Kazakhstan’s consumer confidence slightly rebounds in March, still negative

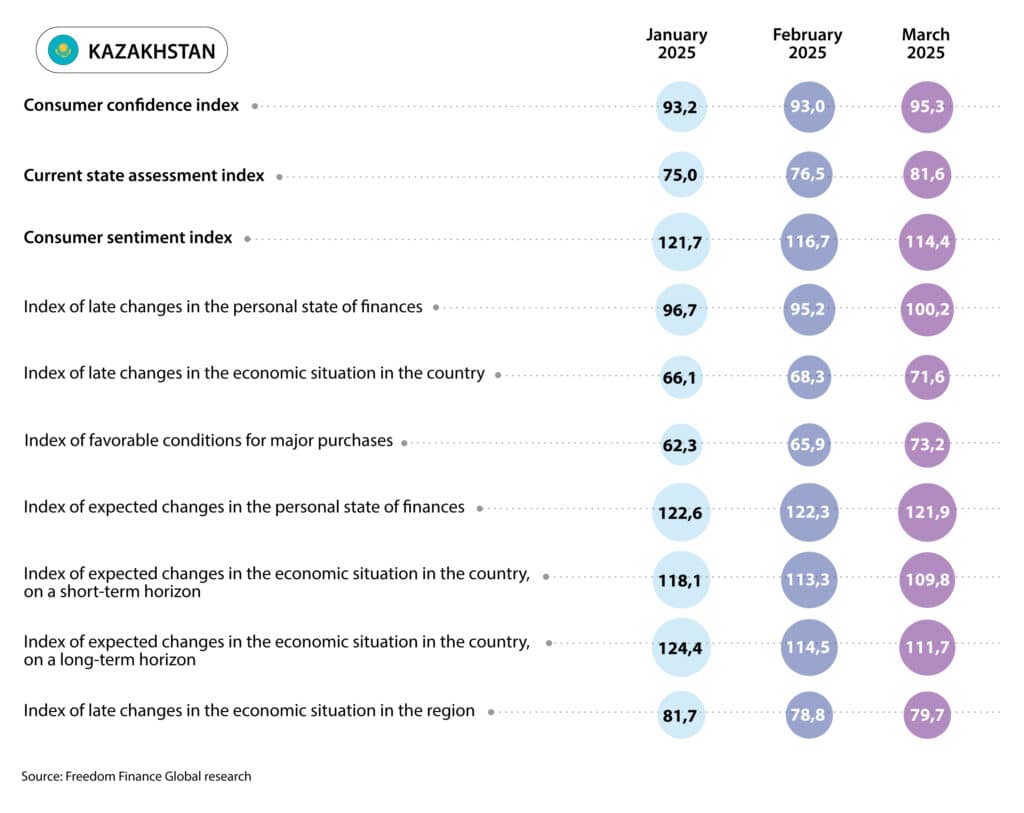

Freedom Finance Global has been studying consumer confidence, inflation and devaluation expectations of residents of Kazakhstan for the twenty-ninth month. March 2025 showed positive dynamics, and the consumer confidence index (CCI) increased from 93 to 95.3 points, demonstrating a slight recovery from the lowest value in the history of the study. Negative responses generally continue to prevail over positive ones. There was a full restoration of favorable conditions for large purchases. At the same time, optimism regarding economic situation forecasts continued to decline. Inflation estimates have declined after four months of continuous growth, although there have been structural changes in the responses of the Kazakhstanis; more people notice a strong increase in prices for some types of services and non-food products. On the other hand, inflation expectations have increased slightly, while devaluation expectations have reached new records.

Analysts collect 3,600 questionnaires monthly in Kazakhstan, which provides a sufficient sample to assess various parameters. The research is based on the methodology used to obtain consumer confidence indices in many countries worldwide and adapted for local tasks by United Research Technologies Group. The data collection method is a telephone survey. The survey questionnaire is adapted, and the research is conducted in the respondents’ native language.

Conditions for large purchases have been restored

The sub-index of assessments of the favorable conditions for large purchases increased by 7.2 points, compared to February and reached 73.2 points. The indicator has been recovering for the second month in a row. This time, we can say that the sub-index has fully recovered from the sharp January decline. In December 2024, it was 74 points, and last year the average monthly value reached 71.7 points. The share of the Kazakhstanis who believe that the current conditions for large purchases are favorable increased from 25.9 to 27.6%. At the same time, most of the growth in the sub-index was due to a much more noticeable drop in the share of pessimists: from 63.3 to 59.6%.

Among age groups, the decline in pessimism is widespread. Young people under 29 showed a more significant positive trend, among whom the share of negative answers decreased from 57.5 to 52%. This became the best indicator of the month among all age groups. People over 60 also showed a noticeable improvement. The same indicator for this age group decreased from 68.3 to 63.4%. However, even this improvement did not allow the older generation to get rid of the outsider status, since in the other two age groups the share of pessimists is 1.5-3 percentage points (p.p.) lower.

Regionally, improvement was observed in only 14 regions, and in some of them, the monthly increase in the proportion of pessimists was significant. Thus, the share of negative responses has noticeably increased in the Ulytau (+10.6 p.p.), Abay (+8 p.p.) and East Kazakhstan (+7.6 p.p.) regions. As a result, the Abai Region took the lead in the share of pessimists, with a result of 69%. On the other hand, in the Kyzylorda and Kostanai regions, the share of negative responses fell by 16-17 p.p. Also, a significant improvement in sentiment was recorded in the Atyrau, Almaty, Mangistau and West Kazakhstan regions, where the monthly dynamics were -7 to -12 p.p. As a result, the best result in March was shown by the Kostanai region, where the share of those noting unfavorability of the current conditions for large purchases was only 50.4%. The share of positive responses in this region reached 39.6%, which is significantly higher than the national average.

Partial restoration of personal financial situation assessments

The sub-index of changes in personal financial situation over the past 12 months also showed a marked recovery, rising by 5 points from the all-time low in February. The share of those who believe their personal financial situations have improved over the past year rose from 28% in February to 30.1% in March.

In terms of age, a monthly increase in optimism is recorded for all groups except for people over 60. Among them, the share of those who noticed an improvement in their financial situation over the month fell from 20.7 to 19.6%. This was the worst value of March among all age groups. On the other hand, among respondents aged 30–44, the same indicator increased from 28.4 to 31.9%, which is the best monthly dynamics. And yet, the largest number of optimists by a significant margin is noted among young people under 29. There, the same share increased by 3.1 p.p., reaching 45.4%.

In the regional context, monthly improvement of indicators is observed in 12 out of 20 regions. The best monthly dynamics were shown by residents of the Kyzylorda region. Among them, the share of those reporting an improvement in their personal financial situations increased from 14.2 to 34.7%. Also, in March, similar indicators increased by 11-14 p.p. in the Shymkent and Atyrau regions. As a result, the best answers were given by residents of the Atyrau region with a similar share level of 40.2%. The indicators of Shymkent residents differed from citizens of the western region by only 0.2 p.p. The most noticeable deterioration in the share of positive answers was recorded in the Aktobe region: from 34.9 to 25.1%. The similar share also noticeably fell in the Ulytau and West Kazakhstan regions, by 7-8 p.p. As a result, the worst answers were given in the Ulytau region, where this indicator was 22%.

The population’s economic forecasts continue to worsen

The sub-index of the forecast of changes in the economic situation over the next 12 months fell by 3.6 points and remains the lowest since June 2023. This is the third month in a row that this indicator has fallen. The share of those who believe that the economic situation will improve fell from 40% in February to 37% in March.

In terms of age, the monthly decline in optimism is observed among all age groups, except for those under 29. The most noticeable deterioration is recorded among respondents over 60, where the share of positively-minded respondents fell from 41.6 to 36.4%. However, the worst indicator among all age groups is observed among residents of the country aged 45-59, where this share reached only 31.3%. The share of those expecting an improvement in the economic situation among respondents aged 30-44 also fell by slightly less than 5 p.p. The leader is still young people under 29, with an indicator of 45.7%, which is 0.6 p.p. higher than the February indicator.

In regional terms, a decrease in optimism regarding forecasts for changes in the economic situation is observed in 14 out of 20 regions. The biggest surprise was shown by the Ulytau region, where the share of positive responses fell sharply from 60.7 to 32.7%. Also, the similar share indicator decreased by more than 9 p.p. in the Mangistau (-13.4 p.p.), Karaganda (-10.7 p.p.), Atyrau (-9.2 p.p.) regions and in Almaty (-9.2 p.p.). On the other hand, a sharp increase in positivity in the question of forecasting economic improvement over the next year is observed in the Pavlodar, North Kazakhstan and Kyzylorda regions. The shares of positive responses in these regions increased by 16.1, 9.5 and 7.9 p.p., respectively. Nevertheless, the Zhetysu region (49.4%) became the leader of the month. However, the gap between the three regions at once – the Kyzylorda, Turkestan and Almaty regions – turned out to be very small.

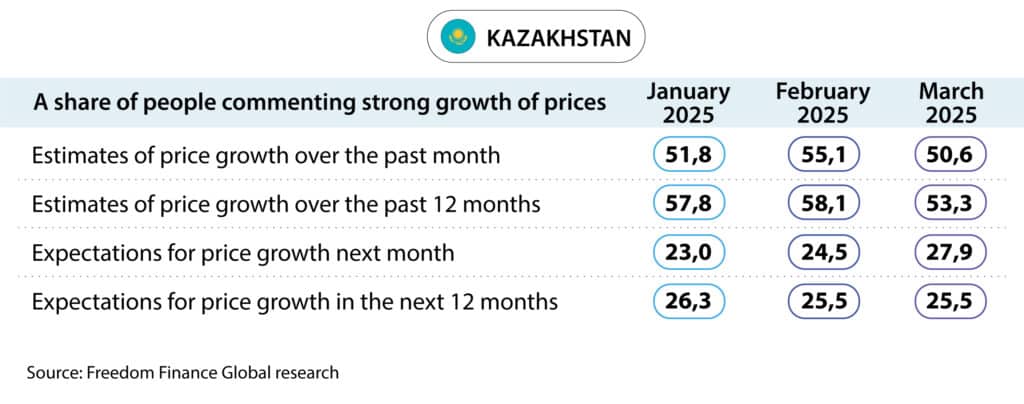

Inflation estimates of the population have significantly decreased

Inflation estimates of Kazakhstan residents fell in March after a continuous four-month growth. Although the improvement was not complete and the levels of the end of 2024 were not reached, the indicators were the best this year. In the past month, 50.6% of respondents (55.1% in February) indicated a strong increase in prices. This figure is nevertheless still significantly higher than the monthly average for 2024, which was 41.4%. The proportion of people who noticed a rapid increase in prices over the previous 12 months also fell significantly, from 58.1% in February to 53.3% at the time of the latest data collection, which is close to the average values of last year and the figure for the end of 2024.

However, inflation expectations in Kazakhstan in general showed a slight increase, in contrast to inflation estimates. The share of people expecting a strong increase in prices, in the horizon of one month, increased from 24.5 to 27.9%, while in the horizon of the next 12 months, the share of those expecting an acceleration in price growth remained at the same February level of 25.5%.

A similar study by the National Bank of the Republic of Kazakhstan, regarding inflation estimates and expectations, shows a much greater increase in optimism in March, especially in terms of expectations. According to the data presented, the share of those expecting a strong price increase during the year fell from 29 to 26.1%. While in the one-month horizon, the same indicator fell sharply from 29.2 to 22.5%. In general, in both time horizons, for the fourth month in a row, there have been swings in the main indicator: after growth, there is a decline, and this process is repeated. Inflation estimates have generally decreased, but this does not apply to both time horizons, as our study showed. If the share of respondents recording a strong price increase over the past month fell from 46.1 to 44.7%, then the share of those indicating a rapid price increase over the previous 12 months increased from 53.1 to 54.2%.

The trend of changing the structure of responses on concerns due to a sharp increase in prices for individual goods and services continues. While food products used to consistently rank among the top four most expensive goods and services according to Kazakhstanis, this hasn’t been the case for the second month in a row. In February, housing and communal services were in the top 4, and in March, they were joined by the Internet and mobile communications. 44.7% of respondents noticed a sharp increase in prices for communications, which is significantly lower than in February (32.8%) and January (11.4%). Concern about housing and communal services also continues to grow. Almost 42.3% of respondents noticed a significant increase in tariffs for this category (35.7% in February). Nevertheless, the Meat and Poultry category continues to hold the first place. This product was chosen by 57% of the surveyed population against 54.3% in February, which is a new record for the entire study. In addition, the population continues to be concerned about the increase in prices for vegetables and fruits. According to them, the share of people who noticed a strong increase in prices was 51.3%, which is only 1.5 p.p. lower than the record value of January. We also note the non-food product in the Medicines category that took sixth place. It was indicated by 34.7% of respondents, and 30.1% for the Medical Services category. Both indicators increased by more than 10 percentage points over the month.

According to official statistics, prices for communication services, as a whole, did not increase in March, compared to February. However, the annual growth was 13.9%, and specifically for mobile communication services, as much as 19.5% year-on-year. Prices for housing and communal services continue to grow and in March increased by an average of 1.4% month-on-month (MoM). Cold water stood out in particular, with prices increasing by 15.2% in a month. Medicines saw an average price increase of 0.7% MoM, while prices for outpatient services rose much more significantly — by 1.8% MoM. Prices for vegetables and fruits increased in March by an average of 3.1% MoM, and this rate has been maintained for the third month in a row. Bananas, tomatoes and beets have become noticeably more expensive. Also, for the second month in a row, the price of meat and poultry continues to increase significantly: by 2.2% per month. Since the beginning of the year, their value has already increased by 5.6%. The growth is mainly due to red meat.

Devaluation expectations reach new records

Devaluation expectations of the Kazakhstanis have noticeably worsened in March and reached new records for the entire period of the study. The dollar exchange rate in March rose by less than 1%. Considering the survey was conducted in April, after the exchange rate had already risen in the first week, these dynamics come as no surprise. According to the results of the study, the share of the Kazakhstanis expecting the tenge to weaken over the horizon of one year increased from 59.4 to 65.1%. And over the horizon of a month, it increased much more significantly, from 40.4 to 47.8%.

Conclusions

March 2025 turned out to be a recovery month, in terms of consumer confidence among the Kazakhstanis, after two consecutive months of decline. However, the index continues to be below 100 points, which indicates the predominance of negative responses over positive ones. This time, among the positive moments, we note a complete recovery of assessments of favorability of current conditions for large purchases. The level of these assessments returned to the average value of last year. Also, after record-low levels of changes in personal financial situations in February, it partially recovered in the following month. Nevertheless, for the third time in a row, deterioration in the population’s forecasts for changes in the economic situation has been recorded, which continues to be at the lowest level over the past 20 months of observations. In general, the Kazakhstanis are still very concerned about the prospects and assessments of the economic situation, as opposed to their personal financial situations. These factors put pressure on consumer confidence, compared to last year, and they are also expressed in issues of inflation and expectations for the dollar exchange rate.

The dynamics of inflation estimates and expectations in March turned out to be more positive, as inflation estimates decreased for the first time after four consecutive months of growth. Nevertheless, we note a sharp structural change in the responses over the past couple of months for individual goods and services, for which residents noticed a strong increase in prices. For the first time, two types of services were in the top 4, although previously these places were almost always occupied by food products. In general, more Kazakhstanis have started noticing a sharp increase in prices for paid services, which are now the main driver of inflation in the country. In addition, inflation expectations increased significantly in March. This was probably also facilitated by a sharp increase in devaluation expectations for the tenge. Never before during the study did so many people expect the dollar exchange rate to remain unchanged, both in the short-term and long-term

As a result, the twenty-ninth wave of the study of consumer confidence of the population of Kazakhstan showed a positive result for the first time in 2025. However, not all components of the index demonstrate growth, and one of them even updated the recent minimum. True, one component has fully recovered, and the other two – partially. Nevertheless, the Kazakhstanis, as in January-February, are very worried about the economic situation in the country. The continued acceleration of inflation, as well as a slight increase in inflation expectations, gives fewer reasons for the continued recovery of consumer confidence among residents. In addition, devaluation expectations were at record highs. This, along with potential further pressure from external factors like falling oil prices, could also negatively impact residents’ views on economic issues.