How amendments to the Tax Code have affected the market of mobile transactions in Kazakhstan

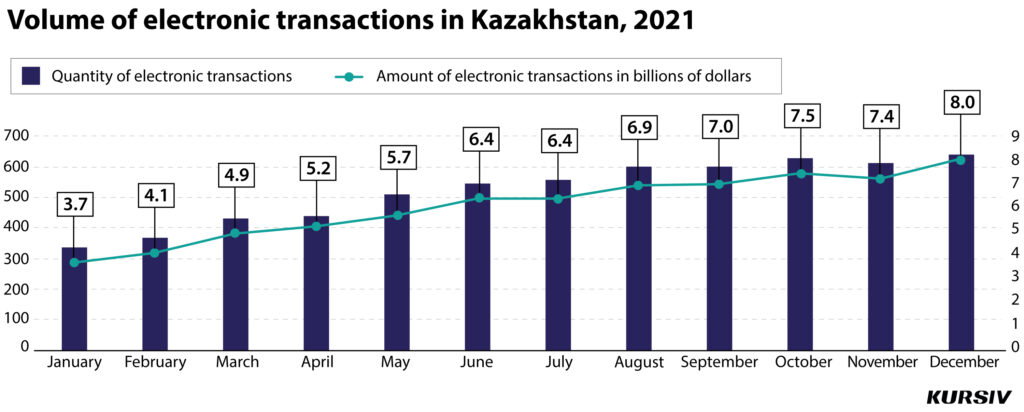

In 2021 the volume of electronic transactions in Kazakhstan was increasing from month to month. It dropped only once in November when the volume of electronic transactions decreased to $162.9 billion. This is not a coincidence for sure as the new amendments to Kazakhstan’s Tax Code were adopted exactly that month. The amendments have been aimed at regularizing revenues Kazakhstan’s entrepreneurs receive as more and more customers prefer to pay online through mobile apps. The authorities have introduced the notion of mobile payment and made it mandatory for entrepreneurs and companies to accept payments to an official account approved by the tax authority.

In other words, the business has to divide all mobile payments into two separate categories: private transactions and business transactions. The government even wanted to make a system that would be able to track revenue sent to bank accounts that aren’t designated for commercial purposes.

Because of this bulk information, many small and medium-sized businesses thought that the system could have started to work on December 1. Almost all entrepreneurs who sell fruits or food staples and even taxi drivers were uncomfortable with accepting mobile payments and insisted their clients pay in cash. However, soon after the authorities and Kaspi, the key operator of electronic transactions in Kazakhstan managed to calm these people down by saying that the tax authorities aren’t going to receive that data until 2025.

Before that date, nothing will change for private entrepreneurs and public servants. «Electronic money transfers between individuals aren’t a subject for taxation,» the bank said.

The same statement made by the Committee on the State Revenues as the obligation for banks to send such data on individuals is set to enter force in 2025.

As a result, the turmoil surrounding mobile payments lasted just a couple of days. However, this caused the first quite noticeable plunge in the volume of electronic transactions starting from April 2020. Back then the volume of transactions lost about $919 million due to quarantine restrictions and economic downturn.