FRHC hires new auditors and changes the structure of the holding

Sanctions imposed against Russia by Western countries and countersanctions by Russia have made it almost impossible for publicly traded companies to work with Western money in Russia. These companies are now trying to sell their assets in Russian and looking for other options to develop their businesses. Freedom Holding Corp. (FRHC), which is traded on NASDAQ and runs businesses in Russia, Ukraine, Kazakhstan and many other countries, has also found itself trapped in the situation. However, the holding is currently going through a massive restructuring. Evgeniy Ler, CFO of the holding shared some details of that process with the Kursiv edition.

– Evgeniy, what figures were on the FHRC book in the last quarter?

– In the first quarter of FY 2023 ending on June 30, 2022, the net profit of the holding was $59 million which is a 7.2% increase over the same period last year ($55 million). The report has already been published on the U.S. Securities and Exchange Commission (SEC) website.

The earnings per share ratio reached $0.99 (it was $0.93 last year) and other comprehensive income rose from $59 to $83 million. The holding’s earnings for the quarter rose by 56% and reached $227 million.

During this period, FRHC assets and liabilities increased by $620 and $559 million respectively. As of June 30, 2022, the number of clients’ accounts was about 479,000, a 17% increase compared to March 31, 2022.

– What were the drivers of that earnings increase?

– Our fee and commission income rose by 36% to $132 million thanks to the increase in the number of client accounts. The interest yield has risen by 96% to $49 million. This increase is based on the company’s trading book which has gotten bigger and now includes more bonds than it had before. Also, Freedom has reported the increase in loans it issued. The company’s insurance business has risen by 71% and reached $24 million.

The increase in fee and commission income has been mainly driven by lower competition in the region as many Russian financial companies have faced infrastructural obstacles. We have managed to preserve our infrastructure and as a result, we have developed our business even further.

– What are the reasons your business is growing, including the segment of trading with order flow?

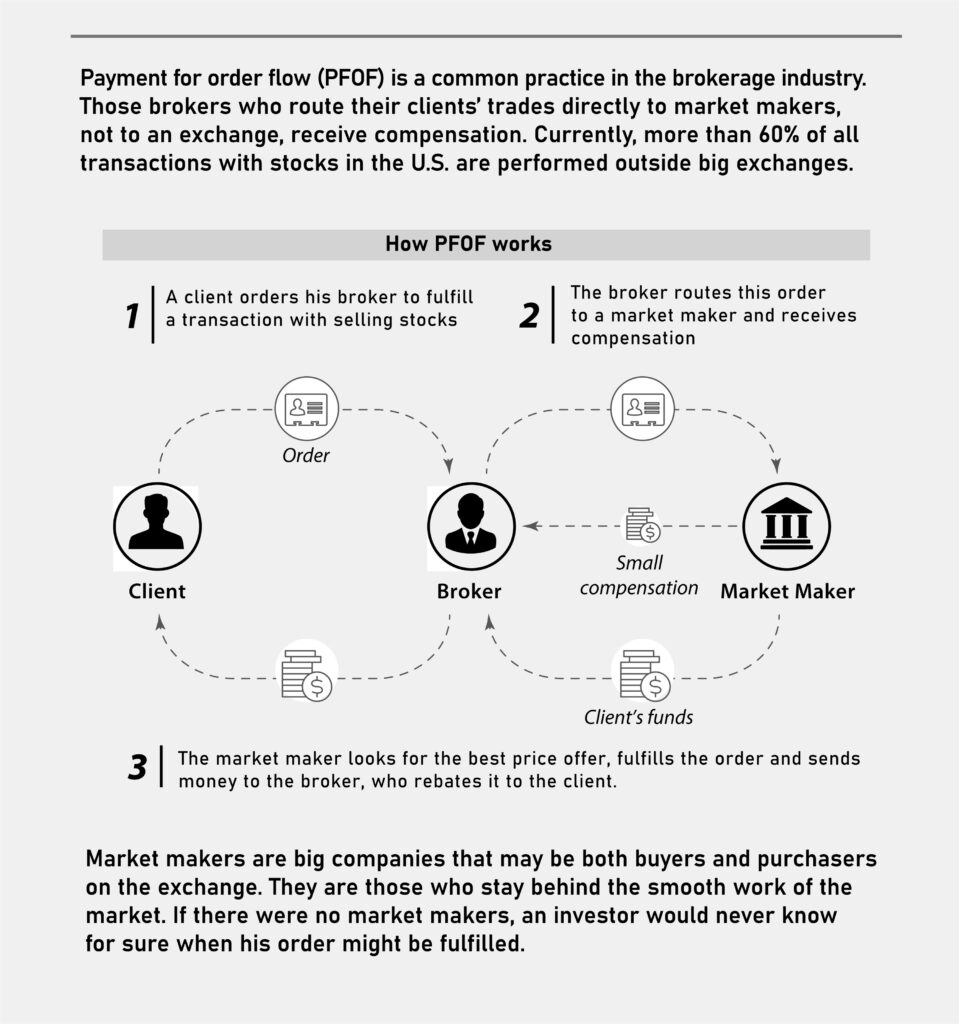

– Our business of providing access to trading with financial tools on local trading platforms is developing very fast as the interest of our clients in foreign stock markets has skyrocketed. Currently, a significant part of the revenue our European broker receives is income generated by trading of order flow. Now we are moving this order flow trading business from Europe to Freedom Finance Global, a company registered with the Astana International Financial Center (AIFC), where it is going to be fully transparent and supervised by the Astana Financial Services Authority (AFSA).

Earnings from related parties are about $102 million, according to the last quarterly report. We reflected this income in our financial report as a commission income received by our European broker from a market maker who has been working with a pool of our clients and order flow.

– The holding’s costs increased by 84% in the last quarter, according to the report. Why is this so?

– First, an increase in operational costs by $32 million is the result of the holding’s expansion as the company hired more workers, paid bigger rewards to key employees, and poured more money into advertising, charity and sponsorship

Second, an increase in interest costs by $29 million is the result of an increase in the volume of short-term financing due to repurchase agreements on securities and interest expenses on deposits, which in turn is a result of an increase in deposit accounts.

– What kind of requirements does the holding have to follow while on the audit?

– While preparing any financial report the parent company and its American subsidiaries have to follow Generally Accepted Accounting Principles (U.S. GAAP), as required by the NASDAQ exchange, SEC and Financial Industry Regulatory Authority (FINRA). Other FHRC subsidiaries outside of the U.S. must prepare financial reporting under International Financial Reporting Standards (IFRS) and local legislation.

Moreover, the holding’s subsidiaries in Kazakhstan, Europe, Russia and Ukraine are going through audits under IFRS standards whenever national regulators require that.

– Who are your auditors?

– We are a public company and everyone can find information about us. For audit under IFRS standards, auditing review, services linked to our M&A activities and tax and legal consultations we currently work with Big Four.

The holding is represented in 11 countries all over the world. These are different companies like licensed brokers, banks and insurance companies which all are subject to the external audit. For example, the Kazakhstani segment of FHRC business – a bank, brokers and insurance companies – is audited by Deloitte. For the European broker, the same task is implemented by KPMG.

In the U.S. the holding is audited by WSRP, a company that is doing so under the standards of the Public Company Accounting Oversight Board (PCAOB). WSRP has accreditation to audit public companies whose shares are traded in the U.S.

Under PCAOB the holding is also subject to a separate audit under the Sarbanes–Oxley Act of 2002 that institutionalizes the standards of risk management under the concept of COSO (the Committee of Sponsoring Organizations of the Treadway Commission). Today, the COSO’s standard for internal control is key guidance in internal control assessment and improvement for big companies around the globe.

– WSRP used to be the main auditor for the holding. Why do you want to change the auditor?

– Yes. We are going to change our auditor and have already notified it about this decision. However, due to Big Four having left Russia, we’ve asked the auditor to support us for one more quarter.

Under US GAAP we have worked with them for years. WSRP took part in establishing and developing FHRC. We established the holding in conjunction with them, and it was a really rewarding and highly effective cooperation. WSRP was always ready to support our growing company and they were always eager to implement an audit and keep our business information safe.

Nevertheless, we knew that our growing business will require a switch to one of the Big Four. This is something the global equity market – investing bankers and rating agencies – are requiring from us.

Additionally, WSRP has changed its area of expertise. Now they are focused on audits in the public and non-commercial sectors. Also, FHRC audits require a lot of human resources and WSRP, which has faced a shortage of young specialists in this field, can no longer meet our needs. At the same time, there is a huge demand for audit services in the state of Utah, where WSRP is located, as many businesses are moving here from neighboring California.

We started the process of migration to a new auditor from Big Four last year before the Russian invasion of Ukraine. Later, global auditors changed their requirements, revised their structures and left the Russian market. Of course, the process of changing an auditor is very laborious from both administrative and technical points of view.

Currently, we are working on adopting external committees on compliance, ethics and risks, preparing documentation and responding to questions from concerned parties.

– What is going on in the holding’s insurance business in Kazakhstan?

– During the quarter under review we officially completed all legal and formal procedures on acquiring two insurance companies Freedom Finance Insurance and Freedom Finance Life.

– FRHC is going through restructuring. What is going on?

– As our last quarter report says: «In light of the Russia/Ukraine Conflict, and the consequent U.S., UK and EU economic sanctions and Russian countersanctions, we are seeking to sell our interests in our two Russian subsidiaries, Freedom RU and Freedom Bank RU. Any transaction entertained by us to sell our Russian subsidiaries must comply with U.S. sanctions and related OFAC guidance, as well as Russian countersanctions, in effect at the time of the sale and any transaction related thereto.

On August 5, 2022, Russia introduced a ban restricting the ability of investors from “unfriendly-states» to exit from investments in businesses in certain Russian industries, which could impair our ability to sell our Russian subsidiaries.

Until such time as we are approached by a willing and able buyer, in a manner consistent with U.S. sanctions, we will provide financial support only for «maintenance» of our investment in our Russian subsidiaries consistent with our previously established practices and in support of pre-existing projects and operations in conformity with OFAC guidance concerning such activities. We will not engage in funding of new projects or expansion of pre-existing projects of our Russian subsidiaries.”

– Have you found a buyer for the business in Russia?

– Yes. We have received several offers concerning the Russian segment of our business. These are the brokerage company and bank. Currently, we are reviewing these offers. Of course, the upcoming deal must be approved by the Bank of Russia. This potential investor is not linked to our group. The brokerage company is going to work on the Russian stock market, while the bank will focus on payment and cash services and provide all other kinds of banking products.

We and our partners are highly interested in the quick completion of the holding’s restructuring. We will reveal the details of the deal as soon as we have such an opportunity.

– What about the holding’s business in Kazakhstan?

– Previously, our Russian companies owned the vast majority of the Kazakhstani segment due to some regulating specifics of owning a financial organization in Kazakhstan and requirements to ratings and capital.

Now it is planned that the American holding will be a direct owner of the FHRC business in Kazakhstan. At the moment, we are in the process of applying to the Agency of the Republic of Kazakhstan for Regulation and Development of Financial Market to register FRHC as a big stakeholder in the Kazakhstani segment of our business (bank, broker and insurance companies).