Kazakhstan сonsumer сonfidence shows moderate growth in July

The consumer confidence index (CCI) in Kazakhstan continued its upward trend in July, with nearly all regions reflecting increased consumer optimism. While inflation expectations are rising, consumers are less likely to report price hikes in key food items compared to utilities and communication services. Concerns about unemployment and overall anxiety are easing, though the growth in credit confidence has slowed and confidence in deposits has decreased.

This report highlights the findings from the 21st wave of Freedom Finance Global PLC’s Consumer Confidence Survey, conducted monthly since November 2022 using United Research Technologies Group’s methodology.

Optimistic but Weak Growth

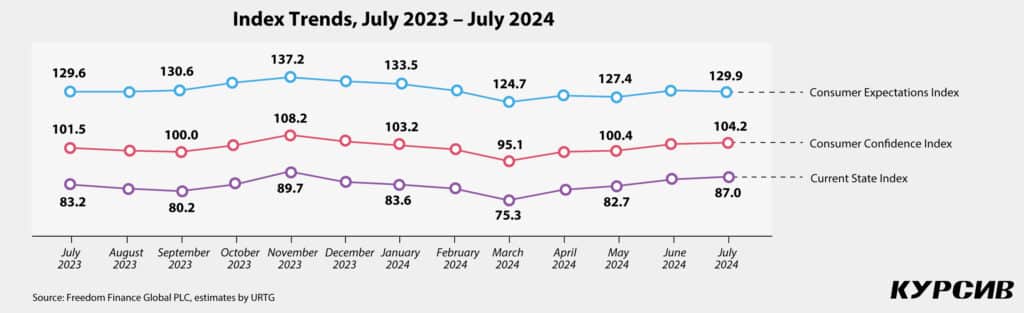

The pessimistic trend in consumer confidence observed in the spring reversed as the CCI edged into positive territory, reaching 104.2 points in July — up 0.4 points from the June survey. The current state index saw a modest increase of 0.8 points, rising to 87, while the consumer expectations index declined slightly by 0.4 points to 129.9 in July.

Compared to June, the July survey revealed a decline in some subindices, reflecting a slightly more cautious outlook among Kazakhstanis regarding the national economy’s prospects. The subindex for short-term economic expectations dropped by 1.3 points to 127.4, while the long-term economic assessment subindex decreased by 0.8 points to 130.1. However, other subindices showed positive trends, with the most notable growth in the personal financial situation subindex, which rose by 1.1 points to 105.6. The subindex for the expected personal financial situation also increased by 1 point, reaching 132.4. Additionally, the major purchases index grew by one point, reaching 77, signaling an optimistic view of personal finances among respondents, despite their more cautious outlook on the broader economic situation.

The July CCI broke the previous record for consumer optimism, coming close to the highest reading ever recorded in December 2023 (104.7 points). If the economic and social conditions remain stable in the coming month, the index is expected to continue its moderate growth within the optimistic range, which is typical for the summer months.

Adult Consumers Remain Pessimistic

The July CCI reveals notable gender differences. Women remain more optimistic, with a confidence index of 105.6 points, up by 0.4 points, compared to men, who are also positive but at a lower level of 102.6 points, up by 0.6 points. Women also lead in the consumer expectations index, scoring 133 points versus 126.5 points for men. However, the current state index shows little disparity between genders, with women at 87.1 points and men at 86.9 points.

Trends in age groups remain consistent. Overall, adult consumers continue to display a sense of pessimism. However, those aged 45 to 59 are approaching the neutral zone with a confidence index of 98.6 points, up by 3.8 points. In contrast, consumers over 60 experienced a decline, with their index falling to 91.9 points, down by 5 points. Young people aged 18 to 29, as usual, demonstrate the highest consumer confidence, reaching 118.7 points and showing a significant increase of 2.9 points in optimism.

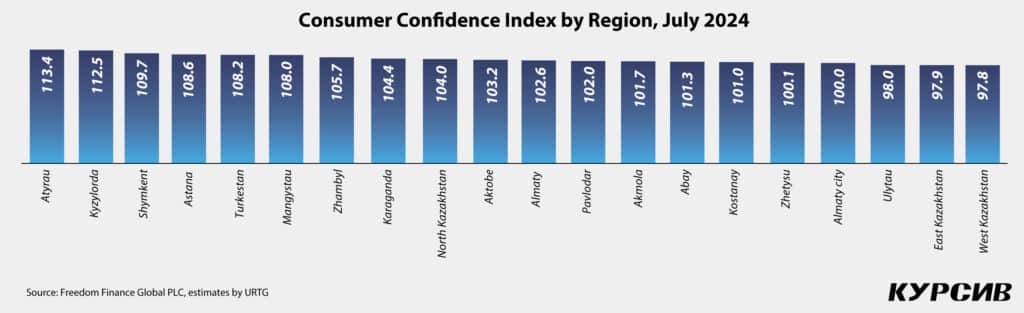

Almost All of Kazakhstan in the Optimistic Zone

In June, 13 regions of Kazakhstan were in the consumer optimism zone. By July, this number had risen to 17 regions. The only exceptions to this optimistic trend are the following regions, which remain in the pessimistic zone: East Kazakhstan stands at 97.9 points, up by 2.5 points; West Kazakhstan is at 97.8 points, down by 10.6 points; and Ulytau is at 98 points, down by 7.2 points.

In July, the most significant increases in consumer confidence were observed in the Aktobe region (103.2 points, up by 11 points), Pavlodar region (102 points, up by 7.6 points) and North Kazakhstan region (104 points, up by 8.1 points). Notably, Pavlodar and North Kazakhstan regions had previously recorded some of the lowest levels of consumer optimism. In contrast, Aktobe’s confidence levels had fluctuated between optimistic and pessimistic in the spring and summer.

Conversely, a decline in consumer confidence was noted in several regions: West Kazakhstan saw a decrease of 10.6 points to 97.8 points; Zhetysu fell by 8 points to 100.1 points; Turkestan decreased by 7.6 points to 108.2 points; Ulytau dropped by 7.2 points to 98 points; and Almaty declined by 2.9 points to 100 points.

Less Worry, Yet Financial Concerns Persist

Although the CCI saw a slight increase in July compared to June, Kazakhstani consumers reported feeling less worried overall, with 34.4% stating they had no concerns during the month (up by 3.7 percentage points).

However, concerns about financial difficulties and a lack of money rose by 1.8 percentage points, reaching 28.2%. Worries about inflation, rising costs and rates have become more pressing compared to earlier in 2024, now ranking fourth among the main concerns of Kazakhstanis at 7.7% (up by 0.9 percentage points).

Additionally, 10.9% of Kazakhstanis (up by 0.8 percentage points) were worried about their health or the health of their loved ones. Family and domestic issues were less frequently cited as a cause of anxiety in July, declining to 7.2% (a drop by 1.7 percentage points).

Concerns about the economic situation and political climate in the country showed slight increases, with worries about the economy rising to 2.8% (up by 0.6 percentage points) and about politics to 2.2% (up by 0.6 percentage points). Environmental concerns are also gaining increased attention, reaching 1.9% (up by 0.8 percentage points), though they remain less prevalent than other concerns among Kazakhstanis.

Acceleration Trend

According to data from the Bureau of National Statistics of Kazakhstan, annual inflation accelerated in July, rising to 8.6% — an increase of 0.2 percentage points year-over-year (YoY) after a prolonged period of decline.

This shift marks a departure from the «optimistic trend» in price assessments observed over the past year. In July, a slightly higher proportion of consumers noted that prices had risen faster than before (52.7%, up by 0.6 percentage points). On the other hand, there was also an increase in optimistic views, with more Kazakhstanis observing that prices were growing more slowly than before (12.8%, up by 2.2 percentage points). This indicates a polarization in consumer sentiment, with a reduction in moderate assessments and a shift toward either pessimistic or optimistic views.

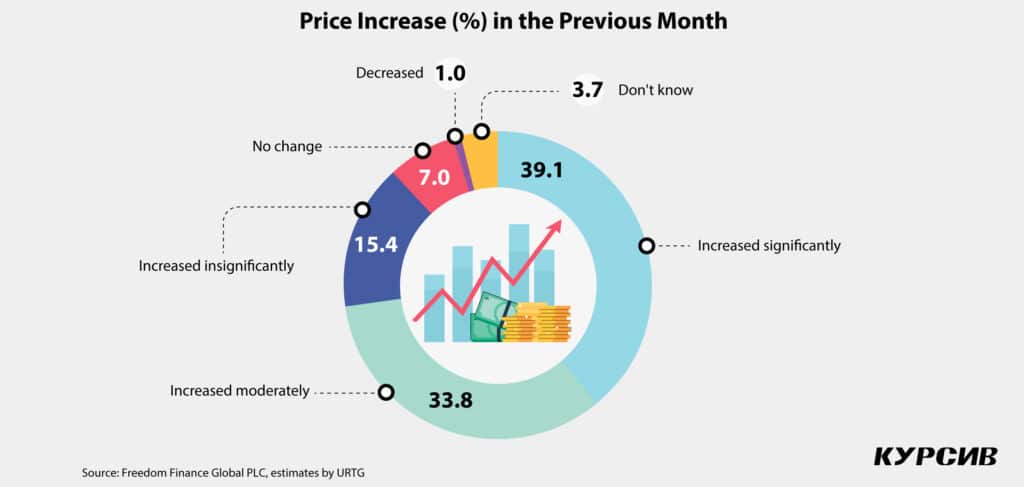

Monthly inflation also accelerated in July, reaching 0.6%, compared to 0.4% in June. Reflecting this trend, a larger proportion of consumers reported moderate price increases by the end of the month (33.7%, up by 1.5 percentage points). Meanwhile, the proportion of those who noted significant price increases remained relatively stable (39.1%, up by 0.1 percentage points). The expectations of a modest price increase observed in May and June have thus materialized in the current month.

No Changes in Inflation Expectations

This survey employs probabilistic quantification based on Burke’s methodology to calculate inflation expectations, which are inherently inertial.

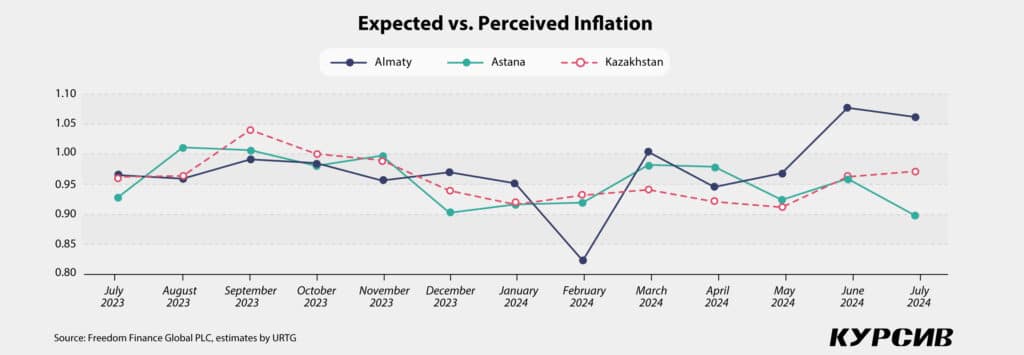

The expected annual inflation rate for July 2024 remained unchanged at 8.2%, the same as in June. However, the ratio of expected to perceived inflation increased to 0.97 from 0.96 in June. While the public’s expectations are below current inflation trends, the assessments indicate that inflationary pressures are rising.

Regional differences observed in June persist. As expected, residents of Astana and Almaty have different views on inflationary processes. In July, residents of Astana displayed optimism above the national average (0.9 compared to 0.97 percentage points), whereas residents of Almaty showed notable pessimism regarding inflation (1.06).

Adult Consumers Track Prices

In July, the gender gap in assessing price changes for goods and services over the past month remained significant. Compared to June, women again showed an increase in pessimistic assessments, up by 0.3 percentage points to 41.8%, while men experienced a drop in pessimistic views, down by 0.3 percentage points to 36%. The situation differs slightly when assessing annual price changes. In July, men showed a slight increase in pessimistic assessments, up by 1.1 percentage points to 48.1%, whereas women continued to report a significant price increase over the past year, up by 0.2 percentage points to 56.7%.

Young consumers were more optimistic about price changes over the past month. However, unlike in June, young people and retirees were more likely to report strong price increases this month, with young people up by 2.5 percentage points to 35.7% and retirees up by 3.1 percentage points to 42.6%. Assessments of price trends over the past year remained relatively stable: young adults showed the most pessimistic views, down by 0.7 percentage points to 55.9%, while young people were less inclined to view price growth as significant, despite a shift towards less moderate assessments, up by 2.4 percentage points to 49.4%.

At the end of the month, sharp price increases were notably reported by residents of East Kazakhstan (52.2%) and West Kazakhstan (50.4%). By the end of the year, more moderate estimates were reported in East Kazakhstan (60.7%), Zhetysu (65.8%) and North Kazakhstan (60.5%).

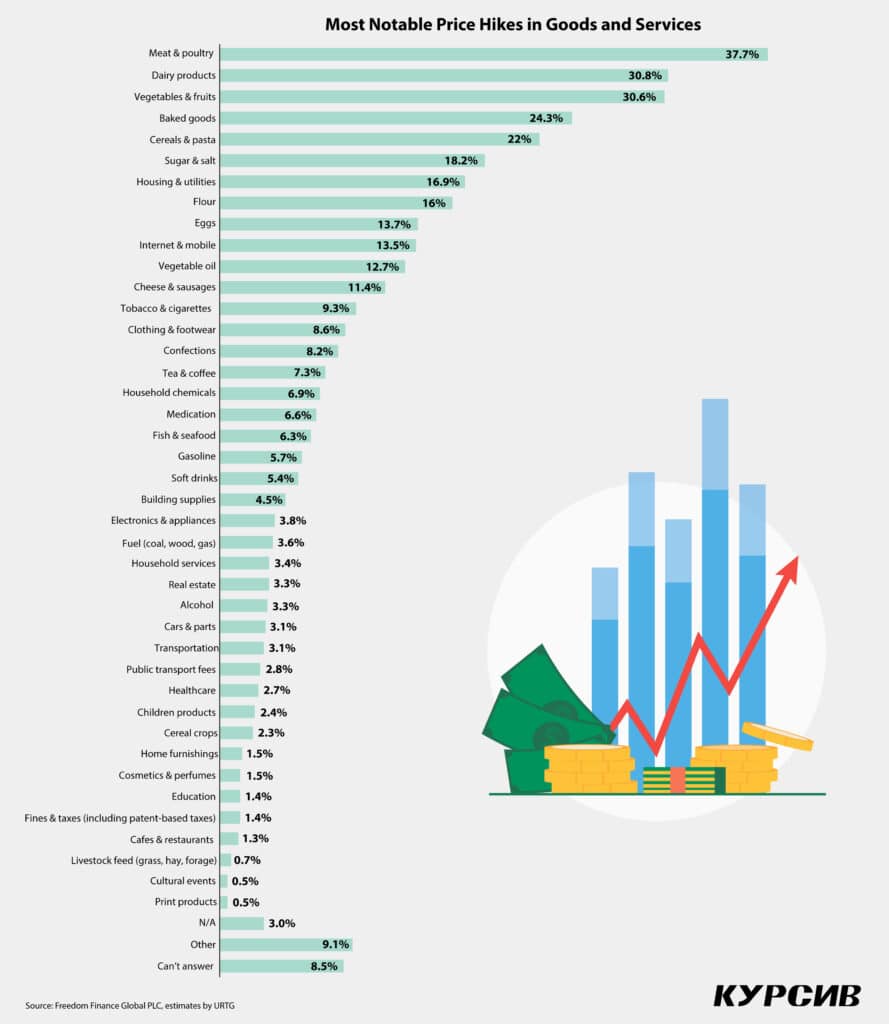

Top Price Increases in Communications, Housing and Utilities

In 2023, staple foods accounted for the top 10 most noticeable price increases for goods and services. Starting in February 2024, the top 10 now includes the following services: housing and utilities (16.9%, up by one percentage point), followed in July by internet and mobile services (13.5%, up by 1.4 percentage points), with a significant increase in these services in June (up by 7.5 percentage points).

Notably, in July, Kazakhstanis reported significant price increases for services, while key food items became less frequently cited. The smallest decrease in mentions was observed for dairy products (30.8%, down by 2.7 percentage points), cereals and pasta (22%, down by 1 percentage point) and flour (16%, down by 1.4 percentage points).

In July, price increases were comparatively more noticeable for clothing and footwear (8.6%, up by 1.3 percentage points), confections (8.2%, up by one percentage point), fish and seafood (6.3%, up by 0.6 percentage points) and soft drinks (5.4%, up by 0.6 percentage points).

Expecting Strong Growth in the Coming Month, but No Growth Over the Year

This month, there has been a continued rise in pessimistic assessments: the share of those expecting strong price growth over the next month has risen to 17.3% (up by 1.3 percentage points), while those expecting moderate price growth has increased to 34.3% (up by 0.8 percentage points). This increase is due to a decrease in those anticipating only modest price growth, which has fallen to 18.3% (a drop of 2.7 percentage points).

In the yearly outlook, consumer forecast estimates, previously noted as moderate, are now polarized. The share of those expecting rapid price growth has increased to 22.2% (up by 1.4 percentage points), as has the share of those expecting no change in prices, which has risen to 10.1% (up by 1.4 percentage points). The most common scenario remains the price growth forecast at the same rate as this year, at 39.2% (down by 2.6 percentage points), although the share of those expecting this price dynamic decreased in July.

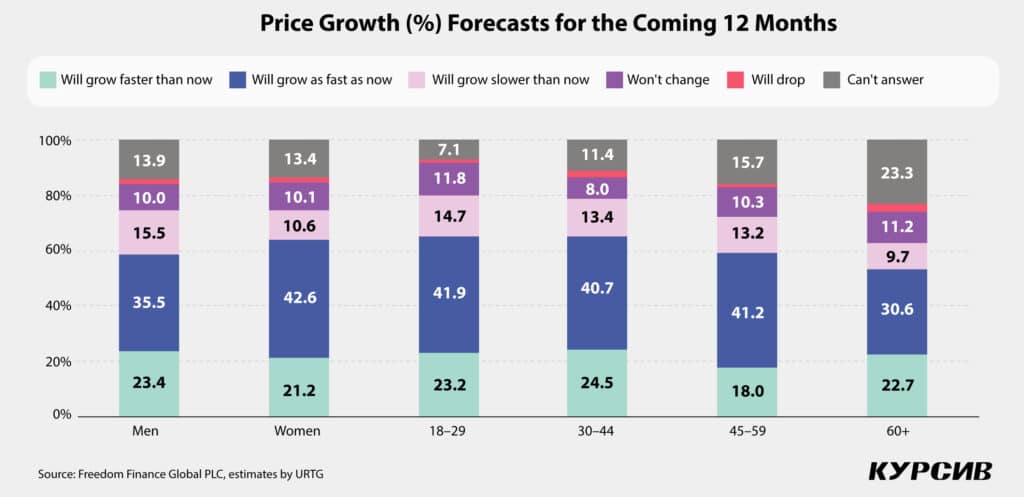

Men and Young Adults are Concerned About Rising Prices

The greater concern about price growth over the next month that was noted among men in June has shifted in July. Women are now slightly more likely to expect strong price growth (17.4%, up by 1.6 percentage points) compared to men (17.3%, up by one percentage point). However, looking ahead to next year, men are more likely to expect strong price growth (23.4%, up by 3.2 percentage points) compared to women (21.2%, down by 0.2 percentage points). This contrasts with June, when men showed more optimistic sentiment.

Young adults in Kazakhstan remain the most pessimistic group, forecasting strong price growth for the year (24.5%, up by 2.9 percentage points) and the month (18.6%, up by 0.9 percentage points). Young people continue to show an increase in pessimistic forecasts for the month ahead (17.1%, up by 2.7 percentage points). Growing pessimism about price trends over the year is also prevalent among Kazakhstanis aged over 60 (22.7%, up by 3 percentage points).

Residents of the Atyrau region and Ulytau region expect strong price growth both in the coming month (25.1% and 25.3%, respectively) and over the year (33.3% and 35.1%, respectively). Additionally, residents of the West Kazakhstan region anticipate significant price growth over the year (31.7%).

Moderation After Dramatic Growth

Following the significant rise in devaluation expectations for both the month and the year, July forecasts are shifting towards more moderation. Slightly more than one-third of Kazakhstanis (34.3%, down by 2.6 percentage points) expect the dollar to appreciate against the tenge in the coming month. In contrast, slightly more than one-third (39.8%, up by one percentage point) are leaning towards a «stable» outlook. The yearly forecast estimates have remained unchanged since June, with over half of Kazakhstanis (56.8%, up by 0.6 percentage points) continuing to believe that the dollar exchange rate will be higher against the tenge.

Traditionally, men are more likely to expect the dollar to appreciate both in the short term and over the year (35.7% and 59.7%, respectively). Among age groups, young people are more optimistic about dollar growth over the year (66.9%, up by 0.6 percentage points), while young adults are more inclined to expect dollar growth in the short term (37%).

Residents of the Aktobe region (43.6%) and Ulytau region (39.4%) are more confident about the prospect of dollar growth in the next month. In contrast, residents of the Atyrau region (66.4%) and Almaty (65.2%) are more confident about dollar growth over the next year.

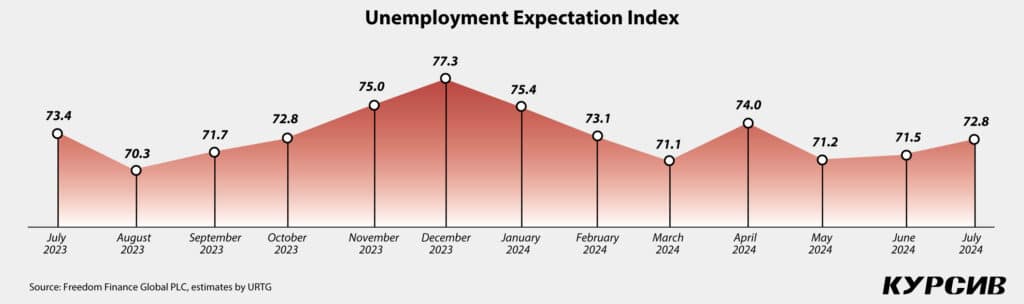

Unemployment Is Less of a Concern

The unemployment expectations index for July shows a notable increase compared to June, up by 1.3 points to 72.8 points. This suggests a stabilization in assessments and a reduced level of concern about unemployment. This change is attributed to a decrease in the proportion of Kazakhstanis who expect an increase in unemployment over the year, now at 40.7% (down by 0.6 percentage points).

As in June, gender differences in worries about the labor market are less noticeable than at the beginning of the year. However, men are slightly less concerned about the situation (40.5%, down by one percentage point) compared to women (40.9%, down by 0.4 percentage points). Greater concern about unemployment is observed among older age groups, including pre-retirement age Kazakhstanis (43.3%, down by 3.3 percentage points) and retirees (43%, up by 5.2 percentage points), with a significant increase in concern among those over 60 years old in July.

Residents of western regions, such as Atyrau (51%, down by 1.6 percentage points) and Mangystau (53.2%, up by one percentage point), continue to show significant concern about job availability. Conversely, residents of the Abay region (24.1%) and Kyzylorda region (21%) are less concerned about unemployment.

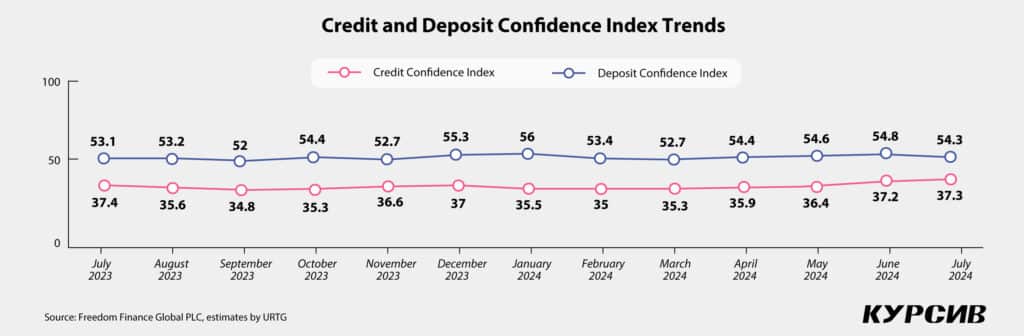

Positive Towards Loans, but No Stronger Reliance

In July, the percentage of those planning to take out a loan increased following a rise in credit confidence in June. Approximately 20.2% of Kazakhstanis (up by 1.4 percentage points) plan to use credit in the next 12 months. This increase in loan plans was driven primarily by women (20.8%, up by 3.6 percentage points) and young adults (26.7%, up by 5.9 percentage points). Regionally, residents of Zhambyl (26.6%) and Mangystau (25.7%) regions are more likely to plan for loans, while residents of Ulytau region are less inclined (4.2%).

Despite the rise in loan planning, the credit confidence index remained nearly unchanged, increasing by just 0.1 points to 37.3 points. Similar to the trends in price expectations, there has been a polarization in credit assessments: the share of those undecided has decreased (22.2%, down by 2.9 percentage points), with shifts towards more optimistic (17.3%, up by 1.5 percentage points) and more pessimistic (49.2%, up by 1.3 percentage points) views, with pessimism continuing to dominate among Kazakhstanis.

In terms of gender, the growth in credit confidence was slightly more noticeable among women, up by 0.3 points to 38.6, while men saw a decrease of 0.3 points to 35.7. By age group, credit confidence is rising more notably among young people aged 18 to 29, increasing by 0.9 points to 38.7 and returning to typical patterns. However, older age groups, which had previously shown growth in credit confidence over the past few months, experienced a slight decline in July. For those aged 45 to 59, credit confidence fell to 36.1 points, down by 0.6 points, and for those aged 60 and over, it decreased to 37.5 points, down by 0.1 points. Regionally, the highest level of credit confidence in July was found among residents of the Kyzylorda region, at 43.9 points, down by 1.7 points, while the lowest was among residents of the Atyrau region, at 30.9 points, down by 2.8 points.

The deposit confidence index in July declined slightly after minimal growth, decreasing by 0.5 points to 54.3. This figure is close to the April level of 54.4 points. As with credit confidence, the proportion of people uncertain about their assessments has significantly decreased, dropping by 5.2 percentage points to 22.9%. This shift is mainly toward more pessimistic views on savings instruments, which increased by 2.8 percentage points to 26.7%.

The drop in deposit confidence affects both men (down 0.5 points to 52.5) and women (down 0.6 points to 56), as well as the oldest age group (down 3.7 points to 47.2). In contrast, younger individuals show an increase in deposit confidence in July, rising by 1.5 points to 61.1. The highest deposit confidence is observed among residents of the Karaganda region (59.1 points) and the capital (59.3 points), while the lowest confidence is found in the Zhetysu region (50.7 points).

Less Anxiety and Stress in Midsummer

In July, more than 50% of Kazakhstanis felt that the overall sentiment around them was calm, with this share increasing by 0.9 percentage points to 58.2%. However, over a third (36.7%) still perceive the prevailing sentiment as rather anxious.

Women report higher levels of anxiety compared to men, with 40.3% of women feeling anxious (a decrease of 0.7 percentage points) compared to 32.7% of men (a reduction of 2.3 percentage points). In the older age groups, the highest level of anxiety is found among the eldest Kazakhstanis, with almost half (44.7%) reporting an overall sense of anxiety. The West Kazakhstan region has the highest level of anxiety at 48%, while the Kyzylorda region has the lowest at 23.2%.

Alongside the increase in calm sentiments, the proportion of Kazakhstanis who reported experiencing stress in July has decreased to 49.3% (a drop of 4 percentage points). However, the share of those who encountered stress daily during the month has slightly increased, rising by 0.4 percentage points to 11.3%.

Women also lead in the frequency of experiencing stress, with 12.2% reporting daily stress (an increase of 2.1 percentage points), compared to 10.4% of men (a decrease of 1.5 percentage points). Among age groups, young people report the highest frequency of stress at 52.7%. Regionally, the highest frequency of stressful situations is observed in the Zhetysu region (59.6%) and Astana (59%), while the North Kazakhstan region (35.3%) and Ulytau region (35.1%) report the lowest frequencies.

Optimistic Trend

In July 2024, the consumer confidence index showed modest growth, moving further into the optimistic zone. Kazakhstanis have become more positive about their financial situation, though they still view the country’s economic situation as relatively moderate.

Regionally, almost all areas and major cities are now in the consumer optimism zone, with three exceptions. Adults aged 45 to 59 are nearing the positive zone of consumer confidence, while those over 60 remain firmly in the consumer pessimism zone.

Inflation estimates have increased, and price forecasts are becoming more polarized: consumers are more likely to adjust moderate estimates toward pessimistic views, rather than optimistic ones. In July, Kazakhstanis began to feel the impact of rising prices for services — such as housing, utilities, internet and mobile communications — more acutely. Conversely, they have noted the boost in staple food prices less frequently.

The proportion of people planning to take out loans is increasing, while growth in credit confidence is slowing. In July, deposit confidence declined. However, concerns about the labor market have eased significantly this month. Stress and anxiety levels among Kazakhstanis continue to decrease, despite growing worries about financial difficulties, health conditions and rising inflation and costs.