How Kazakhstan’s shoppers guide central bank rate decisions

How has wholesale trade changed?

What’s next for trade in 2025?

Emerging trends in Kazakhstan’s domestic trade sector during the first quarter (Q1) of 2025 are shaping not only economic growth forecasts but also influencing the National Bank’s decisions. While wholesale trade is showing strong momentum, retail is growing at a more measured pace.

Kursiv Research continues its in-depth analysis of Kazakhstan’s trade sector. Domestic trade often serves as a leading indicator, signaling broader economic shifts before other metrics catch up.

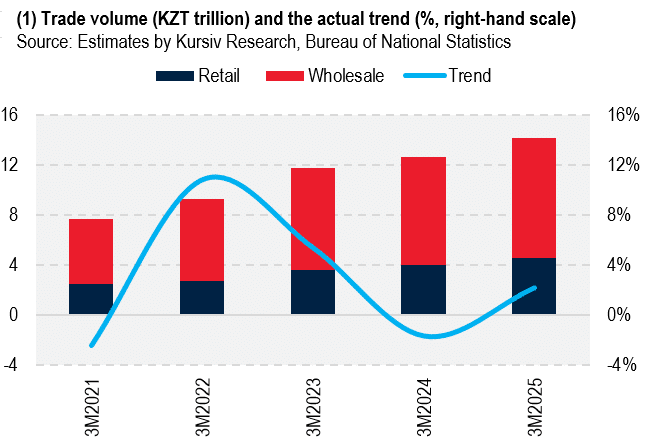

According to preliminary data from the Bureau of National Statistics (BNS), Kazakhstan’s total domestic trade volume, including retail and wholesale, reached 14.2 trillion tenge (about $27 billion) in Q1 of 2025. That marks an 11.8% increase in nominal terms or 2.2% growth after adjusting for inflation.

Retail trade, though making up just one-third of the total trade volume, plays a key role in driving trends across the sector. Retail turnover rose to 4.6 trillion tenge ($8.8 billion), a 13.3% increase in nominal terms. In real terms, the segment grew by 4.8% year-on-year (YoY).

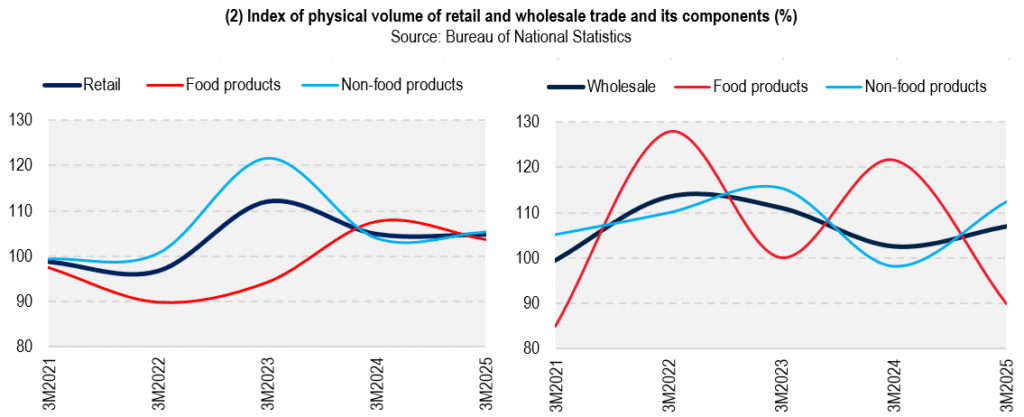

Non-food products continued to dominate retail growth. Turnover in this segment reached nearly $6 billion, rising 14.1% in nominal terms and 5.3% in real terms. Strong demand, particularly for durable goods, has been fueled by consumer lending. In January and February 2025, Kazakhstani banks issued approximately $4.6 billion in new consumer loans. Kursiv Research estimates that, after inflation, this reflects a 2.5% growth rate, outpacing other lending categories.

Meanwhile, food sales saw more modest gains. From January to March, food retail reached approximately $2.3 billion, rising just 3.6% in real terms. That represents a slowdown from the same period last year, when food sales rose 7.6%, and from the full-year growth of 9.1% in 2024.

How has wholesale trade changed?

Wholesale trade climbed to nearly 9.6 trillion tenge ($18.3 billion) in Q1 2025, up 11.1% in nominal terms and 7.0% in real terms. While wholesale food sales fell by 10.2% in real terms to approximately $3.2 billion, the sharpest decline in three years, strong growth in non-food segments kept overall momentum positive.

Non-food products now account for roughly 80% of wholesale trade and include a broader range of items than in the retail segment. This includes industrial and technical goods (ITG): raw materials, components, tools, fuel, machines, spare parts and semi-finished products. These goods are largely purchased by businesses, though current statistics don’t distinguish between consumer non-food items and industrial goods within wholesale data. However, given the size of wholesale turnover compared to retail, industrial demand dominates.

In Q1 2025, sales of non-food and industrial goods reached around $15 billion, up 15.3% in nominal terms and 12.4% in real terms. That’s a sharp reversal from the same period in 2024 when sales declined 1.9%. By the end of last year, however, the segment had recovered to show 7.4% annual growth.

Wholesale trade in non-food products and ITG depends heavily on investment levels and overall business activity. The most recent available statistics on fixed asset investment and corporate lending cover only the first two months of 2025. Preliminary data suggest that sales in these sectors are not increasing alongside investment activity.

For example, from January to February 2025, capital investment rose by just 0.5% in real terms, while inflation-adjusted corporate lending dropped by 8.2% YoY.

What’s next for trade in 2025?

Retail trade trends are closely monitored as part of monetary policy decisions. In early March 2025, the National Bank of Kazakhstan tightened monetary policy, raising the base rate by 1.25 percentage points to 16.5%. The regulator cited inflationary pressures from both supply and demand. These included rising global food prices, inflation in Russia and a surge in domestic demand fueled by continued fiscal stimulus and an overheated consumer lending sector, which grew 33.5% YoY by the end of 2024.

At its most recent meeting on April 11, the National Bank’s Monetary Policy Committee chose to keep the base rate unchanged. National Bank Chairman Timur Suleimenov, speaking at a post-meeting briefing, pointed to a 5% growth rate in retail trade as a sign that consumer demand is stabilizing.

«After rapid growth at the end of 2024, consumer demand returned to historical averages in early 2025,» Suleimenov said. «The first signs of normalization are evident in retail turnover and major purchases. In February, retail trade volumes grew 5.1%, compared to 19.3% in October of last year. According to a population survey, the share of respondents who made a major purchase in the past three months dropped from 27.3% in October to 19.9% in March. These are clear signs of normalization in consumer demand.»

In a press release following its April meeting, the regulator stated that newly announced macroprudential standards are designed to cool consumer lending. Notably, the debt burden ratio calculation was tightened last year to support this goal. Under the updated rule, total loan payments may not exceed 50% of a borrower’s income. This requirement now applies to all borrowers and all types of loans, excluding those within the housing savings system. Previously, this limit did not apply to loans secured by collateral or to borrowers whose income was at least twice the national average monthly salary. The central bank also banned the use of indirect indicators such as utility payments, online purchases and property ownership to assess a borrower’s income.

If retail turnover begins growing faster than the current «normal» rate of about 5%, and if the impact of the new macroprudential standards on consumer lending fades quickly, the National Bank is expected to take additional measures to temper consumer demand.

Meanwhile, the government is working to sustain high growth in wholesale trade, particularly in the ITG sector. Investment activity in Kazakhstan has declined in recent years when measured against the size of the economy, falling from 18% of GDP in 2019 to 14% in 2024. In response, the government plans to recapitalize Baiterek Holding, Kazakhstan’s major state-owned financial holding company, with an additional $1.9 billion. The holding is expected to finance approximately $15 billion in investment projects in 2025. Another major growth driver is the newly launched national project to modernize Kazakhstan’s energy and utilities infrastructure. The project is set to receive nearly $25 billion in funding over five years, with $2.3 billion allocated for 2025.