What’s driving Tajikistan’s surprising 8% economic growth?

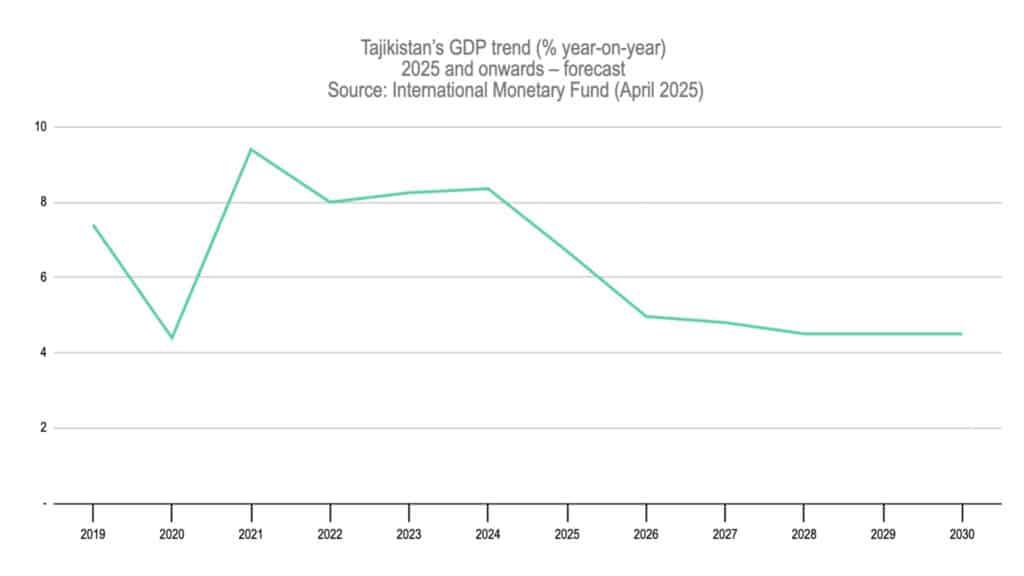

Tajikistan has sustained strong economic momentum in the post-COVID period. Between 2021 and 2024, the country’s GDP grew at an average annual rate of 8.5%. Although some international organizations predict a slowdown in Tajikistan’s economic growth, data from the first quarter of 2025 suggests that real GDP growth may again surpass 8%.

Public money and its impact on Tajikistan’s economy

In 2024, Tajikistan’s economy grew by 8.4%, marking one of the highest growth rates among post-Soviet states and Central Asian countries. In dollar terms, the country’s GDP reached $14.2 billion. The previous year saw an 8.3% increase, while the highest growth in recent years occurred in 2021, hitting 9.4% amid post-crisis recovery.

The momentum carried into 2025, with GDP growth reaching 8.2% year-on-year (YoY) in March. Historically, Tajikistan’s economic activity accelerates in the second half of the year.

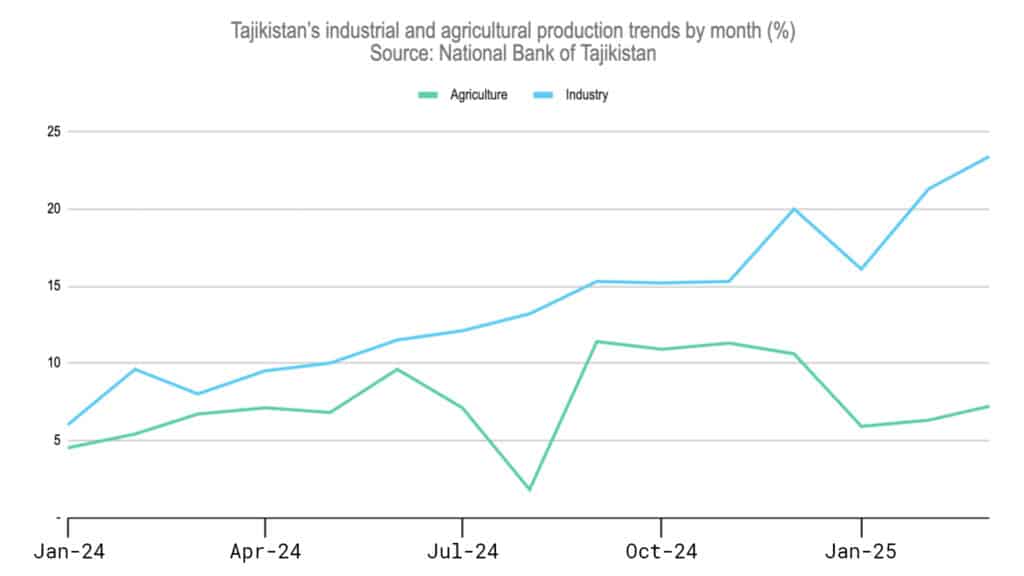

This seasonality is tied to the structure of its economy: agriculture accounts for about 20%, while construction contributes 8% to 10%. Both sectors experience strong seasonal effects, with the bulk of added value generated in the third and fourth quarters. Industry represents 18% to 20% of GDP and has seen rapid growth in recent years, driven by new mining projects and expansion in manufacturing. By the end of 2024, agriculture grew nearly 11%, while industry surged by 20%, including a 1.8-fold increase in mining.

The growth continued into early 2025. During the first three months, agriculture grew by 7.2% YoY, while industry expanded by an impressive 23.4%, according to the National Bank of Tajikistan.

This industrial boom is largely driven by Tajikistan’s National Development Strategy through 2030, which prioritizes industrial innovation and attracting investment.

Following its April update to the global economic outlook, the International Monetary Fund (IMF) projects Tajikistan’s GDP will grow by 6.7% in 2025, slowing to 5% in 2026 and 4.5% in the years ahead. The World Bank’s January 2025 forecast predicts 6% growth this year and 5% next year. In contrast, the Eurasian Development Bank is more optimistic, expecting 8.4% growth in 2025, citing robust investment and consumer activity. Tajikistan’s government is similarly optimistic, forecasting growth above 8%.

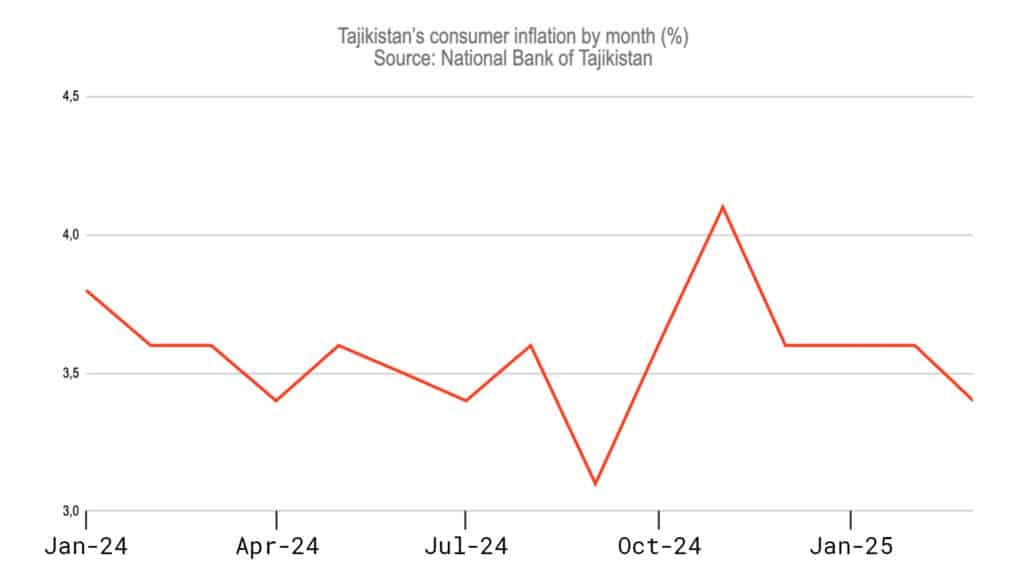

Amid rapid economic growth, inflation remains under control. As of March 2025, the inflation rate was 3.4%. Prices in the country have risen by 1.3% since the start of the year, primarily driven by food products (+2%) and services (+1.8%), while non-food items have remained relatively stable.

Tajikistan has announced a transition to an inflation-targeting regime, setting a medium-term inflation target of 5%, with a corridor of ±2 percentage points (p.p.). Since the summer of 2022, consumer price trends have remained at the lower end of this target range. In response, the National Bank of Tajikistan began easing its monetary policy.

As of the first quarter (Q1) of 2025, the real interest rate — calculated as the difference between the National Bank’s refinancing rate and annual consumer inflation — stood at 4.85%. The most recent monetary easing occurred in February 2025, when the central bank cut the refinancing rate by 25 basis points to 8.75%.

Key drivers of consumer prices include global food and fuel costs. Tajikistan heavily relies on imports for essential goods such as grain, flour and fuel. Additionally, fluctuations in the somoni’s exchange rate against the Russian ruble and the U.S. dollar significantly impact domestic inflation.

Public money and its impact on Tajikistan’s economy

Tajikistan’s public finance system plays a more prominent role in economic development compared to other Central Asian nations. According to the IMF, government spending in Tajikistan averaged 29% of GDP over the past five years. For comparison, government spending averaged 23% of GDP in Kazakhstan, 28% in Uzbekistan and a slightly higher 30% in Kyrgyzstan.

The state budget for 2024 closed with a surplus of 1.5 billion somoni (about $144 million), representing approximately 1% of GDP. Budget revenues surpassed forecasts by 4.1%, driven mainly by stronger-than-expected VAT collections (107.2% of the target) and income tax revenues (101.2%). On the expenditure side, the budget was executed at 95.2% of the target due to underutilization in certain sectors, with the largest gaps in the fuel and energy complex (93.1%) and education (95%).

The trend continued into 2025, with the first two months posting a surplus of 1.7 billion somoni as revenues again outpaced expenditures.

Despite its large role in the economy, Tajikistan’s public finance system remains relatively stable. According to the IMF, the country’s government debt was around 30% of GDP at the end of 2024 and is projected to stay between 28% and 29% of GDP through 2030. Tajikistan’s Ministry of Finance offers slightly different figures, reporting a reduction in public debt from 46.5% of GDP in 2020 to 25.2% in 2024.

In 2024, Tajikistan’s public debt totaled $3.6 billion, with 89% of it comprised of external liabilities. Of these external debts, about 70% were loans tied to investment projects, while 16% stemmed from Eurobonds — 10-year securities issued for $500 million at a 7.125% interest rate, maturing in 2027. Servicing the external debt cost the government $299 million last year, equivalent to 2.1% of GDP or 8.6% of government revenues.

Domestic debt primarily consists of government bills, largely used to recapitalize several state-owned banks. Notably, 90% of Tajikistan’s internal debt is financed by investments from the National Bank of Tajikistan.

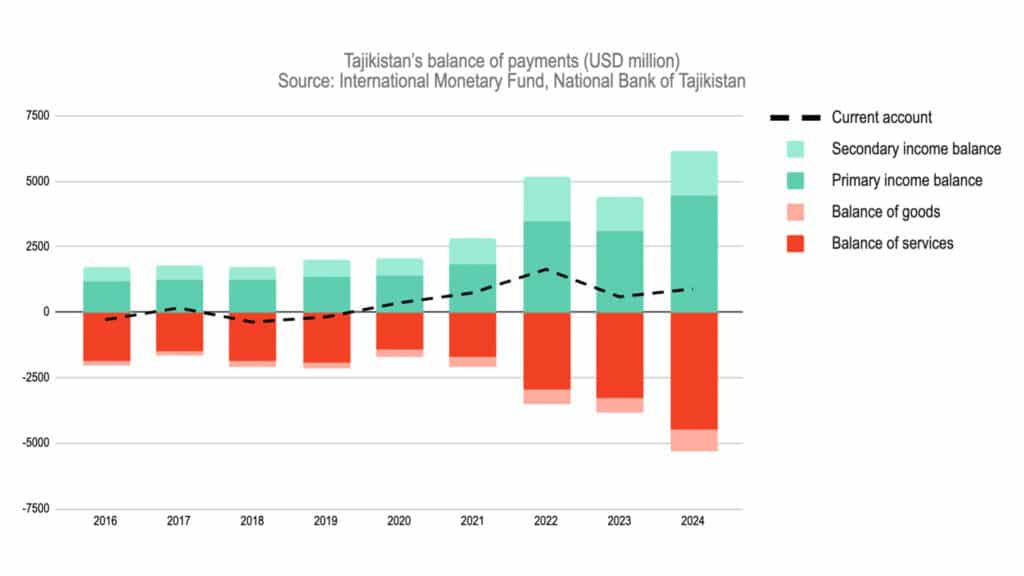

Over the past five years, Tajikistan’s balance of payments has remained positive. In 2024, the current account surplus reached 6% of GDP, amounting to $887 million. While the country traditionally runs a high trade deficit in goods and services, this gap is offset by strong primary and secondary income inflows.

Tajikistan’s exports have been modest, totaling $1.9 billion in 2024. Key exports include precious metal ores and concentrates, aluminum and dried fruits. In contrast, imports reached $7 billion, covering a broad spectrum of products, including consumer goods, technological equipment, fuel, lubricants and agricultural raw materials.

Tajikistan’s primary and secondary income streams largely stem from remittances. These come from Tajik citizens working abroad (mainly labor migrants) and financial support sent by relatives living in other countries. By the end of 2024, the surplus in primary and secondary income reached $6.2 billion. The World Bank has highlighted record-high remittance-to-GDP ratios in recent years: 50% in 2022 and 38% in 2023.

This steady inflow of funds has enabled Tajikistan to ramp up imports, which grew by 20% YoY in 2024.

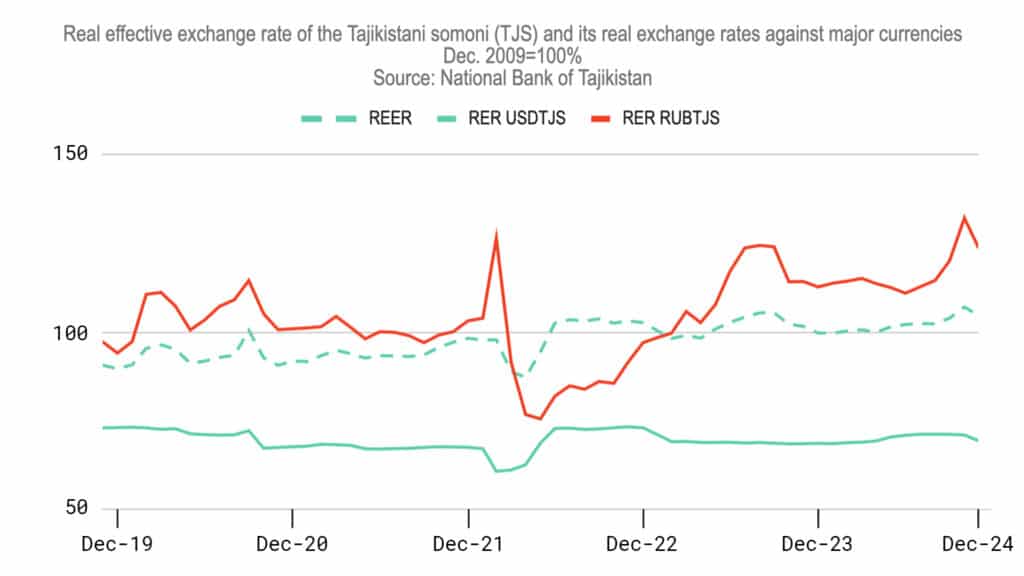

Remittances and labor migrant incomes significantly influence the exchange rate of the somoni (TJS). Since most labor migrants work in Russia, a major trade partner, accounting for 25% to 30% of Tajikistan’s imports, the Russian ruble (RUB) plays a crucial role in Tajikistan’s foreign transactions.

Until 2022, the TJS-RUB exchange rate hovered around 7 rubles per somoni. However, shifts in the ruble’s strength caused volatility: the somoni first weakened to 5 rubles per somoni, then strengthened, reaching a range of 7 to 9 rubles by the end of Q1 2025. This movement reflects a broader search for a new equilibrium, roughly 5 to 10 p.p. below historical averages.

Meanwhile, the USD-TJS exchange rate has remained relatively stable. Over the past five years, it has mostly stayed within the 10 to 11.5 somoni range. Notable volatility occurred in 2022, driven by fluctuations in the USD-RUB pairing, but since 2023, the somoni-dollar rate has stabilized at around 10.6 to 11 somoni. This reflects a strengthening compared to 2021 levels, when the rate was around 11.3 to 11.4 somoni.

A weaker ruble, combined with a stable dollar and conservative fiscal policies, has helped keep inflation in check. This stability, along with Tajikistan’s strides in industrial growth and innovation, is expected to drive short-term economic trends in the country.