Small-cap Diversified Energy gains on news of acquisition of peer

Yesterday, Monday, January 27, quotes on the small-cap oil and gas producer Diversified Energy rose 4% on the New York Stock Exchange after the company announced it had entered into an agreement to acquire peer Maverick Natural Resources for about $1.28 billion. Diversified expects the deal to nearly double its revenue and boost its free cash flow by 55%. Noble Capital Markets believes this could spark further consolidation in the industry.

Details

Yesterday, Diversified Energy gained 4% on the NYSE to close at $16.40 per share, before dipping less than 1% at the start of premarket trading today. In London, where Diversified is also listed, the stock had climbed 0.22% to GBP1,308.90 per share as of 9:30 London time today.

Earlier in the day yesterday, Diversified announced a definitive agreement to acquire its oil and gas peer, Maverick, from EIG Global Energy Partners, which specializes in investments in energy assets. The deal is valued at $1.28 billion, including the assumption by Diversified of about $700 million of Maverick debt. The price tag is 55% higher than Diversified’s market capitalization, which stood at $828.5 million on the NYSE as of yesterday.

As part of the transaction, Diversified will issue 21.2 million new shares worth $345 million to EIG and pay an additional $207 million in cash. When the deal closes, EIG will own approximately 20% of the combined company’s shares, including those it holds now from previous transactions.

The deal values Maverick at about 3.3 times last-12-month EBITDA, according to the press release.

«Diversified may have found value in a market where quality assets often command premium multiples,» wrote investment bank Noble Capital Markets.

For investors

Diversified Energy specializes in the production, marketing, transportation, and retirement primarily of natural gas and natural gas liquids. It is one of the few companies in the industry that have actively pursued deals in recent years, despite a broader slowdown in oil and gas M&A activity, reports the Wall Street Journal, which noted that this acquisition will be the largest in the company’s history.

Diversified sees this deal, expected to close in the first half of 2025 upon regulatory approval, increasing revenue by 95% to $1.8 billion and boosting free cash flow by 55% to $345 million. Noble Capital Markets believes that with such free cash flow, the company should have ample resources to fund growth initiatives and shareholder returns.

«For investors watching the energy sector, this merger could signal a broader trend toward consolidation as companies seek to build scale and improve operational efficiency in an evolving market landscape,» Noble remarked.

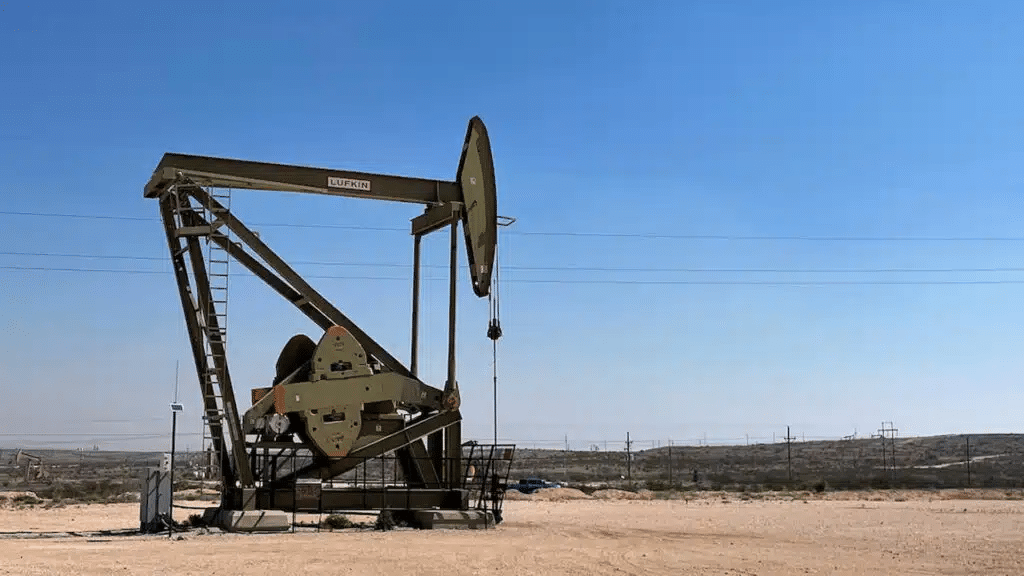

The acquisition will expand Diversified’s presence in the highest-producing U.S. oil patch, the Permian Basin, the WSJ points out, adding that President Donald Trump has already started putting in place measures to support the oil and gas industry.

Stock performance

According to MarketWatch, Diversified has seven «buy» ratings and no «sells» among coverage analysts. Their average target price of $29.60 per share implies upside of more than 80% versus the last closing price.