) and raw silver (+251%, to $11.5 million).