Tajikistan’s banking sector sees nearly 40% asset growth

In the first quarter of 2025, Tajikistan’s banking sector experienced strong growth, with assets increasing by 38% year-on-year and the loan portfolio expanding by 22%. This growth was broad-based, spanning nearly all banking activities and market participants. New entrants are also joining the competitive landscape, adding momentum to the sector’s expansion. Despite high penetration of digital solutions, Tajik banks have yet to establish full digital ecosystems, a challenge the market is expected to address in the medium term.

Monetary policy and the financial sector

Monetary policy and the financial sector

The environment for Tajikistan’s financial sector mirrors that of Kazakhstan. The nation’s 2021-2025 monetary policy strategy outlines the National Bank’s commitment to an inflation-targeting policy. According to its analysis of key policy areas, the central bank highlighted that its approach aligns with the main requirements of inflation targeting. These include enhancing the efficiency of interest rate policies, strengthening the monetary policy transmission mechanism, improving forecasting, maintaining central bank independence, transitioning to a managed float exchange rate and setting clear inflation targets. The National Bank aims to complete its transition to full inflation targeting by the end of 2025, following the successful implementation of necessary reforms.

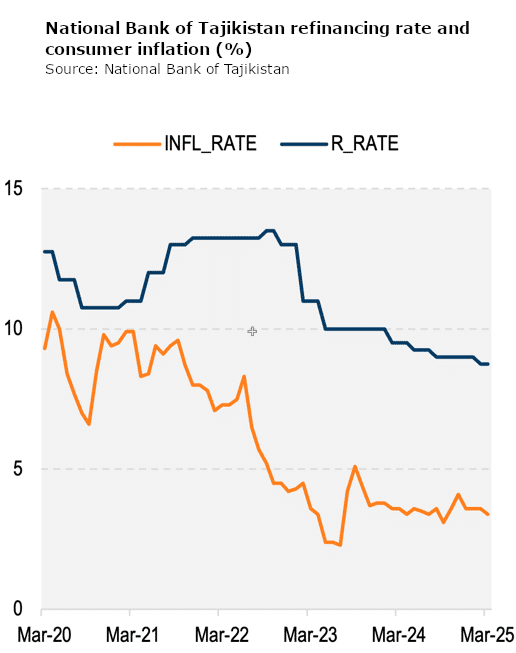

Compared to peer economies in Central Asia, Tajikistan’s current monetary policy is moderately tight, though there are emerging signs of easing. The medium-term inflation target is set at 5%, with a margin of ±2 percentage points (p.p.).

Kursiv Research noted in its Q1 2025 macroeconomic review that, since mid-2022, inflation in Tajikistan has remained within the target range, i.e., closer to the lower bound. This stability prompted the National Bank to ease its monetary policy beginning in early 2023. The refinancing rate, which peaked at 13.5% in September and October 2022, has since gradually declined to its current level of 8.75%. Throughout this period, inflation consistently remained within the target range set by the regulator.

As of March 2025, the real interest rate stood at 5.4%, within the maintained range of 4% to 6%. For comparison, Kazakhstan’s real interest rate during the same period was 6.5%.

Current conditions in Tajikistan’s financial sector are not considered restrictive. In Q1 2025, the total assets of all credit institutions grew by 36% year-on-year (YoY), reaching 52.4 billion somoni (approximately $4.8 billion).

Tajikistan’s lending market consists of the banking sector, which includes both conventional banks and one Islamic bank, as well as a network of microfinance institutions. As of the end of Q1 2025, 66 credit institutions operated in the country, including 16 second-tier banks, 49 microfinance organizations and one non-bank credit institution. The banking sector accounts for approximately 85% of the total assets of the nation’s credit institutions.

The latest addition to Tajikistan’s list of second-tier banks occurred in October 2024, with the launch of Freedom Bank Tajikistan CJSC, a subsidiary of Kazakhstan’s Freedom Bank, which is advancing its digital banking concept. The new bank’s financial reports haven’t yet appeared on the website of Tajikistan’s National Bank, which provides consolidated data for all banks in a standardized format.

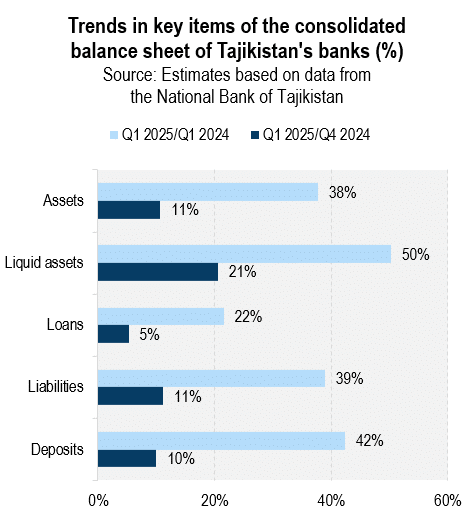

In Q1 2025, the total value of assets in Tajikistan’s banking sector reached 44.5 billion somoni (about $4.1 billion), showing an 11% quarterly increase and 38% annual growth. (Hereafter, this report uses operational data from the National Bank of Tajikistan and estimates based on that data.) The increase in assets is attributed to growth in both the loan portfolio (+22%) and liquidity (+50%). Quarterly, liquid assets grew faster than other components (+21%).

The asset structure of Tajik banks in Q1 2025 was as follows:

- Loans to customers (excluding delinquencies): approximately $1.6 billion or 39% of total assets.

- Liquid assets: nearly $2 billion (primarily concentrated in current accounts with the National Bank) or 48% of total assets.

- Delinquencies: $211 million, accounting for 5% of total assets.

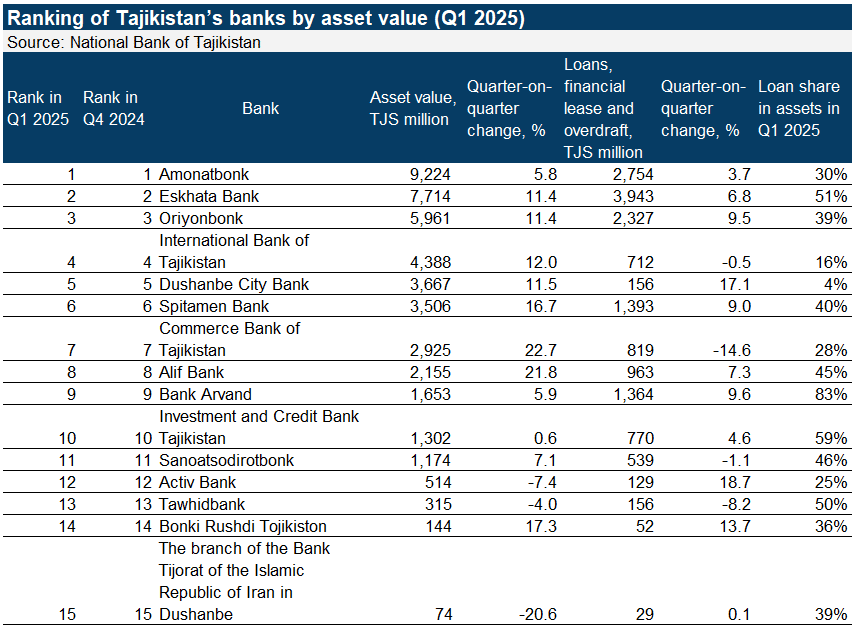

Based on data from the National Bank, Kursiv Research compiled a ranking of Tajik banks by asset value. State-owned Amonatbonk, whose full name includes «savings,» leads the list with assets valued at 9.2 billion somoni (TJS) or approximately $844 million. The bank, which has a representative office in Moscow, according to its financial statements under International Financial Reporting Standards (IFRS), lends primarily to the consumer sector, trade and agriculture, but also participates in interbank lending. The share of loans on the bank’s balance sheet does not exceed 30% of its total assets. Amonatbonk is also the leader in the number of branches (75), service centers (547), issued bank cards (1.9 million) and operating POS terminals (3,900).

Ranked second in terms of assets is Eskhata Bank, with nearly $706 million. The bank offers clients a wide range of credit products, from consumer and agricultural loans to mortgages, car loans and «buy now, pay later» (BNPL) loans, a highly popular product in Kazakhstan. Among the leading banks, Eskhata has the highest share of loans in its asset portfolio at 51%. The bank is actively developing its environmental, social and governance (ESG) agenda, undertaking several initiatives to improve the environmental situation in its regions of operation and also supporting women entrepreneurs. Eskhata is a privately owned financial institution, with the European Bank for Reconstruction and Development (EBRD) holding a 5.6% equity stake.

Oriyonbonk ranks third with assets of about $550 million and has representative offices in Dubai, London, Seoul, Beijing and Washington. The bank, known for being the first of Tajikistan’s second-tier banks to launch internet banking in 2006, is active in the retail sector, both in credit and deposit markets, offering clients a wide range of products.

International Bank of Tajikistan (IBT) ranks fourth with assets of nearly $404 million. According to the bank’s IFRS reports, it engages in traditional banking activities as well as leasing and insurance, though the latter two account for less than 1% of IBT’s operating profit.

Fifth in terms of assets is Dushanbe City Bank (DC), with about $340 million. Publicly available information indicates that DC is a universal bank actively developing in areas such as leasing, cargo services and the DC Avia airline ticket purchase service. This segment is seen as a potential foundation for building a digital ecosystem. The bank’s credit products include standard consumer loans, installment plans (BNPL), mortgages and car loans. According to statistics from the National Bank, DC leads the banking sector in the number of ATMs, with 785 units as of the end of Q1 2025. Nationwide, there are more than 1,200 ATMs.

Collectively, the top five banks account for 69% of the assets of the country’s banking system.

The ranking structure of Tajikistan’s banks remained unchanged. As of the end of March 2025, all participants held the same positions as they did at the end of December 2024.

The total loan portfolio of Tajik banks in Q1 2025, including financial leases and overdrafts, amounted to 17.3 billion somoni ($1.6 billion), reflecting a 22% increase YoY. Eskhata Bank was the most active lender, with a loan portfolio totaled nearly $358 million at the end of March 2025, marking a 32% annual increase and a 7% rise over the quarter. Amonatbonk also expanded its lending activities. Over the past 12 months, the bank’s loan portfolio grew by $78 million (+45%), bringing its total portfolio volume to approximately $256 million.

Oriyonbonk, which ranked second in lending volume a year ago, has lagged slightly. Its client loan balances increased by 17% YoY, positioning the bank in third place with a portfolio of $211 million at the end of Q1 2025.

In fourth place is Spitamen Bank, with a portfolio of $128 million, representing a 49% increase YoY, equivalent to nearly $42 million. Arvand Bank holds the same loan volume, having grown its portfolio by 32% over the year. The top five banks collectively account for 46% of the total loan portfolio in the banking sector.

Notably, no bank in Tajikistan reported a reduction in its loan portfolio in annual terms.

Over the past year, interest rates on term loans in somoni have exceeded the refinancing rate by an average of 14 p.p. As of March 2025, the average interest rate on loans in somoni stood at 23.05%.

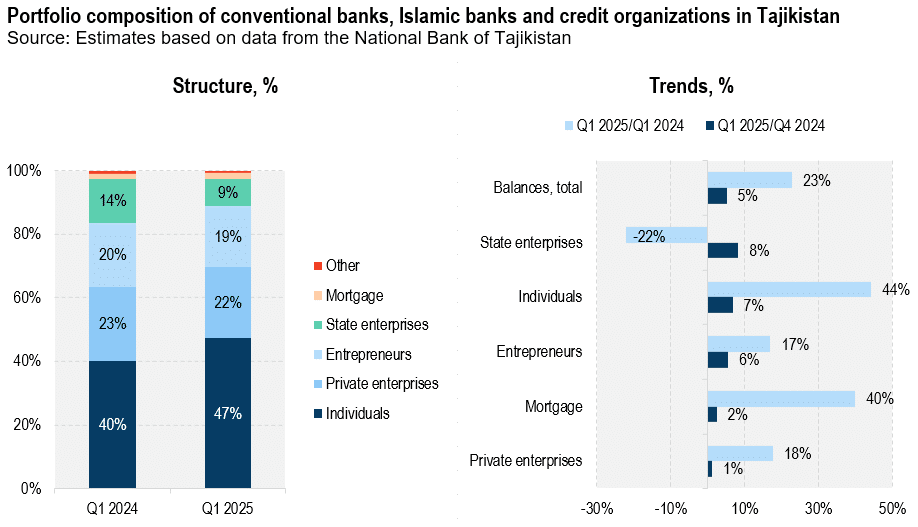

An analysis of the banks’ portfolios by borrower category shows a growing share of the retail segment. Labeled as «individuals» in statistics, this category increased its share from 40% to 47% over the year, accompanied by reductions in the shares of:

- Private enterprises: from 23% to 22%.

- Entrepreneurs: from 20% to 19%.

- State-owned enterprises: from 14% to 12%.

Not all borrower groups saw reductions in absolute loan balances. A decline was recorded only among state-owned enterprises, which saw their debt volumes drop by 22% YoY. Conversely, loan balances grew in other categories:

- Individuals: +44%.

- Mortgage portfolio: +40%.

- Private enterprises: +18%.

- Entrepreneurs: +17%.

In quarterly terms (Q1 2025 vs. Q1 2024), the most significant growth came from state-owned enterprises, which posted an 8% increase.

A sectoral breakdown reveals that industrial enterprises were the most active borrowers. In the first three months of 2025, the volume of loans to industrial enterprises grew by 89% YoY, while consumer loans increased by 44% and agricultural loans by 15%. Consumer loans dominated the overall loan structure, accounting for 48% of all loans issued in Q1 2025.

The quality of the loan portfolio has improved over the past 12 months. The volume of standard loans increased by 35%, with their share rising from 80% to 85% of the total portfolio. The share of doubtful and bad loans declined from 9% to 4% in the portfolios of second-tier banks. According to the National Bank of Tajikistan, the share of non-performing loans (NPLs) in credit institutions, including banks and microfinance organizations, stands at 7%. To address this, a provision fund of approximately $128 million has been established, covering 90% of the value of non-performing loans.

In Q1 2025, the total volume of deposits in Tajikistan’s banking sector hit 25.8 billion somoni ($2.4 billion), marking a 42% annual increase and a 10% quarterly rise. These funds were distributed unevenly across the sector, with the five largest deposit-holding banks accounting for 75% of all client deposits.

These top five banks were the most active in increasing deposit volumes on an annual basis. Amonatbonk led the pack, growing its deposit portfolio by about $174 million or 35% YoY. Currently, it holds nearly $670 million in deposits, representing 28% of all deposits in Tajikistan’s second-tier banks.

Eskhata Bank ranked second, adding $146.7 million (up by 57%) and reaching a total deposit portfolio of $395 million or 17% of the banking sector’s deposits. The International Bank of Tajikistan ranked third with a 12% market share and customer deposits of $284 million, an annual increase of 54% (or $100 million) and a quarterly increase of 15%.

The Commerce Bank of Tajikistan placed fourth with a deposit portfolio of $220 million, more than doubling its deposits over the past year with a 77% increase. It also posted the strongest quarterly growth (31%) among the top five banks. Dushanbe City Bank rounded out the top five with $201 million in deposits, nearly doubling its portfolio over the past year by approximately $100 million.

Only three financial institutions saw declines in deposit volumes, both quarterly and annually. The Tajik branch of Iran’s Tijorat Bank saw deposits fall 71% quarterly and 77% annually. Deposits at Islamic Tawhidbank dropped 20% for the quarter and 34% over the year. Aktiv Bank posted a modest 4% decline in Q1 2025.

Deposit yields in Tajikistan vary significantly by type. Rates on demand deposits in somoni, which comprises 45% of all deposits, have remained below the refinancing rate, ranging from 0.1% to 0.9% in recent years. Term deposit rates have been more responsive to changes in monetary policy, typically running 2 to 4 p.p. above the refinancing rate. As of March 2025, the average annual rate on all fixed deposits was 10.85%, compared with the central bank’s refinancing rate of 8.75%.

Tajikistan’s financial regulator, mirroring Kazakhstan’s approach, has turned its attention to the dollarization of deposits from individuals and companies. Despite the overall de-dollarization trend, the share of deposits in foreign exchange remains high.

According to the National Bank, «The share of deposits in foreign currency at credit financial institutions reached 42.2% during the reporting period, down 0.5 p.p. from the same period in 2024.»

Overall, banking sector liabilities rose 39% over the year to 37 billion somoni ($3.4 billion), while total capital in the sector increased 26%, reaching 7.5 billion somoni ($700 million).

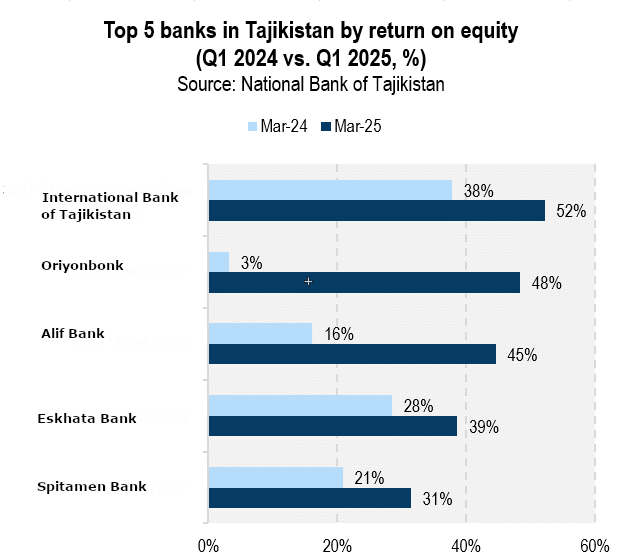

According to data from the National Bank of Tajikistan, the country’s banks improved their efficiency in Q1 2025, as return on equity (ROE) rose for most institutions. Out of 15 banks, only three either maintained or saw a decline in ROE quarter-on-quarter.

The regulator reported that the average ROE for all credit institutions in Q1 2025 was 26.8%. However, several banks significantly outperformed this benchmark, some more than doubling it. This group includes both market leaders and mid-sized players. The highest ROE was recorded by the International Bank of Tajikistan at 52%, followed by Oriyonbonk (48%), Alif Bank (45%), Eskhata Bank (39%) and Spitamen Bank (31%). All five are among the eight largest banks in Tajikistan by total assets.

«The financial activities of credit institutions as of March 31, 2025, yielded a profit of 643.2 million somoni ($59 million), an increase of 376.6 million somoni ($34 million) or up by 1.4 times YoY,» the National Bank stated.