How Kazakhstan uses off-take contracts to drive business revenue

Kazakhstani authorities have successfully promoted off-take contracts among subsoil users and in the quasi-public sector. In 2024, the number of concluded off-take agreements doubled, reaching a total value of more than 200 billion tenge (approximately $426 million). Kursiv Research explores why this model has gained traction in developing the country’s manufacturing industry.

How did off-take contracts become a tool of industrial policy?

How many off-take agreements have been concluded?

What does an off-take agreement look like for a sovereign wealth fund portfolio company?

How are off-takes and bank lending connected?

«An off-take contract is an agreement between a customer and a supplier for the future delivery of goods that the supplier plans to produce, under pre-agreed terms regarding cost, quantity and delivery time,» according to a guiding document from Kazakhstan’s Ministry of Finance. This definition aligns with international standards and practices.

Off-take agreements are not limited to public policy; they are especially common in the extractive sector, where large-scale development projects require substantial investments. In this industry, securing a guaranteed supply of raw materials is crucial for consumers. Such agreements reduce uncertainty for both parties while allowing manufacturers to use projected revenue as loan collateral.

This arrangement also plays a role in industrial policy, aligning state and business interests. The framework is as follows. The state needs tax revenue and job creation. It offers guaranteed payment for goods or services consumed by the government or state-controlled companies. An investor agrees to build a local production facility to meet that demand. However, without a formal contract, the investor remains uncertain about future demand and may struggle to secure financing. Off-take agreements provide that certainty, allowing future revenue to serve as loan collateral, making the situation more predictable for all stakeholders, i.e. the government, investors and lending banks.

If the product supplied under an off-take contract is a high-demand intermediate good, e.g. electricity or gasoline, the agreement can also stabilize costs and pricing for other businesses.

Globally, off-take agreements extend beyond the public sector. International companies, particularly in subsoil extraction, rely on them to manage supply chains and investment risks. In resource-rich countries, governments can leverage off-take deals to increase tax revenue, boost local job creation and improve cost management for extractive industries. This approach is especially critical for countries operating under production sharing agreements (PSAs) with foreign investors.

To further support industrial policy objectives, off-take contracts may include investment obligations for suppliers, such as localizing component production and increasing the use of domestic labor and capital resources.

How did off-take contracts become a tool of industrial policy?

Although off-take contracts have long been used by companies operating in Kazakhstan (e.g., Samruk-Kazyna, the country’s sovereign wealth fund, has been incorporating them into its import substitution program since 2018), their role in industrial development was formally defined only in the 2021 law on industrial policy.

The law classifies off-take agreements as one of two contract types designed to promote industrial growth (the other being contract procurement agreements). According to the legislation, an off-take contract involves «the long-term guaranteed purchase of goods from the manufacturing industry, including those acquired as part of work performed and services rendered, where production is organized by the supplier and was previously unavailable.»

Under these agreements, suppliers commit to establishing production facilities using funds received from customers. The price and volume are fixed for the contract’s duration and cannot be unilaterally reduced. Suppliers can also use off-take contracts as collateral when applying for loans from commercial banks or development institutions. To ensure transparency, the Ministry of Industry and Trade maintains a registry of off-take contracts, tracking contractors, deadlines and manufactured goods.

Off-take contracts are a key tool, particularly in state-directed industrial policy, for managing in-country value (formerly «Kazakhstani or local content»). The government tracks the domestic value of purchased goods, services and works across various entities, including government agencies, state-owned enterprises, national companies, development institutions, subsoil users and concessionaires.

Samruk-Kazyna, Kazakhstan’s largest corporate entity with assets worth approximately $80 billion as of October 2024, has developed the most detailed off-take policy. In 2014, the fund launched a program to modernize existing production facilities and establish new ones, including the aforementioned import substitution initiative. As part of this effort, Samruk-Kazyna regularly reviews and updates a register of products for import substitution based on long-term procurement needs. The current list, valid through 2029, includes over 10,000 items worth nearly $1 billion.

For a product to be included in the register, portfolio companies must:

- Demonstrate long-term demand for the product.

- Confirm that the product is either not produced in Kazakhstan or that existing local production does not meet demand.

Once these conditions are met, private companies can submit applications and business plans for import substitution projects to Samruk-Kazyna. The approval process follows these steps:

- Entrepreneurs submit their applications and business plans.

- A potential customer reviews the submission.

- If approved, the project is assessed by an expert group.

- The commission for project review and approval conducts a final evaluation.

- If all levels approve, the initiator receives a signed off-take contract and can begin implementing the project.

According to Eldar Doskenov, CEO of Samruk-Kazyna Contract, the entity overseeing procurement for the fund’s portfolio companies, the entire process, from application submission to contract signing, takes just 30 days.

How many off-take agreements have been concluded?

The use of off-take contracts in Kazakhstan has steadily expanded since 2018. In 2023, President Kassym-Jomart Tokayev emphasized their importance as a key mechanism for national business development in his state-of-the-nation address:

«The state, in partnership with large enterprises, should close the production cycle within the country. Achieving this will necessitate both regulatory and incentive mechanisms. The manufacturing sector should have access to raw materials in sufficient quantities and at reasonable prices. Additionally, it is vital to expand the proportion of domestic goods in regulated procurement and fully execute the off-take system. The share of off-take contracts with domestic manufacturers should increase to at least 10%, amounting to an annual two trillion tenge.»

Kazakhstan’s 2024 national report on the state of industry highlighted that, through joint efforts between the government and the business community, the total value of long-term contracts and off-take agreements signed in 2023 more than doubled year-on-year (YoY), reaching approximately $1 billion and $510 million, respectively. According to the report, these agreements contribute to increasing domestic value in production and enhance the ability of local enterprises to secure contracts with large customers and multinational corporations looking to improve their local procurement indicators.

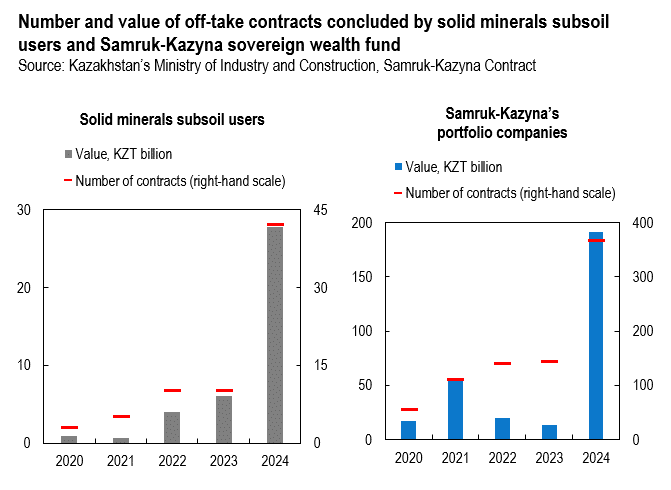

In February 2025, Samruk-Kazyna reported that in 2024 alone, it signed off-take contracts worth approximately $407 million with Kazakhstani entrepreneurs, a tenfold increase YoY. Between 2018 and 2024, the fund concluded a total of 842 off-take agreements, including 367 signed in 2024, with a combined value of approximately $740 million.

According to the Ministry of Industry and Construction’s response to Kursiv.media’s inquiry, between 2020 and 2024, the agency facilitated 70 off-take contracts worth nearly $90 million and 353 long-term contracts worth approximately $507 million with solid minerals subsoil users.

The Ministry of Energy reported that from 2021 to 2024, 24 agreements were signed with international investors and equipment manufacturers, and 27 localization projects were prepared, seven of which were successfully implemented. However, the agency did not disclose the contract values.

Samruk-Kazyna’s portfolio companies have concluded most of their off-take contracts in mechanical engineering and the chemical industry. «The industries in which manufacturers primarily enter into off-take contracts with tracked entities are mechanical engineering, metallurgy and metalworking, light industry and the chemical industry,» the ministry noted.

The agencies listed the following supplied products: transformers, oil and gas production pipes, pumps, automated control systems, shut-off equipment, electric submersible pumps, solid-rolled wheels, conveyor rollers, metal structures, gearboxes, forgings, channels, angles, workwear, footwear, rubber-metal linings, graphite electrodes and lime.

Manufacturers primarily sign off-take contracts with subsoil users in the East Kazakhstan, Karaganda, Aktobe and Pavlodar regions. Samruk-Kazyna identified suppliers from Astana, Almaty and Shymkent, as well as from the Pavlodar, Aktobe, Zhetysu, Zhambyl, Akmola, East Kazakhstan and West Kazakhstan regions.

What does an off-take agreement look like for a sovereign wealth fund portfolio company?

KEGOC, Kazakhstan’s electricity grid operator, and its contractors provide a strong example of how off-take agreements support import substitution and local production development. In 2024, KEGOC signed off-take contracts worth nearly $43 million, a fivefold increase YoY. To put this into perspective, KEGOC’s total capital expenditures (cash outflows for acquiring fixed assets) in 2024 amounted to approximately $94 million.

Asia Trafo LLP, a Shymkent-based manufacturer of transformers, autotransformers and shunt reactors, has been one of KEGOC’s key off-take partners in recent years. KEGOC’s orders have served as a «booster» for the company, enabling the plant to export its products to neighboring countries.

«KEGOC prioritizes the products of local manufacturers when implementing investment programs. As part of major projects — such as strengthening the electric grid in the southern zone of Kazakhstan’s unified energy system and integrating the power grid of western Kazakhstan with the unified energy system — domestically produced electric grid equipment is actively used,» the company said.

How are off-takes and bank lending related?

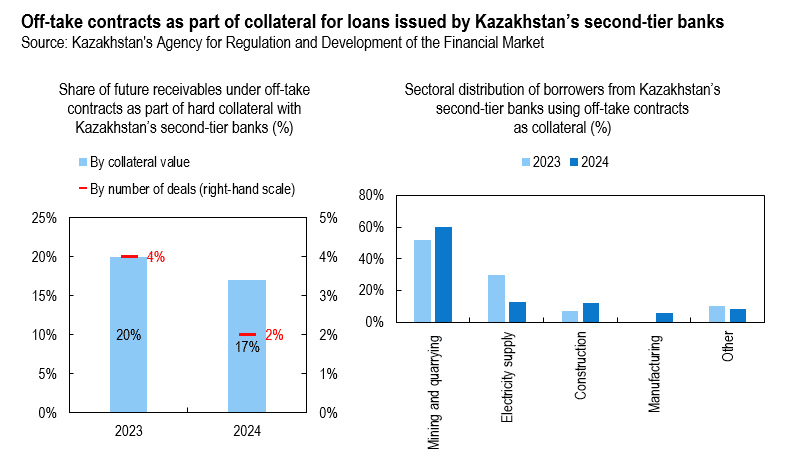

The funds manufacturing companies receive through off-take contracts can serve as collateral for loan agreements with Kazakhstan’s second-tier banks, alongside real estate, vehicles and other company assets.

This form of collateral was highlighted in the last two asset quality review (AQR) reports on the local banking sector, which covered 11 Kazakhstani banks. According to the 2024 report, future cash flows from off-take contracts accounted for 2.2 trillion tenge (approximately $4.7 billion) or 17% of the total volume of hard collateral with second-tier banks and 2% by quantity. In 2023, those figures were nearly $5.5 billion (20%) and 4%, respectively. As a result, «off-take assets» ranked second in terms of collateral volume, after real estate, and fourth in quantity, following real estate, vehicles, equipment and money in borrowers’ accounts.

Half of the borrowers using off-take cash flow as collateral are mining companies, while 13% are in the energy sector, 12% in construction and 6% in manufacturing.

Off-take contracts that borrowers use as collateral with second-tier banks may differ significantly from those reported by the Ministry of Industry, the Ministry of Energy and Samruk-Kazyna. While the public sector tracks contracts from specific enterprises with in-country value contributions, banks assess any client transactions with planned future deliveries. This classification includes both contracts for new import-substituting products, such as transformers, and more standard agreements, such as those for steam coal or electricity.