Kazakhstan is expected to emerge as the regional leader in Islamic finance, according to a recent report by the Eurasian Development Bank (EDB). The report, developed in collaboration with the Islamic Development Bank, forecasts that Kazakhstan’s Islamic banking sector will grow to $3.3 billion by 2033.

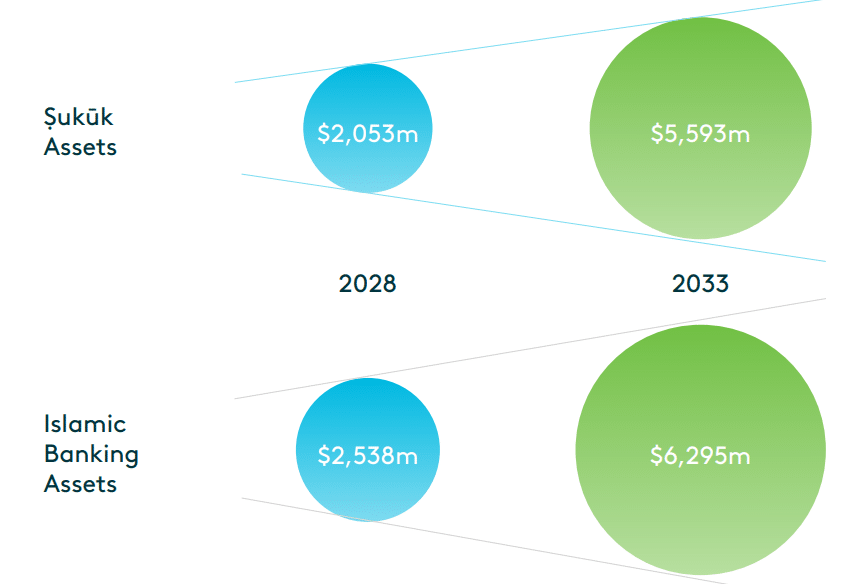

EDB’s analysts are optimistic about the potential for Islamic finance across Central Asia, even though the sector remains relatively small. As of 2023, Islamic finance in the region totaled just $699 million. However, it is projected to more than double to $2 billion by 2028 and to reach $6.3 billion by 2033. The sukuk (Islamic bond) market is expected to grow from $2 billion in 2028 to $5.6 billion by 2033.

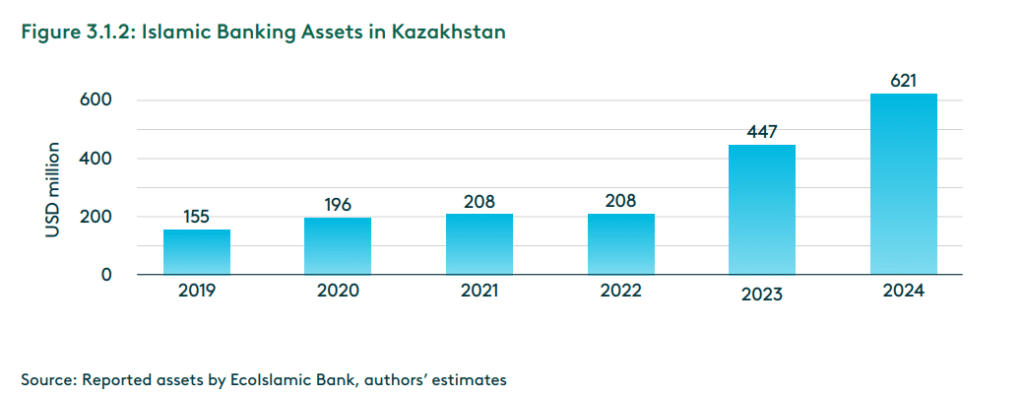

Kazakhstan’s Islamic banking assets, estimated at $621 million in 2024, are forecast to rise to $1.2 billion by 2028 and triple to $3.3 billion by 2033. Sukuk assets alone could reach $1.3 billion by 2028 and $3.3 billion by 2033. The report attributes this projected growth to policy initiatives like the Islamic Finance Master Plan for the Republic of Kazakhstan 2020-2025, developed by the Astana International Financial Centre (AIFC). The AIFC estimates domestic demand for Islamic deposits at $6.3 billion.

The EDB also noted that Islamic finance could strengthen Kazakhstan’s financial system by mobilizing locally available liquidity, in line with the government’s aim to develop a market-driven rather than state-supported economy.

The study bases its forecasts on population growth, the region’s large Muslim population and rising demand for inclusive financial services. However, the projected expansion hinges on governments across Central Asia implementing supportive legal, regulatory and tax frameworks, as well as public education campaigns to raise awareness and accessibility of Islamic finance for individuals, businesses and investors.

One key recommendation from the EDB is the introduction of Sharia-compliant financial products tailored to Central Asian markets. These include «Islamic windows» — dedicated units within conventional banks offering Islamic services — to support microfinance, agriculture and renewable energy.

Kazakhstan’s Agency for Regulation and Development of the Financial Market (ARDFM) is taking steps in that direction. A draft of the country’s new banking law includes provisions that would allow conventional banks to offer Islamic financial services via Islamic windows, according to Dauren Salimbayev, head of ARDFM’s methodology and prudential regulation department, who discussed the proposed changes at an expert panel in April.

Unlike conventional mortgages, Islamic mortgages do not charge interest (riba), which is prohibited in Islam. Instead, they rely on the murabahah model, where the bank purchases the property and sells it to the client at a fixed profit margin.

Two of Kazakhstan’s three Islamic banks have announced plans to offer Islamic mortgages and expand their financial products. The proposed new banking law would also allow Islamic banks to operate through the AIFC platform. Currently, only Al Safi Bank operates within the AIFC jurisdiction. The other two — ADCB Bank, with approximately $387 million in assets as of April, and Zaman Bank, with about $82 million — operate under ARDFM regulation. These two banks currently rank lowest in Kazakhstan by total assets.