How Russian tech talent is driving Armenia’s unexpected economic boom

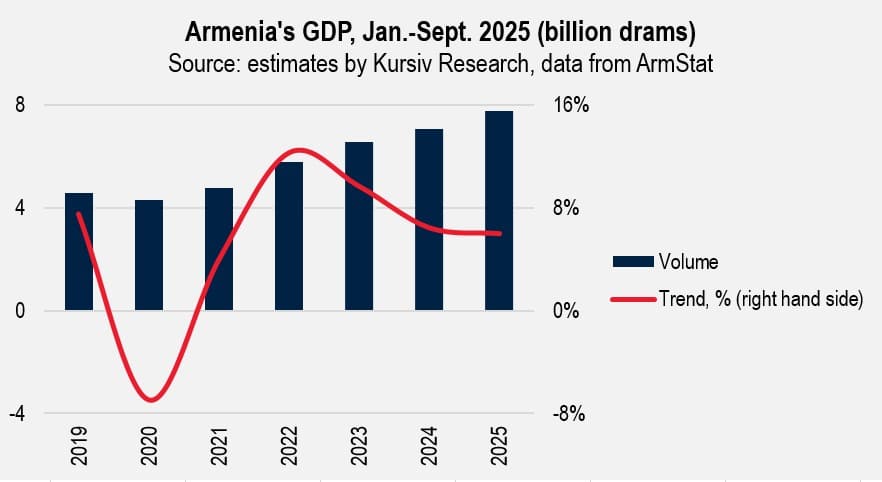

Kursiv Research continues its series of macro market reviews for Central Asia and the Caucasus. This installment focuses on Armenia, one of the region’s fastest-growing economies. The key conclusion of this country review: after a period of rapid growth in 2022-2024, Armenia’s economy achieved a soft landing in 2025.

According to the World Bank, Armenia’s economy grew by 5.2% in 2025. That pace is well below the average of 8.9% recorded in 2022-2024. Among Commonwealth of Independent States countries, only Kyrgyzstan — like Armenia, a member of the five-nation Eurasian Economic Union (EEU) — posted faster growth.

Relocation-driven boom

The post-2022 expansion was largely driven by external factors, including capital inflows, the relocation of Russian businesses and professionals, and a sharp increase in exports. Armenian authorities estimate that about 110,000 Russians relocated to the country in 2022 — a substantial inflow for a nation of 3.1 million people.

IT professionals formed the core of this wave. As many as 50,000 Russian programmers and roughly 2,000 IT companies moved to Armenia. High incomes in the tech sector boosted demand for goods and services, particularly housing. By the end of 2022, GDP had surged by 12.6%, the fastest growth rate in 15 years. Economy Minister Vahan Kerobyan said relocators accounted for roughly one-quarter of total GDP growth that year, while the Ministry of Finance estimated their contribution could be as high as one-half.

Trade disruptions and export surge

Western sanctions on Russia disrupted trade within the EEU. Armenia temporarily became a transit hub for the re-export of Russian precious metals and stones to global markets, as well as electronics and automobiles flowing in the opposite direction.

These shifts immediately affected the balance of payments. Armenia’s current account, which had traditionally run a deficit, posted a surplus of 0.7% of GDP for the first time in 2022. The surplus proved short-lived, returning to deficit a year later. Still, export growth was dramatic: merchandise exports, which had not exceeded $3 billion prior to 2022, rose to $5.3 billion that year and reached a record $13 billion in 2024.

Growth cools but remains resilient

External support for the economy began to fade in 2024. Economist Suren Parsyan notes that some IT specialists departed the country and that the re-export of Russian gold ended in May. As a result, GDP growth slowed to 5.9% in 2024, down from 8.3% in 2023.

The slowdown did not turn into stagnation. In the first three quarters of 2025, Armenia’s economy reached 7.7 trillion drams, or about $20 billion, growing by an estimated 6.0% in real terms, according to our calculations.

Four of the five largest sectors, which together accounted for about half of the economy on average in 2020-2024, posted positive growth. Trade turnover rose 3.2%, while agricultural output increased 6.1% (growth rates refer to physical volume indices). Services expanded rapidly, with real estate services up 11.2% and financial services up 13.8%.

Manufacturing, however, declined by 10.2%. The steepest drops were in industries that dominate Armenia’s «natural» export basket, including metallurgy, which plunged 58.0%, and beverage production, which fell 13.8%. These declines partly reflect a high base effect from the previous year, as well as the prolonged appreciation of the national currency.

Sectoral divergence

Among sectors with a high comparison base, construction delivered the strongest performance, expanding 20.7%. IT and telecommunications followed with growth of 18.4%. Both sectors are now growing at their fastest pace since 2022.

Monetary policy and inflation outlook

The Central Bank of Armenia acknowledges that current GDP growth exceeds long-term sustainability estimates and expects a moderately positive output gap. Economic signals remain mixed: strong lending and consumption growth contrast with weak retail turnover and low inflation in the services sector. As a result, the central bank believes any overheating is localized, primarily in construction.

In December 2025, the central bank cut its refinancing rate by 25 basis points to 6.50% after annual inflation slowed to 3.1% in November, close to the 3% target. Policymakers said domestic demand is not yet putting excessive pressure on prices, though they warned of potential risks tied to a real estate price correction.

The regulator expects the policy rate to decline further to 6.25% in 2026, while emphasizing its readiness to respond swiftly to macroeconomic shifts to keep inflation near 3% over the medium term.