Kazakhstan’s coffee craze gets pricey: Espresso costs up 16%

The price of a cup of espresso in Kazakhstan has increased by 16% over the past year, while consumption has risen by 10% during the same period. Coffee shop owners predict an even steeper price hike ahead. How will this impact coffee consumption, which has already become an integral part of everyday life and culture in Kazakhstan?

Coffee consumption in Kazakhstan is on the rise

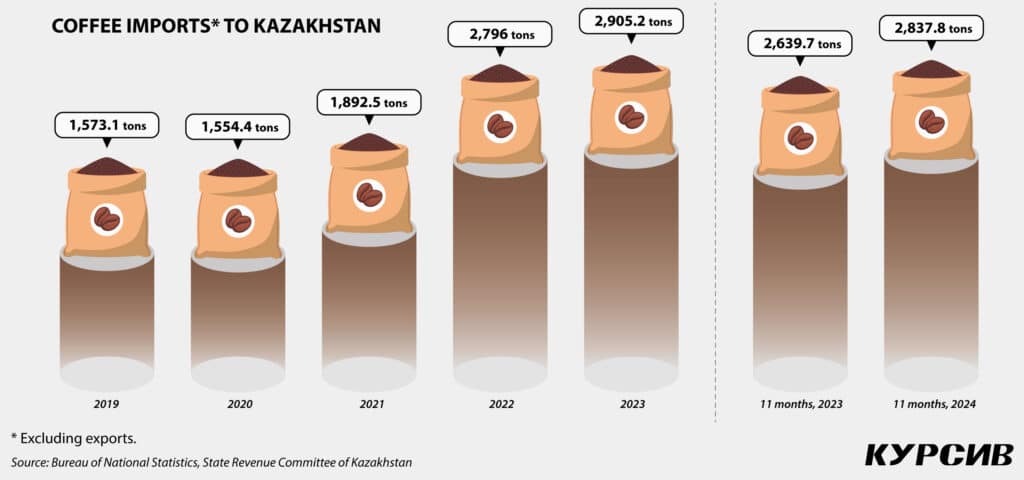

Global coffee consumption reaches 2.25 billion cups daily, according to the International Coffee Organization, which forecasts annual growth of 1% to 2% through 2030. This trend is evident in Kazakhstan, where net coffee imports increased 1.8 times between 2019 and 2023. During the first 11 months of 2024, imports rose 7.5% year-on-year (YoY).

Coffee consumption in Kazakhstan is increasing by approximately 5% to 7% annually, according to the Zakon.kz news portal, citing Euromonitor International, a leading provider of global market analysis and consumer insights. In 2024, the local market was estimated at 12,850 tons of coffee, with 35% comprising whole bean and ground coffee.

«Coffee consumption in Kazakhstan is growing rapidly. It’s no longer just a drink. It’s becoming part of the culture and daily life, especially among young people. Milk-based drinks like cappuccinos and lattes remain the most popular, but Kazakhstanis are also rediscovering classic black coffee,» said Rodion Yeroshek, CEO and co-owner of Poster, a cafe and restaurant automation company.

Poster has been operating in Kazakhstan for more than a decade and serves over 1,000 clients in the catering sector. According to its data, in 2024, espresso sales in the country surged by 10% YoY.

Asylzhan Qazi, founder of the EspressoDay coffee shop chain, attributes Kazakhstan’s growing love for coffee not only to global trends but also to the natural evolution of the local market.

«Kazakhstan is experiencing a coffee boom. Coffee shops are no longer just places to grab a snack; they’ve become hubs for communication and leisure. People hold business meetings and even work from here,» he said.

Qazi opened his first coffee shop in June 2023. His chain has since expanded to more than 50 locations in Astana and Almaty. Coffee consumption, he noted, is increasingly becoming a daily habit and ritual for many people.

Kazakhstan’s favorite coffee drinks

According to Poster, the latte was the most popular coffee drink in Kazakhstan at the end of 2024. A study, based on aggregated, non-personalized sales data from a representative sample of 150 shops operating continuously from 2023 to 2024, found that for every espresso sold, 68 lattes and 66 cappuccinos were purchased. Cappuccino ranked second, followed by the Americano. In 2023, the same three drinks topped the list, though the cappuccino held the No. 1 spot.

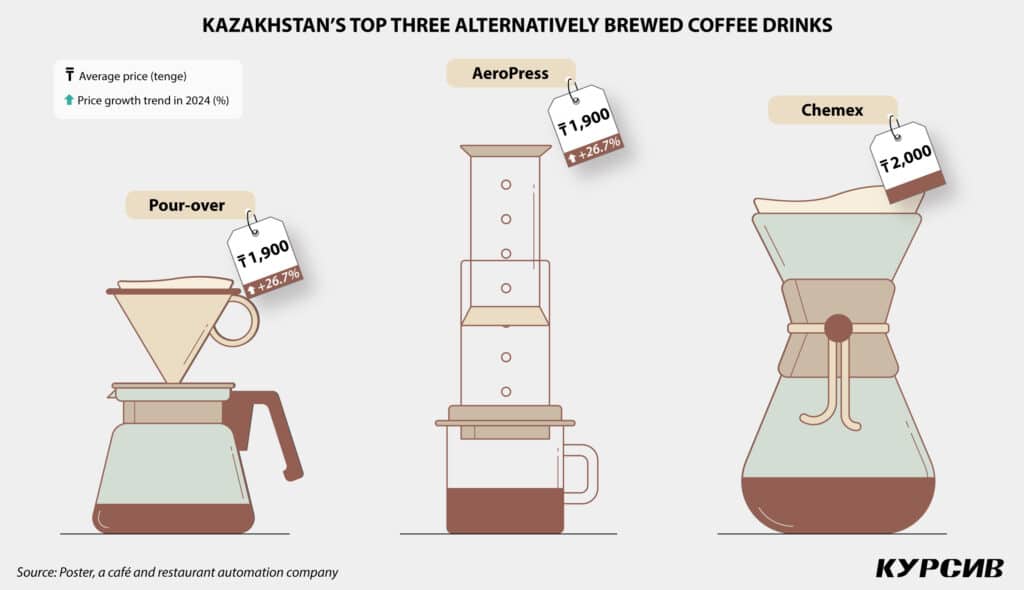

Among alternative brewing methods, the pour-over, also known as the «dripper cone,» was the most popular in 2024, according to Poster. This method involves brewing coffee in a cone-shaped device with a paper filter. The second most popular alternative method was the AeroPress, which uses pressure, similar to a syringe, to force water through coffee grounds. However, the AeroPress was significantly less popular than the pour-over, with cafes offering it about half as often in 2024. The Chemex, an hourglass-shaped glass coffee maker designed for filtered coffee, ranked third.

«Kazakhstan’s coffee market is currently experiencing its “second wave,» characterized by increased consumer interest in coffee and growing demand for beans and equipment. While a «third wave» of specialty coffee enthusiasts is emerging, with a deeper understanding of varieties and brewing methods, they remain a minority for now,” said Roman Pan, director of Spectre Coffee training center.

Spectre Coffee has been operating in Kazakhstan since 2015, roasting coffee and running its own coffee shop, retail store and barista training center.

According to Vadim Ovechkin, owner of Holder Coffee shop in downtown Almaty, third-wave coffee culture, focused on high-quality beans and diverse brewing methods, has only recently started gaining traction in Kazakhstan.

«When we opened seven years ago, the coffee shop market was relatively untapped. Few cafes emphasized coffee quality and taste,» Ovechkin said.

At that time, he noted, most visitors were satisfied with coffee from an espresso machine. Now, however, there is a growing demand for more refined coffee varieties and alternative brewing methods.

«Initially, we didn’t offer alternative brewing methods regularly, though we occasionally prepared specialty brews. Over time, we saw demand for ‘alternative’ coffee emerge. About a year and a half ago, we decided to add alternative brewing methods to the permanent menu,» he said.

While demand for these brews remains relatively low, it has become consistent. On average, for every 50 to 70 cups of standard coffee served at his cafe, two or three are brewed using alternative methods.

Asylzhan Qazi also plans to introduce alternative brewing options in his coffee shop chain.

«The market for ‘alternative’ coffee is still small, perhaps only about 0.5% of the population in Kazakhstan, but it’s growing steadily each year,» he said.

How coffee prices have changed

According to Poster, a cup of alternative coffee averages between $3.80 and $4.00. Over the past year, the price of pour-over and AeroPress coffee has increased by nearly 30%.

Industry experts attribute the higher prices to rising coffee production costs and the more labor-intensive and time-consuming nature of alternative brewing methods.

For comparison, in 2024, the average price of a classic espresso in Kazakhstan was about $1.70, a 16% increase YoY from $1.50. The price of a latte also rose, up 13.3% YoY to an average of $2.50 in 2024.

Market participants forecast even steeper price increases for coffee drinks in 2025. At the end of January, average monthly exchange prices reached record highs, with Arabica at $7.81 per kilogram and Robusta at $5.41 per kilogram, according to the World Bank. These prices represent year-on-year increases of 74% for Arabica and 65% for Robusta.

The sharp rise in coffee prices is attributed to droughts in Brazil and Vietnam, two of the world’s largest coffee producers. Poor harvests, coupled with growing global demand and potential trade duties, have further strained the market.

«Take Brazilian coffee, for example. Last year, we paid $8 to $9 per kilogram for green beans. Now, that same coffee costs $14 to $15 per kilogram, a more than 50% increase, and prices are still rising. So yes, coffee prices in the country will go up,» Pan of Spectre Coffee said.

He added that in January 2025, roasted coffee prices increased from 2,000 to 5,000 tenge (about $10) per kilogram, depending on the variety.

«The price hike is driven by more than just production costs. For example, utility bills have risen by 30% this year, and rental rates have also increased. Based on our calculations, the price of a standard cappuccino is projected to average 2,000 tenge (roughly $4) within the next year or two, up from the current 1,000 to 1,200 tenge,» Qazi predicted.

Roman Pan believes rising coffee prices are unlikely to dampen consumption, as coffee has become a staple. However, some consumers may opt for less expensive varieties.