For years, the U.S. has ranked among the largest investors in Kazakhstan. But in 2023, foreign direct investment (FDI) from the U.S. dropped by nearly 80%. In 2024, the country recorded a net outflow of $870 million in U.S. investment, the first such outflow since data tracking began in 2005, according to Freedom Finance Global analyst Ansar Abuyev.

Data from Kazakhstan’s National Bank shows that over the past five years, the Netherlands has been the leading source of FDI, contributing $30.3 billion. Russia ranks second with $11.7 billion, followed by the U.S. with $10.3 billion.

The Netherlands’ leading role stems from the fact that international oil and gas majors, including Royal Dutch Shell — involved in the Kashagan and Karachaganak projects — are registered there. U.S. involvement largely comes through oil giants Chevron and ExxonMobil, which have significant stakes in the Tengiz and Kashagan projects.

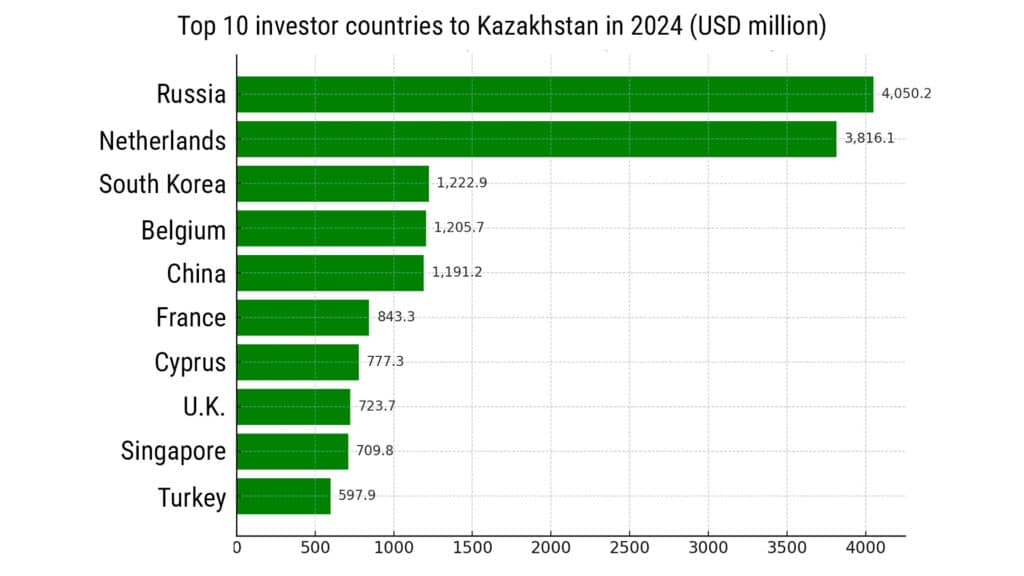

As U.S. investment declines, Russia is expanding its financial footprint in Kazakhstan. In 2023, Russian investments doubled year-on-year, reaching a record $4 billion in 2024.

While the mining sector remained the top recipient of FDI in 2024 ($6.4 billion), more than $17 billion in total was spread across various industries, reflecting growing economic diversification. Notable investments went into trade and vehicle repair ($5.3 billion), as well as manufacturing, telecommunications and financial services.

The city of Almaty attracted the highest volume of investments ($5.8 billion), thanks to its developed financial and business infrastructure. Among oil- and gas-producing regions, West Kazakhstan ($1.9 billion), Atyrau ($1.86 billion) and Mangystau ($1.15 billion) stood out. Investment activity in central and southern Kazakhstan, however, remains low.

Kazakhstan’s heavy reliance on foreign investment in the commodities sector leaves its economy exposed to external volatility. In 2023, FDI inflows fell 16.9% to $23.4 billion. Net capital inflows dropped by more than half, from $6.5 billion to $3.2 billion. Abuyev noted that these trends highlight the urgent need to attract long-term investment in non-resource sectors such as manufacturing, digitalization and transportation.

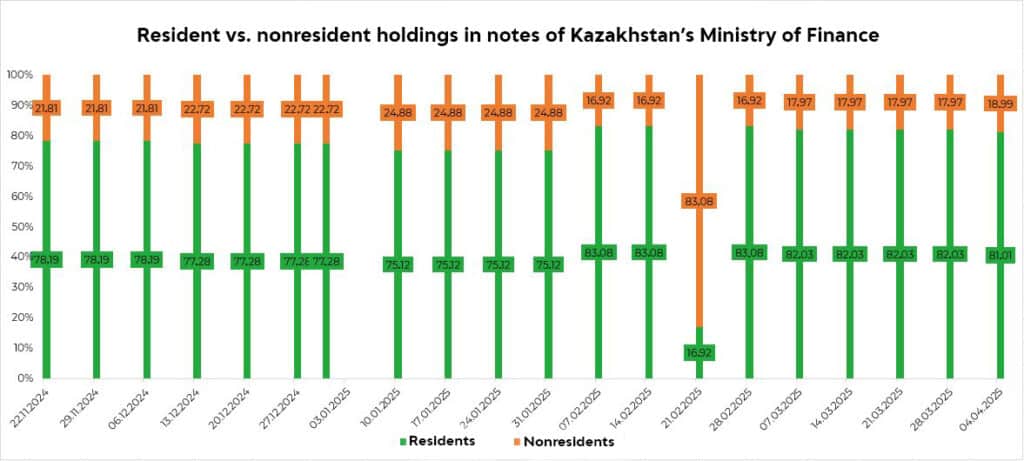

Despite the capital outflow seen in 2022, nonresident investors returned to Kazakhstan’s government securities market in 2023 and 2024. Investments in government bonds increased 2.5-fold, reaching approximately $2.3 billion, driven by yields of up to 16.7% annually. The share of nonresident holdings in government bonds rose to 4%, the highest level in recent years.

Interest in the stock market is also growing. Nonresident participation on the Kazakhstan Stock Exchange (KASE) jumped from 4.4% in 2021 to 29.8% in 2023, spurred by capital outflows from Russia, new company listings and easier market access. Still, in absolute terms, the market remains relatively small and needs continued development.

Key sectors showing the greatest investment potential include energy, manufacturing, transport and telecommunications. Companies identified as having strong growth prospects over the next six to 12 months include Air Astana (42% growth potential), KazTransOil (39%), Kazakhtelecom (34%), KazMunayGas (30%), Kazatomprom (26%), Halyk Bank (19%) and Kaspi.kz (15%).