Investment in fixed assets across enterprises in Kazakhstan continues to grow. Notably, this growth is driven less by oil projects and more by infrastructure developments, including schools and hospitals. Despite this shift, the ratio of investments to GDP has declined, reaching a 10-year low.

Top 100 largest investment projects by sectors

Top 5 investment projects implemented in 2024

How did investment activity change in 2024

Kursiv Research is continuing its analysis of Kazakhstan’s largest new industrial and infrastructure projects. Trends in capital investments and overall investment activity are critical indicators for predicting economic growth, as well as understanding its industrial and regional distribution, concentration and quality. This report ranks major investment projects by their value.

Top 100 largest investment projects by sectors

To evaluate the state of investment activity, Kursiv Research reached out to all 20 regional akimats (local administrations) in Kazakhstan, including the capital city of Astana and the major cities of Almaty and Shymkent. All responded:

- Sixteen akimats disclosed the structure of the projects.

- East Kazakhstan’s akimat shared the cost of one project but withheld information on the rest.

- West Kazakhstan’s administration provided a list of projects without indicating their value.

- The akimats of Almaty and Astana did not provide a list of projects.

Based on this data and additional information from open sources, Kursiv Research compiled a portfolio of 379 investment projects for 2024. Akimats provided information on 315 projects, while details on the remaining 64 were sourced from the national pool of investment projects published on the Kazakh Invest website.

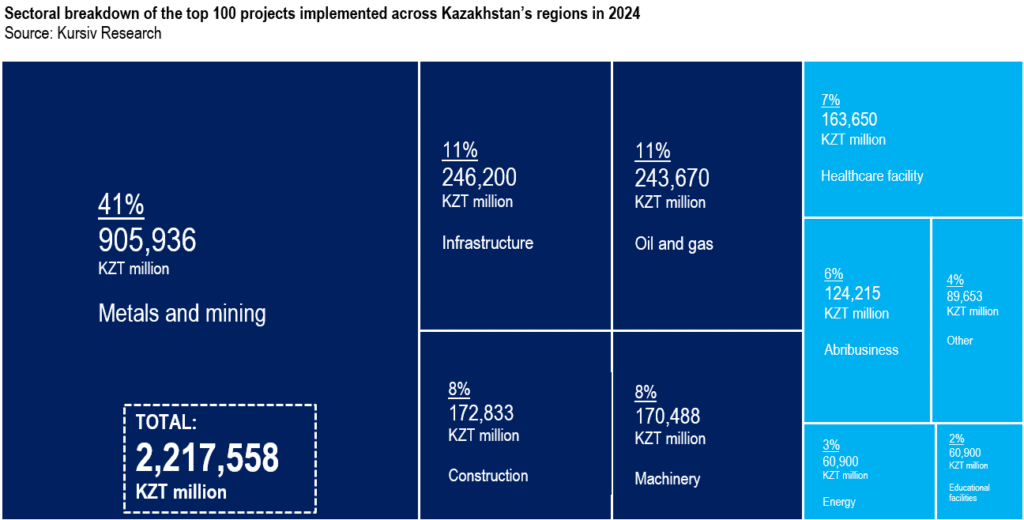

As with previous studies, the 100 largest projects by investment volume were included in the structural analysis. Their combined value reached 2.2 trillion tenge (approximately $4.5 billion), marking a 139.9% increase year-on-year (YoY), a record across all previous Kursiv Research surveys. The previous highest figure was in 2022, when the top 100 projects were valued at 1.7 trillion tenge (about $3.7 billion).

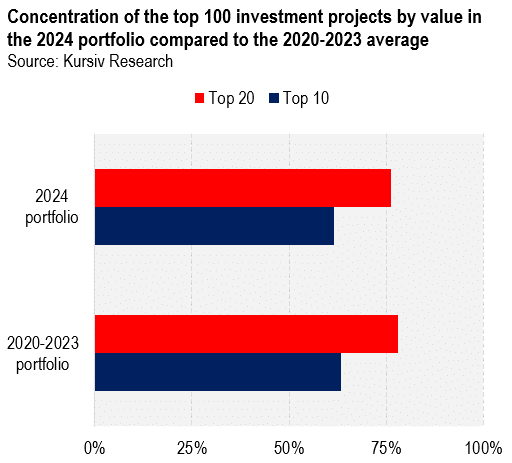

Despite the surge in total investment value, the concentration of investments within the top 100 was slightly below the four-year average. In 2023, the top 10 projects accounted for 61.5% of the total value, compared to an average of 63.5% from 2020 to 2023. This shift was driven by the noticeable growth of mid-sized projects within the top 100. The median project value increased from 3.95 billion tenge ($8.6 million) in 2023 to 6.8 billion tenge ($14.5 million) in 2024.

The sectoral distribution of the top 100 projects in 2024 was less balanced than in previous years. In 2023, four industries — energy, healthcare, agribusiness and metals and mining — each contributed 11% to 19% of the total investment value. However, in 2024, metals and mining alone represented about 41% of the total value of the project portfolio. Infrastructure projects followed at 11%, matched by oil and gas (11%), with construction and machinery manufacturing each accounting for 8%.

The increase in new infrastructure projects (21 units) and educational facilities (7 units) is particularly notable. Many of the new infrastructure projects include wholesale distribution centers, marketplaces and warehouses for e-commerce. This shift is partly due to state regulations mandating the modernization of marketplaces by 2025 — non-compliance could result in closures. At the same time, businesses are responding to the growth of digital commerce by investing in warehouse facilities.

The surge in new school projects is tied to the government’s Comfortable School national project, launched in 2022 and set for implementation from 2023 to 2025. This initiative aims to address the shortage of student spaces across the country.

Top 5 investment projects implemented in 2024

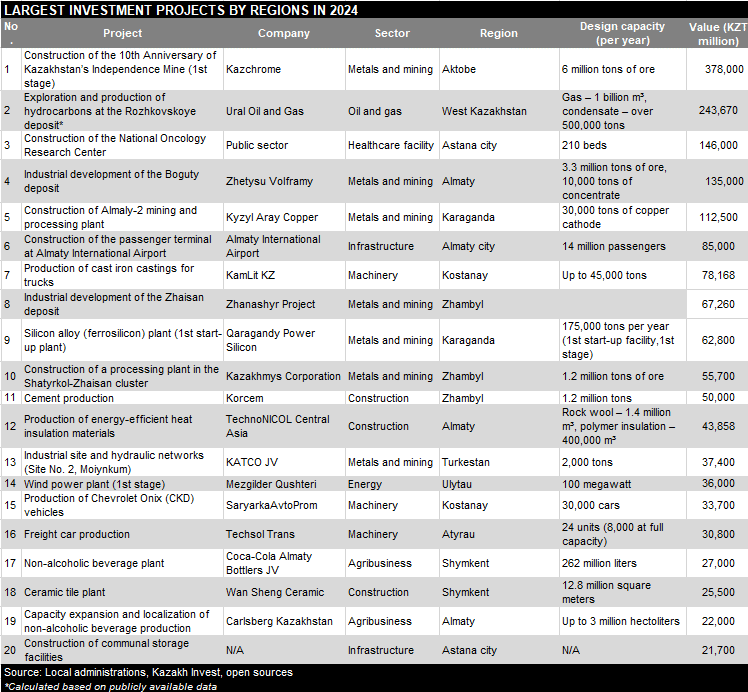

In 2024, the largest investment project in Kazakhstan was the first stage of construction at the 10th Anniversary of Kazakhstan’s Independence Mine. This phase boosted the mine’s annual output to 6 million tons of ore. Valued at approximately $800 million, the project was implemented by Kazchrome, part of the Eurasian Resources Group.

Kursiv Research included this project in its 2024 portfolio based on information provided by the local administration of the Aktobe region. When requesting updates from local authorities, Kursiv Research specifically asks for projects with commissioning certificates signed during the reporting year. However, discrepancies emerged when cross-referencing information from open sources.

In early December 2024, the Bolashak mine — formerly known as the 10th Anniversary of Kazakhstan’s Independence Mine — was presented to President Kassym-Jomart Tokayev. The project’s value was reported at over $1.9 billion, with expectations to ramp up capacity to 7.5 million tons of chrome ore annually. This expansion represents the second stage of the mine project, known as ShDNK-2, with an investment cost of approximately $1.7 billion, according to Kazchrome’s corporate publication.

In Kazakhstan, large industrial projects are often showcased to top officials ahead of national holidays, sometimes even before all technical and operational work is fully completed.

The first stage of the mine’s upgrade is among the largest investment projects in Kursiv Research’s five-year database. When factoring in the costs of ShDNK-2, it emerges as a true megaproject. The extensive costs are justified by the scale of the work; the mine features some of the deepest shafts in Kazakhstan, over a kilometer deep. Kazchrome’s corporate media illustrated the scale with this comparison: «The world’s tallest building, the Burj Khalifa, is about 900 meters high, whereas ShDNK-2 descends 1,200 meters underground.»

Currently, Kazchrome holds the leading global position in chromium content in its products. The Bolashak mine will further strengthen its dominance, ensuring a steady supply of high-carbon ferrochrome to international markets, where it remains one of Kazakhstan’s top 10 export revenue generators.

The Rozhkovskoye gas condensate field, located in the West Kazakhstan region, secured the second spot among the largest investments in 2024. The field is projected to produce 1 billion cubic meters of gas annually, alongside 500,000 tons of condensate and 150,000 tons of liquefied carbon gas. Raw gas from Rozhkovskoye is processed at Zhaikmunai’s gas facilities, after which commercial gas is distributed to the domestic market.

The project is operated by Ural Oil and Gas, a consortium that, at the time of launch, included: Kazakhstan’s KazMunayGas (50%), Hungary’s Caspian Oil and Gas Plc. (27.5%) and China’s First International Oil Corporation (22.5%).

Although the West Kazakhstan regional administration did not disclose the project’s cost, Kursiv Research calculated the investment amount based on publicly available data. According to the government of Kazakhstan, the project’s total investment reached $534 million.

Securing third place is the National Oncology Research Center in Astana, with a planned annual patient intake capacity of 6,000 hospitalizations. The project, valued at nearly $280 million, marks the first cancer research facility in Central Asia to offer proton therapy.

This development is significant for Kazakhstan, as patients requiring proton therapy, essential for treating conditions like thyroid cancer, previously had to seek treatment abroad.

The Boguty tungsten ore deposit in the Almaty region takes fourth place. A massive mining and processing plant was built for industrial development of the deposit, with a production target of 3.3 million tons of ore per year. The facility is designed to process 10,000 tons of ore daily. The project is managed by Zhetysu Volframy, a company backed by Chinese and Singaporean investors, who collectively allocated $260 million for its implementation.

Rounding out the top five is the Almaly-2 mining and processing plant in the Karaganda region. This facility is projected to produce 30,000 tons of cathode copper annually through heap leaching technology applied to secondary ores. The project, valued at $220 million, was developed by Kyzyl Aray Copper, a firm controlled by a group of Kazakhstani businessmen.

How did investment activity change in 2024

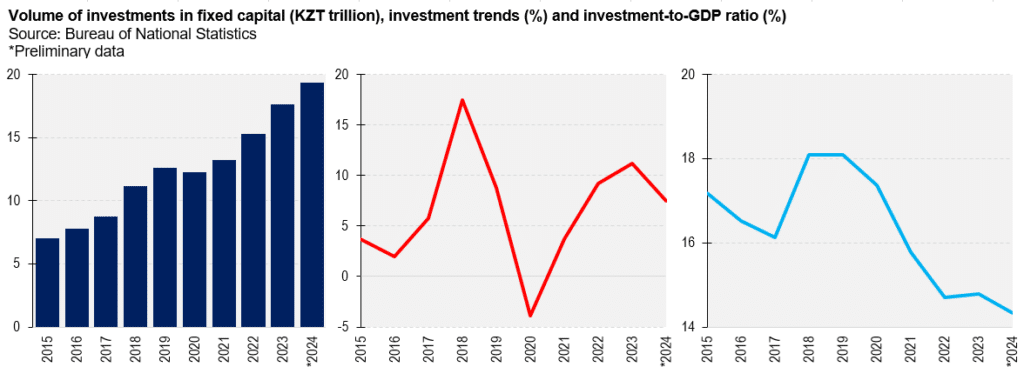

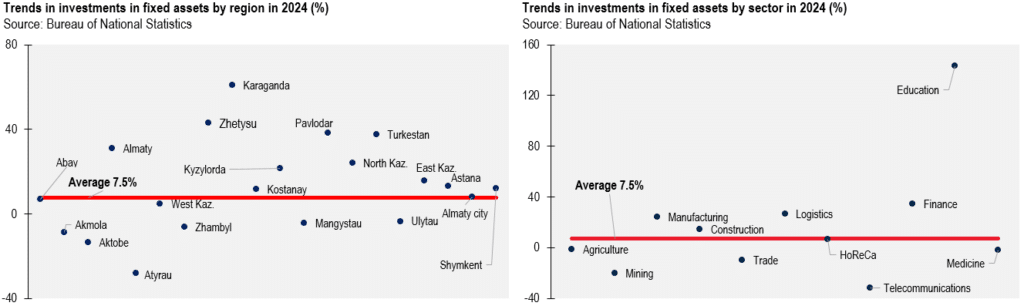

Investment activity in Kazakhstan experienced its fourth consecutive year of growth in 2024. According to the Bureau of National Statistics, the volume of investment in fixed assets (IFA) climbed to nearly $41 billion, marking a 7.5% increase YoY in real terms.

Significant gains were observed across various sectors:

- Education: +143.3% (boosted by the Comfortable School national project).

- Finance: +34.5%.

- Transport and warehousing: +26.6% (leading with $7.4 billion in investments).

- Manufacturing: +24.1% ($4.4 billion in total investment).

- Construction: +14.5%.

- Hospitality and catering services (HoReCa): +6.6%.

For the first time, education surpassed the $2 billion investment mark, underscoring the government’s commitment to expanding educational infrastructure.

Despite overall growth, some key sectors saw investment declines:

- Mining industry: -20.1% ($7.9 billion in investments), reflecting the conclusion of major expansion projects at the Tengiz, Kashagan and Karachaganak oil fields.

- Information and communications: -31.6%.

- Trade: -9.8%.

- Healthcare: -1.9%.

- Agriculture: -1.1%.

Many regions of Kazakhstan focus heavily on a narrow range of industries, resulting in regional disparities in capital investments. This specialization drives uneven distribution patterns, making the country’s overall IFA highly dependent on just three key regions: Atyrau, Astana and Almaty. Investment activity in any one of these regions significantly influences the national IFA figures. A decline in one often outweighs the combined positive growth from smaller regions.

The Atyrau region serves as Kazakhstan’s primary oil hub, hosting two of the country’s three largest oil fields: Tengiz and Kashagan. These vast oil reserves have established Atyrau as a long-term leader in capital investments. In 2024, Atyrau attracted nearly $4.7 billion in IFA, accounting for 11.2% of the nation’s total. However, it was the only one among the top three regions to experience a decline in investment activity. The volume of capital investments fell by 28.1% YoY, largely due to the completion of major oil expansion projects.

For the second consecutive year, Almaty ranked second in Kazakhstan in terms of investment in fixed assets. In 2024, the city attracted nearly $4.3 billion, marking an 8.2% increase in real terms. Astana followed closely, securing third place with almost $4 billion in investments, up 13.1% YoY. While these major urban centers led the way, several regions also recorded significant investment growth. The Zhetysu region saw the most substantial increase (+43.1%), followed by the Pavlodar (+38.3%), Turkestan (+37.4%), North Kazakhstan (+23.9%) and Kyzylorda regions (+21.7%).

Despite four consecutive years of IFA growth, Kazakhstan’s investment-to-GDP ratio has continued to decline. In 2024, it fell to 14.3%, down 0.7 percentage points from the target set in the nation’s investment policy concept through 2029, approved in late 2024. The strategic roadmap aims to raise the investment-to-GDP ratio to 18% by 2026, a level last seen in 2018-2019. This ongoing decline has become a key concern for policymakers, prompting efforts to boost investment through large-scale infrastructure initiatives. To address the issue, Kazakhstan has launched a national project to modernize the energy and utility sectors, marking the beginning of the most significant investment cycle in the country’s housing and utility infrastructure in decades. Adopted at the end of 2024, the project aims to inject approximately $28 billion from 2025 to 2029 to build new power plants and upgrade heating, electricity, water supply and wastewater networks. About 10% of these funds will come directly from the state budget. In March 2025, the government announced plans to recapitalize Baiterek Holding, Kazakhstan’s largest state-owned financial institution, with an additional $1.9 billion. The holding is expected to finance about $15 billion in investment projects throughout 2025.