World Bank reveals key challenges for Kazakhstan’s economy

The World Bank (WB) has issued a report on Kazakhstan’s economy, citing the budget deficit, an increase in public debt and a decline in investment inflows as key challenges for the country.

According to the bank, Kazakhstan’s economy is expected to grow rapidly this year due to increased oil output, as Tengizchevroil reported the first oil from its Future Growth Project (FGP). Authorities estimate that the launch of the FGP will boost oil production at Tengiz by 12 million tons per year.

However, after 2025, Kazakhstan’s economic growth is expected to slow down to 3% to 3.5% due to low productivity and a decline in investment inflows. In this situation, the country will need to find new economic levers.

The WB forecasts that inflation in Kazakhstan will slow down to 7.5% to 8% in 2025 and 6% in 2026 (it stood at 8.6% in 2024). However, experts have made reservations, noting that actual figures might differ from the forecast due to the depreciation of the tenge and the current fiscal policy, which remain uncertain.

The budget deficit will remain significant — at 3.1% in 2025 and 2.7% in 2026. (It stood at 2.7% in 2024.) Nevertheless, the WB assesses Kazakhstan’s public debt as low and manageable, having reached 24% of GDP. However, the bank said the increasing cost of servicing the debt may affect other sectors, diminishing the government’s financial capabilities.

Kazakhstan may face several risks, according to the World Bank, including:

• A decline in oil prices, which will affect budget revenue and increase tenge volatility.

• Drawn-out budget expansion (where authorities boost expenditures for economic growth), which may pressure the balanced budget, lead to higher prices and keep the base rate high for a prolonged period, making loans less affordable for people and businesses.

• An increase in internal borrowings, which could squeeze out private entities and raise the cost of debt servicing.

• Extreme weather conditions that could also damage economic stability.

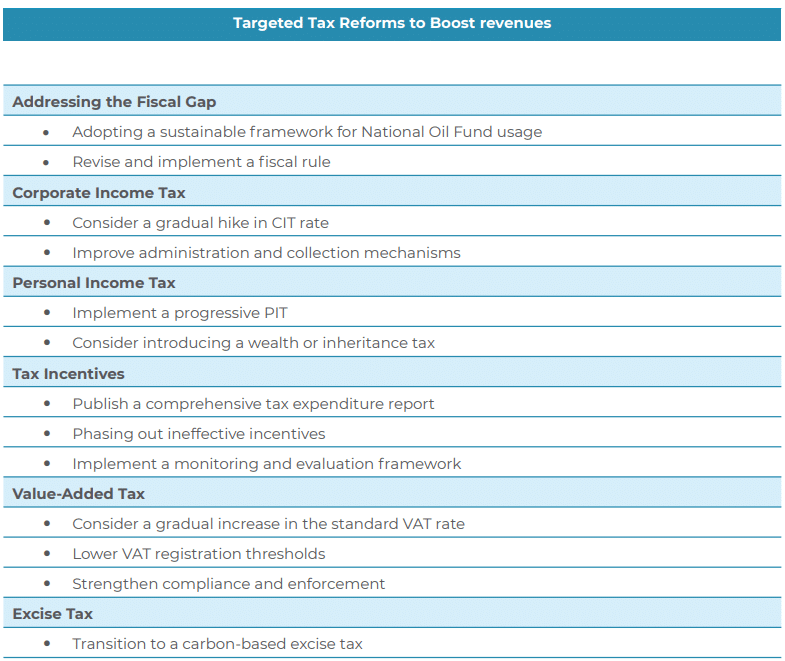

«Tax revenue in Kazakhstan is still lower than in those countries that Kazakhstan aims to emulate, as well as in those with a comparable economic structure. This underscores the urgent need for reforms to mobilize revenue,» the WB said.

Analysts point out that, between 2015 and 2022, tax revenue was just 17% of GDP in Kazakhstan, compared to 34% within the Organization for Economic Co-operation and Development (OECD).

«Tax revenue continues to lag behind, which can result in the underfunding of critically important public services and missed opportunities for long-term growth,» the report said.

The WB also emphasized that public spending will continue to grow due to various social programs and the need to upgrade infrastructure. Given that Kazakhstan is increasingly reliant on the National Fund due to a lack of funds in the state budget, this poses a long-term threat to the country’s fiscal sustainability.

The financial institution suggests that Kazakhstan undertake a massive tax reform. The International Monetary Fund presented similar analysis and proposals in late January. Currently, the country’s cabinet is reviewing the option of raising VAT from 12% to 20% and decreasing the threshold for registering businesses as VAT payers. Authorities project that this could bring an additional inflow of funds between $9.6 billion and $13.5 billion.