The influence of innovative anti-obesity drugs (GLP-1 drugs) such as Ozempic, Mounjaro, and other so-called «slimming shots» has clearly moved far beyond the pharmacy. The impact of these game-changers is now visible in mass-market retailers, on red carpets, and even on restaurant menus.

Notably, the share of U.S. adults taking popular weight-loss medications — including Ozempic, Wegovy, Mounjaro and Zepbound — has surged over the past year, climbing to 12.4%, according to new polling from Gallup. Over the same period, the national obesity rate edged down, slipping from nearly 40% in 2022 to 37% in 2025.

Businesses are already adjusting. Some are buying up health-focused food brands, revamping hotel fitness centers, or rethinking workplace cafeteria options as the new drugs reshape consumer behavior.

A recent report by Jaclyn Peiser in The Washington Post details how these medications are filtering through the broader consumer economy.

Grocery stores

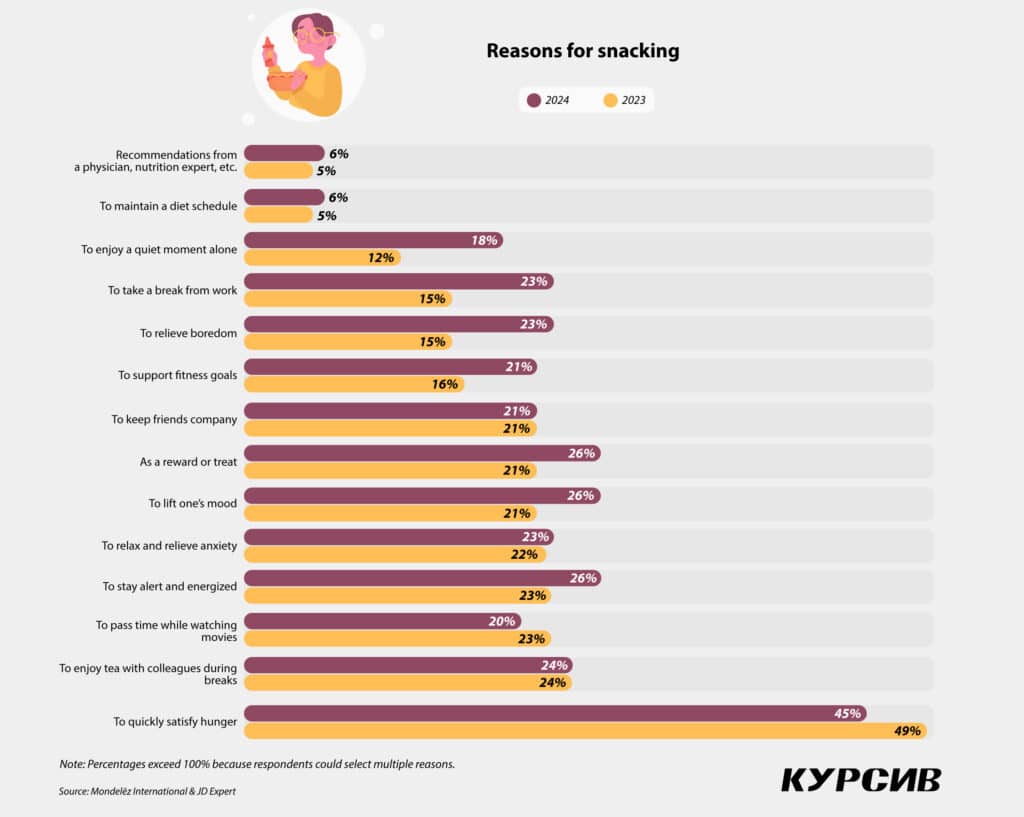

People using GLP-1 medications — synthetic versions of a hormone that regulates appetite, digestion and blood sugar — are shifting their shopping patterns. Many are cutting back on snack foods and instead gravitating toward fresh produce, high-protein products meant to help maintain muscle, and convenient, nutrient-dense frozen meals.

Nonalcoholic beverages

Research indicates that GLP-1 drugs may reduce the desire to drink alcohol, particularly among heavy drinkers. Spending in the alcoholic beverage category dropped 14.5% among users after starting treatment. At the same time, according to NielsenIQ, purchases of nonalcoholic wine and beer exploded, rising 1,158% and 935%, respectively.

Pharmacies

Because the medications can trigger side effects such as nausea, indigestion, and hair or muscle loss, buyers are turning to supplements and beauty products with added vitamins. Retailers report a notable spike in demand for these items.

Smaller sizes

Clothing trends are shifting as well. Sales of smaller sizes of apparel for both men and women have increased, according to research from Impact Analytics. Analysts expect plus-size items to become harder to find in stores, with much of that inventory moving primarily online.

Gyms and fitness spending

To protect against muscle loss, GLP-1 users are urged to exercise and incorporate strength training. That recommendation is influencing their spending habits. Consumer Edge data shows a 29% rise in sales of wearable fitness devices among users over a six-month period, along with broader interest in exercise-related purchases and services.

But not so affordable…

Despite their widening influence, Peiser highlighted, these drugs remain out of reach for many Americans. Even with discounts, annual costs can climb to roughly $6,000, creating a steep financial barrier for prospective users.