Kazakhstan’s consumer confidence improves moderately in September

The consumer confidence index (CCI) has shown improvement, indicating a slightly more optimistic outlook among consumers, though growth remains weak. However, adult consumers and a quarter of Kazakhstan’s regions are still in the pessimistic zone. Inflation expectations exceed perceived levels and consumers anticipate price hikes in the short and long term. There is also increased concern about the labor market, although the overall anxiety level continues to decrease.

This report highlights the findings from the 22nd wave of Freedom Finance Global PLC’s Consumer Confidence Survey, conducted monthly since November 2022 using United Research Technologies Group’s methodology.

Moderate growth continues

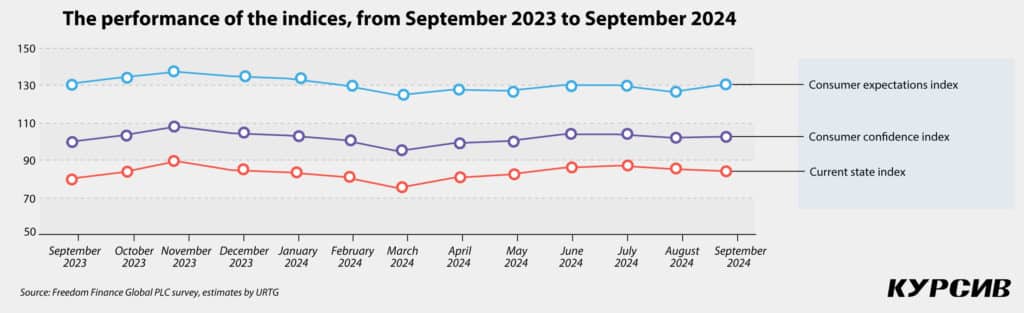

Following a decline in consumer confidence in August (to 101.9 points), September’s survey shows a slight strengthening of the optimistic trend, with the CCI rising by 0.8 points to 102.7. However, the current state index continued to drop (down by 1.3 points to 84.4), offset by a 4.5-point increase in the consumer expectations index, which reached 130.9.

In September, Kazakhstanis were more pessimistic about changes in their financial situation (down by 1.5 points to 102.2) and conditions for major purchases (down by 5.2 points to 71.3). This contrasts with the previous trend where domestic economic conditions were viewed pessimistically, but personal finances were seen more positively. In September, however, Kazakhstanis became more optimistic about recent economic developments in the country (up by 2.7 points to 79.6), as well as short-term (up by 7.1 points to 131.3) and long-term (up by 5.7 points to 132.4) prospects. While expectations for the country’s economy are increasingly positive, forecasts for personal finances remain rather moderate (up by 0.8 points to 129.1).

The CCI for September 2024 is higher than in the same period last year and shows similar levels to January 2024 (103.2 points). If there are no significant social or economic disruptions, the weak growth of the CCI is expected to continue in October.

Adult consumers are still in the pessimistic zone

In September, the more typical gender gap returned after a brief period of optimism in August. Men’s consumer confidence dropped by 2.2 points, placing them closer to the neutral zone at 100.8 points. Meanwhile, women became more optimistic, with their CCI rising by 3.5 points to 104.4, widening the gender gap to 3.6 points in favor of women. Women also exhibited higher consumer expectations (135.5 points compared to 125.9 points for men), though their assessment of the current state was slightly lower (84.2 points vs. 84.5 points for men).

As for the age groups, trends remained consistent despite fluctuations in the overall CCI. Younger groups stayed in the optimistic zone, though they experienced slight declines: the youth dropped to 113.6 points (-1.5 points) and young adults fell to 103.4 points (-0.3 points). Adult consumers stayed in the pessimistic zone, though those aged 45 to 59 edged closer to neutral with a 3.1-point increase to 97.5, while retirees saw a modest rise of 2.4 points, reaching 94.9.

Most of Kazakhstan’s regions are in the optimistic zone

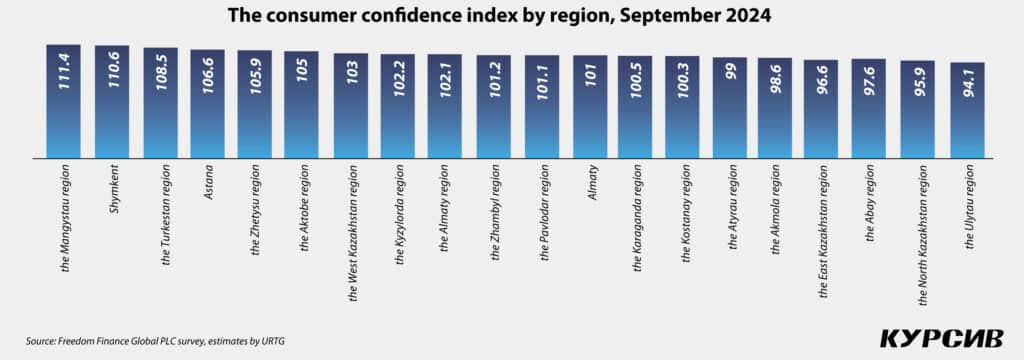

The September survey showed results similar to those of June in the regional outlook. In June, 13 regions were in the optimistic zone, while in September, 14 regions were included. However, pessimism persisted in the Abay (97.6 points), Akmola (98.6 points), Atyrau (99 points), East Kazakhstan (96.6 points), North Kazakhstan (95.9 points) and Ulytau (94.1 points) regions.

The most significant growth in consumer confidence was observed in regions of Zhetysu (+10.4 points to 105.9), Almaty (+5.7 points to 102.1) and Mangystau (+4.9 points to 111.4, which is the highest CCI across the country). The Pavlodar, West Kazakhstan and Shymkent regions also recorded noticeable gains.

Conversely, declines in consumer confidence were seen in the Kyzylorda (-12 points to 102.2), North Kazakhstan (-3.4 points), Turkestan (-5.9 points to 108.5) and Ulytau (-1.7 points) regions. Major cities like Almaty (-1.3 points to 101) and Astana (-2.2 points to 106.6) also experienced slight drops.

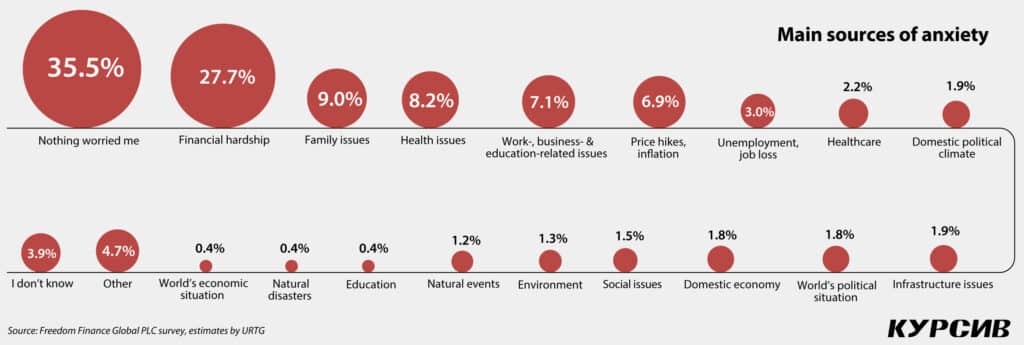

Fewer worries in early fall

The latest survey shows a significant decrease in anxiety among Kazakhstanis, with 35.5% of respondents indicating they had no worries over the past month — an 8 percentage point (p.p.) increase.

Concerns in other areas have also dropped: health-related worries fell by 4.1 p.p. to 8.2%, family-related issues decreased by 3.8 p.p. to 9% and concerns about inflation and rising costs dropped by 3.9 p.p. to 6.9%. However, financial hardships continue to affect 27.7% of the population, as many Kazakhstanis remain worried about money issues, debts and loans. On the other hand, compared to August, fewer people are concerned about healthcare (down by 2.9 p.p. to 2.2%) and education (down by 3.9 p.p. to 0.4%).

Recurring slowdown

According to the Bureau of National Statistics (BNS), annual inflation continued declining in September, falling to 8.3%, down 0.1% year-on-year (YoY).

Although half of Kazakhstani consumers (50.8%) still believe prices rose faster than before, this sentiment is relatively unchanged (down by 0.2 p.p.). About a quarter (26%, down by 4.1 p.p.) felt that prices increased more rapidly, while 11.4% (up by 1.7 p.p.) noted a slower rise.

Monthly inflation also slowed, dropping to 0.4% from August’s 0.6%. Despite these improvements, a more pessimistic view of price growth persists: 39.7% (up by 2.1 p.p.) of respondents said prices rose significantly in September, while 33.8% (down by 1.7 p.p.) believed they increased moderately.

Inflation expectations outpaced actual (perceived) inflation

This survey employs probabilistic quantification based on Burke’s methodology to calculate inflation expectations, which are inherently inertial.

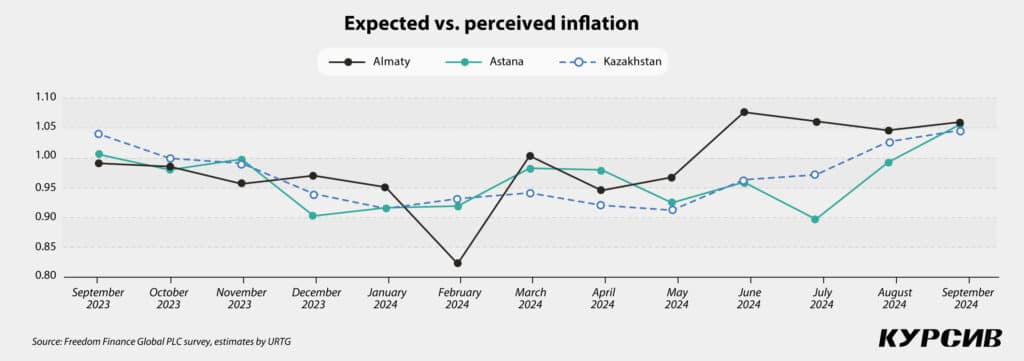

Inflation expectations remained higher than actual inflation. In September 2024, expected annual inflation was 8.8%, unchanged from the previous month, while the actual inflation stood at 8.3% YoY. This marks the second consecutive month where the public’s inflation expectations exceeded actual inflation rates, based on survey data from BNS.

The ratio of expected to perceived inflation continued to grow for the fifth month in a row and reached 1.05, indicating strengthening inflationary pressure during the fall. Uncertainty among respondents was also on the rise.

As for the regional differences in September, inflation assessments by residents of Astana and Almaty were similar, only slightly exceeding the national average. The expected-to-perceived annual inflation ratios in Astana and Almaty were 1.056 and 1.06, respectively, while the national average stood at 1.046.

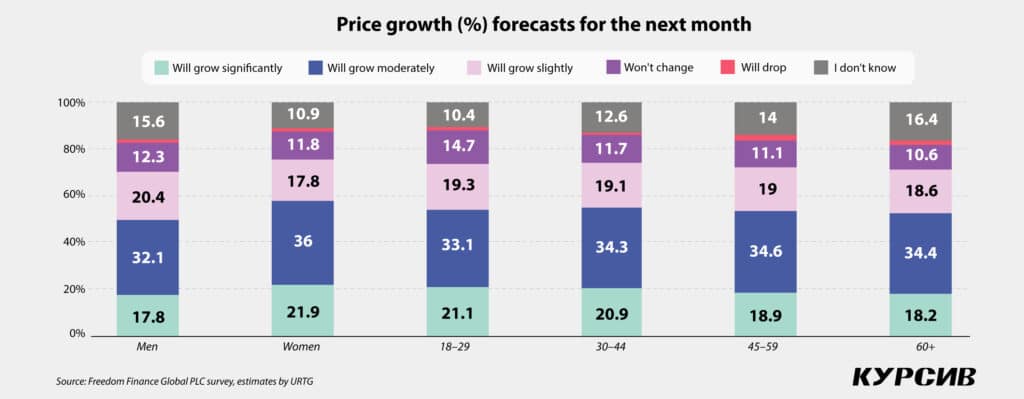

Women and youth are more concerned about price hikes

Women tend to be more pessimistic in evaluating price increases. About 43.4% of women reported significant price growth in the past month and 54.7% noted faster price growth over the past year. However, men’s pessimism about price increases has grown more noticeably — 35.6% (+3 p.p.) pointed out stronger price growth in the last month and 46.4% (+0.8 p.p.) over the last year. Nonetheless, this hasn’t significantly affected the gender gap.

Young adults also remain more pessimistic about price trends. About 53.2% of Kazakhstanis aged 25 to 34 observed faster price growth over the past year, with 41% noticing significant price increases in September. However, their annual assessment has become more moderate (-1.1 p.p. to 53.2%). While young people displayed greater optimism regarding recent price trends (+3.3 p.p. to 37.9%), retirees were more optimistic about price growth over the past year (+0.3 p.p. to 46.8%).

At the regional level, residents of the Atyrau (55.9%) and Ulytau (52%) regions were the most likely to report sharp price hikes in September. The Atyrau region also led in annual pessimism, with 62.9% of residents noting significant price increases.

Prices for meat and dairy products continue to worry the population

The most significant price hikes were observed in key food items, especially meat and dairy products. Additionally, since February, rising costs for housing, utilities and communication services have become a major concern. Despite a slight reduction in frequency, about a third of Kazakhstanis still report price increases for meat (36.1%, -4.4 p.p.) and dairy products (31%, -4.1 p.p.). Price hikes for other goods, such as fruits and vegetables (27.2%, -5.4 p.p.), bakery items (25.7%, -3.1 p.p.), cereals (20.9%, -2.8 p.p.) and housing and utilities (16.9%, -3.8 p.p.) were also less frequently mentioned.

Meanwhile, there was a slight increase in those reporting rising prices for real estate rentals and purchases (+0.7 p.p. to 5.8%), cereal crops (+1.6 p.p. to 4.1%), agricultural goods (+0.7 p.p. to 2.8%) and dining in cafes and restaurants (+0.7 p.p. to 2.8%).

Predicting strong growth

In contrast to previous months, when Kazakhstani consumers anticipated price growth mostly for the next month rather than over the year, September saw increased pessimism in both short-term and long-term outlooks. In the yearly forecast, there was a rise in expectations of faster price growth (+3.2 p.p. to 24.9%), meaning one in four Kazakhstanis now holds this view. Meanwhile, the share of those predicting stable price growth over the year dropped significantly (-9.3 p.p. to 40%).

For the next month, a third of Kazakhstanis expect moderate price growth (34.1%, -2.2 p.p.), while one in five forecasts strong price increases (19.9%), with this share rising in September (+1.9 p.p.). At the same time, there was a decline in moderate (-2.9 p.p. to 19%) and optimistic (-1 p.p. to 12%) expectations, reflecting increased pessimism about short-term price trends.

Women and youth are more worried

As usual, women display more pessimistic forecasts for the monthly (21.9%, +0.9 p.p.) and yearly (25.6%, +2.5 p.p.) outlooks. However, men saw a stronger increase in pessimistic forecasts, both for the next month (+3.1 p.p. to 17.8%) and for the next year (+3.9 p.p. to 24%), slightly narrowing the gender gap.

Despite rising pessimism across all age groups, young adults showed the highest growth in negative expectations for both the short term (+3.5 p.p. to 20.9%) and the long term (+3.9 p.p. to 26.5%). According to the annual forecast, this group now ranks among the most pessimistic. Young people also remain the most pessimistic in their monthly outlook (21.1%, +2.2 p.p.), while they and young adults share the lead in the yearly forecast (26.5%, +3.4 p.p.).

Residents of the Zhambyl region (27%) expect strong price growth in the coming month, while those in the Abay (30.6%), Zhambyl (37%) and Kyzylorda (33.3%) regions anticipate significant price hikes over the next year.

Uncertainty in foreign exchange forecasts

Uncertainty regarding foreign exchange forecasts has increased, with a 7.1 p.p. rise to 22.3% in the one-month outlook and a 4.8 p.p. increase to 20.4% in the annual outlook. This growing uncertainty is due to a decline in other estimates, particularly neutral ones (-3.3 p.p. for the yearly outlook and -6.3 p.p. for the monthly outlook). Despite this, more than half of Kazakhstanis (57.5%) expect the dollar to rise over the next year, and over a third (35.2%) believe it will increase within the next month.

Interestingly, the gender gap in dollar growth expectations has narrowed. Men have lowered their expectations of the dollar’s growth (-4.6 p.p. to 57.8%), while women have slightly increased theirs (+1.7 p.p. to 57.2%) for the yearly and monthly forecasts. Men’s expectations for the next month fell by 2.6 p.p. to 36.1%, while women’s expectations grew by 1.4 p.p. to 34.4%. Young people (66.4%, +1.5 p.p.) are the most likely to anticipate the dollar’s growth over the next year, while those aged 45 to 59 (41.2%, +2 p.p.) have higher expectations for the next month. Regionally, residents of the Turkestan region (43.2%) and Shymkent (42.4%) are more confident in the dollar’s rise over the next month, while residents of the Zhambyl region (68%) and the two major cities, Almaty (66.5%) and Astana (64.5%), are more confident about its rise over the next year.

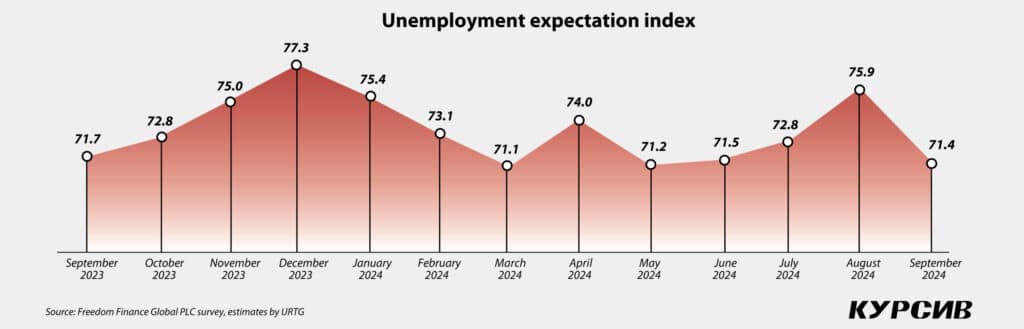

«Disturbed» labor market

In September, the unemployment expectation index dropped significantly by 4.5 points to 71.4 (compared to 71.7 points in September 2023), reflecting growing anxiety about the labor market. This increase is due to a higher share of Kazakhstanis (42.8%, +5.2 p.p.) who believe unemployment will rise in the next 12 months.

Men generally express slightly less concern about the labor market (42.3%, compared to 43.2% among women), though pessimistic views increased more sharply among men in September (+5.5 p.p., compared to +4.9 p.p. among women). Fear of unemployment is more pronounced among older adults, particularly those approaching retirement (45.5%, +5.5 p.p.) and retirees (45%, +6.4 p.p.). Previously optimistic youth also displayed the largest increase in pessimistic views on the labor market (+5.6 p.p. to 40.9%).

As in previous months, residents of western regions — the Atyrau (58.7%) and West Kazakhstan regions (56.1%) — and the Zhambyl region (56.4%) expressed the highest concern about job losses. In contrast, residents of the Pavlodar region (30%) and the capital city, Astana (37.4%), are less worried about unemployment.

Trust itself doesn’t lead to borrowing

The share of Kazakhstanis not planning to take out loans increased slightly in September. The percentage of those planning to apply for loans grew by 0.4 p.p. to 17.9%, while the share of those deciding not to apply for loans in the next year rose by 0.5 p.p. to 79.9%. This shift comes primarily from a decrease in the number of undecided respondents. The increase in loan intentions was driven largely by men (up 1 p.p. to 18.6%, while women fell by 0.2 p.p. to 17.2%) and younger (up 2.1 p.p. to 22.3%) and adult age groups (up 3.8 p.p. to 8.8%). Regionally, residents of the Turkestan region (28.9%) are more likely to plan for loans, while residents of the West Kazakhstan (9.7%) and Ulytau regions (7.8%) are less inclined.

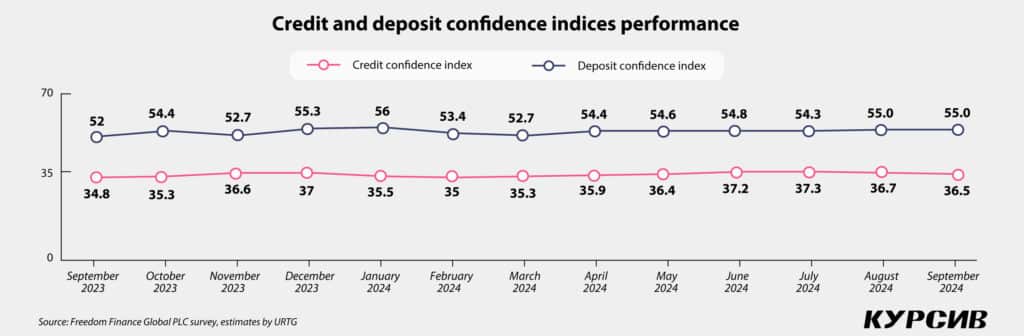

In September, the credit confidence index fell by 0.2 p.p. to 36.5, returning to its March level. Polarized views resurfaced, with a drop in the share of undecided respondents (down 7.6 p.p. to 22.1%) being redistributed between optimistic (up 2.9 p.p. to 16.5%) and pessimistic (up 3.3 p.p. to 50.2%) credit assessments. Pessimistic views continue to dominate.

Women demonstrated a slight increase in credit confidence (up 1.2 p.p. to 37.8), while men showed a decline (down 1.7 p.p. to 35.1). Among age groups, confidence grew most notably among adults aged 45 to 59 (up 1.6 p.p. to 37 points) and among those over 60 (up 0.9 p.p. to 35.6). However, these groups also displayed extreme values, with those aged 45 to 59 showing the highest credit confidence, while the oldest group remained the most pessimistic about credit options. Regionally, the Akmola region (41.5 points, +9.6 p.p.) and the Kyzylorda region (41.8 points, +0.3 p.p.) reported the highest credit confidence, while the Atyrau region saw the lowest level of confidence (26.2 points, -10 p.p.).

The deposit confidence index remained unchanged in September, holding steady at 55 points. As with credit confidence, the share of undecided respondents (-6.8 p.p. to 22.9 points) shifted toward both optimistic (+2.4 p.p. to 37.4%) and pessimistic (+2.5 p.p. to 24.9%) views regarding savings instruments.

Despite the lack of changes in the deposit confidence indicator, the gender gap is becoming more pronounced. Women’s confidence in deposits increased by 1.4 p.p. to 57.1, while men’s confidence declined by 1.7 p.p. to 52.7, further widening the gender disparity. The overall trend of confidence decreasing with age continues to hold, but September saw increased confidence among older age groups (+2.5 p.p. for those aged 45–49, and +1.5 p.p. for those 60+). Meanwhile, confidence fell among younger groups (-3.4 p.p. for the youth, -0.3 p.p. for young adults). The highest levels of deposit confidence were observed in the Karaganda region (58.6 points, +2.1 p.p.), Almaty (58 points, +0.9 p.p.) and Shymkent (58.5 points, +6 p.p.), while the lowest confidence was recorded in the Zhetysu region (49.3 points, +1.4 p.p.).

Fall tranquility

In July, more than half of Kazakhstanis reported that the general sentiment around them was calm, and this feeling has continued to grow (up 0.7 p.p. to 57%). However, over a third (36.9%, -2.3 p.p.) still felt that their environment was anxious, leading the index to reach 120.5 points (+4.5 p.). Men were less likely to report feeling anxiety (33.1%, +2.8 p.p.), while women more frequently noted calm sentiment (+5.2 p.p. to 31%). Among age groups, adults aged 45 to 59 showed the highest levels of anxiety, with nearly half (43.4%) reporting that they felt surrounded by anxious moods. The Ulytau region (41.1%) and Almaty city (43.3%) exhibited the highest anxiety levels, while the Aktobe region (28.5%) had the lowest.

At the same time, the proportion of Kazakhstanis who reported not experiencing stress in September increased to 46.8% (+6.3 p.p.). Still, about 10.8% of respondents reported experiencing daily stress (+0.1 p.p.). Women continued to report higher levels of stress (55.4%) compared to men (45.9%). Among age groups, young adults (54.5%) encountered stress most frequently, surpassing the youth from previous months (53.9%). Regionally, Almaty city residents reported the highest frequency of stressful situations (61.5%), followed closely by residents of Astana (57.9%). The regions reporting the lowest stress levels were the Mangystau (42.4%), Almaty (46.2%) and Karaganda regions (46%).

Steadiness in September

In September 2024, the consumer confidence index showed weak growth, continuing to strengthen in the optimistic zone. Unlike previous months, Kazakhstanis have become more positive in forecasting the future of the national economy, though personal financial outlooks remain moderate.

Three-quarters of the regions are now in the optimistic zone, but adult consumers continue to linger in the pessimistic zone. Women are gaining confidence due to growing consumer expectations, while men are hovering closer to a neutral zone of consumer confidence.

Inflation expectations among the population are still higher than the actual figures, with forecast estimates of price trends turning pessimistic. This shift is evident not only in the monthly outlook, as was seen in earlier periods, but also in the forecast for the coming year. There has been a decline in the index related to key food items and services, such as housing, utilities, internet and communications.

Meanwhile, the credit and deposit confidence indices, as well as the intent to apply for loans, have remained largely unchanged, despite a drop in the major purchases index. However, there is a rising concern about the labor market. Stress and anxiety levels among Kazakhstanis continue to decline, although financial concerns remain the primary issue for nearly one in four people.