President Kassym-Jomart Tokayev has signed a new banking law along with amendments to several legislative acts governing financial market regulation, the presidential press office reported.

The changes aim to strengthen financial security, combat fraud, and reduce debt for Kazakh citizens.

Measures to combat fraud

The law adds safeguards to prevent loans issued in others’ names, aiming to reduce the use of forged documents, stolen phones, and unauthorized remote device access.

Key measures include:

- Biometric data will be collected when opening a bank account or obtaining a loan for the first time. For loans, the data will be collected during an in-person visit to a bank or microfinance organization.

- Electronic digital signatures require client consent and mandatory biometric verification.

Reducing the debt burden

The amendments also streamline bankruptcy and debt-resolution procedures.

- The extrajudicial bankruptcy process will be expedited. Individuals owing less than 1,600 monthly calculation indices (a standard unit set annually by the government for tax and legal purposes) — about $13,500 — and overdue for more than five years will be able to complete the procedure within one month.

- Borrowers owing multiple institutions can resolve debts via the Financial Ombudsman Service platform.

- The ban on selling individual debts to collectors remains in effect through May 1, 2027.

Financial services and market development

The ban on interest for current accounts will be lifted. Banks may again offer up to 1% annual interest on these everyday accounts, making noncash savings more attractive and increasing competition among banks.

Insurance regulations are simplified. Insurance contracts may now be terminated or canceled online. Insurers must refund a portion of the premium within 5 business days if a loan is paid off early.

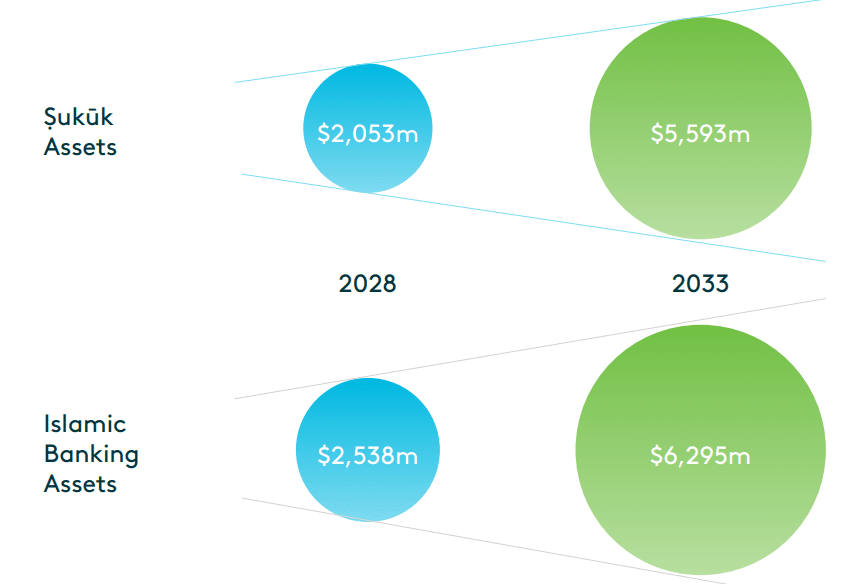

Islamic banking units

Conventional banks may open «Islamic windows,» or Islamic banking units, offering Sharia-compliant financial products.

These units use separate asset systems, dedicated staff, and independent audits. A special council will assess compliance with Sharia.

Cryptocurrency regulation

The amendments expand the legal status of cryptocurrencies through licensed crypto providers and formally establish the status of crypto exchange platform operators.

To improve the management of state-owned digital assets, authorities also plan to create a national crypto reserve.