Sidus Space quadruples in two days

Quotes on Sidus Space, a space services company, have quadrupled over the last two days. This week, the company plans to launch its second satellite. Ahead of this milestone, Sidus has announced a $14 million private placement, marking the fifth stock offering for the company this year.

Details

Shares of Sidus Space have nearly quadrupled on the Nasdaq in the last two days. On Monday, December 16, the stock skyrocketed 220%, followed by a 22% jump the next day to $5.60 per share — its highest mark since early March. However, in U.S. premarket trading today, Wednesday, December 18, Sidus Space has retreated about 9.3%. In year-to-date terms, the stock is still down almost 20%.

On Tuesday, December 17, Sidus announced it had entered into agreements with accredited and institutional investors to sell units comprising nearly 6.8 million Class A shares, along with warrants to purchase almost 3.4 million additional shares, at $2.07 per unit, with the number of shares and warrants in each unit undisclosed. Warrants, exercisable for a period of 5.5 years, grant the right to purchase shares at $2.25 apiece.

The company is offering the units at a price that is little more than a third of the current market price, with the warrants priced at a slightly smaller discount. A company may set a below-market price when it needs to urgently raise capital, noted Sergey Glinyanov, a senior analyst at Freedom Finance Global, in November.

Sidus expects to raise about $14 million from this offering, with proceeds going toward working capital and general corporate purposes.

About Sidus Space

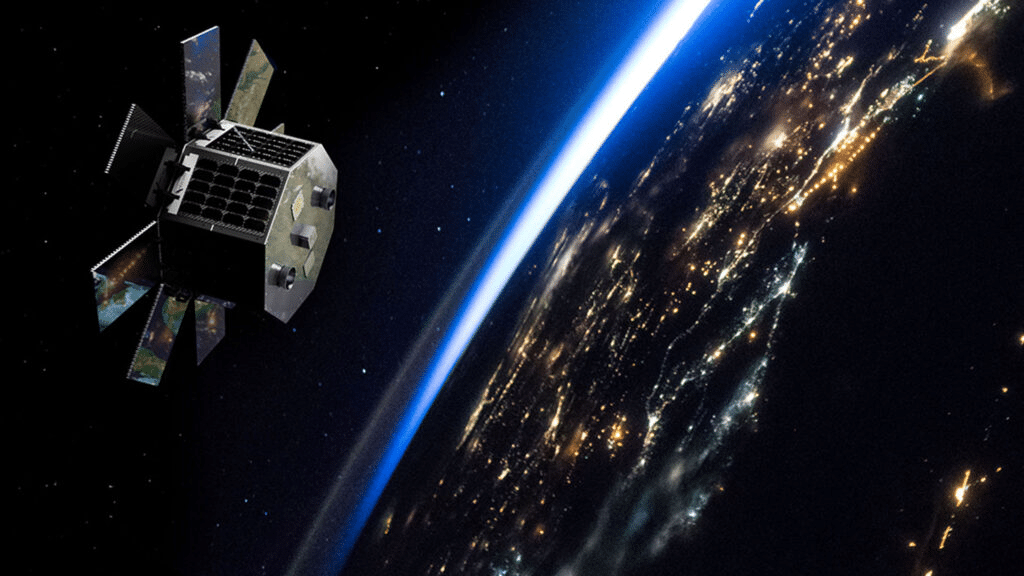

Founded in 2021 by Carol Craig, one of the first women authorized to operate combat aircraft in the U.S. Navy, Sidus Space aims to launch a constellation of 100 LizzieSat satellites, which allow clients to integrate their own sensors and technologies to gather space-based data. The company’s first satellite was launched in March by Elon Musk‘s SpaceX rocket, with the launch of the second one scheduled for December 20.

In the third quarter, Sidus revenue nearly doubled (up 90%) year over year to $1.9 million, while the net loss declined 5% to $3.9 million.

Stock performance

This is the fifth stock offering announced by Sidus Space in 2024. The company sold 1.18 million shares at $4.50 per share in January, 1.3 million shares at $6.00 apiece in March, 3.7 million shares at $2.67 per share in October, and 5.6 million shares at $1.25 each in November. The latter two announcements triggered a significant drop in the share price, which hit an all-time low in November.

According to MarketWatch, the one analyst covering Sidus Space has a “buy” recommendation, with a target price of $10 per share, 1.8 times the last closing price.