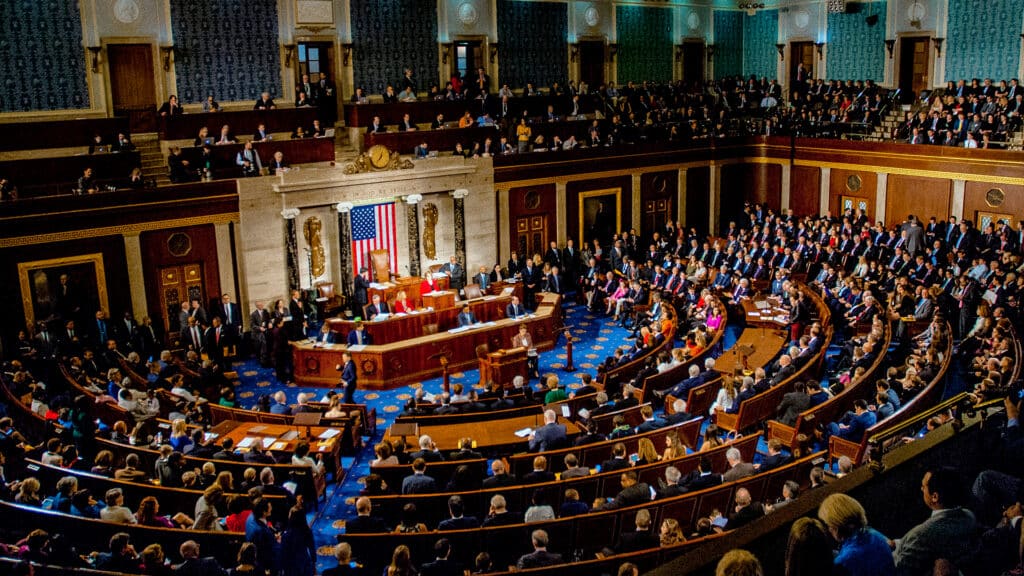

U.S. Congress clears defense bill, setting record military budget

The U.S. Congress has passed the Fiscal Year 2026 National Defense Authorization Act (NDAA), authorizing approximately $901 billion in defense spending, the largest amount approved under the annual legislation. The bill includes a 4% pay increase for service members, investments in modernizing weapons procurement and initiatives aimed at maintaining U.S. military competitiveness, according to Reuters.

The measure was approved by wide margins in both chambers, continuing a more than six-decade tradition of passing the NDAA each year.

Support for Europe

One of the key elements of the bill is its reaffirmation of U.S. commitments in Europe. The legislation, for example, allocates $800 million in military support to Ukraine over the next two years through the Ukraine Security Assistance Initiative, which funds U.S. defense companies supplying weapons and equipment.

The NDAA also authorizes funding for the Baltic Security Initiative, providing support for Latvia, Lithuania and Estonia. In addition, it places restrictions on reducing U.S. troop levels in Europe below a defined threshold and preserves the role of the U.S. European Commander as NATO’s Supreme Allied Commander.

Policy shifts

The bill includes several policy changes. Thus, it repeals prior authorizations for the use of U.S. military force in Iraq, reflecting congressional efforts to reassert its role in decisions related to military deployments.

The legislation also lifts certain sanctions imposed on Syria during the Assad era and links a portion of the defense secretary’s travel budget to compliance with congressional information requests.

In addition, the bill doesn’t provide any funding for renaming the U.S. Department of Defense as the Department of War, as proposed by President Donald Trump and Secretary of Defense Pete Hegseth earlier this year.