Cement industry in Kazakhstan hits historic record

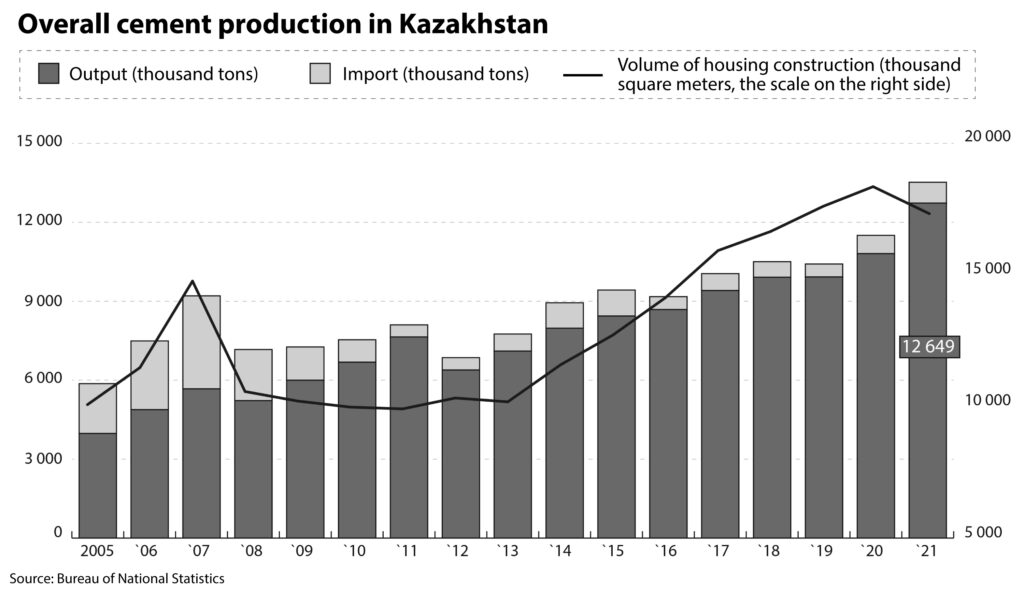

Over the past decade, the ramp-up of the output of the domestic cement industry was about 5.5% on average. However, in 2020-2021 the industry reported intensification of the output growth by 10.4% and 15.4% respectively.

According to the market participants, the main reasons for the production ramp-up are a buzz in the construction and stable demand for high-quality cement from Kazakhstan in neighboring markets.

«The key driver of the increase in output is a surge in construction in Kazakhstan. Cement consumption spiked by 25% in 2021 all over the country. Another driver of the growth is stable demand for Kazakhstan’s cement from neighboring countries. Since 2018 the export of domestic cement has been exceeding 1.5 million tons per year. Kazakhstan’s cement industry is proud of its high quality because there is no such demand for a low-grade product,» said Erbol Akymbayev, executive director of the Kazakhstan Association of Cement and Concrete Producers.

The capacity of the cement industry in Kazakhstan is about 17 million tons per year. Over the coming two years when all cement plants under construction are set to work the rate might reach 19 million tons per year, according to the Ministry of Industry and Infrastructural Development.

Moreover, the current plants (15 in total) use just 60-70% of their capacity which means the cement industry in Kazakhstan has a quite good stock of strength and can easily increase its output if needed. However, some cement producers worry that starting this year the production progress might slow down because the country is going to gradually cut all carbon quotas it is given free of charge. These additional costs can damage the ability of Kazakhstan’s cement to compete with foreign producers and they may take advantage of this.