Kazakhstan’s leading pension fund management entities have released performance reports for the past year. Kursiv.media analyzed them to see which entities outperformed their competitors.

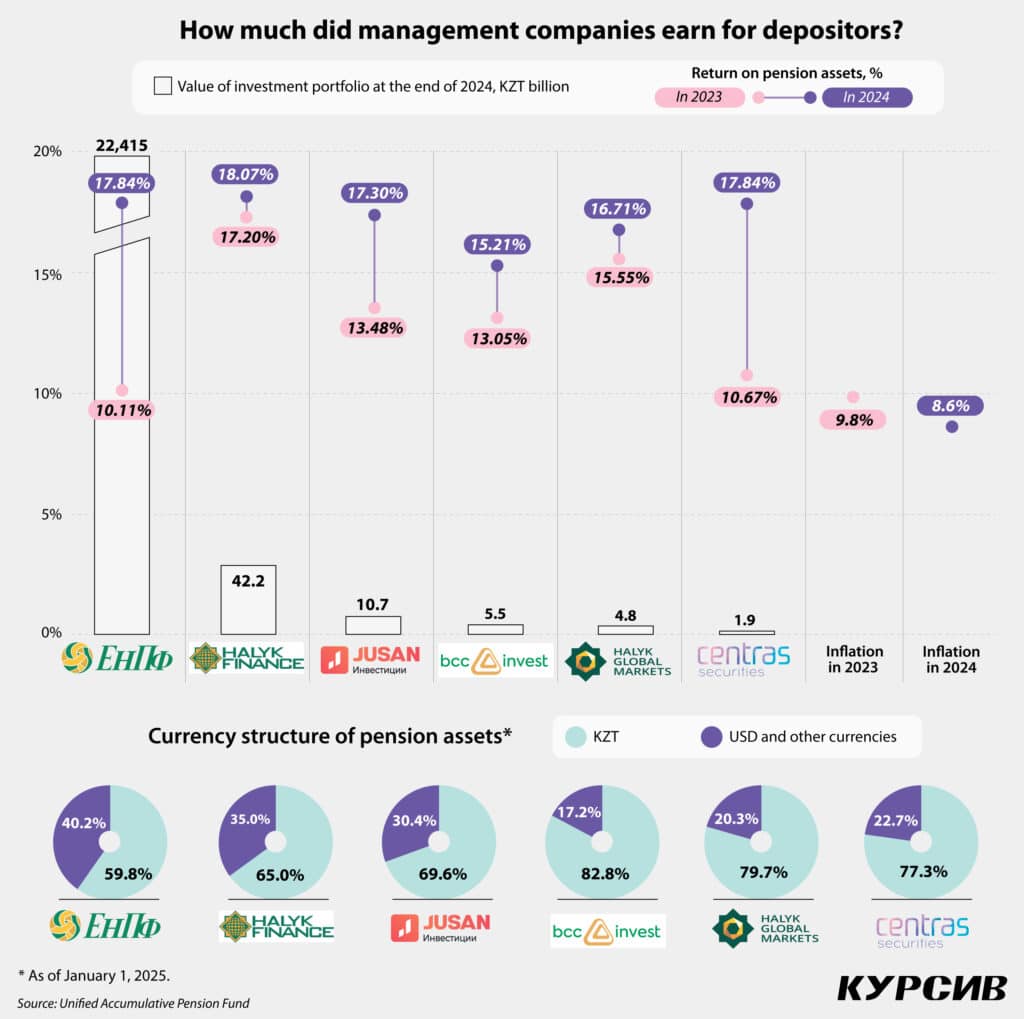

In 2024, pension asset management companies (PAMCs) in Kazakhstan delivered solid returns for depositors. However, six major players in this review showed mixed investment results. BCC Invest had the lowest return at 15.2%, while Halyk Finance led the pack with 18.1%, according to data from Kazakhstan’s Unified Accumulative Pension Fund (UAPF).

For comparison, in 2023, the performance gap between the highest- and lowest-yielding funds was 7.1 percentage points (p.p.), whereas in 2024, it narrowed to 2.9 p.p. In 2023, Halyk Finance also secured the top spot with a 17.2% return, while the National Bank had the lowest return at 10.1%, barely outperforming inflation by 0.3 p.p. (see infographic). In 2024, four PAMCs, except BCC Invest and Halyk Global Markets, achieved returns that more than doubled the inflation rate.

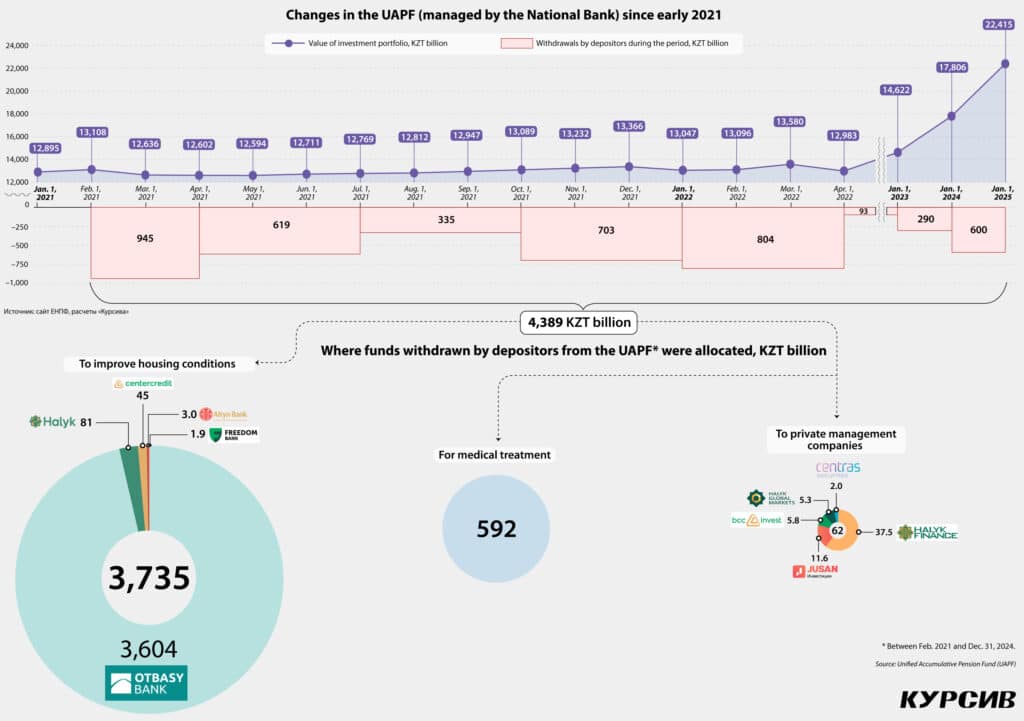

For the vast majority of Kazakhstanis, the National Bank’s performance is of greatest interest, as it manages 22.4 trillion tenge (approximately $47 billion) in pension funds (UAPF) as of Jan. 1, 2025. By contrast, the total assets managed by the other five companies amount to just 62 billion tenge (around$130 million), a mere 0.3% of the total UAPF holdings. In 2024, the National Bank posted a 17.8%return, securing second place among PAMCs. Its investment income surged to 3.4 trillion tenge ($7 billion), up from 1.6 trillion tenge ($3.5 billion) the previous year.

As in 2023, the primary drivers of UAPF’s profits were:

- Securities and deposits: Yielded approximately $3.8 billion in 2024, up from $3.2 billion in 2023. However, while this accounted for 93.4% of investment income in 2023, its share dropped to 52.2% in 2024.

- Externally managed assets: Generated approximately $2 billion or 30.6% of investment income.

- Foreign currency revaluation: Contributed approximately $1.2 billion or 17.0% of investment income.

Had the tenge exchange rate remained stable throughout 2024, instead of sharply declining at the end of the year, UAPF’s overall returns might have appeared less impressive.

In 2023, the National Bank began regularly buying U.S. dollars for the UAPF to maintain a 30% foreign currency allocation in its portfolio, acquiring $2.5 billion. UAPF’s foreign currency allocation reached 31.7% by the end of 2023, surpassing the intended target. Despite this, the dollar-buying strategy continued in 2024, still claiming the need to maintain a 30% foreign currency share. Only in October 2024, when the share of U.S. dollars in the UAPF portfolio rose to 39.2%, did the National Bank revise its explanation. A new statement in its official monthly reports declared that the goal was now to «increase the foreign exchange share of pension assets to 40%.»

According to Kursiv.media calculations, in less than 10 months, the National Bank purchased over $3.6 billion for the UAPF. On Oct. 10, 2024, after hitting the 40% target, the bank suspended dollar purchases, claiming the objective had been met. A comparison with the latest exchange rate shows that the UAPF acquired foreign currency at relatively favorable rates. In the first quarter (Q1) of 2024, the average exchange rate was 450 tenge per dollar, followed by 448 tenge in Q2 and 478 tenge in Q3, with a sharp depreciation in June. In late November, the national currency plunged quickly from 499 to 513 tenge per dollar, and by year-end, it further weakened to 525 tenge per dollar. In October, the UAPF yield was 12.67%. It rose to 14.85% in November and reached 17.84% by December. Thus, the tenge’s depreciation indirectly boosted UAPF’s reported performance, creating a potential conflict of interest: while currency devaluation generally harms the economy, the National Bank, acting as UAPF’s asset manager, could now report strong returns on citizens’ pension funds.

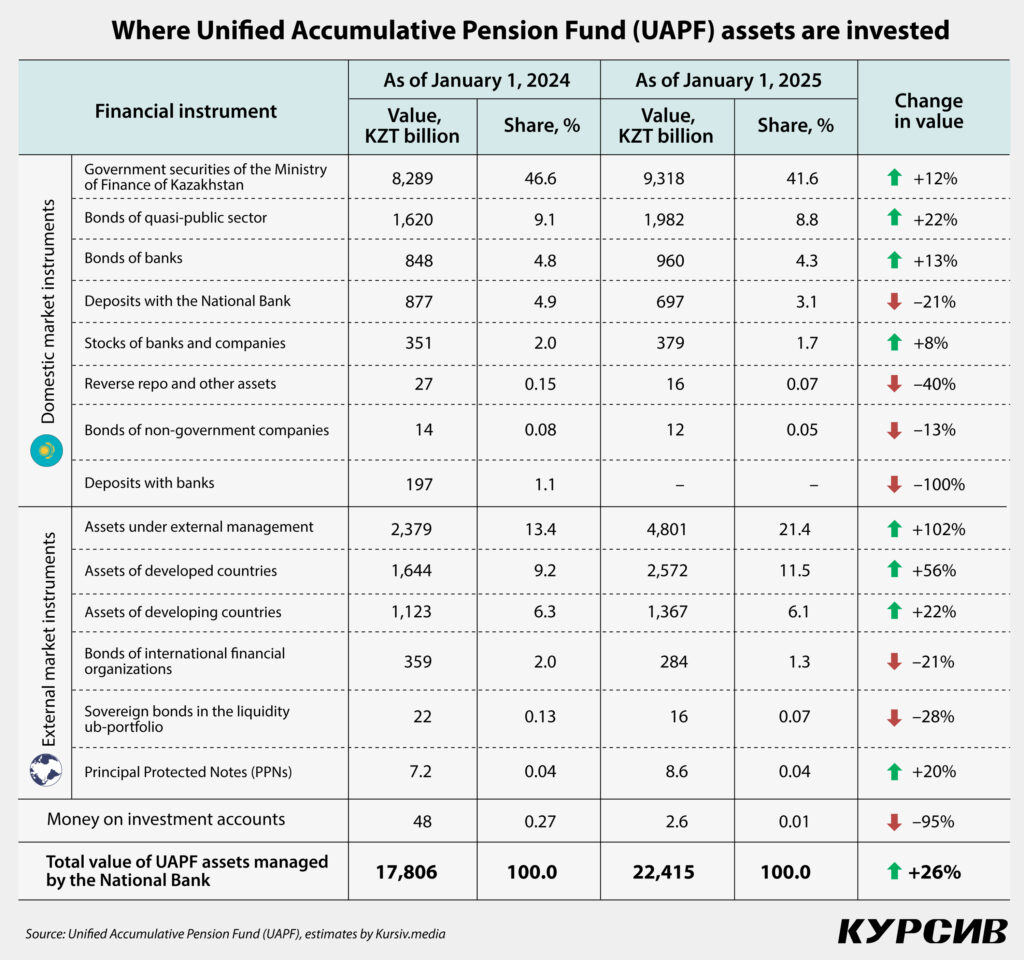

Among the six licensed PAMCs, the National Bank stands out for its high level of portfolio dollarization (40.2% as of early 2025). In contrast, other PAMCs maintain lower foreign currency allocations, ranging from: 17.2% (BCC Invest) to 35.0% (Halyk Finance). In 2024, UAPF’s dollar-denominated portfolio surged by 60% (approximately $7 billion) to nearly $19 billion. Within UAPF’s investment structure, the strongest growth occurred in foreign currency assets, particularly:

- Externally managed assets: +102% (approx. $5 billion).

- Developed-market assets: +56% (approx. $2 billion).

- Emerging-market assets: +22% (approx. $250 million).

Meanwhile, UAPF’s tenge-denominated portfolio grew by 10.2% or 1.2 trillion tenge to 13.4 trillion tenge ($28 billion). Investments in quasi-public company bonds saw the highest growth (+22% or approx. $770 million). UAPF investments in bank debt securities rose by 13% (+$230 million). However, in 2024, the National Bank did not renew UAPF deposits placed in second-tier commercial banks. As of early 2024, these deposits totaled 197 billion tenge (approx. $430 million), meaning Kazakhstani banks received less capital from UAPF than they had to return.

The bonds of Kazakhstan’s Ministry of Finance continue to be the most significant instrument in UAPF portfolio, with their value increasing by 12% over the year or by approximately $2 billion, reaching $19 billion. At the same time, their share in pension assets decreased from 46.6% to 41.6%, while the share of assets under external management increased by 8 p.p. (from 13.4% to 21.4%) and the share of developed-market assets grew from 9.2% to 11.5%.

Since the establishment of the UAPF (and the inheritance of a significant volume of low-quality assets from private pension funds), its managing entity has not shown much appetite for investing in shares of local issuers (including quasi-public ones). At the beginning of 2024, the share of domestic bank and company stocks in the UAPF portfolio was 2.0%. By year-end, it declined to 1.7%. Nevertheless, in February 2024, the National Bank decided (or was strongly encouraged) to take a risk and participated in the Air Astana IPO. At the time, the airline was jointly owned in almost equal shares by Kazakhstan’s Samruk-Kazyna Fund and the British company BAE Systems.

This investment was perhaps a small misstep in an otherwise successful UAPF investment strategy. As part of the IPO, the National Bank spent approximately $53 million on Air Astana securities, acquiring 6.5% of the airline’s shares, making it the third-largest shareholder, after Samruk-Kazyna and BAE Systems. As of early 2025, the market value of this stake had fallen to around $40 million, meaning the UAPF incurred an almost $12 million loss on this deal. Air Astana shares continued to decline, dropping on the local stock exchange from approximately $1.60 to $1.50 per share, a further 4.6% decrease.