Five promising small-cap pharmaceutical companies taking on Alzheimer’s

In 2025, makers of drugs for Alzheimer’s disease are poised to see more interest from investors, Bloomberg reports. The number of Alzheimer’s cases is growing worldwide, and more than 160 clinical trials for Alzheimer’s treatments are currently underway. What are the most promising small caps in this niche?

Market outlook

Bloomberg believes that in 2025, investors looking for the next obesity-like market opportunity will likely focus on developments around Alzheimer’s disease.

Discovered in 1906 by German physician Alois Alzheimer, Alzheimer’s disease is the most common form of dementia in older adults, leading to gradual loss of cognitive functions. It begins with short-term memory loss — patients repeatedly ask the same questions and forget where things are, for example. They might also have speech difficulties, fail to recognize loved ones, and struggle with managing finances.

The number of people living with Alzheimer’s disease worldwide is growing, partly due to rising life expectancy. According to the UN, by the late 2050s, more than half of all deaths will occur at age 80 or older versus just 17% in 1995. In the U.S., one in 10 Americans over the age of 65 has Alzheimer’s, which rises to one in three by the age of 85, according to the pharmaceutical company MSD.

“It’s a miracle that people are living so much longer, but longer life expectancies alone are not enough. People should be able to enjoy their later years – and we need a breakthrough in Alzheimer’s to fulfill that,” Microsoft cofounder Bill Gates said in 2017.

In 2011, the U.S. passed the National Alzheimer’s Project Act (NAPA), which called for a national plan to combat the disease and increased funding for research and patient care. In 2024, federal funding for Alzheimer’s research reached $3.8 billion, according to the Alzheimer’s Impact Movement, a nonprofit.

In 2015, the UK launched the Dementia Discovery Fund venture fund, managed by SV Health Investors. It invests exclusively in companies developing new treatments for dementia. Its key investors include Biogen, Eli Lilly, GSK, Johnson & Johnson, Japan’s Otsuka and Takeda, as well as Pfizer. In 2017, Bill Gates invested $50 million in the fund.

Introspective Market Research expects the global Alzheimer’s drug market to reach $12.26 billion by 2032, up from $7.70 billion in 2023. Meanwhile, Bloomberg Intelligence estimates that sales of Alzheimer’s drugs could hit $13 billion by 2030. Any breakthrough in the science or regulatory approval for promising therapies could have a major impact on drugmakers’ share prices.

“The opportunity remains huge,” Chris Eccles, a portfolio manager at AXA Investment Managers, told Bloomberg. “If we get a strong disease-modifying drug and very positive clinical trials, numbers can go back in models and forecasts can be revised upwards quite significantly, quite quickly.”

Existing treatments

The first Alzheimer’s drug, tacrine (marketed as Cognex), was introduced in 1993, nearly a century after the disease was first discovered. Even though the U.S. FDA approved it, it was discontinued 20 years later due to safety concerns.

Cognex, like many drugs that followed, was designed to stimulate cognitive function — in other words, improve memory.

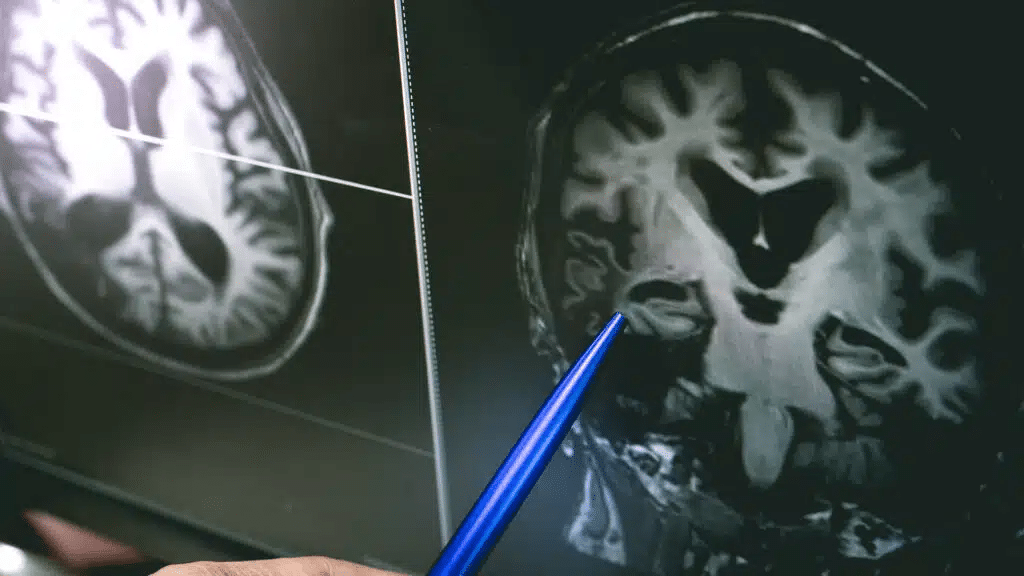

The 1990s saw the emergence of the “amyloid hypothesis,” which posited that Alzheimer’s arises from amyloid deposits in the brain that form plaques, visible on CT and MRI scans. In 2021, the FDA approved Biogen’s aducanumab, the first drug targeting amyloid. However, the European Medicines Agency (EMA) declined to approve it, citing unproven efficacy and significant safety risks.

Three years later, Biogen announced it would discontinue sales of aducanumab and focus on lecanemab (marketed as Leqembi), a drug developed in partnership with Japan’s Eisai. The FDA approved it in 2023, and the following year, Eli Lilly launched its own drug, Kisunla, with a similar mechanism of action.

In the U.S., Leqembi is now covered by the federal health insurance program Medicare, but only for early-stage Alzheimer’s patients with confirmed high levels of amyloid proteins in their brains, points out the nonprofit organization AARP, an interest group for retired Americans. This leaves most Alzheimer’s patients without access to treatment. For example, when the U.S.-based Mayo Clinic recruited participants for a local clinical trial based on the Medicare criteria, only 8-17% of Alzheimer’s patients were eligible.

Where investors see opportunities

Existing treatments only slow the progression of Alzheimer’s without stopping it; moreover, they may even cause brain swelling and bleeding, Bloomberg notes.

Still, Alzheimer’s research continues, with 164 clinical trials assessing 127 drugs globally in 2024. Pharmaceutical giants Roche, Novo Nordisk, Japan’s Eisai in partnership with Sweden’s BioArctic, and AbbVie are developing their own drugs. In October 2024, the latter acquired Aliada Therapeutics along with its molecule ALIA-1758.

The Alzheimer’s Association, which provides research grants, reported receiving 984 full applications in 2024.

Freedom Finance Global analyst Boris Tolkachev urges investors to focus on companies that take a systemic approach to treating Alzheimer’s disease instead of those that target only the buildup of amyloid proteins in the brain.

He highlights three small caps in the space:

— INmune Bio. Currently in phase II (out of three) clinical trials, its drug XPro targets glial cells that cause chronic brain inflammation associated with aging. Over the last 12 months, the company’s stock has dropped more than 29% to $7.88 per share. However, in September 2024, BTIG highlighted INmune Bio’s innovative approach to Alzheimer’s disease while reiterating its target price of $21.00 per share. The six analysts covering INmune Bio have an average target price of $19.83 per share, 2.5 times the current market price.

— AC Immune SA. Partnered with Japan’s Takeda, U.S.-based Eli Lilly, and Janssen, a Johnson & Johnson subsidiary from Belgium, AC Immune is studying multiple molecules for Alzheimer’s disease. In the last 12 months, its stock has plunged almost 33% to $2.70 per share. The four analysts covering AC Immune rate it a “buy.” Their average target price is $8.84 per share, 3.3 times the current market price. In its coverage initiation in May, BTIG spotlighted the company’s comprehensive pipeline, with its most promising candidate being a vaccine for Alzheimer’s disease.

— Coya Therapeutics. Its drug has yet to reach the clinical trial stage. Even though Coya Therapeutics stock has dipped slightly in the last 12 months, to $5.84 per share, analysts remain upbeat on the name. However, this valuation is based largely on its other projects, such as therapies for amyotrophic lateral sclerosis and other neurodegenerative diseases. All six analysts covering Coya Therapeutics have “buy” recommendations, with an average target price of $15.75 per share, 2.7 times the current market price.

The above companies are expected to report preclinical and pilot clinical trial results in 2025, allowing investors to compare their drugs’ prospects with those by Eli Lilly, Roche, and Novo Nordisk as early as this year, Tolkachev notes.

In January, another micro-cap company, ProMIS Neurosciences, began patient trials for its drug PMN310, which targets one specific form of amyloid. The three analysts covering the name rate it a “buy,” with an average target price of $7.83 per share, 8.5 times the current price.

Zacks Small-Cap Research has highlighted Lantheus Holdings, a developer of diagnostic products. Recently, the company announced the acquisition of Life Molecular Imaging, the maker of Neuraceq — a positron emission tomography (PET) imaging agent used to assess the density of amyloid plaques in the brain. Neuraceq helps doctors to confirm Alzheimer’s disease diagnoses and determine whether new therapies are appropriate for patients, Lantheus Holdings claims.

Demand for imaging agents is growing. Neuraceq sales surged 92% in 2024. The entire market for such products has been valued at $300 million, which could reach $1.5 billion by 2030. Additionally, Lantheus Holdings is working on other imaging agents, including one developed in collaboration with AC Immune SA. The stock has 12 “buy” ratings and one “hold,” with an average target price of $131.82 per share, implying 35% upside versus the last closing price.

For investors

Tolkachev warns that investing in companies pursuing new Alzheimer’s drugs comes with high risks, as trials often fail — even in the later stages.

“The devastating failures of Athira Pharma and Cassava Sciences, along with controversial results from studies of Anavex Life Sciences’s drug candidate, highlight the insufficient knowledge about the disease mechanism and the flaws in approaches to assessing the clinical effectiveness of Alzheimer’s treatments,” he said.

Introspective Market Research points to another issue: the high cost of Alzheimer’s drug development. According to the outfit’s estimates, it takes about 13 years and $5.6 billion, versus around $793.6 million for cancer treatments.

The road to Leqembi’s approval was paved with more than 40 years of studies, tens of billions of dollars in research funding, at least 146 failed drugs, numerous debates, and despair among scientists, the AARP points out.

Among the research community, “people were despondent,” neurologist and Alzheimer’s researcher Randall Bateman, M.D., told the AARP. “It was like a clinical depression across the field.”