Gryphon, bitcoin miner with AI focus, gains on acquisition of energy asset

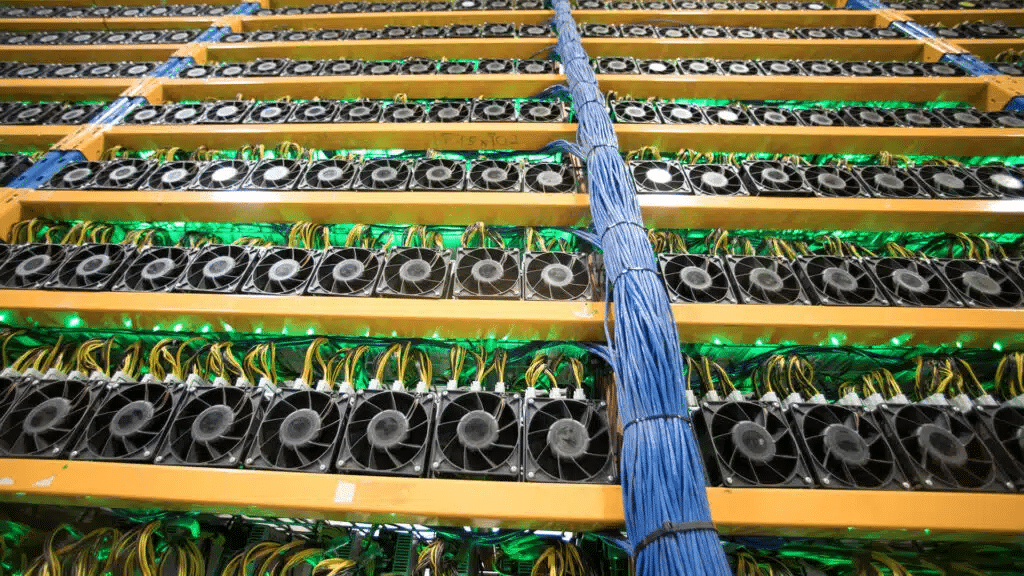

Quotes on Gryphon Digital Mining, which brands itself as a carbon-neutral bitcoin miner, climbed about 2% in premarket trading today, Monday, January 13, following a nearly 20% surge ahead of the weekend. These gains came after the company announced an agreement to purchase an energy site in Canada, which Gryphon believes will help the company to expand into AI and high-performance computing data center infrastructure. Gryphon expects the newly acquired asset to generate over $5 billion in annual revenue at full capacity.

Details

In premarket trading today, Gryphon stock gained about 2%, though the gains were halved to 1% as the opening bell neared. On Friday, January 10, the stock jumped almost 20% to close at $0.45 per share. Still, over the last 12 months, Gryphon has lost nearly half its value.

On Friday, the company announced an agreement to purchase a Captus Energy industrial site in Canada. According to Captus’s official website, it is an 850-acre piece of land around the existing Drywood Generating power plant in Southern Alberta. The site has access to dual natural gas supply, grid connection, non-potable water resources, and dual high-speed fiber connection providers, as noted in Gryphon’s press release.

The acquisition marks a pivotal moment for Gryphon as the company aggressively expands into the AI and high-performance computing data center infrastructure market, said Gryphon CEO Steve Gutterman, as cited in the press release.

“Many investors are still unaware that bitcoin miners now have significant exposure to AI,” stated the research firm VanEck. “The synergy is simple: AI companies need energy, and bitcoin miners have it.”

VanEck estimates that miners could generate about $9.11 million in annual revenue per megawatt (MW). Gryphon believes the Captus asset could generate over $5.0 billion in revenue at full capacity, basing its projections on more conservative estimates of $1.5 million in annual revenue per MW.

The acquisition comes at a cost of CAD27 million (approximately $18.7 million), including CAD3 million in shares to be paid in four installments over four years. The deal is expected to close by April.

About Gryphon

Gryphon brands itself as a carbon-neutral bitcoin miner. In August 2024, the company announced plans to source electricity from flared gas, a byproduct of oil extraction. According to its own estimates, this could generate up to $1 million in annual revenue. In December, Gryphon announced the acquisition of natural gas assets in British Columbia, Canada, to reduce power costs by more than 50%. At that time, Gryphon also reported that it mined 17.26 bitcoins in November, valued at approximately $1.5 million. The company has yet to release its December results.

According to MarketWatch, the lone analyst who covers Gryphon has a “hold” recommendation, with a target price of $16 per share, more than 35 times the last closing price.