Kazakhstan’s consumer confidence cools down after last year’s ups and downs

Freedom Finance Global PLC has been monitoring consumer confidence levels monthly using the United Research Technologies Group methodology since November 2022. The methodology relies on computer-assisted telephone interviewing (CATI). In each survey wave, 3,600 respondents aged 18 and older are interviewed, covering all regions and cities of national importance. The sample is representative in terms of gender, age and region of residence.

This month, Freedom Finance Global PLC presents its annual consumer confidence survey for 13 months from December 2023 to December 2024.

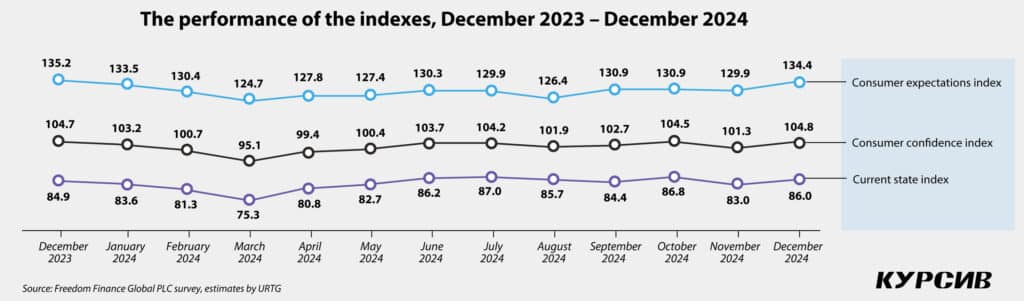

Confidence was shaky but showed slight improvement

Kazakhstan’s consumer confidence index (CCI) exhibited a wave-like pattern throughout the last year, highlighting shifts in public sentiment. After a high level of confidence (104.7) in December 2023, the index gradually declined during the initial months of 2024. The sharpest drop was recorded in March when the index reached its lowest value for the year (95.1).

In the second quarter (Q2), the CCI began to recover: CCI values grew steadily and reached 103.7 by June. In summer, the index remained stable, reaching its maximum in July (104.2). However, there was a slight decline to 101.9 in August and 102.7 in September.

By October 2024, the index grew again, reaching one of the highest values of the year (104.5). Despite a short-term decline in November to 101.3, consumer confidence rebounded by the end of the year, with the index reaching 104.8 in December, the highest value for the entire year.

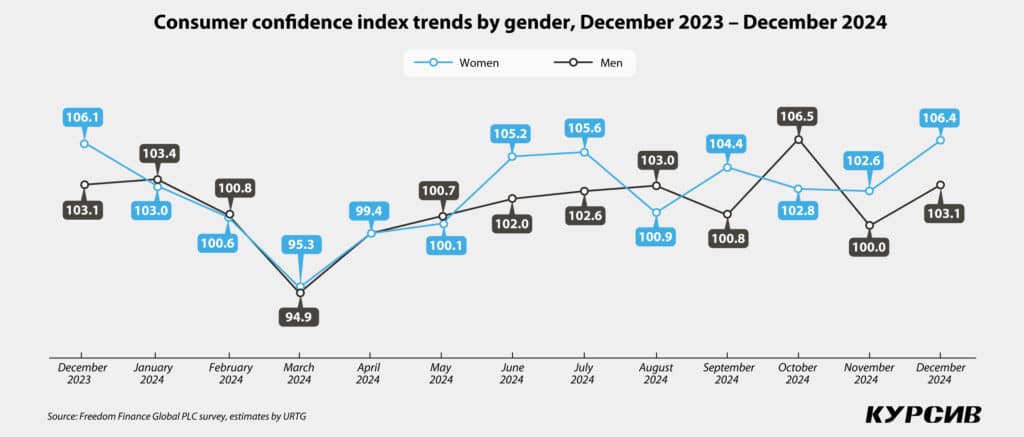

Confidence during the summer: women vs. men

In December 2023, the index was higher for women (106.1) than for men (103.1). Between January and March 2024, there was a decrease in the index for both groups, but the drop for women was more significant, reaching a minimum value of 94.9 in March. For men, the minimum value was slightly higher (95.3).

In April, the index began to rise for both sexes. For men, it gradually increased, reaching a peak of 102.6 in July. For women, the index recovered more quickly, reaching a maximum of 105.6 in July. From August to October, the index showed wave-like fluctuations for both groups.

Among men, confidence slightly declined from 103 in August to 102.6 in October, after which it stabilized. In contrast, women saw a significant increase in September (106.5), followed by a decline in October (102.8).

By November and December 2024, the index for men increased again, reaching 103.1 in December, while women showed a significant recovery, with their index climbing to 106.4.

Overall, women’s confidence showed large fluctuations throughout the year, but remained higher than men’s at most stages, especially during periods of recovery. The index for men was more stable, with less abrupt changes.

The group aged 18 to 29 had the highest consumer confidence, starting at 118.8 in December 2023. The index declined to 107.6 in March 2024, before recovering and peaking in July (118.7). It remained high by the end of the year, reaching 116.6 in December.

Those aged 30 to 44 showed moderate fluctuations. After falling from 105.7 in December to 95.1 in March, the index began to rise, reaching 105.5 in July. The values then stabilized around 100 and ended the year at 105.4.

The 45 to 59 age group showed the least volatile trends, with relatively low values. The index for that group fell from 96.3 in December to 89.9 in March, then recovered to 96.9 in July. In the remaining months, the values stayed within the range of 94 to 96.

The index for the group aged 60 and older remained the lowest. It fell from 96.4 in December to 86.8 in March. There was a slight increase, reaching 94.9 in September, and by December 2024, the index rose to 100.3.

Overall, individuals aged 18 to 29 exhibited the highest confidence, experiencing sharp fluctuations early in the year but maintaining consistently high values toward the year’s end. The 60+ age group recorded the lowest values, though they saw an increase by the end of the year.

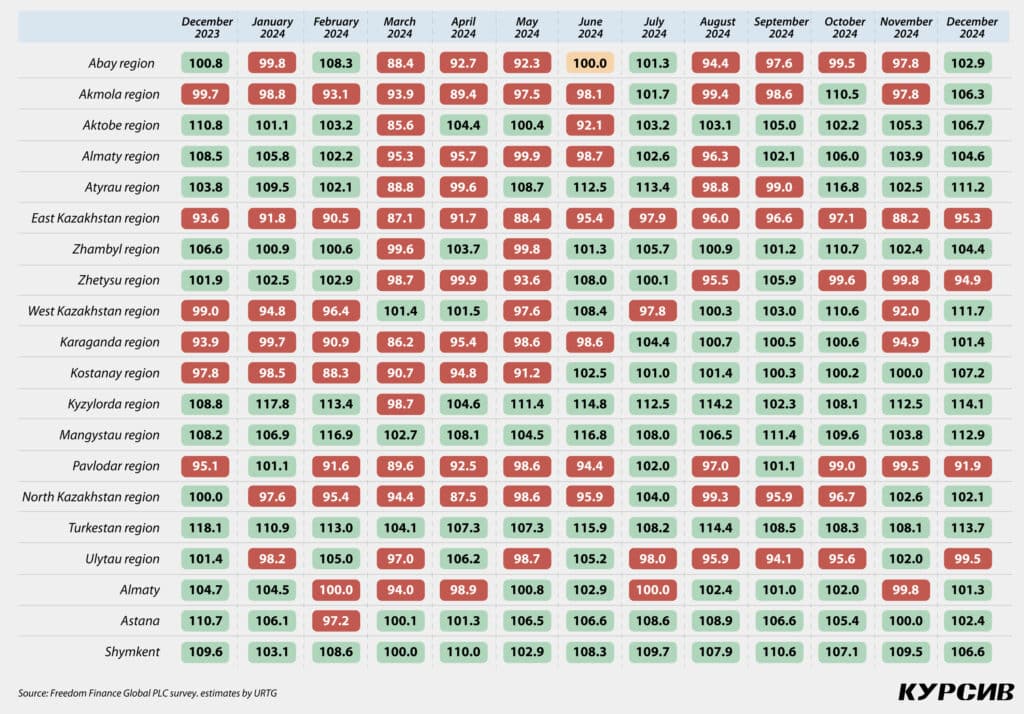

In terms of regions, the highest consumer confidence was reported by residents of the Mangystau, Turkestan and Kyzylorda regions, as well as the cities of Shymkent, Almaty and Astana. Strong fluctuations in the index occurred in the Atyrau region, ranging from 88.8 in March to 116.8 in October. July saw the largest number of regions in the optimistic zone and the peak of consumer confidence occurred in December.

Current state index at an annual peak

The current state index, remaining below the CCI, showed similar trends. In December 2023, it was 84.9, then dropped to a minimum value of 75.3 in March 2024. Since April, the index has begun to recover, reaching a peak in October (86.8). By December, the index had risen to 86.0, reflecting a moderate improvement in the perception of the current economic situation.

The consumer expectations index demonstrated rather stable trends. Having started the year at 135.2 in December 2023, it decreased to 124.7 in March 2024, but then gradually increased, reaching 130.3 in June. In the second half of the year, the index continued to rise steadily, finishing the year at 134.4, nearly returning to the value at the beginning of the period. This suggests that relatively positive consumer expectations were maintained, despite fluctuations in other indexes.

Overall, by the end of 2024, all three indexes had either recovered to or surpassed the levels at the beginning of the year, signaling positive changes in the population’s perception of the economic situation. Despite the downturn at the start of the year, consumer sentiment gradually improved, particularly in terms of future outlook.

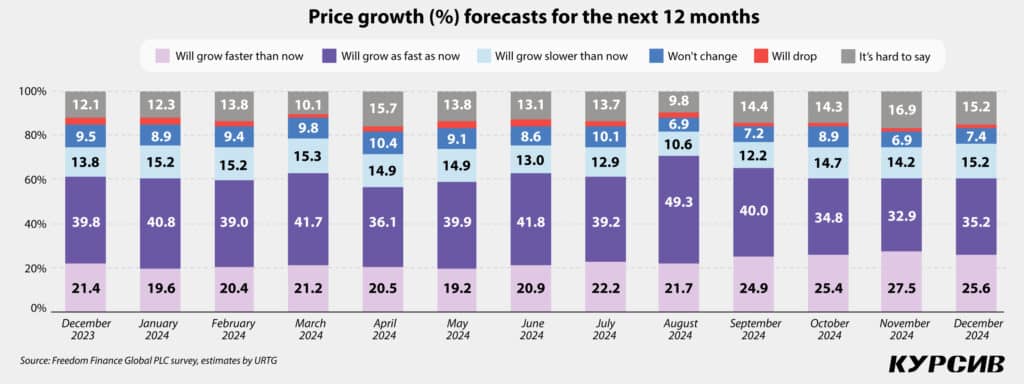

Inflation sentiment: few optimists left

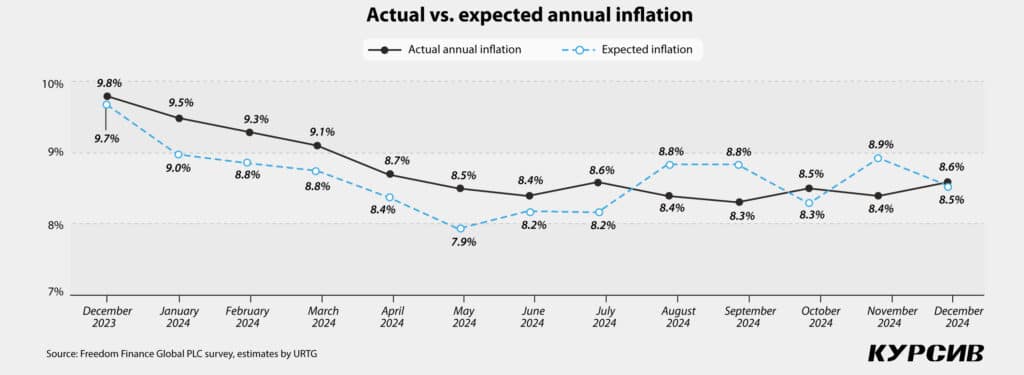

Last year, inflation sentiment among Kazakhstanis remained mostly pessimistic, as reflected both in assessments of price growth over the previous 12 months and in expectations for the future. Most of the population believed that prices were rising faster than before. In December 2023, 58.7% of respondents expressed this view, but by September 2024, that share had decreased to 47.5%. This change was attributed to a decrease in the annual inflation rate, with the Bureau of National Statistics (BNS) reporting that September marked the lowest value for the year (8.2%). Despite this, a significant portion of respondents continued to perceive the price growth rate as moderate (20% to 30%) or the same as before. Only about 8% to 13% believed that inflation had slowed down, and the share of those who observed a decrease in prices remained extremely low (less than 2%).

Expectations for the next 12 months also reflected a predominant sense of pessimism. The majority of respondents (39% to 49%) expected prices to keep rising, with some anticipating an acceleration in inflation. Moderate expectations, which assumed the current price growth rate would continue, were noted by 32% to 41% of respondents. A smaller share of the population (10% to 16%) hoped for a slowdown in growth or stabilization of prices, while virtually no one expected prices to decrease (1% to 2%).

Notably, in 2024, there were three months when the expected inflation rate was higher than the actual one: August, September and November. In the remaining months, the actual inflation rate was higher than expected.

Thus, the inflationary sentiment among Kazakhstanis throughout the year was shaped by the perception of accelerating price hikes, which led to negative expectations for the future. Despite a small group of optimists, the majority of the population remains pessimistic, expecting either a continuation or even an intensification of inflationary pressure shortly.

Confidence in tenge is falling

Throughout 2024, Kazakhstanis’ expectations regarding the dollar exchange rate against the tenge remained largely pessimistic, both in the long and short term. Most respondents predicted the dollar would appreciate over the year. In December 2023, 51.8% of respondents expected the dollar to appreciate, and this figure gradually increased, reaching 64.2% by December 2024. This indicates growing concerns about the long-term stability of the national currency. The share of those who expected the exchange rate to remain stable decreased from 20.6% in December 2023 to 16.3% in September 2024, signaling a decline in confidence in economic sustainability. Meanwhile, only 6% to 9% of respondents expected the dollar to decline, highlighting weak expectations for tenge strengthening in the long term.

In the short term (expectations for the next month), sentiment was also pessimistic, though the deterioration was less pronounced. In December 2023, 30.8% of respondents expected the dollar to appreciate and by December 2024, this figure had grown to 46.1%. Expectations for exchange rate stability were more pronounced in the short term than in the long term, with 46.3% of respondents in December 2023 and 40.5% in October 2024 expressing confidence. However, this figure also showed a gradual decline. The share of respondents expecting the dollar to depreciate in the short term was minimal, ranging from 4.1% to 7.0%, indicating low hopes for tenge strengthening soon.

Over the past year, Kazakhstanis expressed increasing concern about the future exchange rate of the national currency. Expectations for dollar appreciation rose in both the short and long term, while confidence in the stability of the tenge gradually declined. This trend reflects broader pessimism regarding the country’s economic outlook.

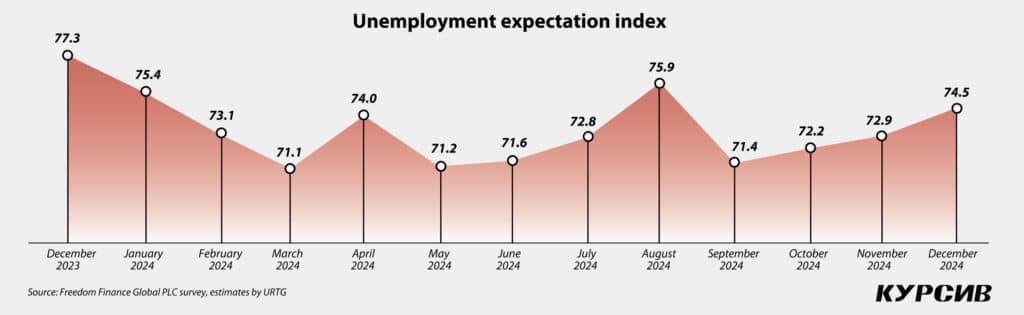

Unemployment expectation index remains high

In 2024, Kazakhstan’s unemployment expectation index fluctuated, reflecting shifts in public sentiment regarding the labor market. The index was relatively high (77.3) in December 2023, suggesting reduced anxiety among the population about potential increases in unemployment. During Q1 2024, the index gradually declined, reaching its lowest point of the year in March at 71.1. This drop indicated growing concerns about unemployment and the increasing relevance of labor market challenges.

In April, the index rebounded slightly to 74.0, but by May, it declined again to 71.2, signaling a short-term improvement in labor market sentiment. During the summer months, the index climbed, peaking at 75.9 in August, which reflected diminishing fears about the upcoming fall season. However, by September, the index fell again to 71.4, potentially indicating a temporary deterioration of conditions in the labor market.

Toward the end of the year, the index remained at relatively high levels, fluctuating between 72.2 and 74.5. Closing the year at 74.5, the index points to an optimistic outlook among Kazakhstanis regarding the labor market, despite being slightly lower than at the start of the year.

Throughout the year, women consistently expressed greater fear of unemployment than men, except in April, November and December, when the unemployment expectation index for men surpassed that of women.

By age group, respondents aged 18 to 29 were the most confident about their employment prospects, while those aged 45 to 59 recorded the lowest index values throughout the year.

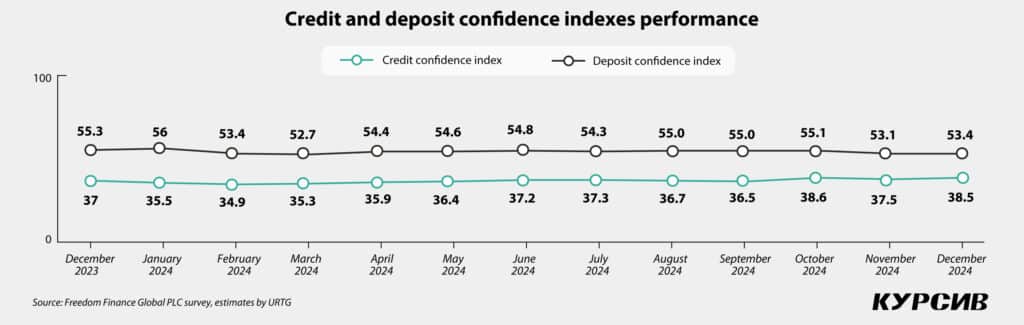

«Yea» to deposits, «nay» to loans

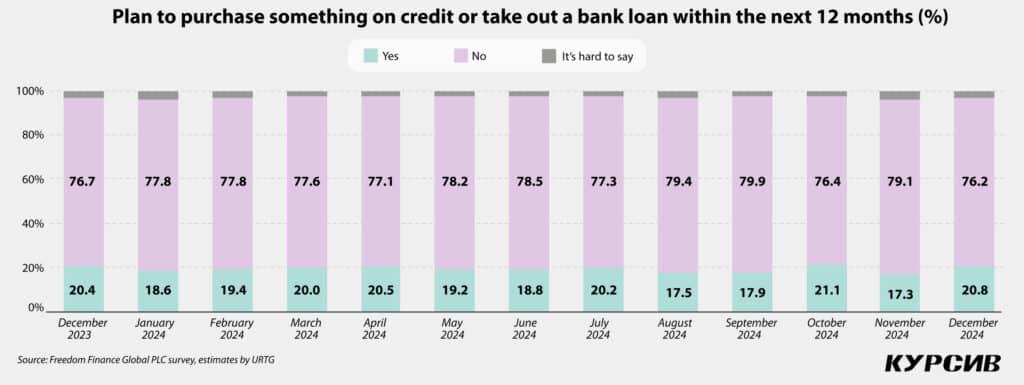

Throughout 2024, the credit and deposit confidence indexes, along with consumers’ plans to make credit-based purchases, demonstrated stability with minor changes.

The deposit confidence index remained relatively high, starting at 55.3 in December 2023 and peaking at 55.1 in September 2024. By the end of the year, the index decreased slightly to 53.4, indicating that public confidence in bank deposits remained steady. Conversely, the credit confidence index was significantly lower. It began at 37 in December 2023 and gradually increased to 38.5 by December 2024. This modest rise suggests a slight uptick in optimism about credit products, but the consistently low index values highlight the population’s cautious attitude toward taking on debt.

Kazakhstanis’ willingness to make purchases on credit remained limited throughout the year. Between 76% and 79% of respondents consistently stated that they did not plan to take out loans or make major purchases using credit. Only 17% to 21% of respondents considered using credit, with the lowest point recorded in August 2024 (17.5%) and the highest in October (21.1%). Meanwhile, a small proportion of respondents (3% to 5%) expressed uncertainty, likely reflecting instability in their financial situations.

In 2024, Kazakhstanis exhibited strong confidence in bank deposits while maintaining a cautious approach to borrowing. Most individuals avoided using credit, prioritizing financial stability and savings. This reflects prudence amid ongoing economic uncertainty. Interestingly, both credit and deposit confidence remained consistently higher among women than men. The only exception was in August when the credit confidence index for both genders was identical. Younger individuals demonstrated greater confidence in credit products throughout the year. However, by December, those aged 60 and older showed a notable increase in credit confidence, surpassing the 30 to 44 and 45 to 59 age groups.

Half of Kazakhstanis reported no stress

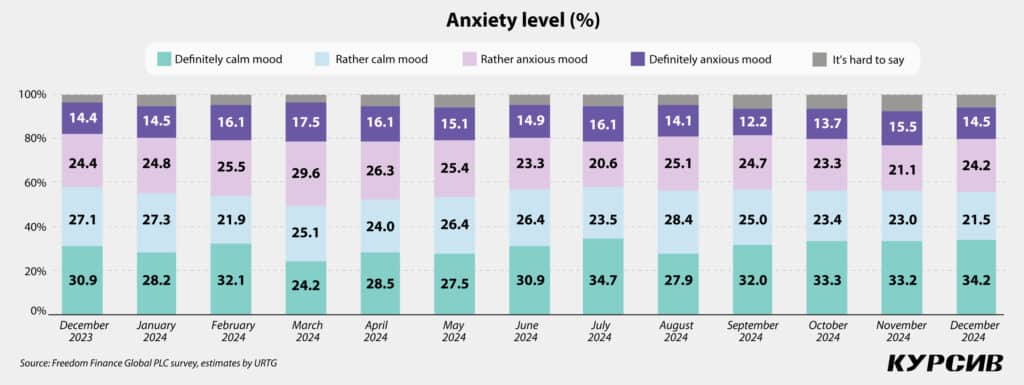

In 2024, anxiety levels and the frequency of stressful situations among Kazakhstanis reflected the emotional state of the population. At the beginning of the year, approximately 30.9% of respondents described themselves as «definitely calm.» However, this share declined to 24.2% by April, signaling increased anxiety during the first half of the year. In the latter half, conditions stabilized, with the percentage of «definitely calm» respondents rising to 34.2% by December. Conversely, the proportion of individuals identifying as «definitely anxious» reached its highest point in September at 16.1% but dropped to 14.5% by the end of the year.

Throughout 2024, most respondents described their emotional state as «rather anxious.» This group rose from 27.1% in December 2023 to a peak of 33.3% in October 2024, highlighting the widespread presence of moderate anxiety throughout society. The share of those who found it difficult to assess their condition remained small (3% to 6%), indicating that the population is highly aware of their emotional well-being.

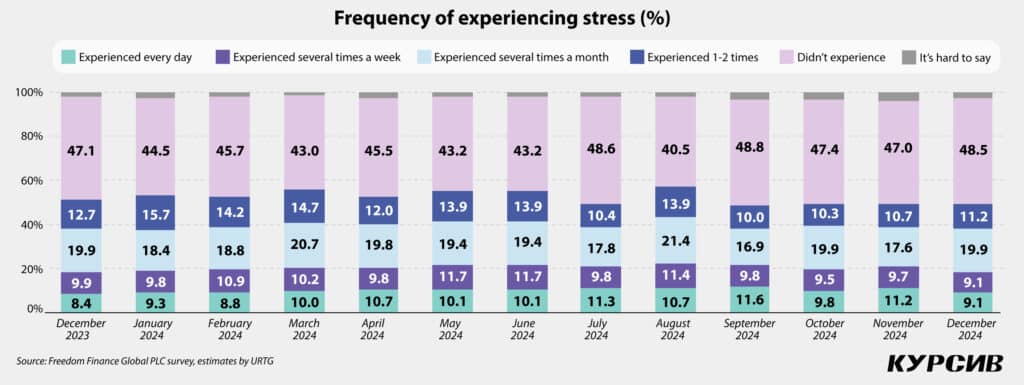

The frequency of stress experienced by respondents remained stable but significant. Between 9% and 11% of individuals reported encountering stress daily. However, most respondents (43% to 48.6%) experienced stress a few times per month, highlighting a more moderate stress level overall. A positive trend emerged by year-end: the proportion of those reporting no stress rose from 44.5% in January to 48.5% in December, suggesting an improvement in emotional well-being.

Women were more likely than men to report experiencing stress throughout the year. August proved to be the most stressful month, with 54% of men and 61% of women indicating they had experienced stress. May was also particularly stressful for women, with the same 61% reporting stress. These months may correlate with the conclusion of the school year in May and the start of the new academic year in August, contributing to increased pressure.

By age group, younger respondents (aged 18 to 29 and 30 to 44) experienced higher stress levels throughout the year, while those aged 45 to 59 reported slightly less anxiety. The 60+ age group demonstrated notable resilience, maintaining the lowest stress levels and experiencing minimal fluctuations.

The year 2024 was marked by moderate levels of anxiety and stress among Kazakhstanis. While there were noticeable improvements by the end of the year, the persistent proportion of individuals reporting a «definitely anxious» state and experiencing daily stress underscores the need for greater attention to emotional well-being.

Young consumer optimism

In 2024, inflation expectations among Kazakhstanis remained largely pessimistic, with noticeable variations across gender and age groups. Women showed higher confidence in the economic situation but experienced greater fluctuations throughout the year. In contrast, men exhibited more stability, albeit at a lower level of confidence. Young people aged 18 to 29 emerged as the most optimistic group, while older age categories (45+) displayed more pessimism. Those aged 60+ recorded the lowest confidence levels overall.

The majority of respondents believed that inflation continued to accelerate, with only a small percentage (10% to 16%) expressing hope for a slowdown. Expectations of price hikes were prevalent across all age groups, particularly among men and older individuals. Thus, despite pockets of optimism among young people and women, the overall sentiment in the country remained negative.