Bypassing Russia. New routes may absorb about 10 million tons of cargo a year

Kazakhstan and its partners have done an incredible job creating TITR. Amid the crisis in Ukraine, these efforts may pay back even though the maximal volume of transit is quite small now and doesn’t exceed 200,000 containers a year.

In overdrive

The crisis in Ukraine has turned into a crisis in transport and logistics for all of Eastern Europe. Kazakhstan and other Central Asian states used to rely on export and import routes via Russia, Belarus and Ukraine. Now the Trans-Caspian International Transport Route (TITR) is the only alternative transport corridor to the West.

During the past couple of weeks, Kazakhstan’s government was incredibly busy with talks. Over March 9-14 Kazakhstan’s officials held several meetings in Azerbaijan. Throughout March 9 and 10, Kazakhstan’s delegation represented by Kairbek Uskenbayev, minister of industry and infrastructural development and Almasadam Satkaliyev, head of the national welfare fund Samruk-Kazyna met with their Azerbaijani counterparts Mikayil Jabarrov, minister of the economy, Rashad Nabiyev, minister of digital development and transportation, Ruslan Alikhanov, CEO of Azerbaijan Investment Holding and Rovshan Hajaf, acting president of SOCAR, the Azerbaijani national oil company.

According to Kazakhstan’s ministry of industry, the transit capacity of TITR booked for 2022 of 30,000 TEU might be increased twofold.

«This year Kazakhstan’s exporters are going to redirect about two million tons of their cargo to TITR. This cargo includes oil products, metal products and coal. In the future, the volume of these goods might be easily increased to 4 million tons,» said Uskenbayev.

Both sides have discussed the establishment of a new joint entity to pursue further development of TITR. As Samruk-Kazyna officials noted, this new joint entity is going to «find a solution for tariff issues; to decide how cargo must be certified; to apply unified IT solutions and to consolidate transit cargos which are going through TITR.» After negotiations, Samruk-Kazyna and the digital ministry of Azerbaijan have signed a memorandum on cooperation. The partners must «unify transport tariffs and synchronize their customs procedures.» Kazakhstan’s officials have also negotiated with the Georgian Ministry of Economy as Georgia get interested in the project.

On March 14, Kazakhstan’s Ambassador to Azerbaijan Serzhan Abdykarimov held a business meeting for local businessmen. He announced the newly established company TDK-Logistics that is going to represent Kazakhstan in Azerbaijan.

On March 16, the ministry of the industry reported that Turkey is also going to join the project.

New ideas, old routes

The original concept of a transport corridor between Eastern and Western Eurasia via the Caspian Sea and bypassing Russia dated back to 1993. For years it has been known as TRASECA (Transport Corridor Europe –Caucasus – Asia). A wide range of countries including Azerbaijan, Armenia, Georgia, Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, Uzbekistan, Moldova, Mongolia, Ukraine, Turkey, Romania, Bulgaria and Iran joined the project.

The project participants have discussed multimodal (by rail, sea, air and road) routes via their territories. In 2001, they have also created a secretariat for the project (with headquarters in Baku, Azerbaijan). However, even though TRASECA had created some mechanisms of technical assistance and a system of training for officials, this project had no significant achievements.

The first phase of the crisis in Ukraine (February 2014) promoted the emergence of another project TITR with three participants on the initial stage (Azerbaijan, Georgia and Kazakhstan) plus five more members later on (China, Poland, Romania, Turkey and Ukraine).

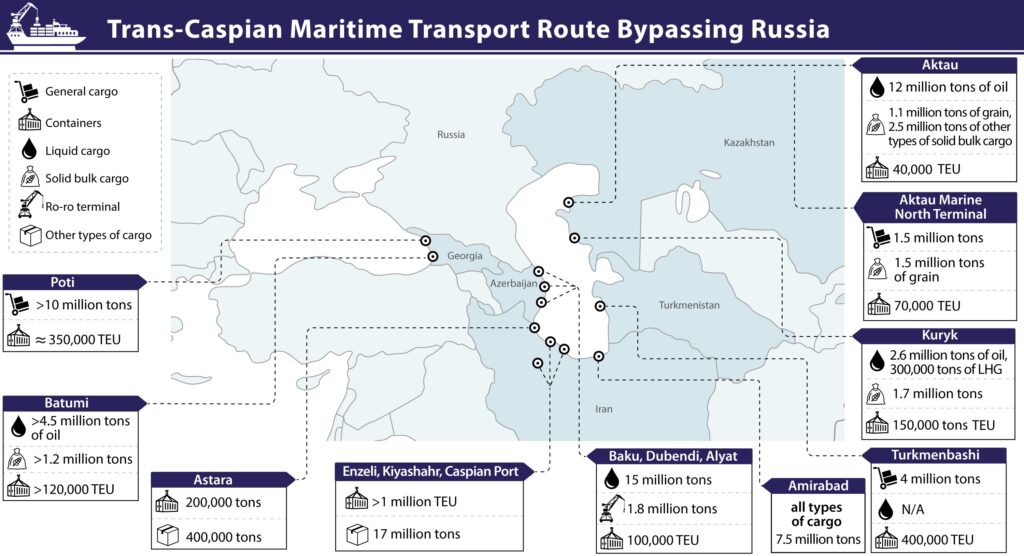

The project of TITR consists of two main routes. The first route starts in Kazakhstan’s ports of Aktau and Kuryk. It goes through the Caspian Sea to Baku and then by railways to Georgian ports of Batumi and Poti at the coast of the Black Sea. The next transit points are Varna and Burgas in Bulgaria or Romanian Constanta. The second route also takes off in Aktau and Kuryk, goes to Baku and then turns to the railway Baku-Tbilisi-Kars and then heads to Turkish seaports. According to the ministry of industry, the total capacity of TITR is about 10 million tons, including 200,000 containers.

Small scale

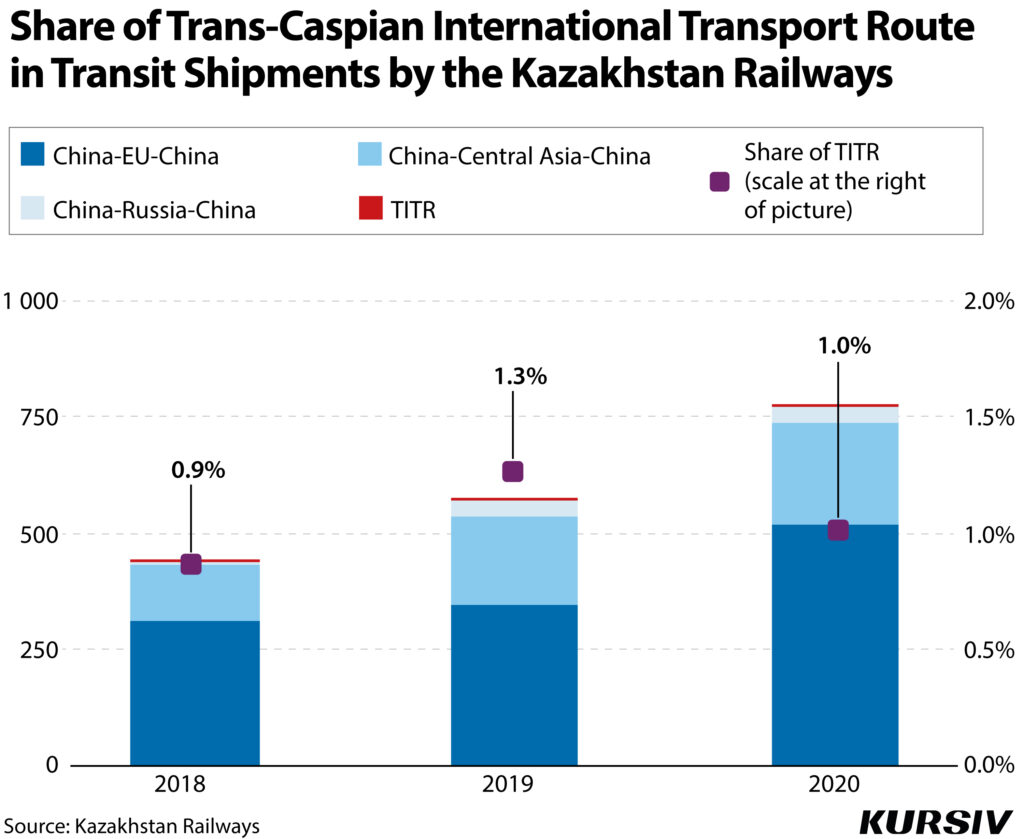

However, even this ready-to-use capacity of TITR hasn’t been used in full. Despite the rapid development of this route, the volume of shipments via TITR is still low compared to the main East-West corridors. Over the period from 2018 to 2020 the volume of Kazakhstan’s container transit via this route rose twofold from 3.9 thousand TEU to 8.1 thousand TEU. Moreover, Kazakhstan’s Railways reported 15.1 thousand TEU in 2021. Chinese container routes have accounted for the main growth via TITR for the past two years. These routes are Xian-Istanbul and Istanbul-Xian.

The current share of TITR in shipments conducted by Kazakhstan Railways is 1-2%. For comparison, Kazakhstan Railways’ transit via routes China-EU-China in 2020 was about 518,000 of TEU; China-Central Asia-China – 216,000 of TEU and China-Russia-China – 37,000 of TEU.

The logistical capacity of TITR is also not used fully. The container capacity of Kazakhstan’s ports is about 260,000 TEU.

The potential of TITR isn’t used fully in any segment including transshipment of liquid and solid bulk cargos. According to official spokespersons of the seaport of Aktau, the port uses just 18% of its capacity on average. Last year the company was forced to shut down two oil terminals because there was no extra cargo to reload (There are 11 terminals in the port).

There are several explanations for the problem. First, the multimodal format drives net prices too high. Even though in 2017 Kazakhstan Railways decreased tariffs by 60% for 10 types of cargo including oil products, fertilizers, grains and other agricultural products if they are headed via TITR to 23 destinations (Poland, Romania, Turkey, Ukraine and so on), transportation tariffs are still too high.

However, according to one of Kazakhstan’s experts, who has preferred to stay anonymous, these tariffs are quite competitive compared to a traditional route. Some other transportation companies said they would prefer to not calculate the costs of TITR as the Russia-Belarus corridor is still available.

There is a bunch of procedural and technical problems that prevent TITR from being developed further. As the transport companies reported since March 2021 mandatory customs control has been conducted in the port of Aktau. The authorities use special technical tools for inspection of all types of cargo in containers, which were unloaded from a ship for further transportation to EEU member-states. As a result, railway cars have stayed there for days. This disrupts supplies and forces cargo shippers to seek alternative routes.

Moreover, as Kazmortransflot, a maritime operator in Kazakhstan reported, since September 2021 ship crews have been obliged to go through a long procedure of getting approval before crossing the state border. If one member of a crew was replaced, the crew needs to go through the process of getting approval once again. Among other problems is the lack of ferries as well as hydrological and navigational maps, which Kazakhstan doesn’t produce.