Space exploration company Intuitive Machines slides after share offer with 26% discount

On Wednesday, December 4, quotes on U.S.-based lunar lander developer Intuitive Machines, with a market capitalization of $1.8 billion, retreated more than 9% following the announcement of a secondary offering priced at a significant discount to the current share price.

Details

On Wednesday, Intuitive Machines stock fell 9.4% to $12.80 per share, a two-week low, having dropped as much as 20% during the session. However, it has managed to claw back 2% in premarket trading today, Thursday, December 5, as of this writing.

On Tuesday, after the market closed, Intuitive Machines announced a public offering of 9.5 million shares (excluding the underwriters’ option) at $10.50 apiece. Additionally, the company agreed to sell another 952,000 shares in a private placement to South Korea-based pharmaceutical company Boryung Corporation at the same price.

Compared to the closing price on Tuesday of $14.15 per share, the offering price is 26% below the market. Barron’s attributes the steep discount to a frothy, nearly 90% surge in the stock over the past month, driven by strong third-quarter financial results and new contracts. In the quarter, the company reported $58.5 million in revenue, up 359% year over year, and a fourth NASA contract worth $117 million.

The offering is expected to raise a net $104.25 million, which Intuitive Machines intends to use for research, development, and potential mergers and acquisitions.

About Intuitive Machines

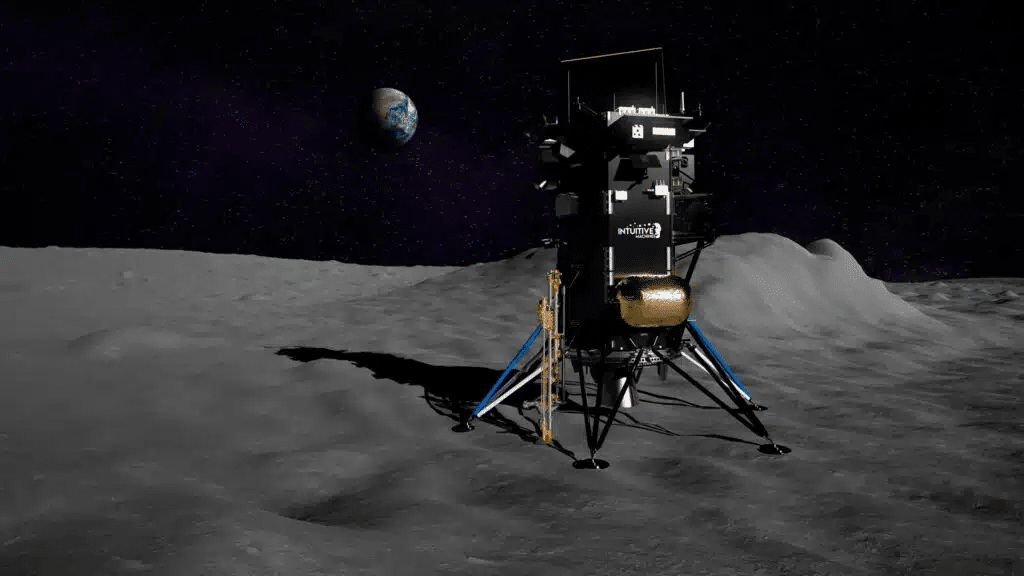

Intuitive Machines is focused on space exploration and building lunar access infrastructure. The company went public in February 2023 through a SPAC merger. A year later, it delivered a module to the Moon, which marks the first successful U.S. lunar project since Apollo 17 in 1972. A second module is slated for launch in February, atop a SpaceX Falcon 9 rocket.

In August, Intuitive Machines announced a $117 million NASA contract to deliver six science and technology payloads to the Moon’s South Pole in 2027. The next month, the company unveiled another NASA contract, running through 2029, with an extension option to 2034. If extended, the contract could be worth $4.8 billion.

Stock performance

Since the start of the year, Intuitive Machines stock has gained more than 400%. According to MarketWatch, all six analysts covering the company have a «buy» recommendation. Their average target price is $17 per share, implying upside of almost 33% versus the last closing price.