The Motley Fool says to hold off on buying stock of space data provider Planet Labs

The Motley Fool warns investors against rushing into shares of Planet Labs, which has a market capitalization of $1.6 billion on the New York Stock Exchange. While the company’s strong financial performance, combined with voiced interest in space exploration by Donald Trump, has buoyed the stock, the investing advice firm sees it as overvalued at this time.

Details

The Motley Fool believes investors should add Planet Labs to their watch list but refrain from buying it for now.

“Planet Labs’ solid revenue growth, declining losses, and excellent balance sheet indicate it’s on track to building a successful long-term business,” the Motley Fool notes.

These factors, coupled with Trump’s interest in space, have kept the company’s stock near highs. However, based on the price-to-sales ratio, which measures how much investors are willing to pay for each dollar of revenue (the lower the ratio, the better), Planet Labs appears to be overvalued, points out the Motley Fool. It recommends holding off on buying the stock until the share price drops or the company releases its financial results for the fiscal-2025 fourth quarter, ending January 31.

About Planet Labs

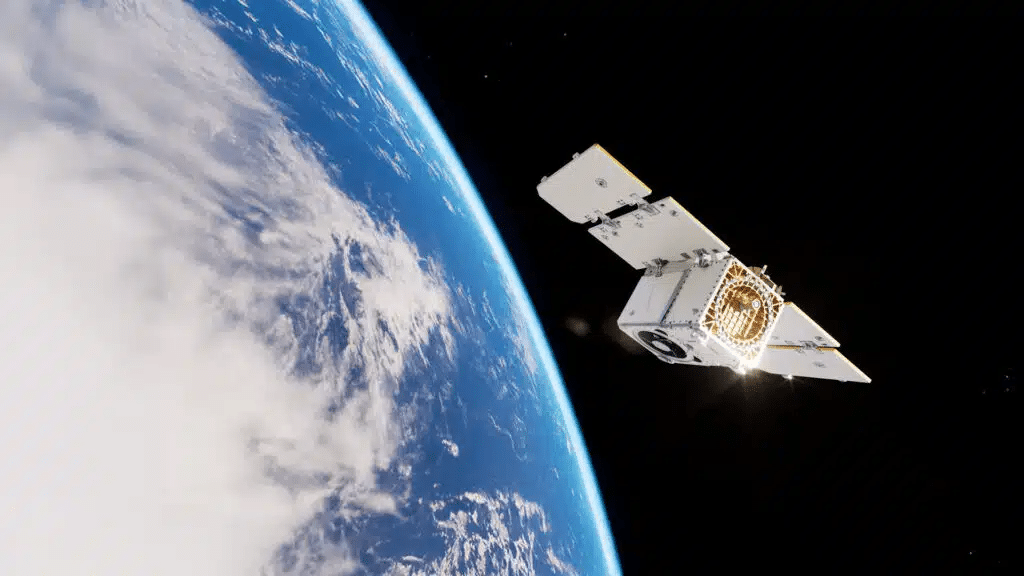

Planet Labs provides space data to companies and government agencies, including NASA. Its fleet consists of 200 satellites that capture images of the Earth’s landmass every day, enabling monitoring of forest fires or pipeline leaks, among other things. The Motley Fool points out that the company’s competitive advantage lies in its ability to collect near-real-time satellite data that is easy to interpret and use, whereas traditional satellite companies tend to offer complex and outdated data.

In its most recent earnings report, for the fiscal-2025 third quarter (ended October 31), Planet Labs posted 11% year-over-year growth in revenue to a record $61.3 million, a gross margin increase of 14 percentage points to 61%, and a 47% decline in the net loss to $20.1 million. At the end of the quarter, the company had $242 million in cash and cash equivalents. For the fourth quarter, Planet Labs guides for a top line in a range of $61-$63 million and adjusted EBITDA of up to $2 million. For context, in the fiscal-2024 fourth quarter, the company reported $58.9 million in revenue and negative adjusted EBITDA.

Stock performance

Over the last 12 months, Planet Labs stock has soared almost 140%, reaching $5.44 per share on Friday, January 24, its highest level since late 2022.

Friday’s gains came after the company announced that the National Geospatial-Intelligence Agency (NGA) had selected it as one of the commercial data providers for the five-year Luno B program. This $200 million program aims to give geospatial intelligence users access to data and analytical services that “add new context to analytic assessments by characterizing worldwide economic, environmental, and geopolitical activities.” The 13 companies selected for the program will compete with each other for future delivery orders.

According to MarketWatch, Planet Labs stock has nine “buy” ratings and two “holds” among coverage analysts. Their average target price is $4.75 per share, below the current market price.